Virginia Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp.

Description

How to fill out Sample Redemption Agreement - Executive Stock Purchase Agreement Of Pic N Save Corp.?

Choosing the best legitimate file template can be quite a battle. Needless to say, there are a lot of templates available on the net, but how do you get the legitimate kind you require? Make use of the US Legal Forms web site. The support offers 1000s of templates, such as the Virginia Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp., that can be used for enterprise and personal requires. All the varieties are inspected by pros and fulfill federal and state specifications.

Should you be presently listed, log in in your account and then click the Obtain key to obtain the Virginia Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp.. Make use of your account to search through the legitimate varieties you have bought formerly. Check out the My Forms tab of your respective account and obtain an additional backup in the file you require.

Should you be a new end user of US Legal Forms, listed here are straightforward directions for you to follow:

- First, make sure you have selected the proper kind for the town/region. You are able to check out the form making use of the Review key and browse the form description to guarantee it is the right one for you.

- If the kind will not fulfill your requirements, use the Seach industry to discover the right kind.

- Once you are certain the form is proper, click the Acquire now key to obtain the kind.

- Pick the prices prepare you desire and enter the necessary information. Make your account and pay money for your order utilizing your PayPal account or charge card.

- Select the file structure and download the legitimate file template in your product.

- Complete, modify and print out and indicator the acquired Virginia Sample Redemption Agreement - Executive Stock Purchase Agreement of Pic N Save Corp..

US Legal Forms will be the biggest catalogue of legitimate varieties for which you can find different file templates. Make use of the company to download expertly-created papers that follow express specifications.

Form popularity

FAQ

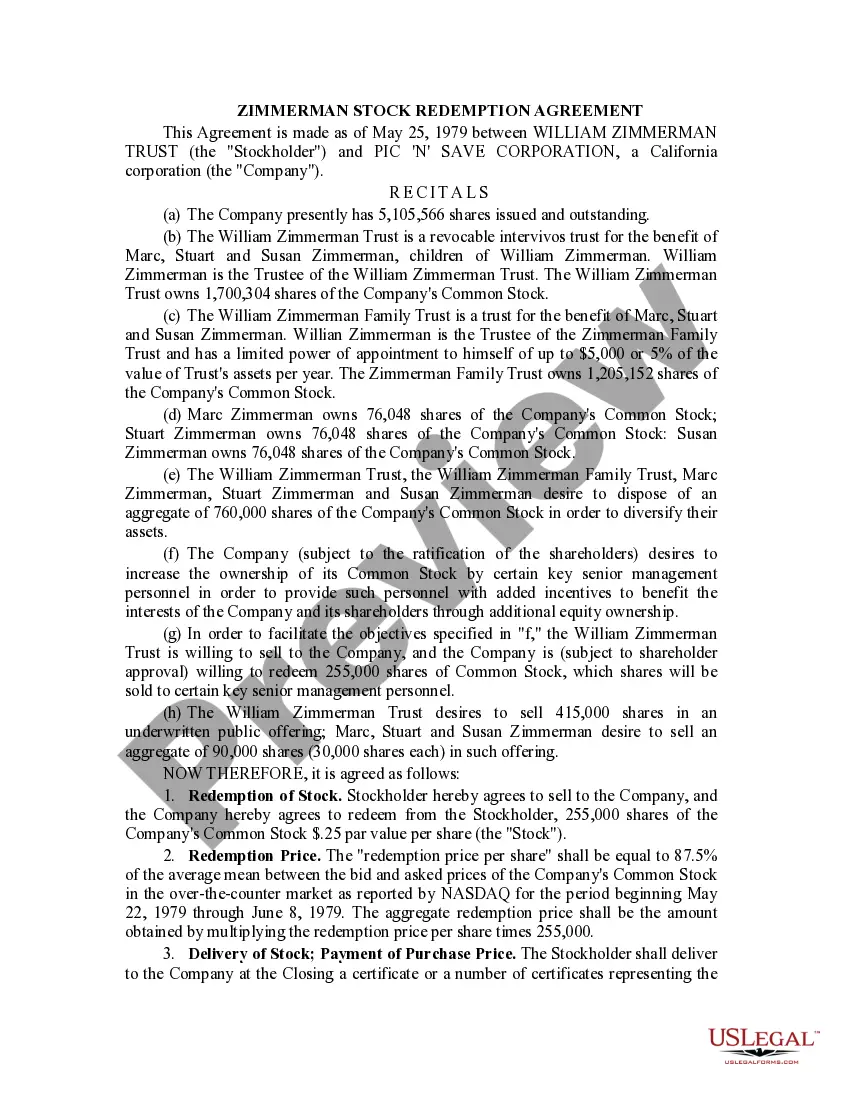

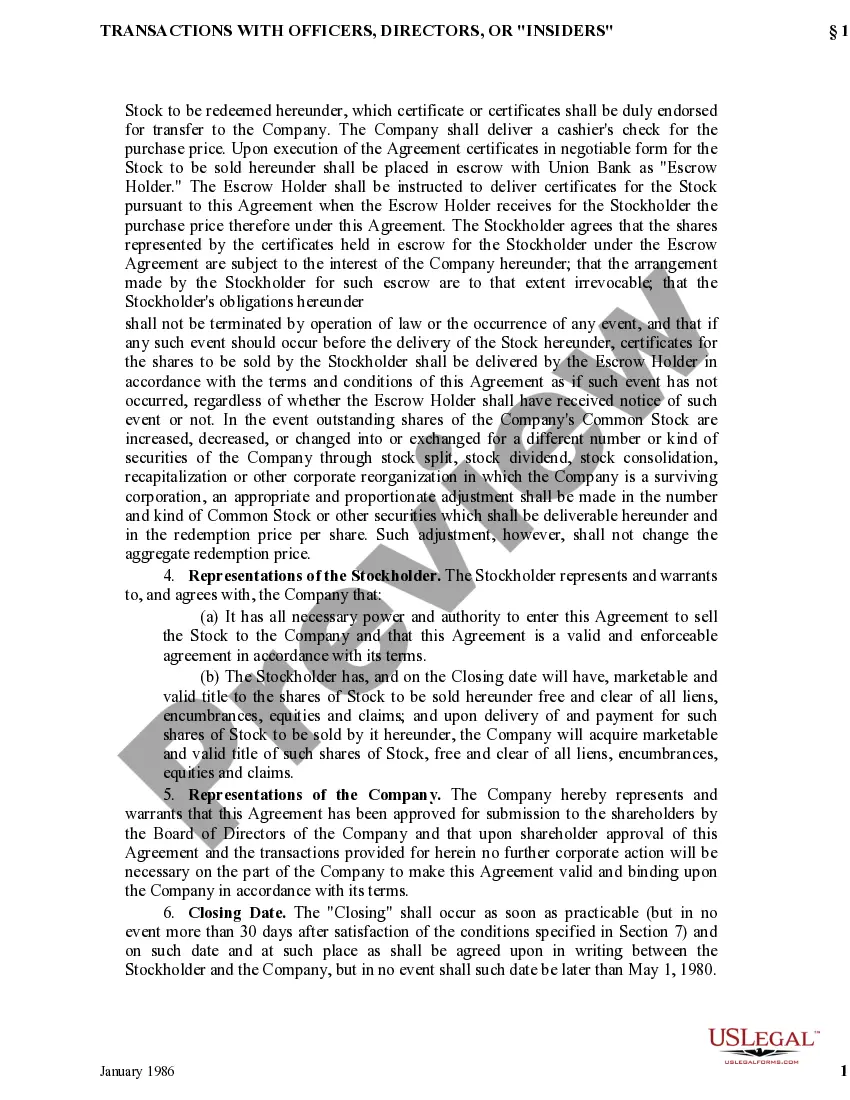

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

The redemption rights clause gives the owner of a property the right to reclaim his/her property during a foreclosure auction. The clause is often included in a mortgage agreement. Redemption rights allow the borrower to prevent foreclosure on the property by paying all liens or back taxes on the property.