Virgin Islands Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

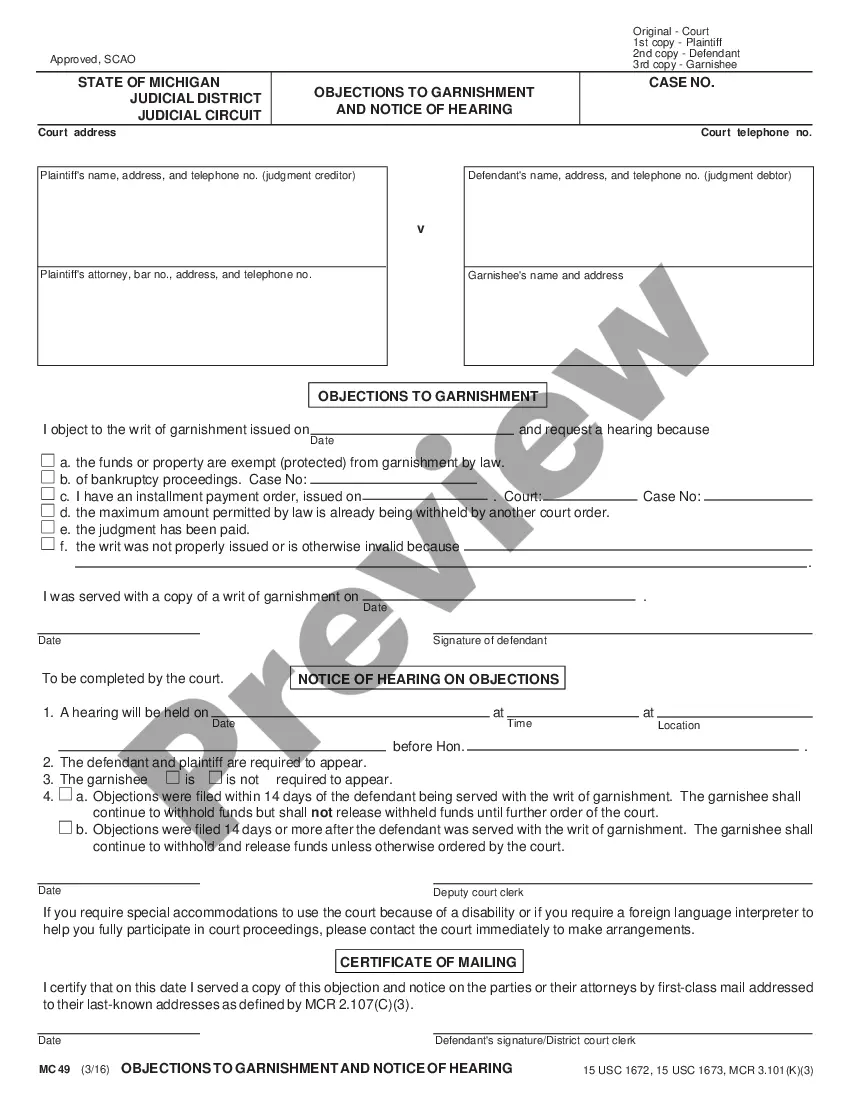

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Have you ever found yourself in a situation where you need to obtain documents for either business or personal purposes nearly every day.

There are numerous valid document templates available online, but finding reliable versions can be challenging.

US Legal Forms provides a wide array of document templates, such as the Virgin Islands Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, which are designed to comply with federal and state regulations.

When you locate the appropriate document, just click Get now.

Choose the pricing plan you desire, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virgin Islands Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you require and make sure it is for your correct location/region.

- Use the Preview button to examine the form.

- Read the description to confirm that you have chosen the right document.

- If the document isn't what you are looking for, use the Search field to find the document that fits your needs.

Form popularity

FAQ

Expenses Sole Proprietorship Companies Can "Write Off"Office Space. DO deduct for a designated home office if you don't also have another office you frequent.Banking and Insurance Fees.Transportation.Client Appreciation.Business Travel.Professional Development.

Excise duty is on the production of goods whereas sales tax is levied on sale of goods. Excise duty is paid by the manufacturer while the burden of sales tax is borne by the end consumer.

Which of the following taxpayers may use the cash method of accounting? A qualified personal service corporation. This answer is correct. The cash method of accounting is only permitted for certain taxpayers.

An excise tax is a legislated tax on specific goods or services at purchase such as fuel, tobacco, and alcohol. Excise taxes are intranational taxes imposed within a government infrastructure rather than international taxes imposed across country borders.

Under which of the following conditions may a taxpayer use the cash method to account for inventory? Annual gross receipts for the three-year period prior to the current year do not exceed $26 million.

Sales tax applies to almost anything you purchase while excise tax only applies to specific goods and services. Sales tax is typically applied as a percentage of the sales price while excise tax is usually applied at a per unit rate.

One difference between sales and excise taxes is that: sales taxes are calculated as a percentage of the price paid, while excise taxes are levied on a per-unit basis. Government lotteries are: used by a large number of states to supplement their tax revenues.

Some example excise taxes that are levied by the federal government include: Alcohol: per unit excise tax. Tobacco products: per unit excise tax. Firearms and ammunition: per unit excise tax.

As a sole proprietor, you can deduct most of your regular business expenses by filling out a Schedule C, Profit (Or Loss) From Business, and turning that over to the IRS along with a Form 1040 tax return.

Actual ExpensesYou can write off direct expenses for a vehicle that you use for your business. These expenses include gasoline, tires, batteries, repairs and maintenance.