Virginia Grant Agreement

Description

How to fill out Grant Agreement?

Are you currently in a position in which you need paperwork for sometimes enterprise or personal purposes almost every day time? There are a lot of legal document templates available on the net, but finding versions you can rely isn`t straightforward. US Legal Forms provides 1000s of kind templates, much like the Virginia Grant Agreement, that are created to fulfill federal and state needs.

If you are presently familiar with US Legal Forms internet site and have an account, just log in. Next, it is possible to download the Virginia Grant Agreement template.

If you do not provide an profile and wish to start using US Legal Forms, adopt these measures:

- Find the kind you want and make sure it is for your proper town/region.

- Utilize the Preview button to review the shape.

- Read the description to ensure that you have selected the appropriate kind.

- If the kind isn`t what you`re looking for, utilize the Research discipline to find the kind that meets your requirements and needs.

- If you find the proper kind, click Buy now.

- Select the rates prepare you desire, submit the required details to create your money, and buy the transaction using your PayPal or charge card.

- Decide on a convenient document format and download your version.

Discover each of the document templates you may have bought in the My Forms food selection. You may get a further version of Virginia Grant Agreement whenever, if necessary. Just select the required kind to download or produce the document template.

Use US Legal Forms, probably the most considerable variety of legal varieties, in order to save time and avoid mistakes. The support provides skillfully made legal document templates which can be used for a variety of purposes. Create an account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

A federal grant in aid is federal money granted to a recipient to fund a project or program. Federal grants in aid are not loans and therefore require no repayment. Federal grants can be awarded to university faculty members to pursue a particular line of research.

Athletic-Grant-In-Aid: Financial Aid that consists of tuition, books, fees and room & board, note that transportation and miscellaneous are not included in this figure. Counter: An individual who is receiving institutional financial aid that is countable against the aid limitations in a sport.

Grant-in-aid: An athletic grant-in-aid (also called financial aid or an athletic scholarship) is a financial aid agreement made between an athlete and his or her head coach.

That amount is based on the value of a full scholarship or what we call, a Full Grant-In-Aid (FGIA). A FGIA is financial aid that consists of tuition, permissible fees, room, board, textbooks, and other expenses related to attendance at the institution up to the cost of attendance (COA).

A grant is a form of financial aid that doesn't have to be repaid (unless, for example, you withdraw from school and owe a refund, or you receive a TEACH Grant and don't complete your service obligation).

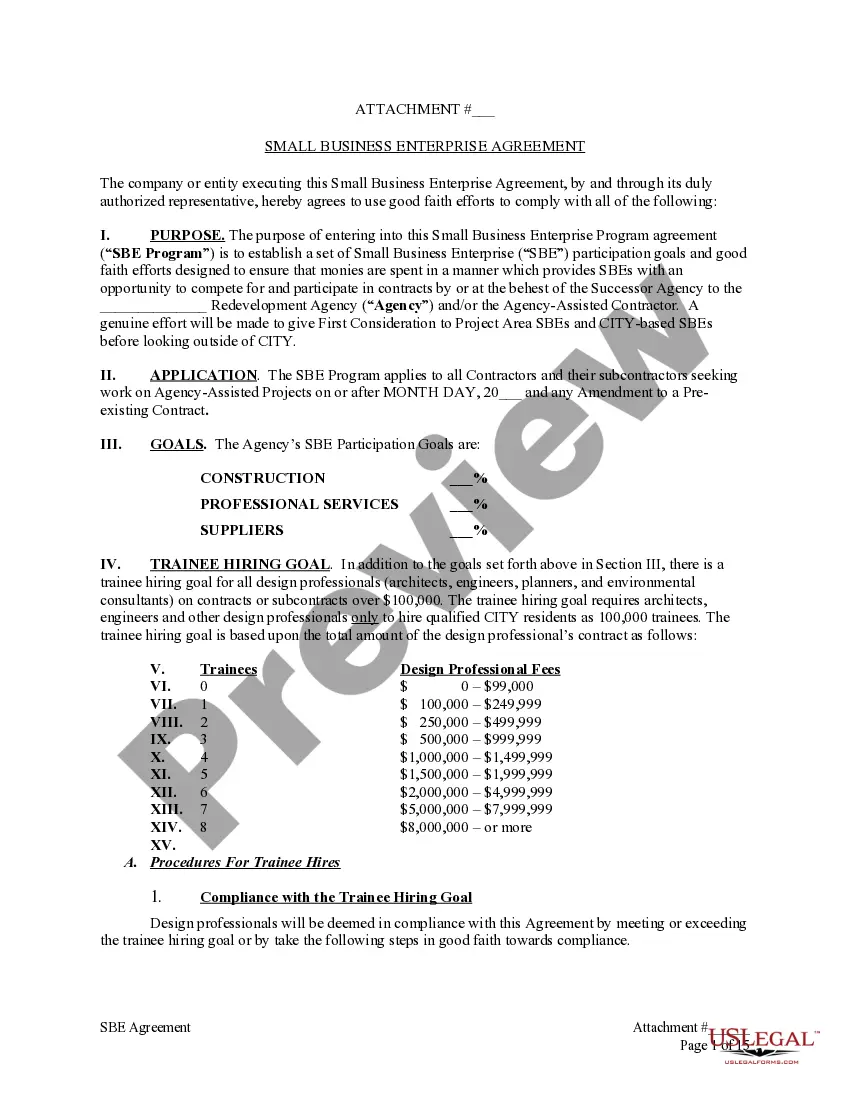

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.

Applicants must reside in an approved residence and meet a variety of other criteria. Initially designed only for persons receiving Supplemental Security Income (SSI), in recent years the eligibility criteria have become less restrictive and today persons with income over $771 per month can receive assistance.

ARPA is a federal grant derived from the American Rescue Plan Act for undergraduate Virginia residents. You must enroll for 6 or more credits per term and be making satisfactory academic progress to receive this award. ARPA funding is only expected to be available for this Aid Year (2022-2023).