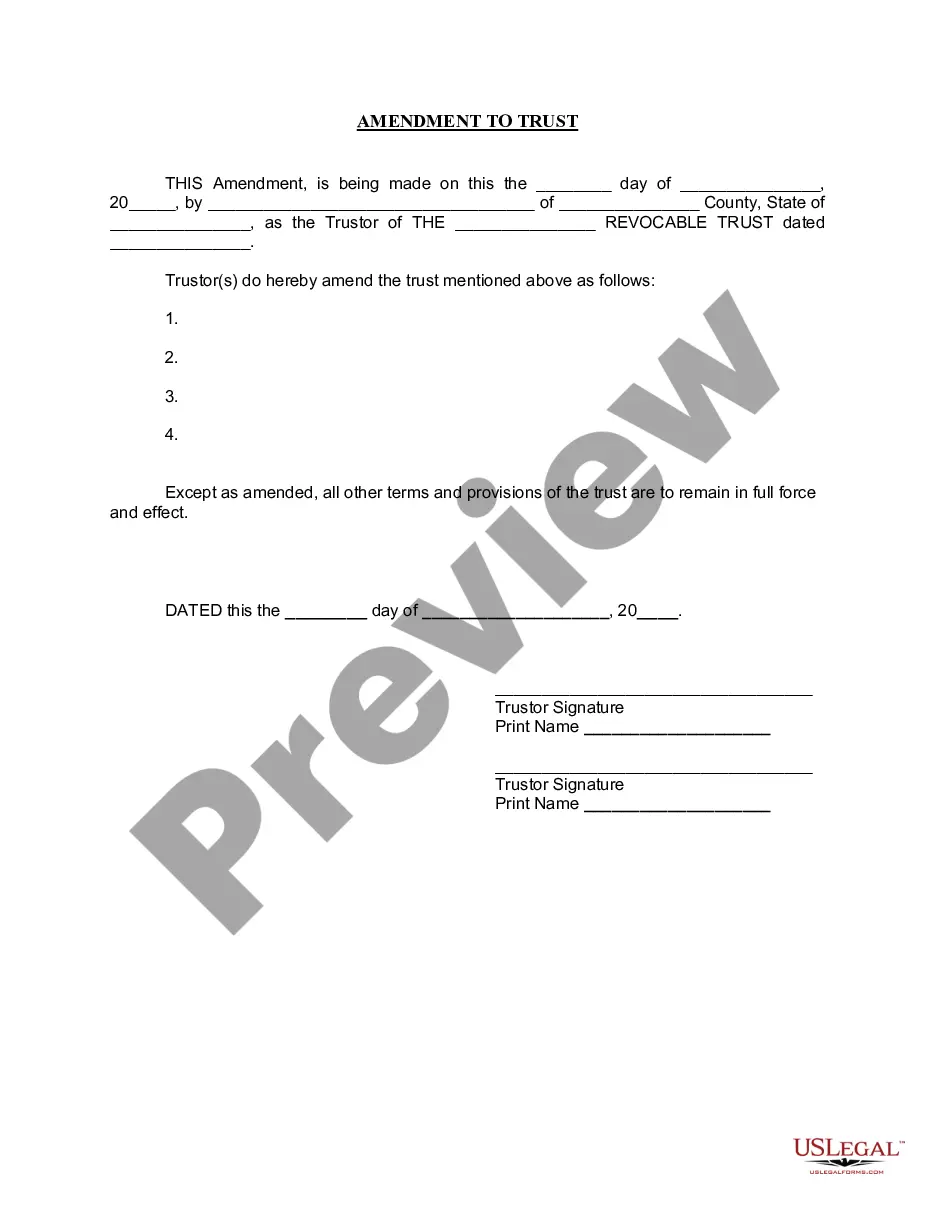

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Virginia Note Form and Variations

Description

How to fill out Note Form And Variations?

Choosing the right legal file web template might be a have difficulties. Needless to say, there are tons of layouts available on the Internet, but how can you get the legal type you require? Utilize the US Legal Forms web site. The assistance delivers 1000s of layouts, like the Virginia Note Form and Variations, that you can use for company and private requirements. All the forms are checked by experts and satisfy state and federal needs.

If you are presently registered, log in in your profile and click on the Acquire switch to find the Virginia Note Form and Variations. Make use of profile to look throughout the legal forms you possess ordered earlier. Proceed to the My Forms tab of your respective profile and acquire another backup of your file you require.

If you are a brand new user of US Legal Forms, here are basic instructions for you to adhere to:

- Very first, ensure you have chosen the proper type for your personal metropolis/area. You are able to look over the shape using the Preview switch and browse the shape information to ensure it is the best for you.

- When the type will not satisfy your expectations, make use of the Seach industry to obtain the proper type.

- Once you are certain that the shape would work, click on the Acquire now switch to find the type.

- Opt for the rates prepare you want and enter in the necessary information. Make your profile and buy an order with your PayPal profile or credit card.

- Opt for the file file format and down load the legal file web template in your product.

- Total, modify and printing and indicator the received Virginia Note Form and Variations.

US Legal Forms may be the greatest local library of legal forms in which you can see various file layouts. Utilize the company to down load expertly-manufactured documents that adhere to state needs.

Form popularity

FAQ

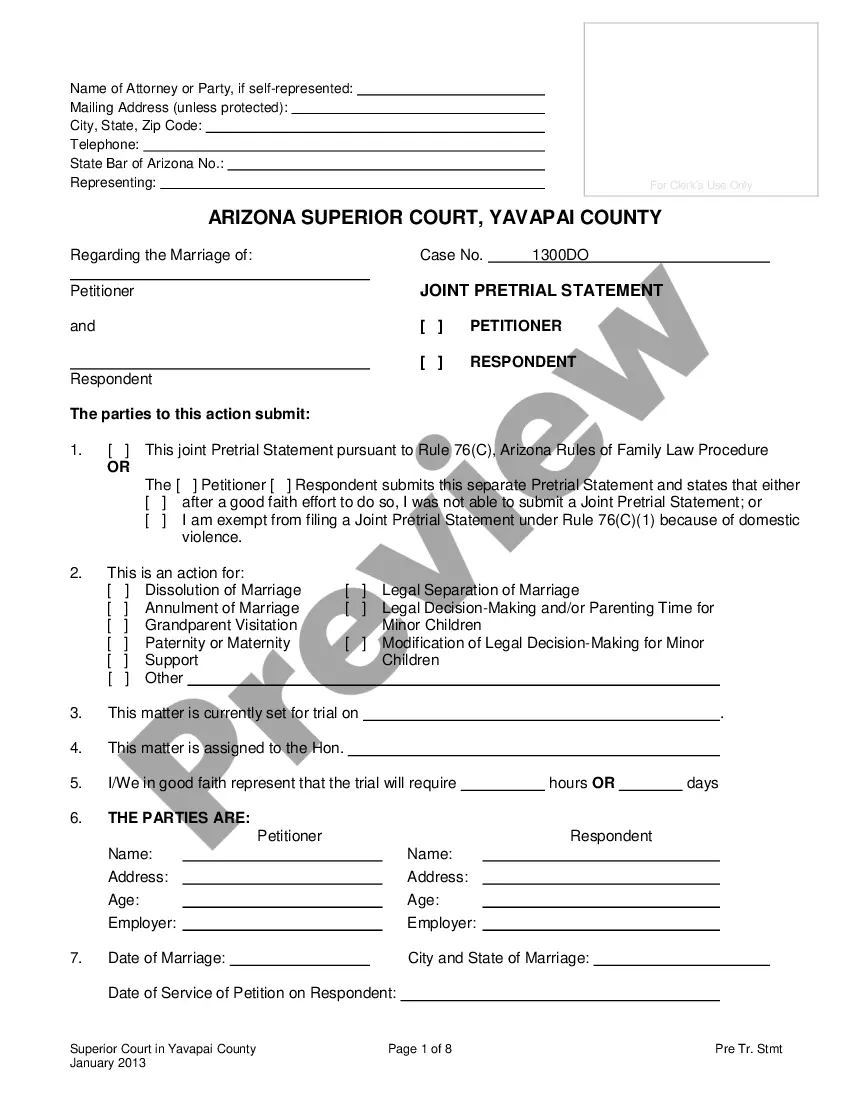

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

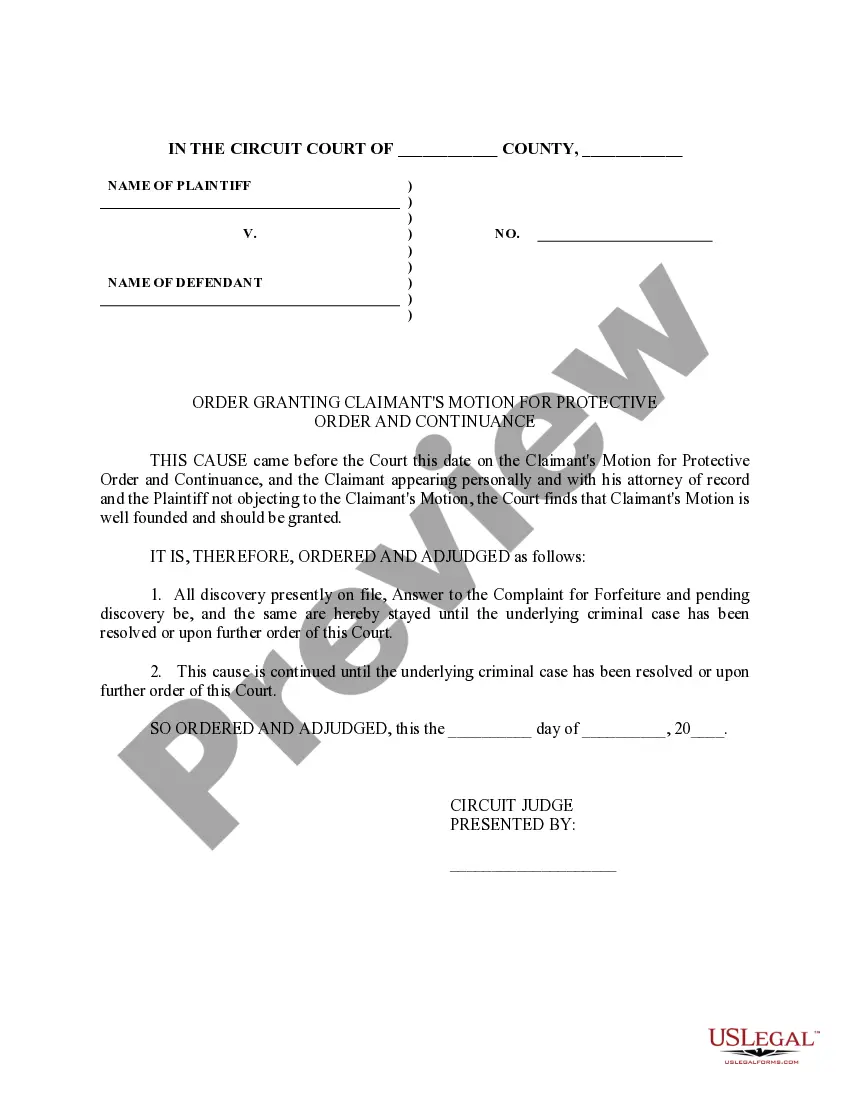

The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately.

How Virginia Tax is Calculated Va Taxable IncomeTax Calculation0 - $3,0002%$3,001 - $5,000$60 + 3% of excess over $3,000$5,001 - $17,000$120 + 5% of excess over $5,000$17,001 -$720 + 5.75% of excess over $17,000

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return.

If you paper filing, it is best the forms are not folded-- assures better scanning. But many people do fold and it generally works.