Virginia Involuntary Petition Against a Non-Individual

Description

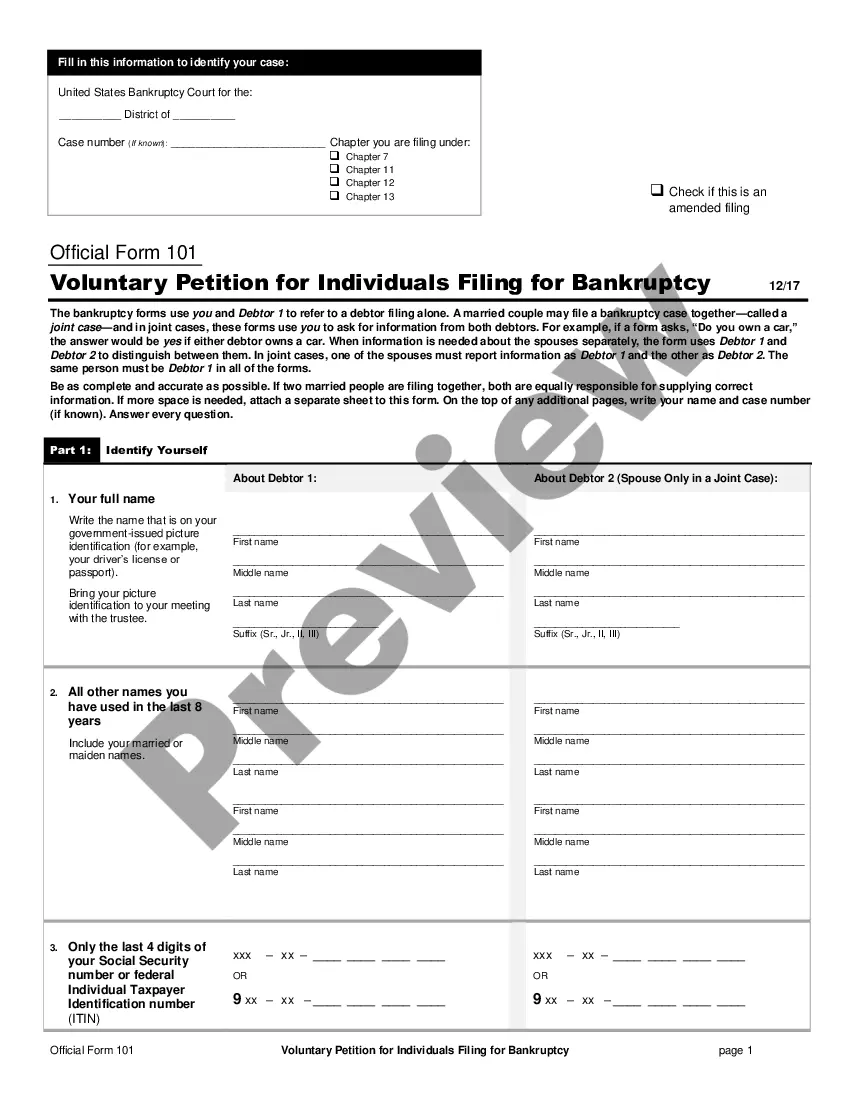

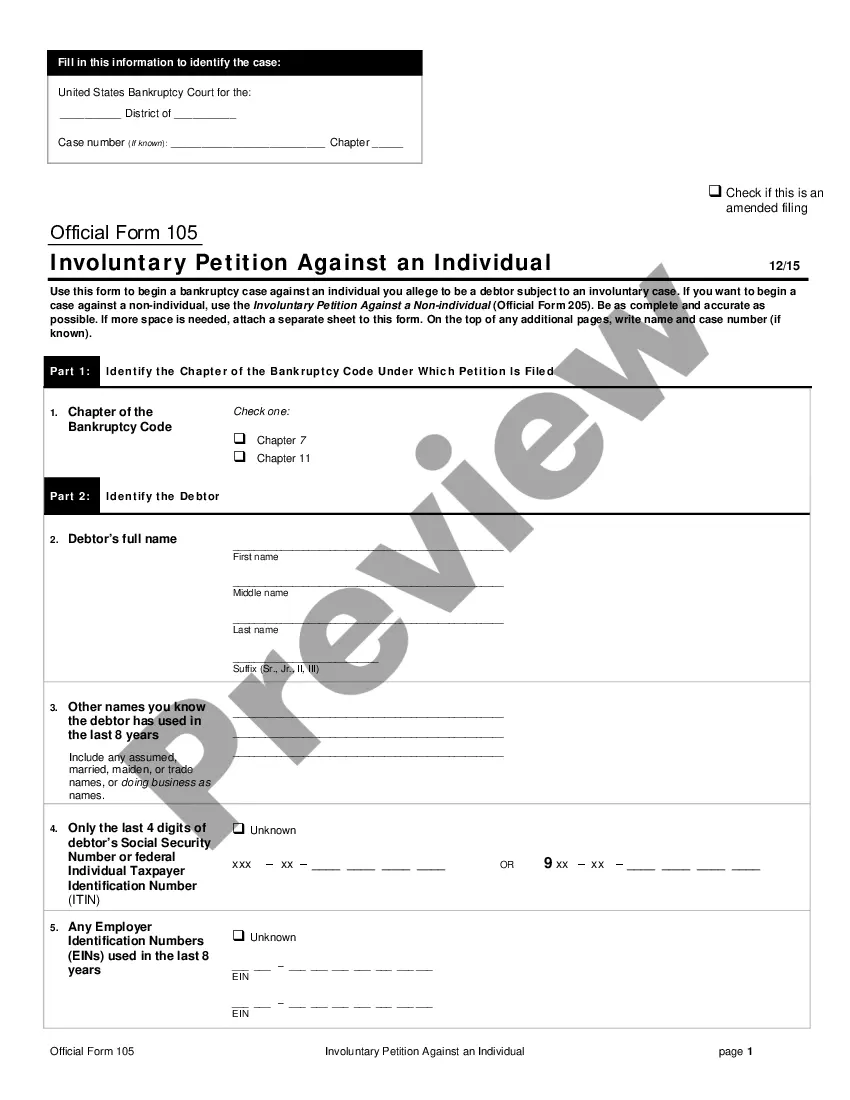

How to fill out Involuntary Petition Against A Non-Individual?

Choosing the best legal document web template can be quite a have difficulties. Naturally, there are tons of layouts accessible on the Internet, but how will you find the legal develop you want? Take advantage of the US Legal Forms internet site. The support offers thousands of layouts, such as the Virginia Notice to Creditors and Other Parties in Interest - B 205, which you can use for business and private requirements. All the forms are checked out by professionals and meet federal and state specifications.

In case you are presently authorized, log in to the bank account and click the Acquire key to obtain the Virginia Notice to Creditors and Other Parties in Interest - B 205. Use your bank account to appear with the legal forms you have ordered formerly. Check out the My Forms tab of your own bank account and acquire yet another duplicate of your document you want.

In case you are a whole new end user of US Legal Forms, listed below are straightforward guidelines that you can stick to:

- Initially, make sure you have chosen the appropriate develop for your personal city/region. It is possible to examine the shape using the Preview key and browse the shape outline to guarantee this is basically the best for you.

- In case the develop does not meet your needs, make use of the Seach area to discover the correct develop.

- Once you are positive that the shape is proper, click on the Purchase now key to obtain the develop.

- Opt for the rates plan you would like and enter the needed information. Build your bank account and purchase your order with your PayPal bank account or bank card.

- Choose the file format and acquire the legal document web template to the product.

- Total, edit and print out and signal the obtained Virginia Notice to Creditors and Other Parties in Interest - B 205.

US Legal Forms may be the greatest local library of legal forms that you can see a variety of document layouts. Take advantage of the service to acquire expertly-made paperwork that stick to express specifications.

Form popularity

FAQ

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

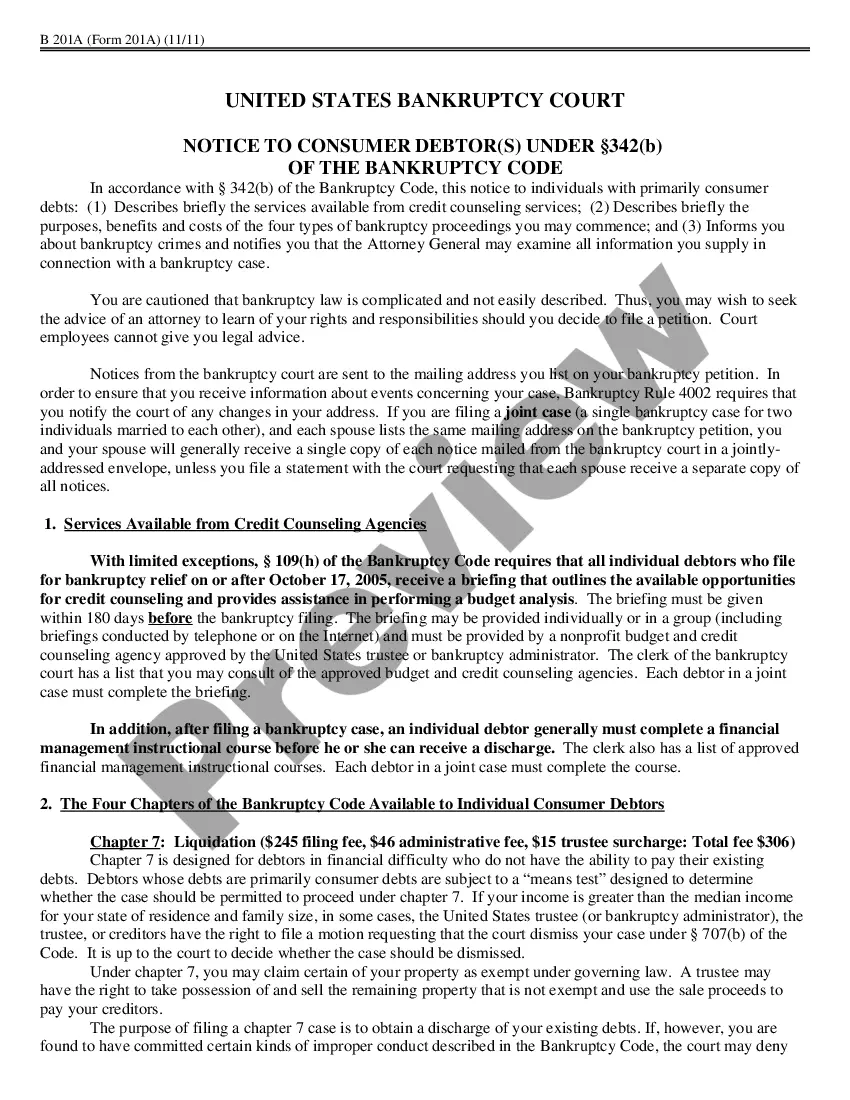

If you receive this notice, it means one of three things: The address you provided for the creditor in your bankruptcy paperwork was incorrect, The court sent you notice of your own bankruptcy via this form, or. Someone who owes you money filed bankruptcy.

In addition, Virginia law has a one-year statute of limitations after the death of a parent for a child out of wedlock to claim inheritance from the deceased parent's estate. The one-year statute of limitations runs even if a child is a minor.

Debts have different degrees of priority. The debts that must be repaid in Chapter 13 are priority debts including child support, alimony, certain taxes, and wages owed to employees. Your plan must also address your secured debts. Secured debts are those that are secured by collateral, such as a mortgage or car loan.

Creditors then have 60 days from the date on the form to file their claim, or four months from the date the estate was opened. Once the claim is received by the representative or the executor, they can pay it or, if it doesn't seem legitimate, they can dispute it.

Many people assume that creditors have one year from the date of death to make a claim against an estate. However, in Virginia, unlike most states, there is no set time by which creditors must make a claim.

A states that ?[a]ny person who seeks to prove that he has a debt or demand against the decedent or the decedent's estate shall file his claim in writing with the commissioner of accounts, who shall endorse upon it the date of the filing and sign the endorsement in his official character.? ?Any such debt or demand? ...

In Virginia, there is no default deadline for creditors to make claims against an estate (other than the normal statute of limitations for a given debt).