The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Virgin Islands Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

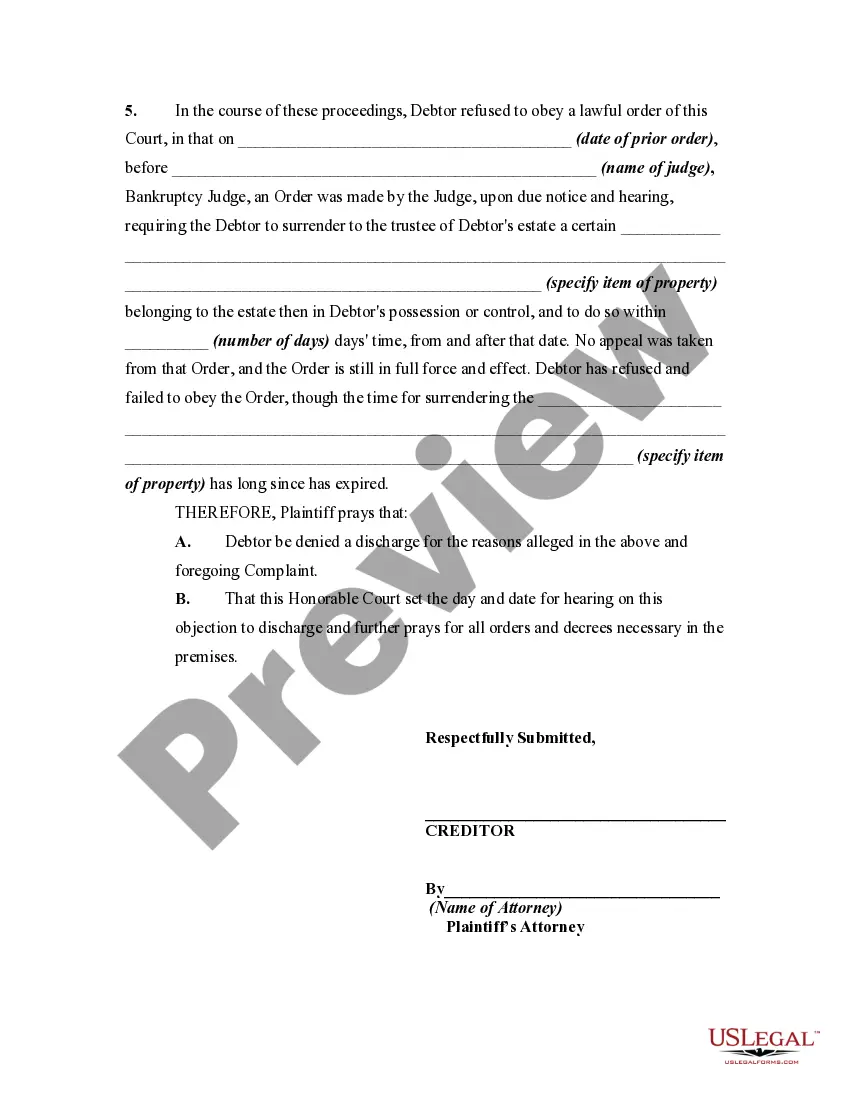

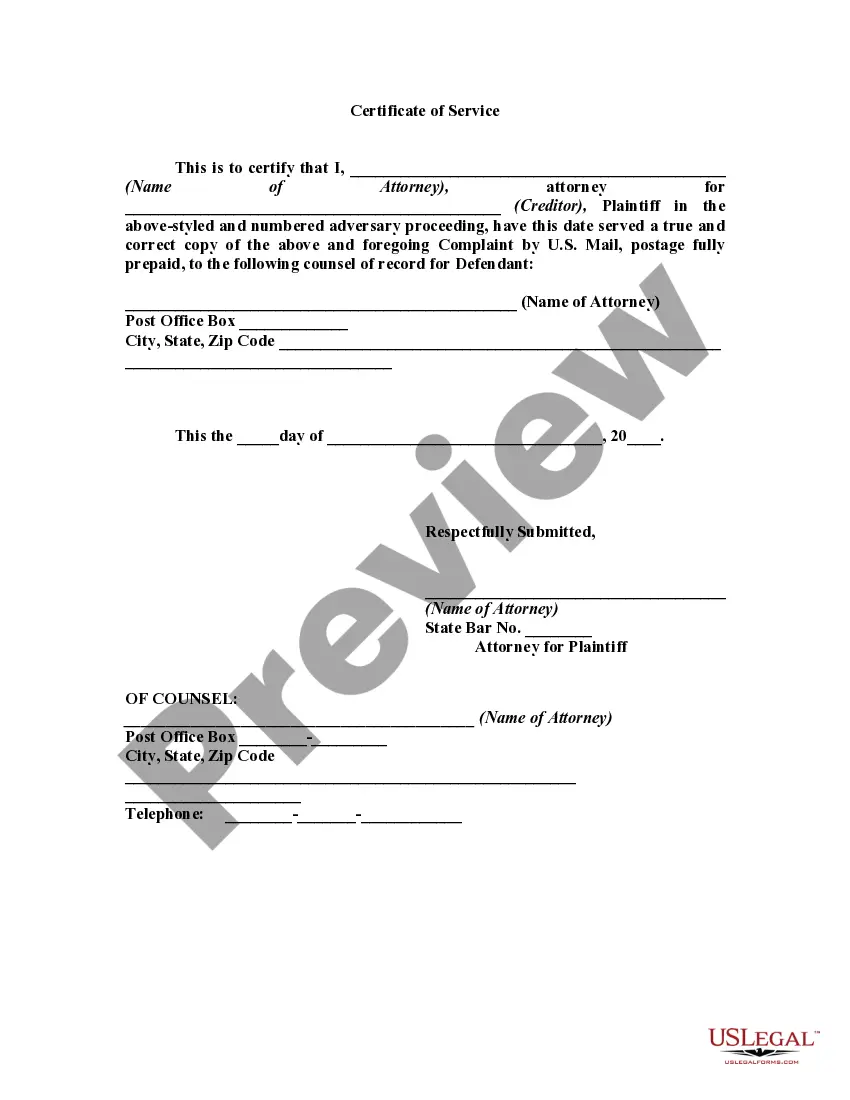

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

You are able to invest several hours online looking for the legitimate document template that suits the federal and state needs you will need. US Legal Forms offers 1000s of legitimate varieties which are reviewed by pros. You can easily acquire or produce the Virgin Islands Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the from my services.

If you already have a US Legal Forms accounts, it is possible to log in and then click the Down load key. Afterward, it is possible to total, edit, produce, or signal the Virgin Islands Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the. Each legitimate document template you get is yours forever. To have yet another version associated with a bought develop, proceed to the My Forms tab and then click the corresponding key.

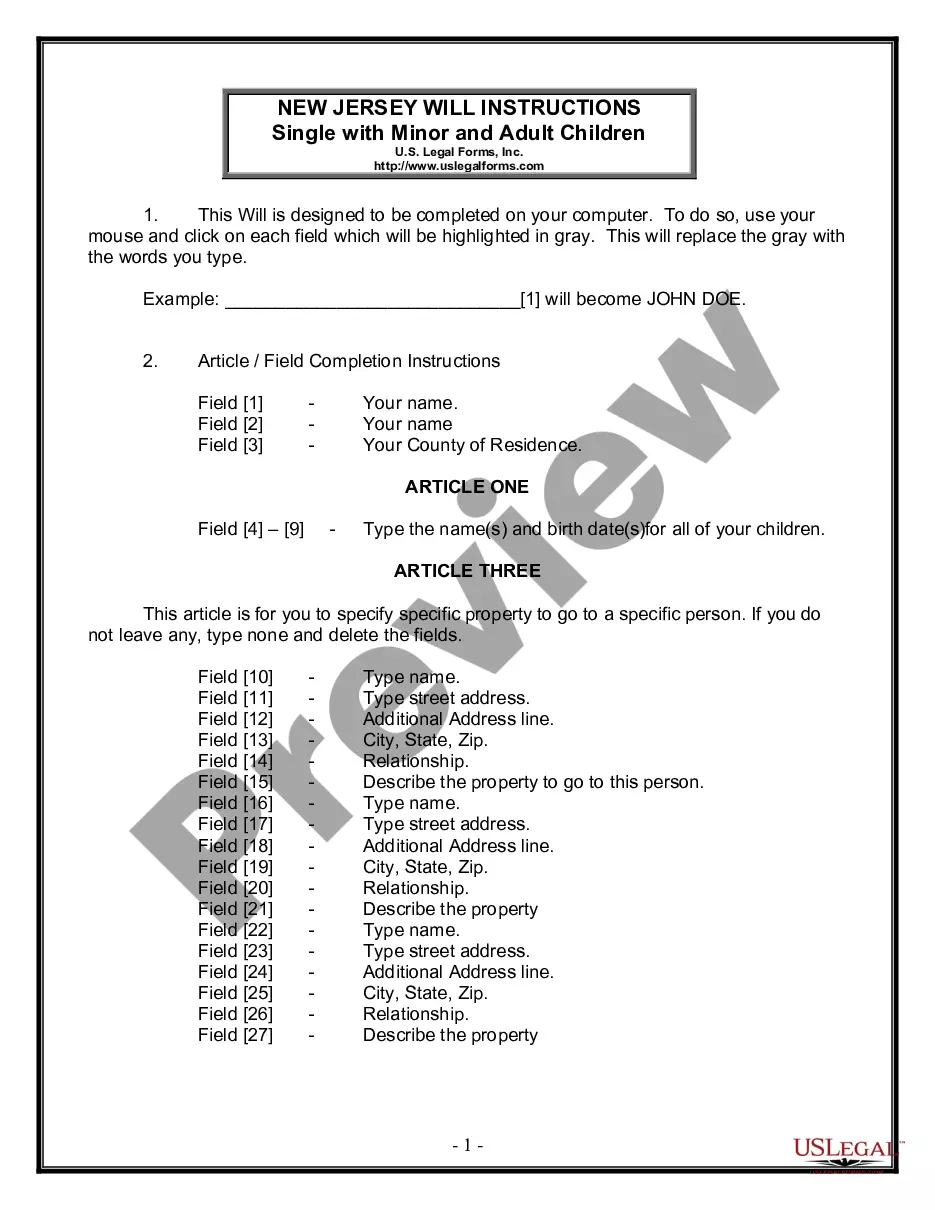

If you use the US Legal Forms site the first time, adhere to the basic directions below:

- Initial, be sure that you have chosen the correct document template for your area/town of your liking. Read the develop information to ensure you have picked out the proper develop. If offered, take advantage of the Review key to check from the document template as well.

- If you would like locate yet another variation in the develop, take advantage of the Lookup field to discover the template that fits your needs and needs.

- After you have found the template you need, click on Buy now to move forward.

- Select the prices plan you need, key in your references, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal accounts to fund the legitimate develop.

- Select the formatting in the document and acquire it to the system.

- Make adjustments to the document if possible. You are able to total, edit and signal and produce Virgin Islands Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

Down load and produce 1000s of document layouts using the US Legal Forms web site, which provides the largest variety of legitimate varieties. Use expert and express-distinct layouts to handle your company or individual requirements.

Form popularity

FAQ

Certain types of debt, such as child support, alimony, and most student loans, cannot be discharged in bankruptcy. Wrongful conduct may make some debts non-dischargeable.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Disadvantages of Bankruptcy This can make it challenging to secure loans, credit, or even housing in the future. Loss of Assets: In Chapter 7 bankruptcy, debtors may be required to liquidate some of their assets to repay creditors. This can result in the loss of valuable property, such as a car or family heirlooms.

Some unsecured debts, like alimony or child support, can never be discharged in bankruptcy. Other things, like tax debts and some student loans*, can be hard to eliminate by filing bankruptcy. *Many people wrongly believe they cannot use bankruptcy to get rid of student loan debt.

Article I, Section 8, of the United States Constitution authorizes Congress to enact "uniform Laws on the subject of Bankruptcies." Under this grant of authority, Congress enacted the "Bankruptcy Code" in 1978.

In fact, the federal courts (which handle bankruptcy cases) list 19 different types of debt that are not eligible for discharge. 2 The most common ones are child support, alimony payments, and debts for willful and malicious injuries to a person or property.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

A typical party in interest would include the bankruptcy trustee, other creditors in the same bankruptcy case, and, in some situations, the debtor. For instance, a Chapter 7 debtor will have standing to object?and thereby be an interested party?only if doing so might put money in the debtor's pocket.