Virginia Self-Employed Wait Staff Services Contract

Description

How to fill out Self-Employed Wait Staff Services Contract?

Are you currently in a situation where you need to have documents for either business or personal reasons almost every workday.

There are numerous legal document templates available online, but locating versions you can rely on isn't easy.

US Legal Forms provides thousands of form templates, including the Virginia Self-Employed Wait Staff Services Contract, which are designed to meet federal and state requirements.

Once you find the correct form, click on Acquire now.

Choose the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virginia Self-Employed Wait Staff Services Contract at any time if needed. Simply click on the required form to download or print the document template. Use US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are currently familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Virginia Self-Employed Wait Staff Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the right city/region.

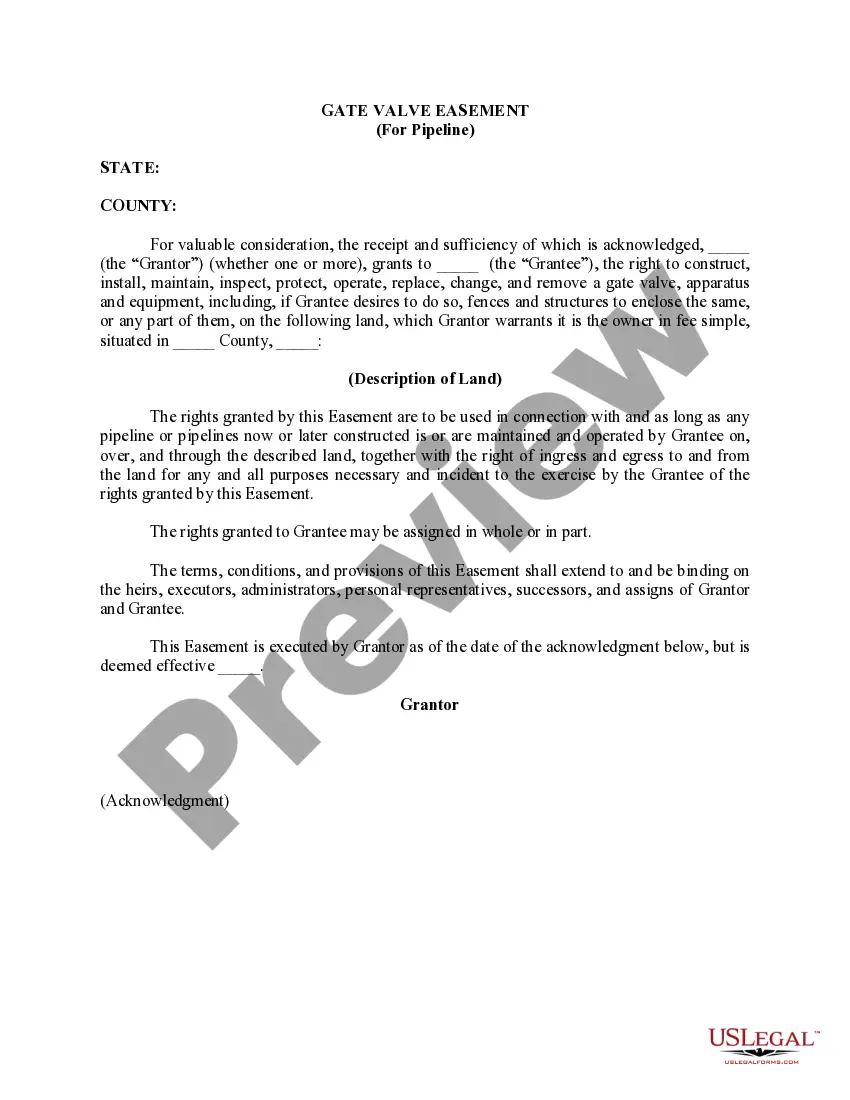

- Utilize the Preview feature to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup section to find the form that suits your needs.

Form popularity

FAQ

To write a self-employment contract, focus on specifying the nature of the work, payment arrangements, and deadlines. Also, consider adding terms related to confidentiality and liability. By utilizing a Virginia Self-Employed Wait Staff Services Contract template from uslegalforms, you can easily create a comprehensive contract that meets your needs.

When writing a self-employed contract, start with a clear description of the services you will provide. Include payment terms, timelines, and any necessary legal disclaimers. A Virginia Self-Employed Wait Staff Services Contract should protect your rights while also clarifying your obligations, making it essential to cover all bases.

To write a simple employment contract, begin by detailing the job title, responsibilities, and compensation. Include terms related to benefits, work hours, and termination procedures. If you're creating a Virginia Self-Employed Wait Staff Services Contract, ensure it reflects the unique aspects of self-employment to avoid any misunderstandings.

Writing a simple service contract involves outlining the services to be provided, payment terms, and deadlines. Make sure to specify any expectations and responsibilities of both parties. For your Virginia Self-Employed Wait Staff Services Contract, incorporating these elements will create a clear agreement that protects your interests.

To write a contract for a 1099 employee, start by defining the scope of work, payment structure, and duration of the contract. It's also important to include clauses that discuss confidentiality and any termination conditions. A well-crafted Virginia Self-Employed Wait Staff Services Contract can serve as a solid foundation, ensuring clarity and legal protection for both parties.

Yes, you can write your own legally binding contract. However, it's crucial to ensure that the contract meets all legal requirements in Virginia. A Virginia Self-Employed Wait Staff Services Contract should clearly outline the services provided, payment terms, and any other essential details. Using a platform like uslegalforms can simplify the process and help you create a compliant contract.

Yes, you can write your own service agreement, but it is crucial to ensure it includes all necessary elements. A Virginia Self-Employed Wait Staff Services Contract should cover payment terms, service details, and client responsibilities. For added assurance, consider using templates or services like uslegalforms to create a professional contract. This approach will help you avoid potential pitfalls.

While freelancing without a contract is possible, it is risky. A Virginia Self-Employed Wait Staff Services Contract protects your interests and clarifies project expectations. Without a contract, you might encounter payment issues or misunderstandings about deliverables. It's always best to have a formal agreement to safeguard your work.

If you are employed without a contract, you may face challenges in proving the terms of your work. A Virginia Self-Employed Wait Staff Services Contract would provide a clear outline of your duties and payment. Without it, you may find it difficult to resolve disputes or claim your rights. Therefore, ensure you have a written agreement in place.

To work as an independent contractor in the US, you typically need to register your business and obtain any necessary licenses. Additionally, having a Virginia Self-Employed Wait Staff Services Contract can streamline your client agreements. It's also wise to consult local regulations to ensure compliance. These steps will help you establish a professional presence.