Virginia Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

Are you currently situated in a location where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy ones isn't easy.

US Legal Forms provides thousands of form templates, including the Virginia Tutoring Agreement - Self-Employed Independent Contractor, which can be crafted to meet federal and state requirements.

When you find the correct form, click Buy now.

Choose the payment plan you prefer, fill in the required information to create your account, and make your purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Virginia Tutoring Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

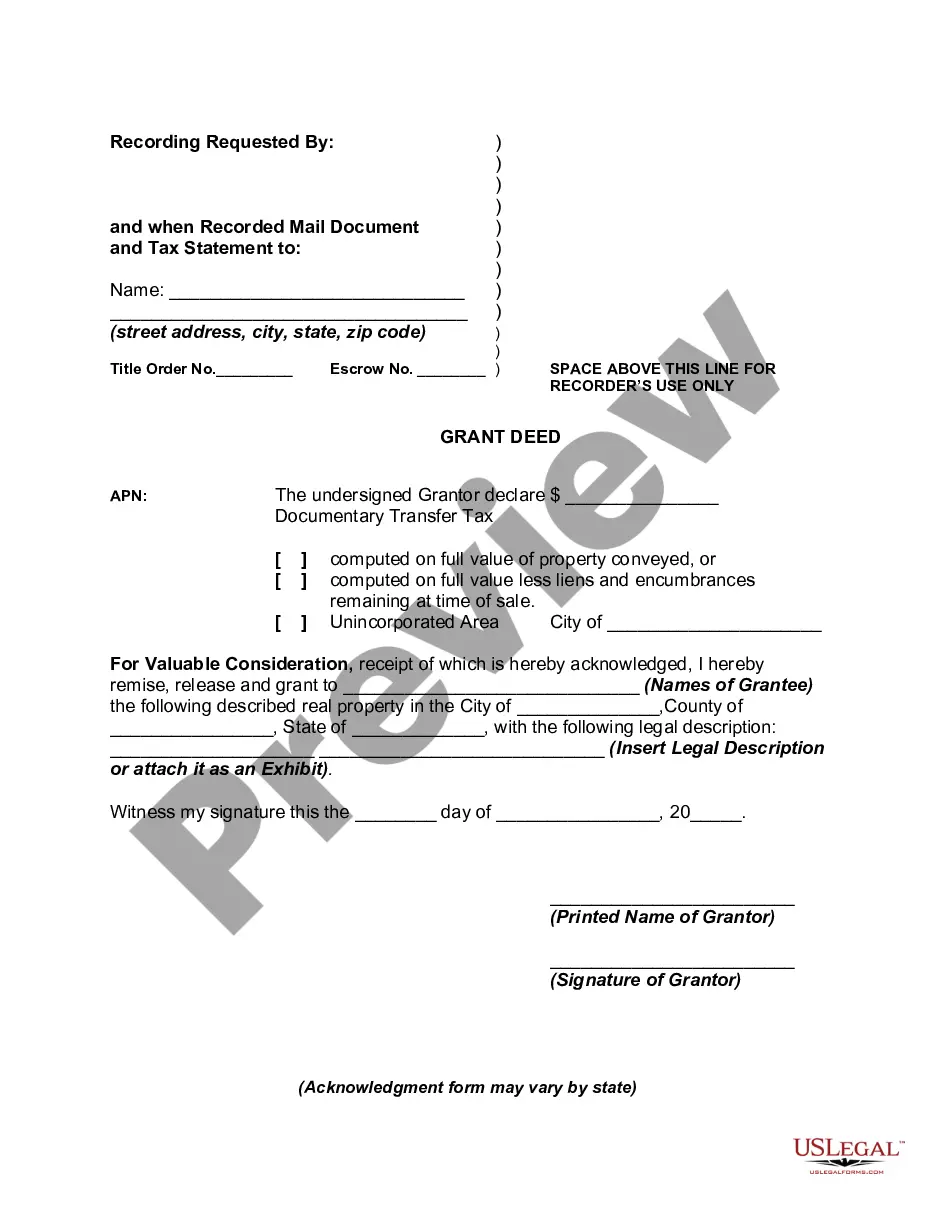

- Use the Preview button to examine the form.

- Read the description to make sure you have selected the right form.

- If the form isn't what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

To write a tutoring contract, start by specifying the tutoring services you will provide, including subject matter and duration. Outline payment terms, including rates and payment schedule, and address cancellation policies. Finally, both parties should review and sign the contract to ensure mutual understanding. For guidance, you can explore uslegalforms to create a structured Virginia Tutoring Agreement - Self-Employed Independent Contractor.

Yes, private tutoring often qualifies as self-employment since tutors operate independently to provide educational services. As a self-employed individual, you manage your own business expenses and set your own rates. This classification enables you to establish a Virginia Tutoring Agreement - Self-Employed Independent Contractor, which ensures clarity about your roles and responsibilities.

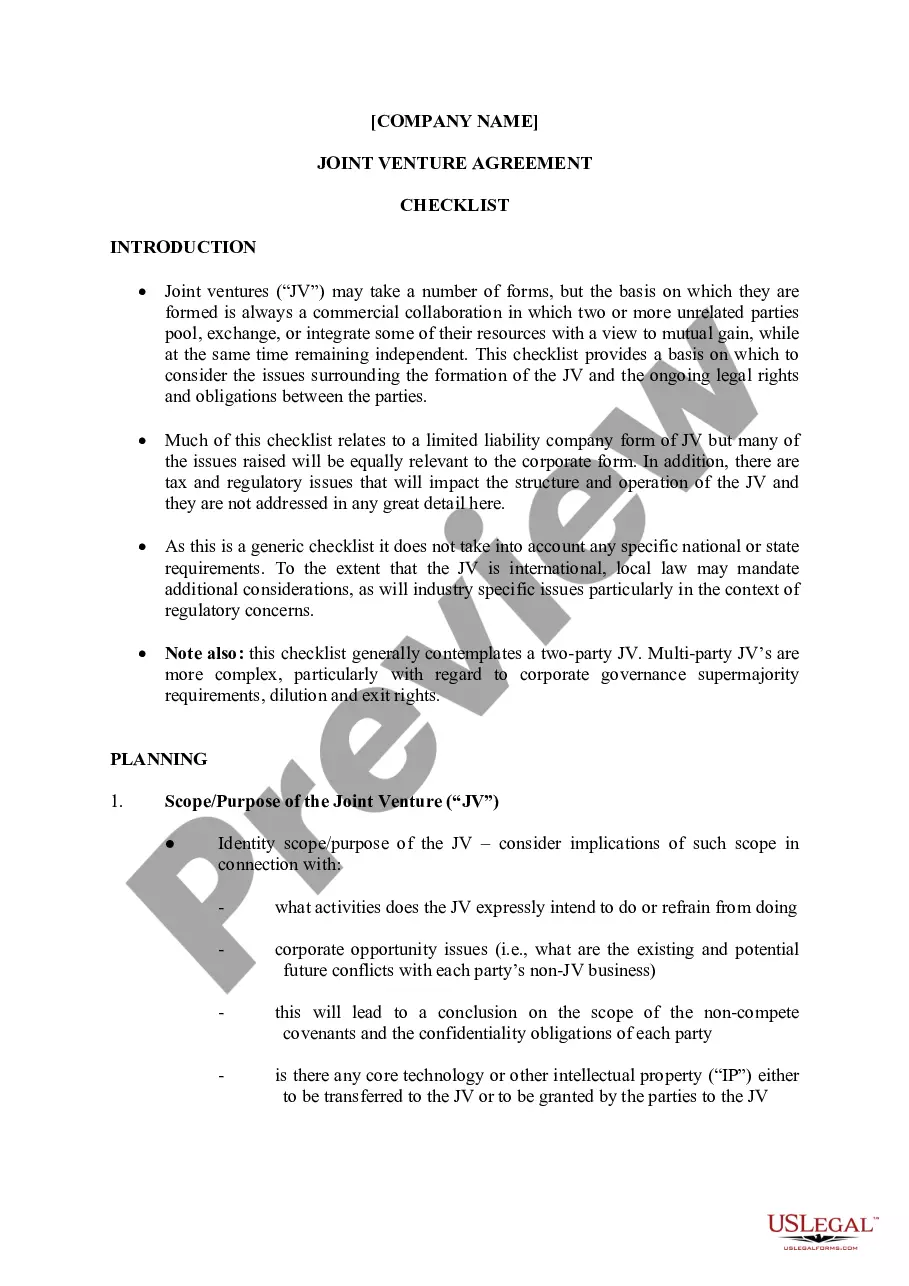

Writing an independent contractor agreement requires outlining the scope of work along with payment rates and deadlines. Clearly state the nature of the relationship, noting that the contractor is not an employee and is responsible for their own taxes. Include any confidentiality clauses and dispute resolution steps. Uslegalforms offers user-friendly resources to help you draft your Virginia Tutoring Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement involves clearly defining the services to be provided and the compensation structure. Include start and end dates, payment terms, and any specific expectations regarding performance. Make sure both parties sign the agreement to validate its terms. For assistance, visit uslegalforms to access templates that specifically cover Virginia Tutoring Agreement - Self-Employed Independent Contractor.

To fill out an independent contractor form, first gather the necessary information such as your name, address, and Social Security number. Next, provide details about your services, payment structure, and timeline for completion. Always ensure that all sections are completed clearly and accurately. For comprehensive forms, consider using uslegalforms for easy-to-understand templates tailored to Virginia Tutoring Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement is a straightforward process. Start by defining the scope of work, payment terms, and duration of the contract. You can streamline this process by using templates available on platforms like US Legal Forms, ensuring that your Virginia Tutoring Agreement - Self-Employed Independent Contractor meets all necessary legal requirements.

Yes, a private tutor often operates as a self-employed independent contractor. This means they have the freedom to set their rates, choose their clients, and determine their schedules. When establishing a Virginia Tutoring Agreement - Self-Employed Independent Contractor, it's essential to outline the terms clearly to protect both the tutor and the student.

Tutors who work as independent contractors typically receive a Form 1099, rather than a W-2 like traditional employees. This classification reflects their independent status and tax responsibilities. Utilizing a Virginia Tutoring Agreement - Self-Employed Independent Contractor allows tutors and their clients to establish clear roles regarding payment and tax reporting, ensuring compliance with IRS regulations.

A tutor can be classified as an independent contractor if they offer services using their own methods, schedule, and tools. They usually have a contractual relationship with their clients, separate from traditional employee roles. To formalize this arrangement, a Virginia Tutoring Agreement - Self-Employed Independent Contractor is beneficial for both parties.

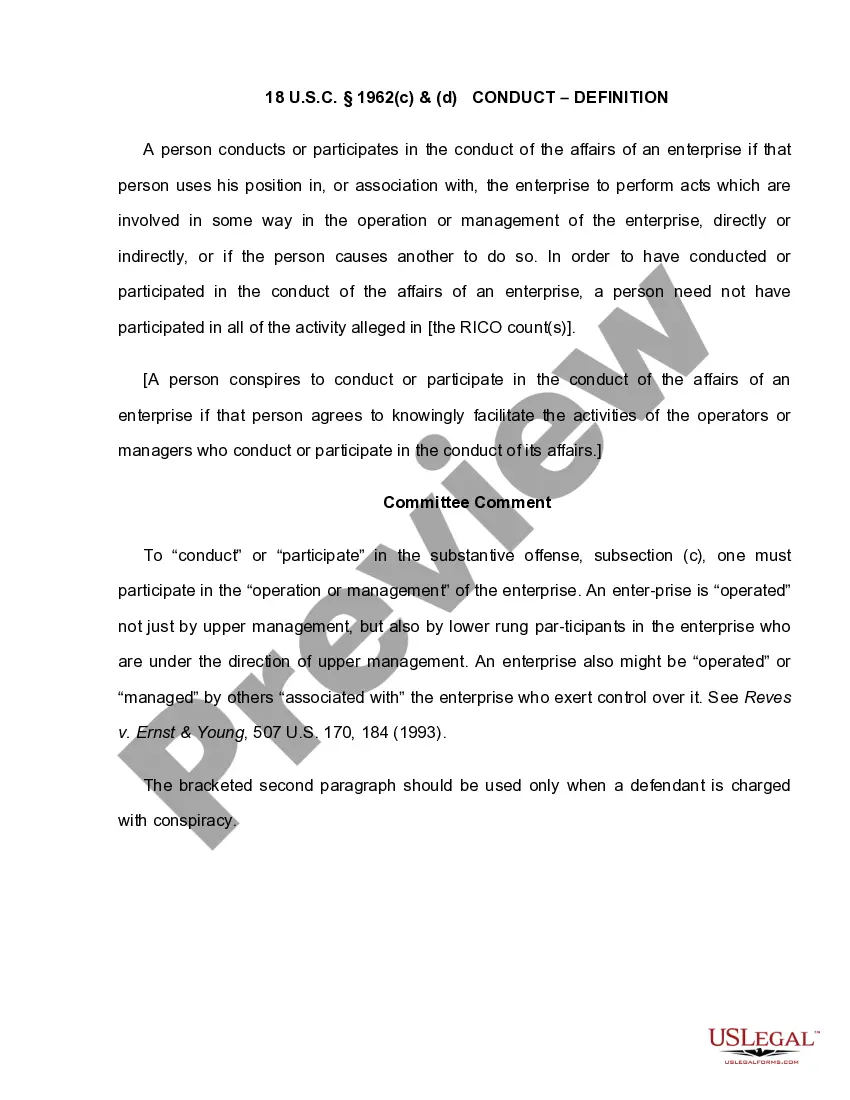

An independent contractor is a person who provides services under a contract and operates independently, without being an employee of a company. They manage their own business, make decisions on work methods, and are responsible for their taxes. Having a clearly defined Virginia Tutoring Agreement - Self-Employed Independent Contractor can help clarify your status and obligations.