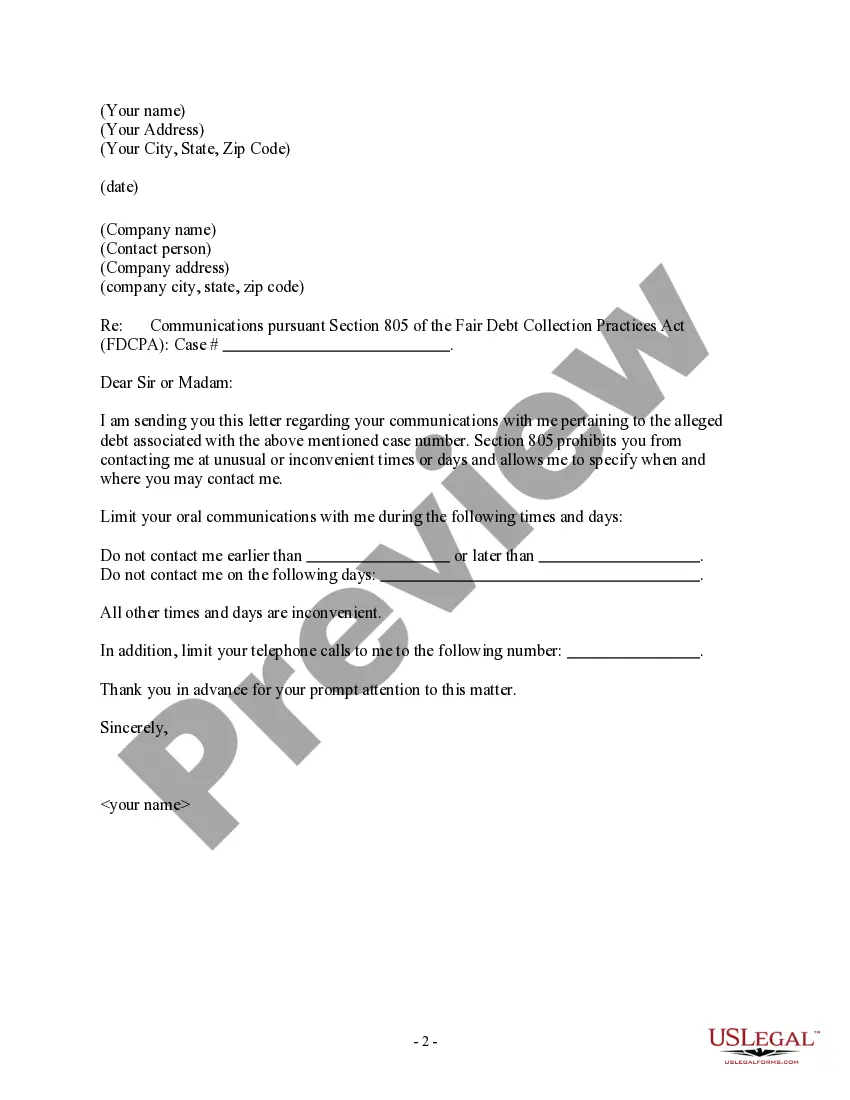

Virginia Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Selecting the appropriate official document template can be challenging.

Of course, there are numerous templates available online, but how can you find the official document you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Virginia Letter to Debt Collector - Only contact me on the specified days and times, for both business and personal use.

You can browse the form using the Preview button and read the form description to confirm it's the right one for you.

- All forms are reviewed by professionals and comply with federal and state laws.

- If you are already registered, sign in to your account and click the Download button to get the Virginia Letter to Debt Collector - Only contact me on the specified days and times.

- Use your account to check the legal forms you have previously ordered.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

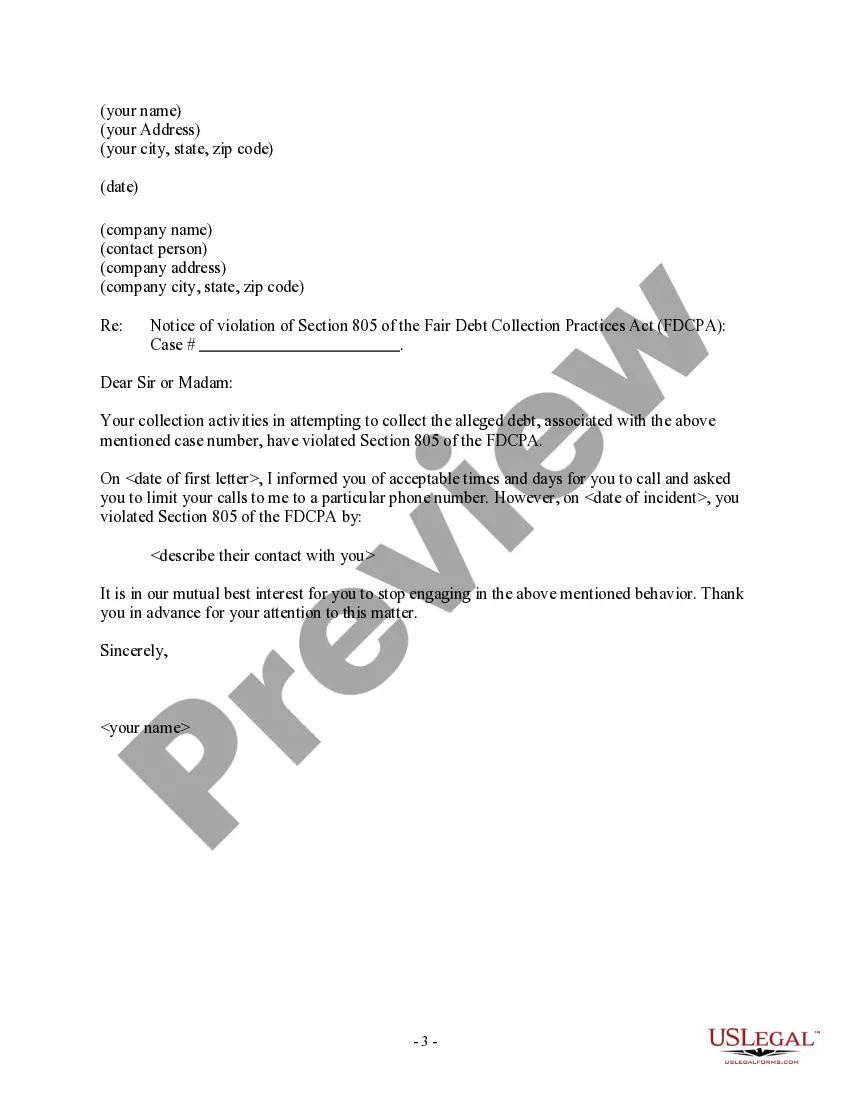

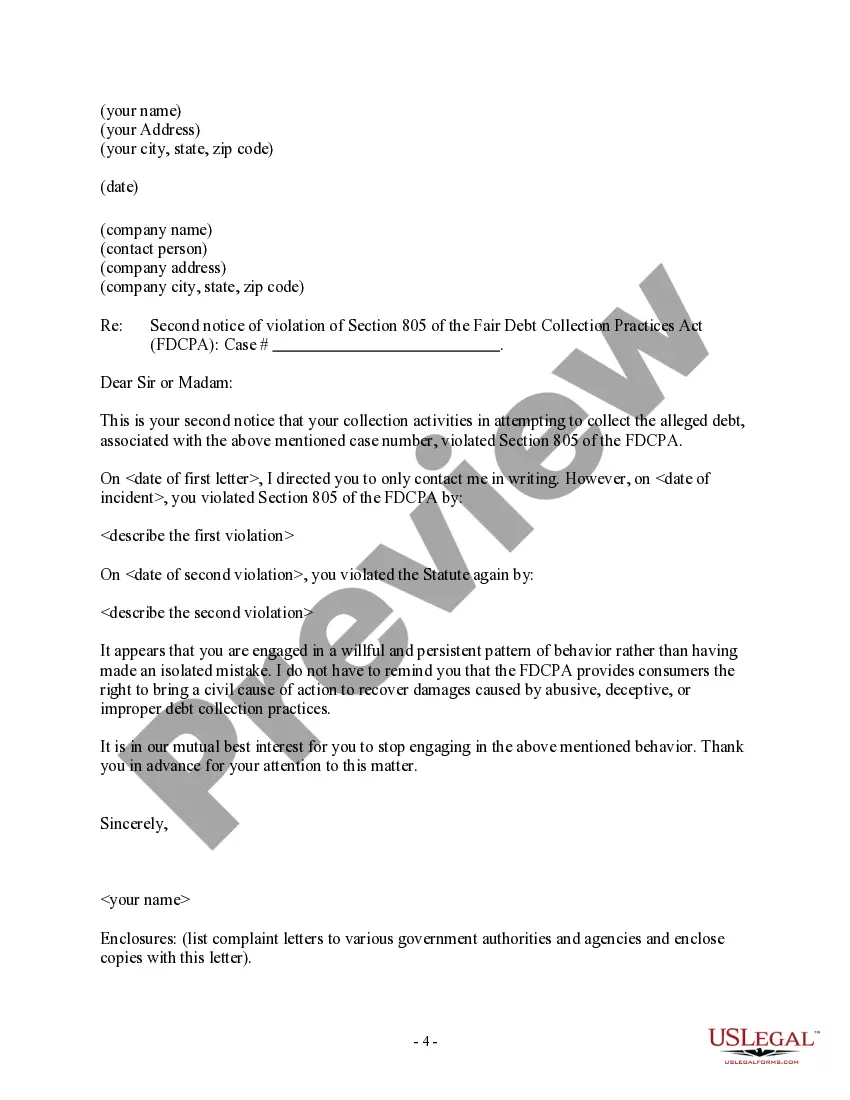

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

If you don't dispute the debt within 30 days, the debt is assumed valid. That means the debt collector can continue to contact you. You can still send a dispute after 30 days. But at that point, the debt is considered valid, and a debt collector is still legally allowed to continue contacting you.

Credit disputes with creditors Once you submit a dispute, the creditor has a duty to investigate your claim, according to the Fair Credit Reporting Act. In most cases, the creditor is expected to respond to your claim within 30 to 45 days and to inform you of the results of its investigation within five business days.