Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Are you currently in a situation where you require documents for occasional business or personal needs almost every day.

There are numerous legal document templates accessible online, yet finding ones you can trust is challenging.

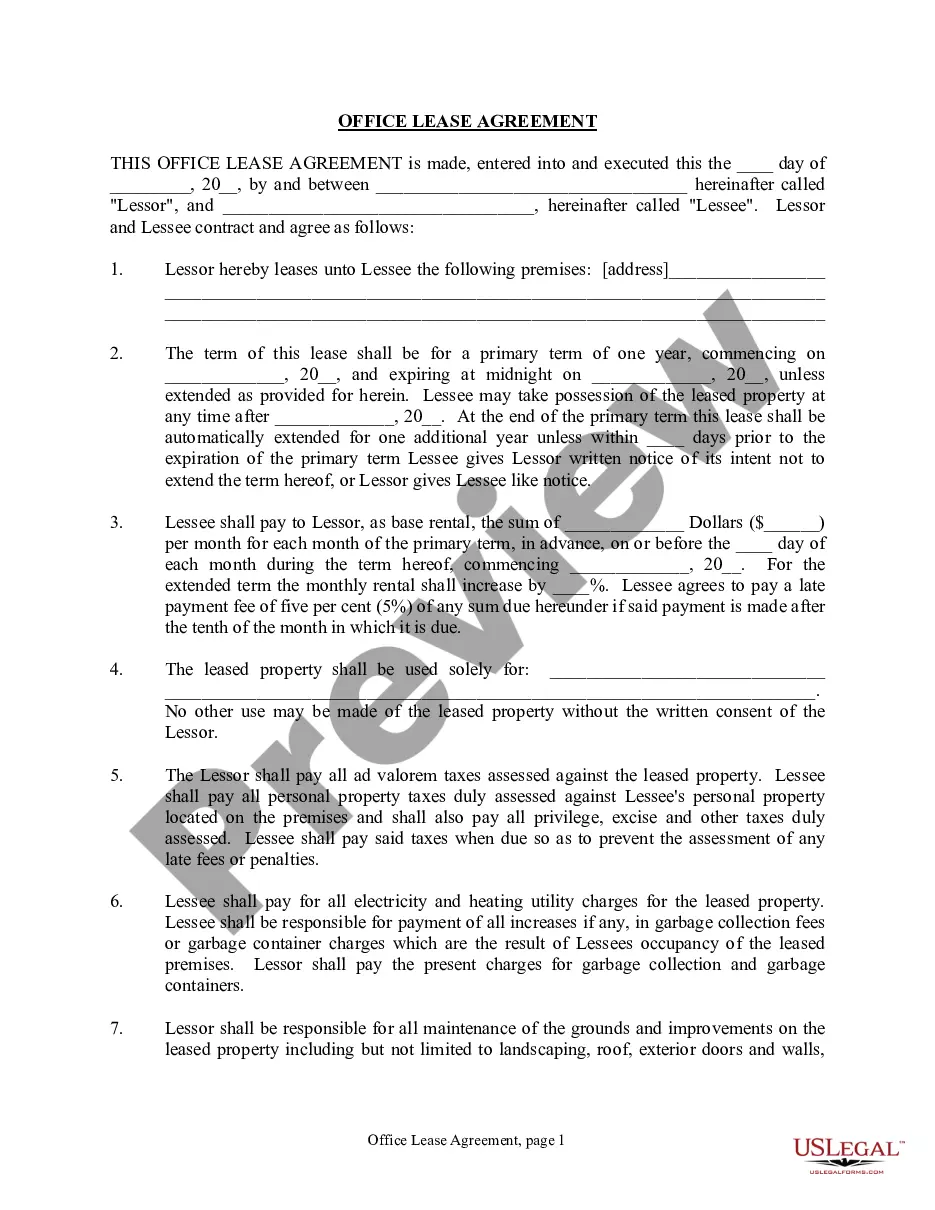

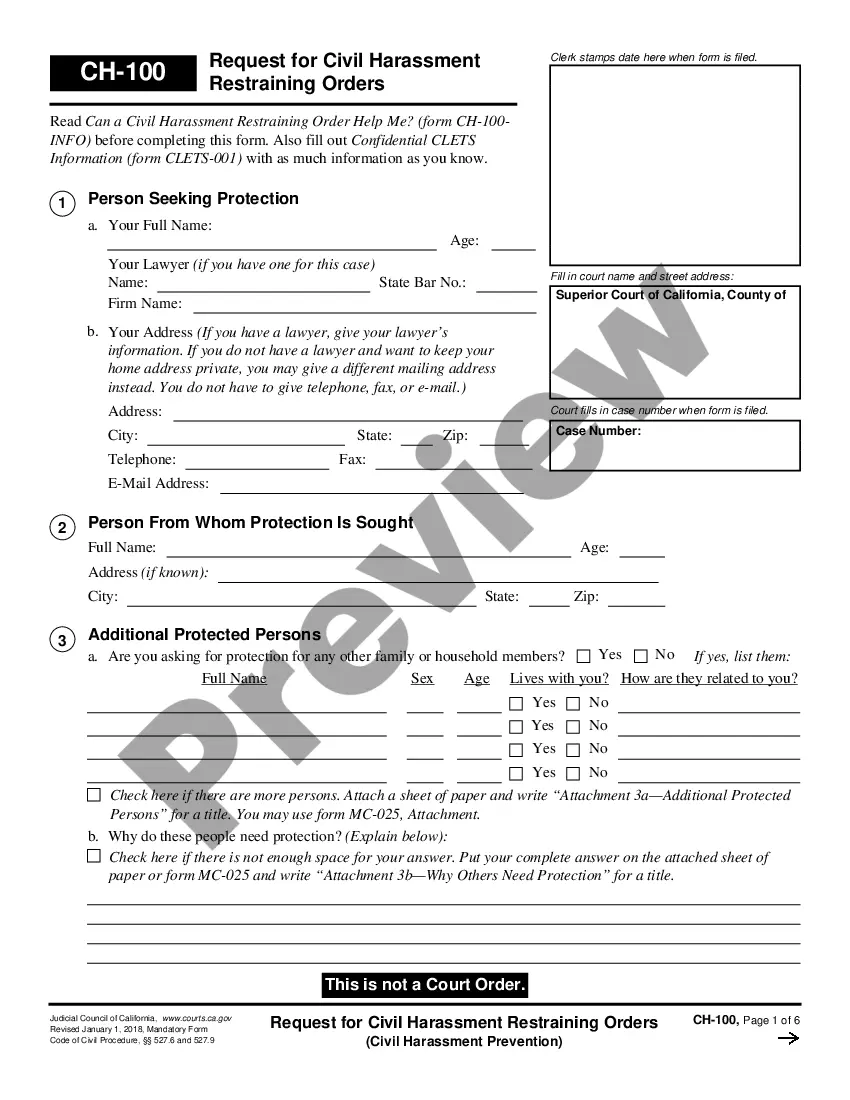

US Legal Forms offers thousands of template documents, such as the Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form, designed to meet both state and federal requirements.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the order using PayPal or credit card.

Choose a suitable file format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Look for the document you need and ensure it is for the correct city/state.

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct template.

- If the document is not what you're looking for, use the Search bar to find the form that fulfills your needs.

- Once you find the right form, click on Acquire now.

Form popularity

FAQ

Yes, BVI companies are generally required to maintain financial records and prepare annual accounts. However, the extent of these requirements can vary based on the company's business activities and structure. It is wise to consult with an expert regarding how the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form might impact your reporting obligations.

Opening a bank account for a BVI company involves preparing the right documentation, such as your company’s registration certificate and identification for the signatories. Choose a bank that specializes in corporate accounts in the Virgin Islands. Ensure you follow the steps outlined in the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form to prevent any delays in the process.

The best bank for your needs in the British Virgin Islands depends on various factors, including your business size, transaction volume, and specific services required. Look for a bank that offers a strong reputation and comprehensive business banking services. Also, consider how their policies align with the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form to help streamline your financial management.

Incorporating in the British Virgin Islands involves choosing a name for your company and filing the necessary documents with the Registrar of Corporate Affairs. Additionally, you must appoint a local registered agent. Completing the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form is a crucial step, as it may simplify future banking relationships.

To open a bank account in the British Virgin Islands, start by gathering the necessary documentation, such as proof of identity and the company's incorporation papers. Next, approach a bank that offers services for international businesses. Be sure to comply with the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form, as this may be a requirement when establishing your account.

When selecting a bank account for your business, consider one that offers features like low fees, online accessibility, and excellent customer service. A checking account tailored for small businesses often meets these needs. Furthermore, ensure you understand the Virgin Islands Minimum Checking Account Balance – Corporate Resolutions Form requirements to maintain your account without additional fees.

Yes, you can open a bank account in the British Islands, but you need specific identification and documentation. Banks typically require proof of residency and financial accountability. Utilizing the Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form can simplify the process, ensuring you meet all necessary criteria for account establishment.

Yes, a BVI company can open a UK bank account, though it may require specific documentation. Generally, banks need proof of business legitimacy and a corporate resolution. Understanding the process of handling a Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form can facilitate smoother interactions with UK banking institutions.

The minimum bank balance requirement can vary based on the type of account and the bank's policies. Most banks require a minimum balance to offer specific benefits, such as avoiding fees or gaining interest. To navigate these requirements effectively, especially related to the Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form, it’s wise to consult with your bank for precise details.

A commercial bank typically needs a minimum net worth that complies with regulations, often around $10 million. This amount ensures the bank's stability and ability to absorb losses. If you are considering how the Virgin Islands Minimum Checking Account Balance - Corporate Resolutions Form plays into this, remember that maintaining a solid financial foundation is crucial for obtaining banking services.