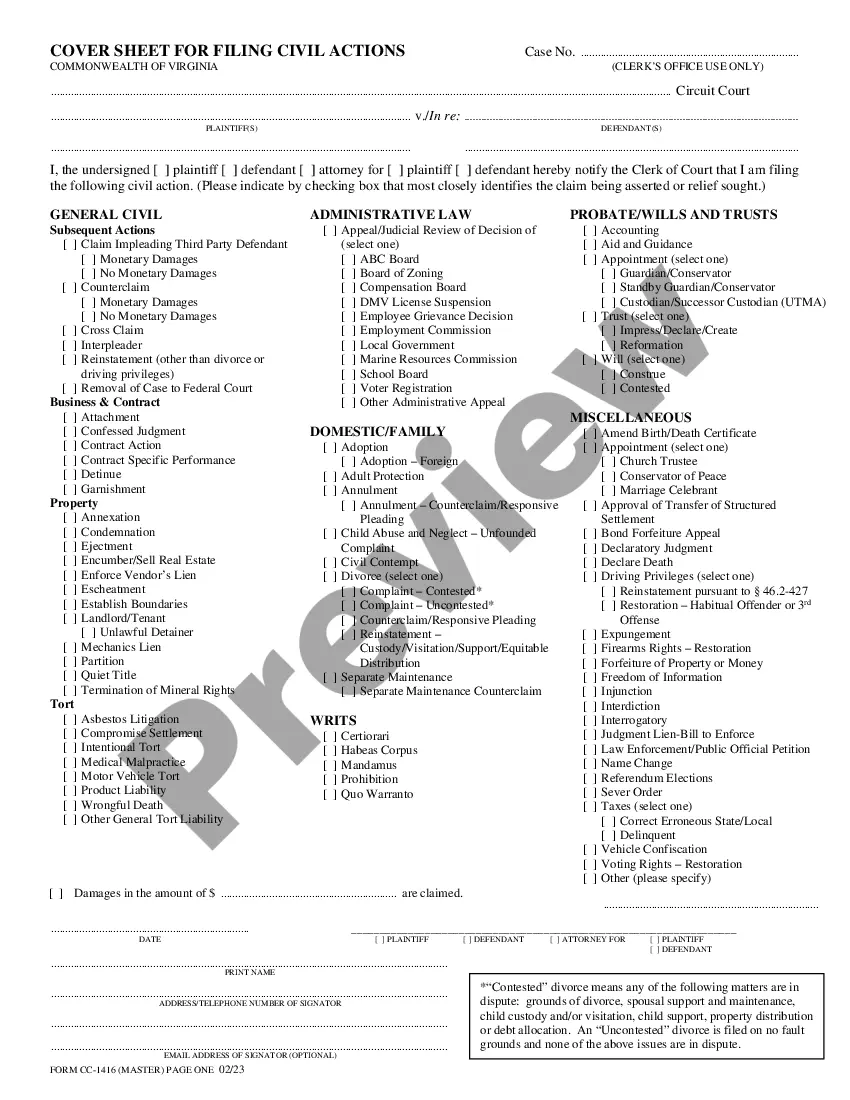

Virginia Request For Information on Payout Status

Description

How to fill out Request For Information On Payout Status?

US Legal Forms - one of several biggest libraries of legitimate varieties in the United States - offers an array of legitimate papers web templates it is possible to obtain or print. Using the website, you can get a huge number of varieties for organization and individual uses, sorted by groups, suggests, or keywords.You will discover the latest types of varieties just like the Virginia Request For Information on Payout Status within minutes.

If you already have a subscription, log in and obtain Virginia Request For Information on Payout Status from your US Legal Forms library. The Obtain button will appear on each and every kind you see. You have access to all previously delivered electronically varieties in the My Forms tab of your respective bank account.

If you wish to use US Legal Forms initially, listed here are easy directions to obtain started off:

- Be sure to have picked out the proper kind to your area/region. Click on the Review button to examine the form`s content material. Look at the kind information to actually have selected the correct kind.

- When the kind does not match your needs, make use of the Search field near the top of the monitor to find the one which does.

- When you are pleased with the form, validate your option by clicking on the Purchase now button. Then, pick the prices program you favor and provide your references to sign up to have an bank account.

- Approach the transaction. Use your charge card or PayPal bank account to finish the transaction.

- Choose the file format and obtain the form on your own gadget.

- Make alterations. Fill out, revise and print and signal the delivered electronically Virginia Request For Information on Payout Status.

Each and every template you put into your money lacks an expiration particular date and is the one you have forever. So, if you would like obtain or print one more version, just proceed to the My Forms section and then click about the kind you want.

Gain access to the Virginia Request For Information on Payout Status with US Legal Forms, one of the most comprehensive library of legitimate papers web templates. Use a huge number of professional and express-specific web templates that meet your small business or individual demands and needs.

Form popularity

FAQ

This letter is to notify you that the agency received a tax return with your name and Social Security number that it believes may not be yours. The letter asks you to take specific steps to verify your identity and confirm whether or not the return is actually yours.

If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts.

What Happens After I Finish the Verification Process? If the verification proves you are the person named on the return and that you personally filed the return, the return will be processed. After successful verification, it takes about 6 weeks to complete processing.

Check your refund status Use our Where's my Refund tool or call 804.367.2486 for our automated refund system. Both options are available 24 hours a day, 7 days a week, and have the same information as our customer service representatives, without the wait of the phone queue.

That's because the Virginia General Assembly passed a law giving some Virginia taxpayers a 2022 tax "stimulus" rebate of up to $250 for individual filers and up to $500 for joint filers. Most of those rebates were sent by Oct. 31, 2022, but you had to have filed your 2021 Virginia individual income tax return by Nov.

It's just an extra step we're taking to verify the returns we process and make sure refunds go to the right person. Our goal is to stop fraudulent returns before they go out the door, not to slow down your refund.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

What happens after I successfully verify? We'll process your tax return. It may take up to 9 weeks to receive your refund or credit any overpayment to your account. However, if we find other problems, we'll contact you again and this may delay your refund.