Virginia Self-Employed Independent Contractor Payment Schedule

Description

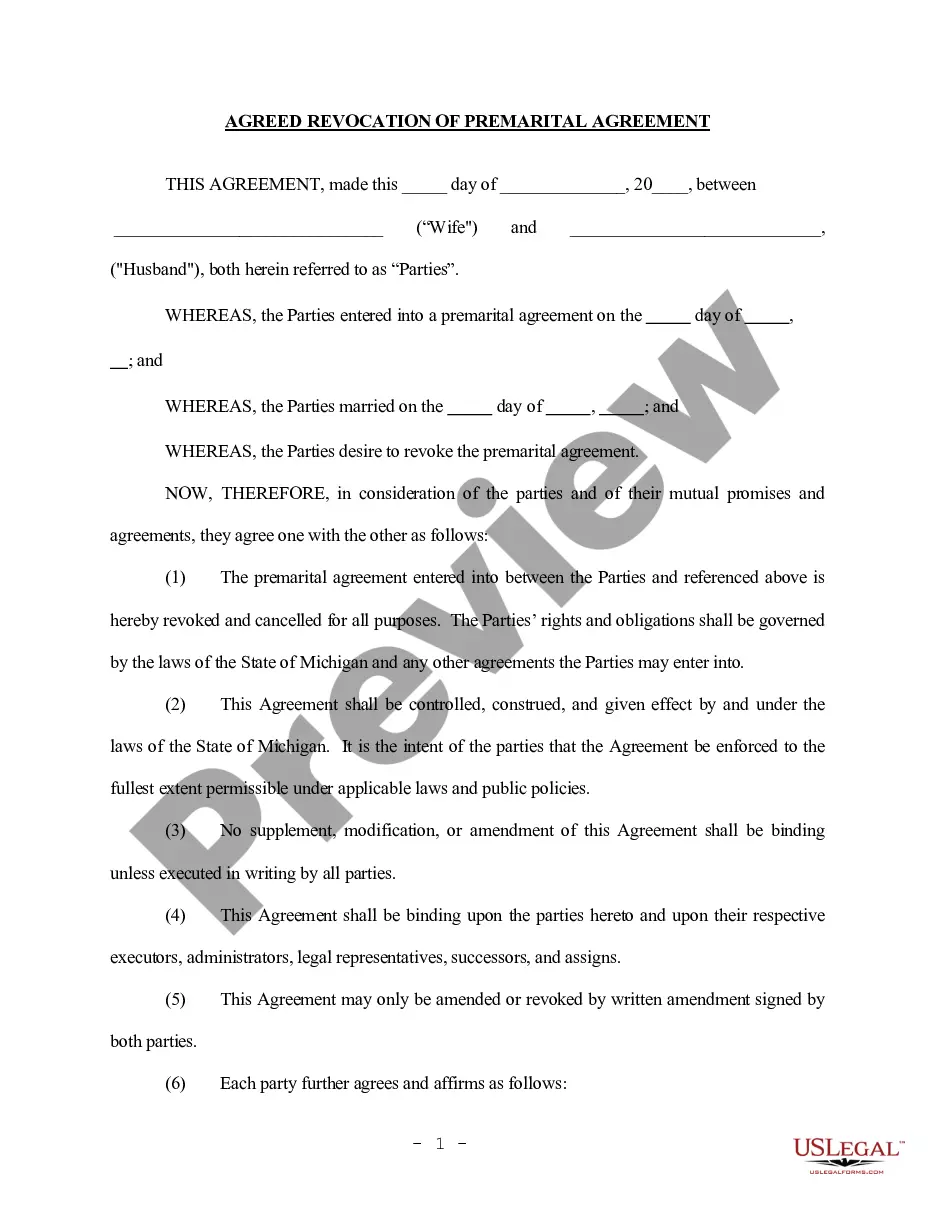

How to fill out Self-Employed Independent Contractor Payment Schedule?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a range of legal document samples that you can download or print. By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can retrieve the latest versions of forms like the Virginia Self-Employed Independent Contractor Payment Schedule in moments.

If you have an account, Log In and download the Virginia Self-Employed Independent Contractor Payment Schedule from the US Legal Forms library. The Download button will show up on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your city/county. Click on the Preview button to examine the form’s content. Review the form summary to ensure you have chosen the right form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. When you are content with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to register for an account. Process the payment. Use a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Edit. Fill out, modify and print and sign the downloaded Virginia Self-Employed Independent Contractor Payment Schedule. Every template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the form you need.

- Access the Virginia Self-Employed Independent Contractor Payment Schedule with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

Setting up a payment plan for Virginia state taxes involves filling out the necessary forms and providing required details to the state tax office. You can propose a payment schedule that aligns with your financial situation, particularly if you follow a Virginia Self-Employed Independent Contractor Payment Schedule. Be proactive, and don’t hesitate to use US Legal Forms for streamlined assistance in this process.

To request a payment plan for taxes owed, reach out to the Virginia Department of Taxation directly. You'll need to provide your tax information and explain your financial situation. Creating a Virginia Self-Employed Independent Contractor Payment Schedule will assist in showing your payment capabilities. Consider using resources from US Legal Forms to ensure you submit your request correctly.

Yes, Virginia offers payment plans for individuals who owe state taxes. By creating a Virginia Self-Employed Independent Contractor Payment Schedule, you can manage your payments effectively over time. It's essential to contact the Virginia Department of Taxation to discuss your eligibility and the required documentation. US Legal Forms can help guide you through this process.

Virginia recently updated its laws regarding independent contractors, aiming to provide clearer definitions and protections for these workers. This change helps distinguish between employees and independent contractors, impacting how payments and benefits are handled. Implementing a Virginia Self-Employed Independent Contractor Payment Schedule becomes vital under these laws, ensuring both contractors and clients understand their rights and responsibilities. Stay informed about these developments to navigate your work effectively.

Independent contractors usually negotiate payment terms directly with their clients, with common arrangements involving milestones or deliverables. For example, a contractor may receive a partial payment upfront alongside the completion of key project phases. Implementing a Virginia Self-Employed Independent Contractor Payment Schedule can help establish these terms in writing. This clarity benefits both parties by ensuring timely payments and reducing potential disputes.

For contractors in Virginia, the typical payment term often ranges from 15 to 45 days after the submission of an invoice. This timeframe allows clients to process payments while ensuring that contractors receive timely compensation for their work. Utilizing a Virginia Self-Employed Independent Contractor Payment Schedule can help you maintain clear expectations regarding the payment process and timelines. Open communication with your clients about these terms is essential for a positive working relationship.

When working as a 1099 contractor, payment terms vary based on the contract between you and the client. Typically, payments are processed after work is completed, and many contractors use a Virginia Self-Employed Independent Contractor Payment Schedule to outline these terms. It's common for clients to specify payment dates, such as within 30 days of invoice receipt. Always ensure your payment terms are clear to avoid any misunderstandings.

To report payments made to an independent contractor, you'll want to complete Form 1099-NEC if you have issued $600 or more during the tax year. This form captures necessary details about the contractor and ensures proper reporting in compliance with the Virginia Self-Employed Independent Contractor Payment Schedule. Make sure to provide a copy to the contractor and file it with the IRS.

As an independent contractor, you can receive payments through various methods, such as bank transfers, checks, or online payment platforms. Utilizing a reliable payment solution not only streamlines the payment process but also helps keep track of your finances in line with the Virginia Self-Employed Independent Contractor Payment Schedule. Choose a method that is convenient for both you and your clients.

Yes, Virginia typically requires self-employed individuals, including independent contractors, to make quarterly estimated tax payments. These payments help you stay on track with your tax obligations, aligning with the Virginia Self-Employed Independent Contractor Payment Schedule. Make sure to assess your income accurately to determine the right payment amounts.