The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Virginia Nonemployee Director Stock Option Plan

Description

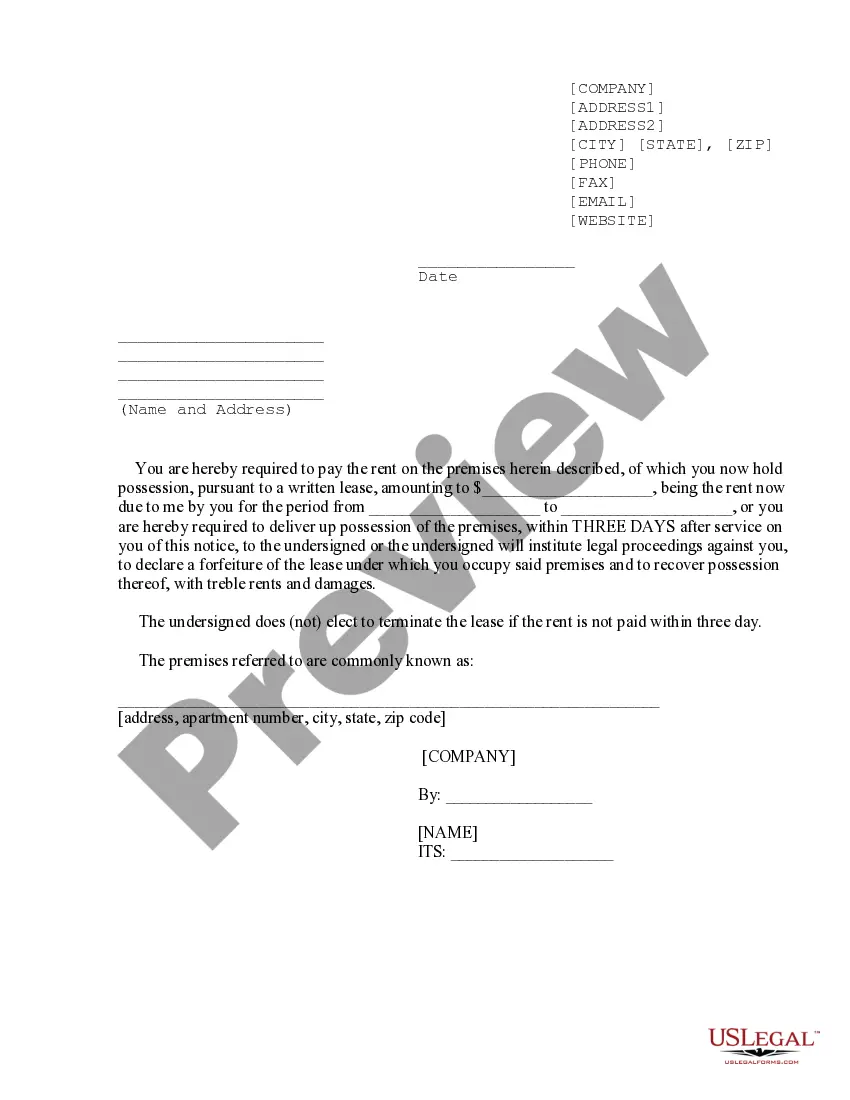

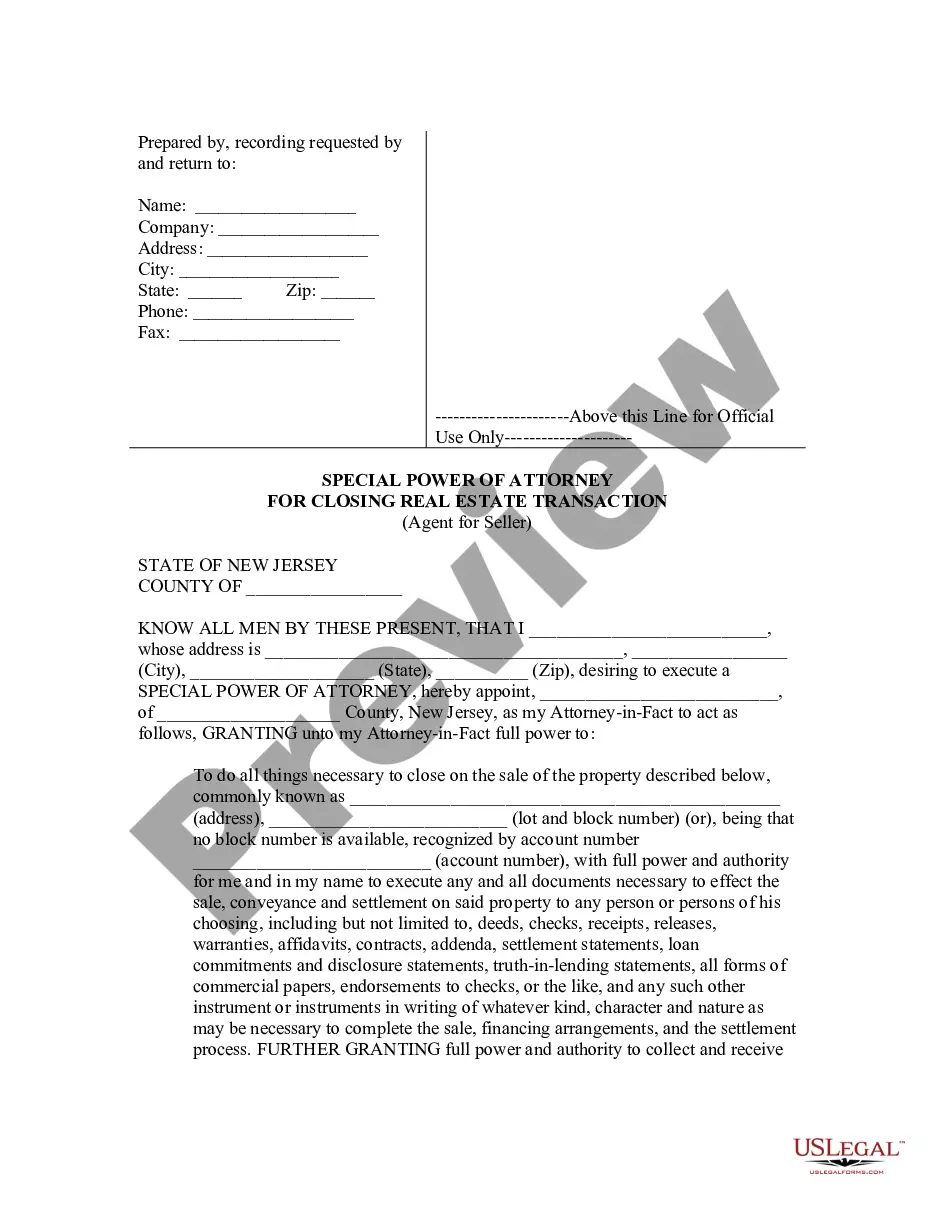

How to fill out Nonemployee Director Stock Option Plan?

Discovering the right lawful papers template might be a have a problem. Needless to say, there are a lot of themes accessible on the Internet, but how would you discover the lawful type you want? Use the US Legal Forms site. The service gives 1000s of themes, for example the Virginia Nonemployee Director Stock Option Plan, which you can use for enterprise and personal demands. Every one of the types are checked by professionals and meet up with state and federal requirements.

Should you be presently registered, log in to your accounts and click on the Download switch to get the Virginia Nonemployee Director Stock Option Plan. Make use of your accounts to check throughout the lawful types you possess bought previously. Proceed to the My Forms tab of your own accounts and obtain yet another version from the papers you want.

Should you be a brand new customer of US Legal Forms, here are easy directions so that you can comply with:

- Very first, ensure you have selected the correct type to your city/state. You are able to examine the shape making use of the Preview switch and study the shape information to make certain it will be the right one for you.

- If the type is not going to meet up with your expectations, use the Seach industry to obtain the proper type.

- When you are sure that the shape is acceptable, go through the Acquire now switch to get the type.

- Opt for the costs prepare you want and enter the essential information and facts. Build your accounts and pay money for your order making use of your PayPal accounts or charge card.

- Pick the document formatting and acquire the lawful papers template to your device.

- Full, modify and produce and signal the acquired Virginia Nonemployee Director Stock Option Plan.

US Legal Forms is the largest collection of lawful types that you can see different papers themes. Use the company to acquire expertly-made paperwork that comply with state requirements.

Form popularity

FAQ

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

Hear this out loud PauseWhat Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.

Hear this out loud PauseA stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

Hear this out loud PauseEmployee stock options are part of a benefits plan and equity compensation. It gives staff the right to purchase shares at a set price (the exercise or grant price) but doesn't require them to do so. Both parties sign a contract that explains the terms, such as how many shares they can buy and when.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.