Virginia Self-Employed Lecturer - Speaker - Services Contract

Description

How to fill out Self-Employed Lecturer - Speaker - Services Contract?

US Legal Forms - one of the most important collections of legal documents in the USA - provides an extensive variety of legal form templates you can download or print. By using the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords. You can find the latest versions of forms like the Virginia Self-Employed Lecturer - Speaker - Services Agreement in seconds.

If you have an account, sign in and download the Virginia Self-Employed Lecturer - Speaker - Services Agreement from your US Legal Forms library. The Download option will be visible on every document you view. You can access all previously saved forms from the My documents section of your profile.

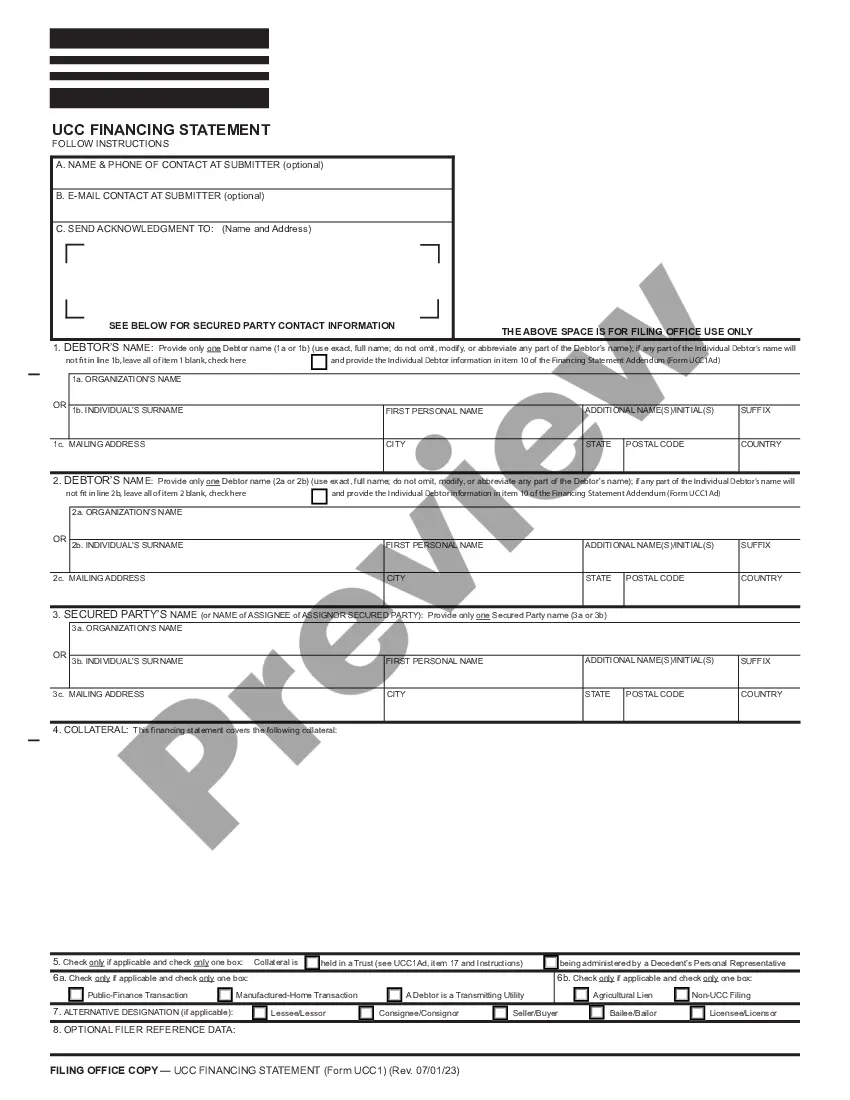

If you are using US Legal Forms for the first time, here are simple steps to get started: Make sure you have selected the correct form for your city/state. Click the Preview button to view the form's content. Read the form description to ensure you have chosen the right document. If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose your preferred payment plan and provide your credentials to register for an account. Process the transaction. Use a Visa or Mastercard or PayPal account to complete the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Virginia Self-Employed Lecturer - Speaker - Services Agreement. Each document you add to your account does not expire and belongs to you indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Virginia Self-Employed Lecturer - Speaker - Services Agreement with US Legal Forms, the most comprehensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Ensure you have selected the correct document.

- Use the preview option to review the content of the form.

- Process your payment securely.

- Modify and save your forms as needed.

Form popularity

FAQ

Determining a good speaking rate for a Virginia Self-Employed Lecturer - Speaker - Services Contract varies based on several factors, including experience, audience size, and event type. Generally, rates can range from $200 to $5,000 per engagement. As you establish your reputation and gather testimonials, you can adjust your rates accordingly. To navigate this process effectively, consider using platforms like US Legal Forms to create a clear and professional services contract that outlines your fees and services.

Starting July 1st, 2025, several new laws will take effect in Virginia, impacting various business practices, including those related to independent contractors. These changes may affect your Virginia Self-Employed Lecturer - Speaker - Services Contract and how you manage your engagements. Staying informed about these upcoming laws can help you adjust your business practices accordingly and ensure ongoing compliance.

The new independent contractor law in Virginia establishes guidelines for classifying workers as independent contractors. This law is particularly relevant for individuals in fields like lecturing or speaking, as it affects your Virginia Self-Employed Lecturer - Speaker - Services Contract. Understanding this law helps you navigate your rights and responsibilities as a self-employed professional.

In Virginia, you can perform a limited amount of work without a contractor license, generally defined as projects valued under a specific dollar amount. However, if your services fall under the Virginia Self-Employed Lecturer - Speaker - Services Contract, you may be exempt from licensing requirements, depending on the nature of your work. Always check local regulations to ensure you remain compliant while providing your services.

The new federal rule on independent contractors aims to clarify the classification between employees and independent contractors. This rule affects how workers are classified and could impact your Virginia Self-Employed Lecturer - Speaker - Services Contract. It's essential to understand these changes to ensure compliance and protect your business interests.

Virginia tax form 760C is the form used to calculate the credit for low-income individuals. If you earn income as a Virginia Self-Employed Lecturer - Speaker - Services Contract, you may qualify for this credit, which can reduce your tax liability. Completing this form accurately can provide significant financial benefits.

The 706 tax form is used to report estate taxes in the United States. If your estate exceeds a certain threshold, this form becomes necessary for compliance. Although it may not directly relate to your Virginia Self-Employed Lecturer - Speaker - Services Contract, understanding tax implications can help in effective estate planning.

For a contract to be legally binding in Virginia, it must have an offer, acceptance, and consideration. Additionally, the parties involved must have the legal capacity to enter into the agreement. If you're drafting a Virginia Self-Employed Lecturer - Speaker - Services Contract, ensure that all elements are present to protect your interests.

The 760, 760PY, and 763 forms are all related to individual income tax returns in Virginia. The 760 is for residents, the 760PY is for part-year residents, and the 763 is for non-residents. As a Virginia Self-Employed Lecturer - Speaker - Services Contract, knowing which form to file based on your residency status is crucial for accurate tax reporting.

In Virginia, seniors aged 65 or older may qualify for certain exemptions or deferrals regarding property taxes. If you are a Virginia Self-Employed Lecturer - Speaker - Services Contract and own property, understanding these benefits can help reduce your financial burden. It's advisable to check with your local tax assessor's office for specific eligibility requirements.