Virginia Joint Filing Agreement

Description

How to fill out Joint Filing Agreement?

It is possible to commit several hours on the web trying to find the lawful papers design which fits the federal and state requirements you require. US Legal Forms provides a huge number of lawful types that happen to be examined by specialists. It is possible to down load or print out the Virginia Joint Filing Agreement from my service.

If you already have a US Legal Forms accounts, you can log in and click the Obtain switch. After that, you can full, edit, print out, or sign the Virginia Joint Filing Agreement. Each lawful papers design you purchase is your own property for a long time. To get one more version of the obtained develop, visit the My Forms tab and click the related switch.

If you work with the US Legal Forms web site for the first time, keep to the basic recommendations under:

- Very first, make sure that you have selected the best papers design for the area/town that you pick. Browse the develop explanation to make sure you have picked out the appropriate develop. If accessible, use the Preview switch to check through the papers design too.

- If you want to get one more edition in the develop, use the Lookup area to obtain the design that suits you and requirements.

- Once you have located the design you desire, simply click Acquire now to move forward.

- Pick the prices program you desire, key in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal accounts to purchase the lawful develop.

- Pick the file format in the papers and down load it to the system.

- Make modifications to the papers if necessary. It is possible to full, edit and sign and print out Virginia Joint Filing Agreement.

Obtain and print out a huge number of papers themes utilizing the US Legal Forms Internet site, that provides the most important collection of lawful types. Use professional and express-distinct themes to take on your business or personal needs.

Form popularity

FAQ

Married Couple with Dependents If you claim 0 allowances or 1 allowance, you'll most likely have a very high tax refund. Claiming 2 allowances will most likely result in a moderate tax refund.

Hear this out loud PauseIf you forget to include a W2 on your tax return, the IRS may reject it. You should check with your employer to ensure they sent it to you. If they did, the next step is to gather all the necessary information and resubmit your return with the missing W2.

Make sure you: Sign your tax return. If you're filing a joint return both people must sign the return. Make sure your name, address, and social security number(s) are correct. Check your math. Attach a copy of your federal return (if not using form 540 2EZ) Attach a copy of your W-2. File your original return, not a copy.

Since filing joint taxes entitles a couple to a larger tax return, the IRS will automatically deem your non-consensual joint tax return to be fraudulent. If your spouse intentionally filed such a return, he or she may be subject to substantial financial penalties.

Hear this out loud PauseIf You're Mailing Your Tax Return, Staple It Properly Staple one copy of each of your W-2 statements to the front of your tax return if you're mailing in a paper copy.

Hear this out loud PauseYou are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

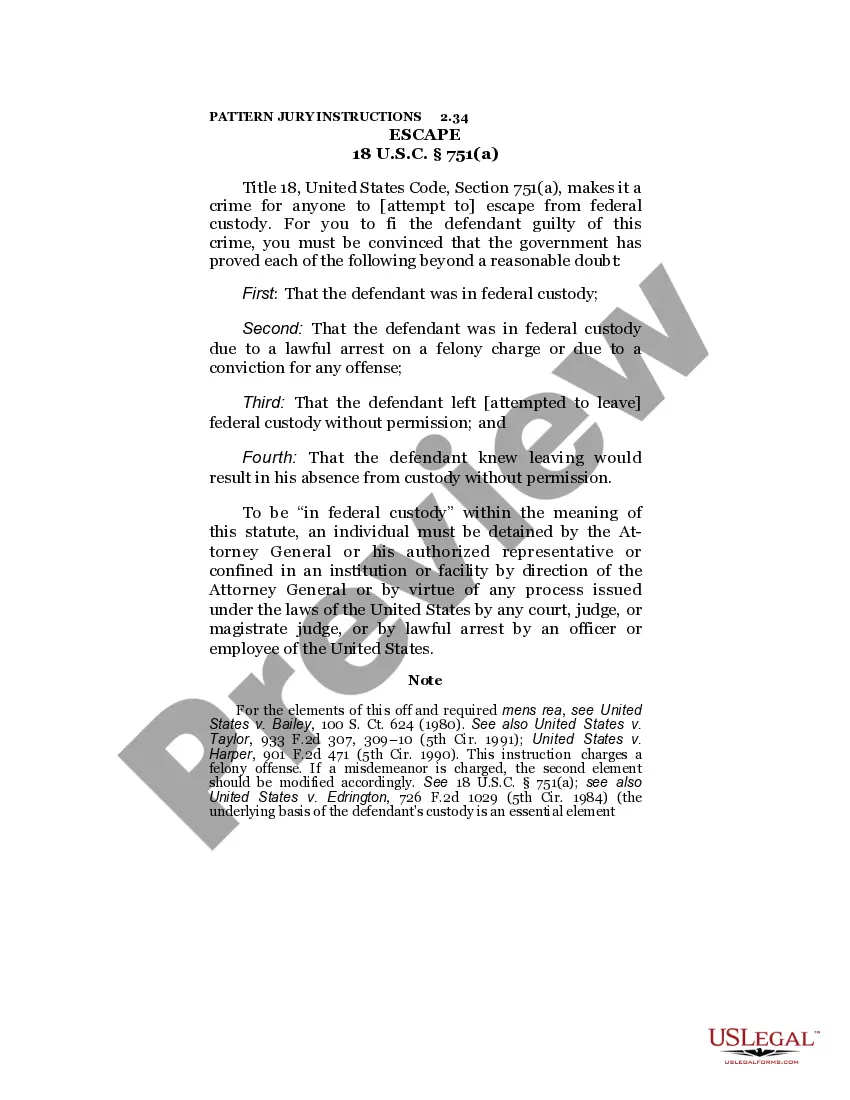

How Virginia Tax is Calculated Va Taxable IncomeTax Calculation0 - $3,0002%$3,001 - $5,000$60 + 3% of excess over $3,000$5,001 - $17,000$120 + 5% of excess over $5,000$17,001 -$720 + 5.75% of excess over $17,000