Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

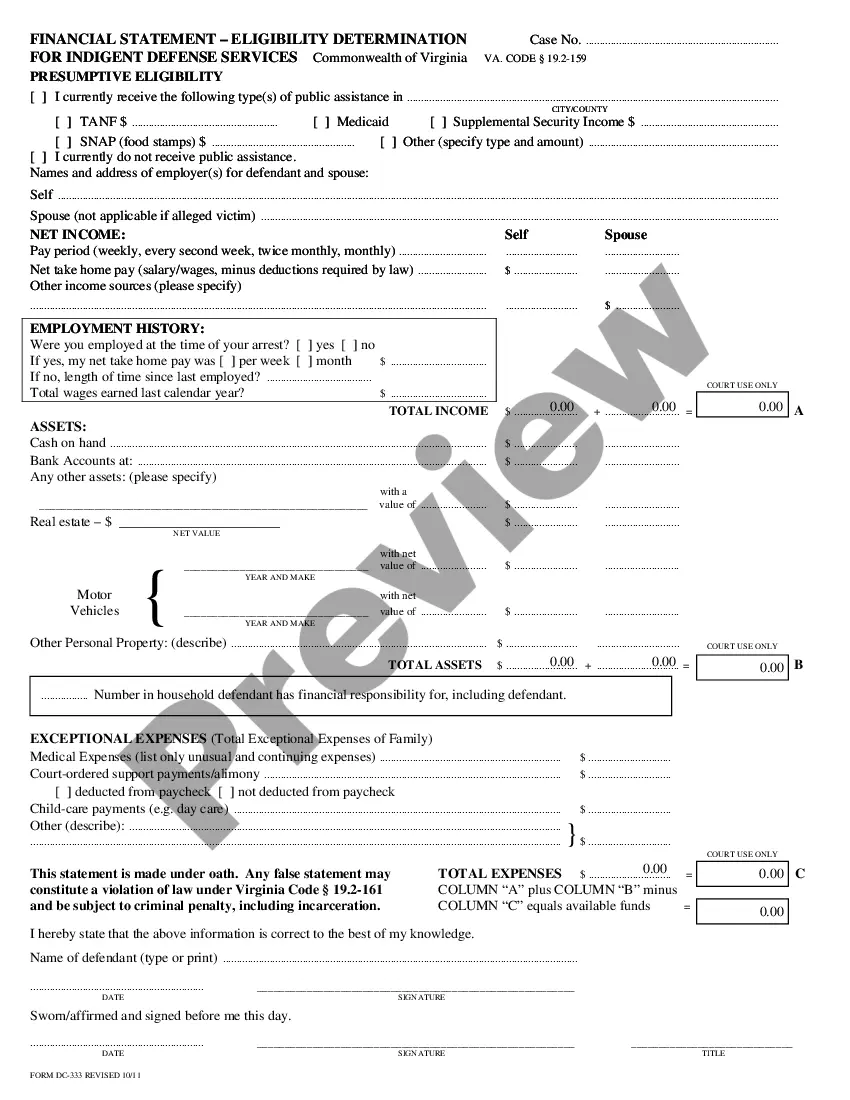

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can quickly obtain the latest versions of forms such as the Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor.

If you hold a subscription, Log In and retrieve the Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the payment.

Choose the format and download the form onto your device. Edit. Fill out, modify, print, and sign the downloaded Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor. Each format you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire. Access the Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to assist you.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to verify the content of the form.

- Check the description of the form to confirm you have chosen the correct one.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Yes, having a contract is essential for independent contractors to establish clear terms of engagement. A well-structured contract protects your rights and outlines expectations for work under agreements like the Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor. It also provides legal backing should disputes arise, ensuring you maintain professional relationships. Utilizing resources from platforms like uslegalforms can help you draft effective contracts.

The new independent contractor law in Virginia focuses on clarifying the classification of workers to protect their rights and interests. This law outlines the criteria for determining whether a worker qualifies as an independent contractor. For those involved in a Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor, understanding these regulations is essential to ensure compliance. Keeping informed will help you navigate the changing landscape of labor laws.

The new federal rule regarding independent contractors aims to better define their employment status, impacting various industries significantly. This rule seeks to ensure fair wages and benefits for workers classified as independent contractors. Adhering to this federal regulation is crucial, especially if you engage in a Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor, as it could alter your responsibilities. Staying updated will assist you in maintaining compliance with labor laws.

Starting July 1st, 2025, Virginia will introduce new regulations affecting independent contractors. These laws will emphasize fair treatment and define independent contractor relationships more clearly. Understanding these new laws is vital for those engaged in work under a Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor. Staying informed will help you comply and adapt your practices accordingly.

To terminate a contract with an independent contractor, first, review the terms outlined in your Virginia Cable Disconnect Service Contract - Self-Employed Independent Contractor. Ensure you meet any notice requirements specified in the contract. Communicate directly with the contractor to discuss the termination, and provide written notice for clarity and record-keeping. This process helps maintain professionalism while concluding your business relationship.

Do I really need to get a business license in Virginia? Yes! It's true that a lot of self-employed individuals, particularly those who work from home, never get a state or local Virginia business license.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.