Virginia Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

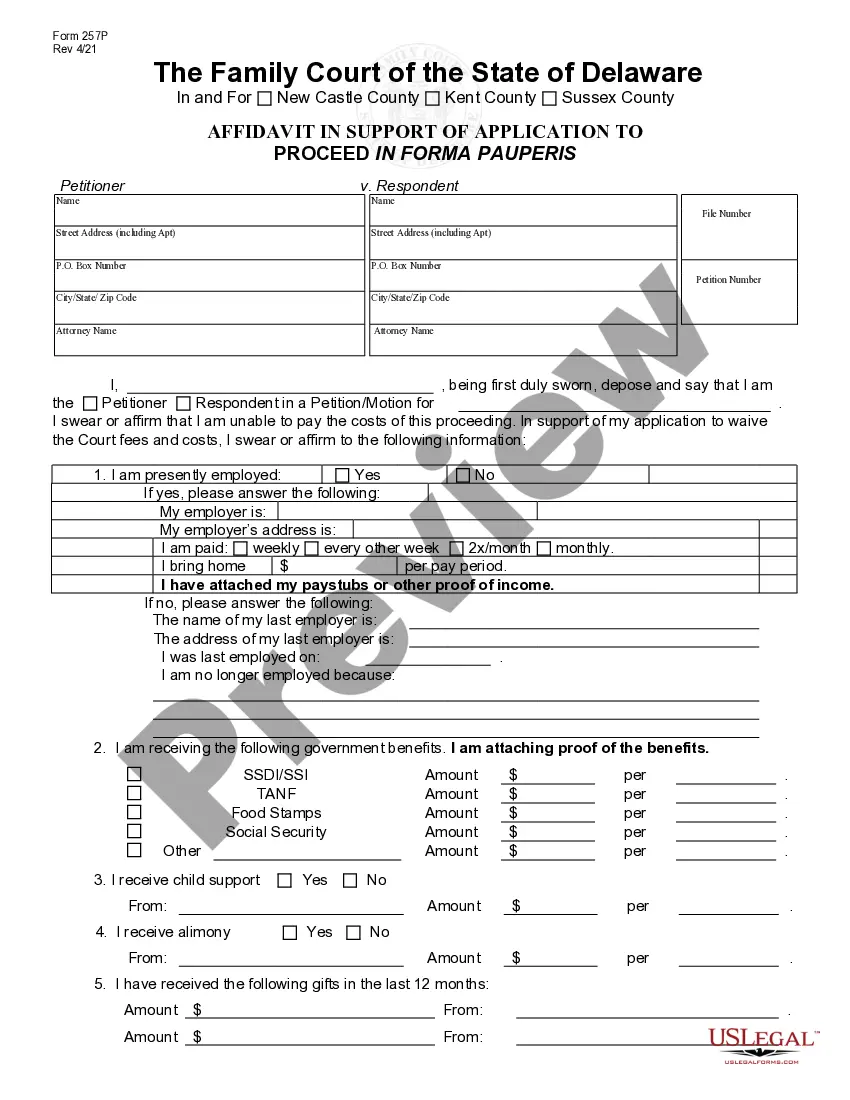

How to fill out Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Have you been inside a place in which you need paperwork for either enterprise or person purposes almost every working day? There are plenty of lawful file web templates accessible on the Internet, but getting versions you can rely isn`t effortless. US Legal Forms provides a huge number of type web templates, such as the Virginia Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, which are published to fulfill federal and state needs.

If you are presently knowledgeable about US Legal Forms site and have a merchant account, simply log in. Next, you may down load the Virginia Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced design.

Unless you come with an accounts and would like to start using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for that appropriate town/state.

- Utilize the Review option to analyze the form.

- Look at the explanation to ensure that you have chosen the correct type.

- If the type isn`t what you are seeking, use the Lookup field to obtain the type that meets your requirements and needs.

- If you discover the appropriate type, just click Acquire now.

- Select the prices strategy you desire, submit the specified info to create your bank account, and pay for the transaction with your PayPal or charge card.

- Pick a hassle-free data file formatting and down load your backup.

Find all of the file web templates you may have purchased in the My Forms menus. You may get a more backup of Virginia Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced any time, if necessary. Just click on the necessary type to down load or print the file design.

Use US Legal Forms, one of the most substantial assortment of lawful kinds, to conserve efforts and steer clear of errors. The support provides expertly produced lawful file web templates that you can use for a selection of purposes. Generate a merchant account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

Royalty Rate: This rate is the percentage stated on the lease agreement as revenue allocation. It represents the amount the resource owner is expected to receive from the sale of the oil and gas. Royalty rates are between 12.5% to 15%.

To do this, you need to multiply your sales or gross revenue by your royalty rate, and then divide by 100. For example, if your sales are $100,000 and your royalty rate is 6%, your royalty payment is ($100,000 x 6) / 100 = $6,000. This means you have to pay $6,000 to the franchisor as a royalty fee for that period.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.