Virginia Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample

Description

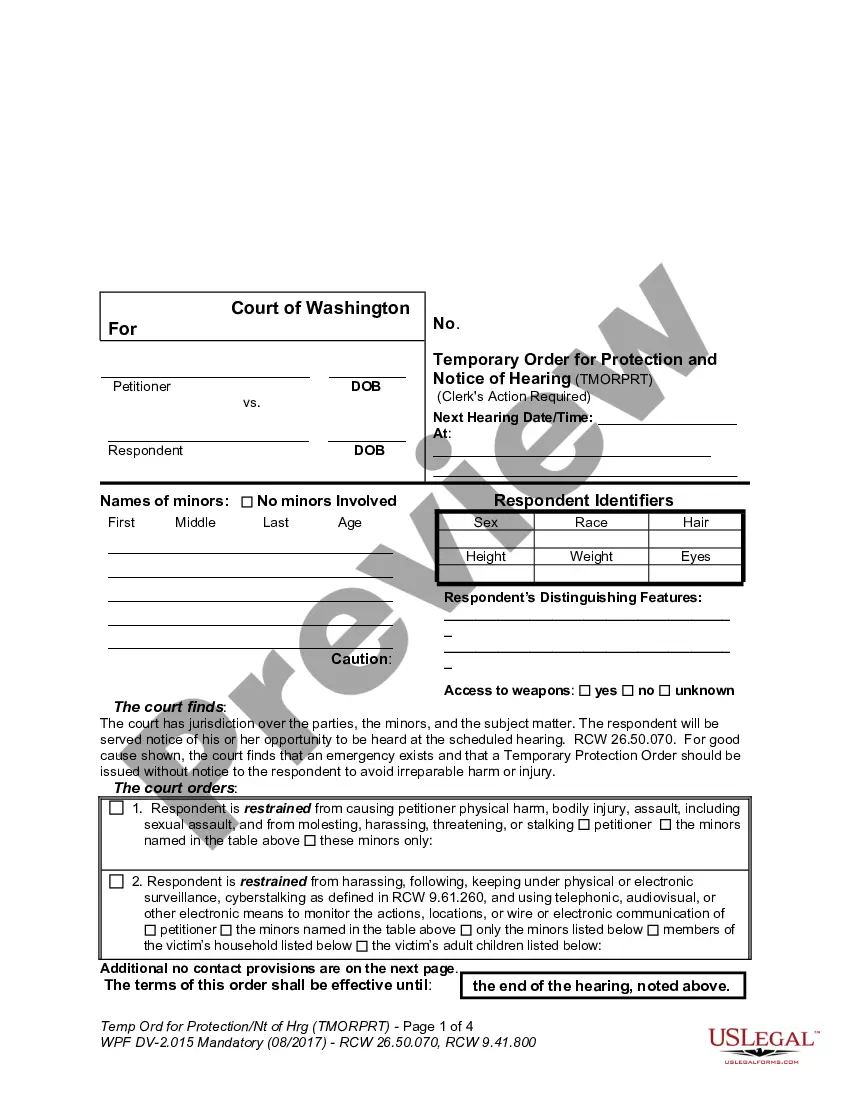

How to fill out Sample Asset Purchase Agreement Between MPI Of Northern Florida And Venturi Technologies, Inc. Regarding The Sale And Purchase Of Assets - Sample?

US Legal Forms - one of the greatest libraries of authorized varieties in America - provides a wide array of authorized file web templates you can download or printing. Making use of the internet site, you can get 1000s of varieties for organization and specific reasons, categorized by classes, claims, or keywords.You will find the most up-to-date variations of varieties just like the Virginia Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample in seconds.

If you currently have a monthly subscription, log in and download Virginia Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample through the US Legal Forms collection. The Acquire option will appear on each kind you see. You have access to all earlier downloaded varieties in the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed here are simple instructions to help you began:

- Be sure you have chosen the best kind for the town/area. Click on the Review option to analyze the form`s content material. Read the kind information to ensure that you have selected the correct kind.

- If the kind doesn`t fit your specifications, make use of the Research area towards the top of the screen to find the one who does.

- If you are happy with the shape, confirm your option by clicking the Purchase now option. Then, opt for the rates plan you favor and provide your references to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to accomplish the purchase.

- Find the structure and download the shape on your product.

- Make adjustments. Complete, edit and printing and sign the downloaded Virginia Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample.

Every template you included with your money lacks an expiry date which is your own property forever. So, if you want to download or printing another backup, just proceed to the My Forms portion and then click around the kind you want.

Get access to the Virginia Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample with US Legal Forms, the most considerable collection of authorized file web templates. Use 1000s of professional and condition-specific web templates that fulfill your organization or specific demands and specifications.

Form popularity

FAQ

An Asset Purchase Agreement (APA) is a contract that spells out the terms of the sale in precise detail. It is a legally binding agreement that formalizes the price, deal structure, terms, and other aspects of the transaction. All in all, it is one of the most important legal documents during the acquisition process.

The answer is pretty simple. In an equity purchase, the big company assumes the assets AND the liabilities of the company they buy, vs in an asset purchase they only buy the assets and the liabilities stay with the owners of the purchased company. Asset Sales Vs Equity Purchases, the Aquirers' Perspective kruzeconsulting.com ? asset-sale-vs-equity-purchase kruzeconsulting.com ? asset-sale-vs-equity-purchase

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

A membership interest represents a member's ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC. Ownership in an LLC can be expressed by percentage ownership interest or membership units. LLC Membership Interest: Everything You Need to Know - UpCounsel upcounsel.com ? llc-membership-interest upcounsel.com ? llc-membership-interest

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate. What Are the Differences Between an Asset Purchase and a Stock ... briskinlaw.com ? what-are-the-differences-b... briskinlaw.com ? what-are-the-differences-b...

A MIPA sells the membership interest of the LLC. This is different from an Asset Purchase Agreement (APA) where only specific assets and not liabilities of the company are sold. When the membership interest of an LLC is purchased, both assets and liabilities are transferred from seller to buyer.

An ?SPA? is a ?Stock Purchase Agreement.? This is similar to a MIPA, but is used to transfer stock in a corporation, rather than membership interests in an LLC. The key terms in the SPA will include a purchase price, representations and warranties of both parties, and instructions for closing. Business Law Acronyms Part Three - Smith + Malek smithmalek.com ? business-law-acronyms-p... smithmalek.com ? business-law-acronyms-p...