Virginia Reimbursable Travel Expenses Chart

Description

How to fill out Reimbursable Travel Expenses Chart?

Are you presently in a situation where you require documents for either business or personal matters nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

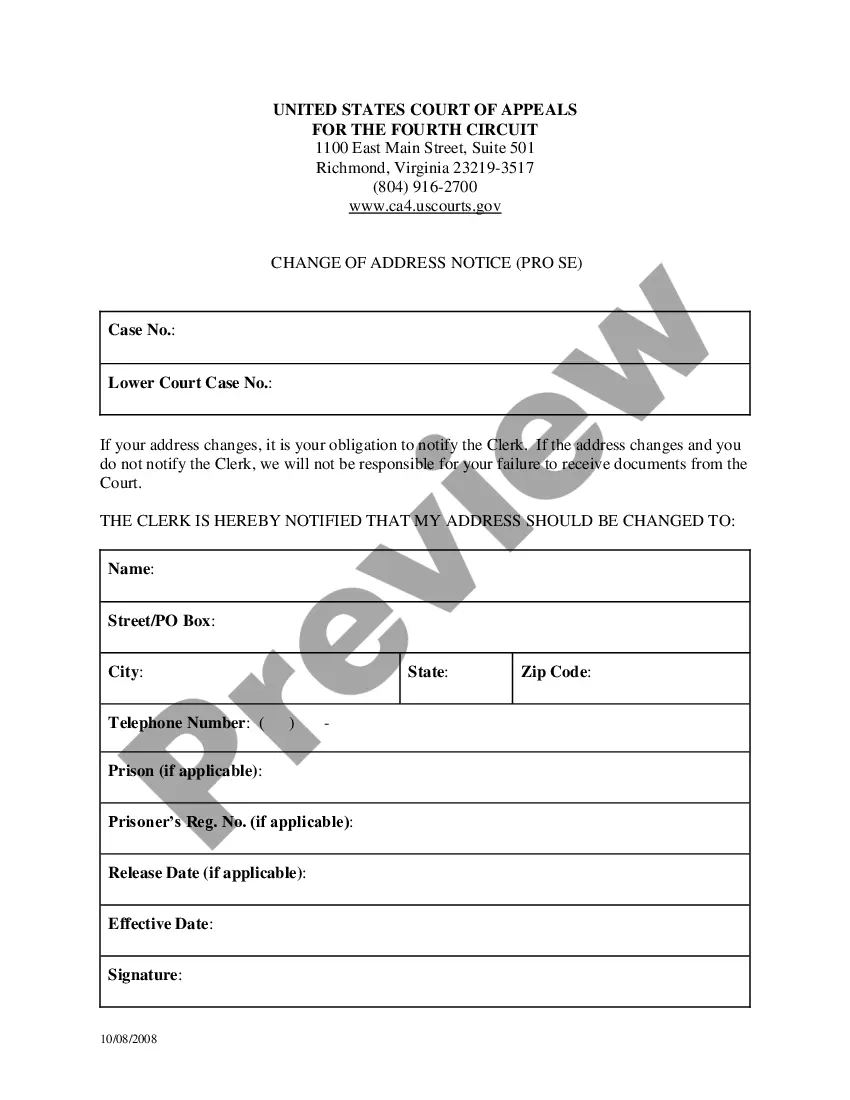

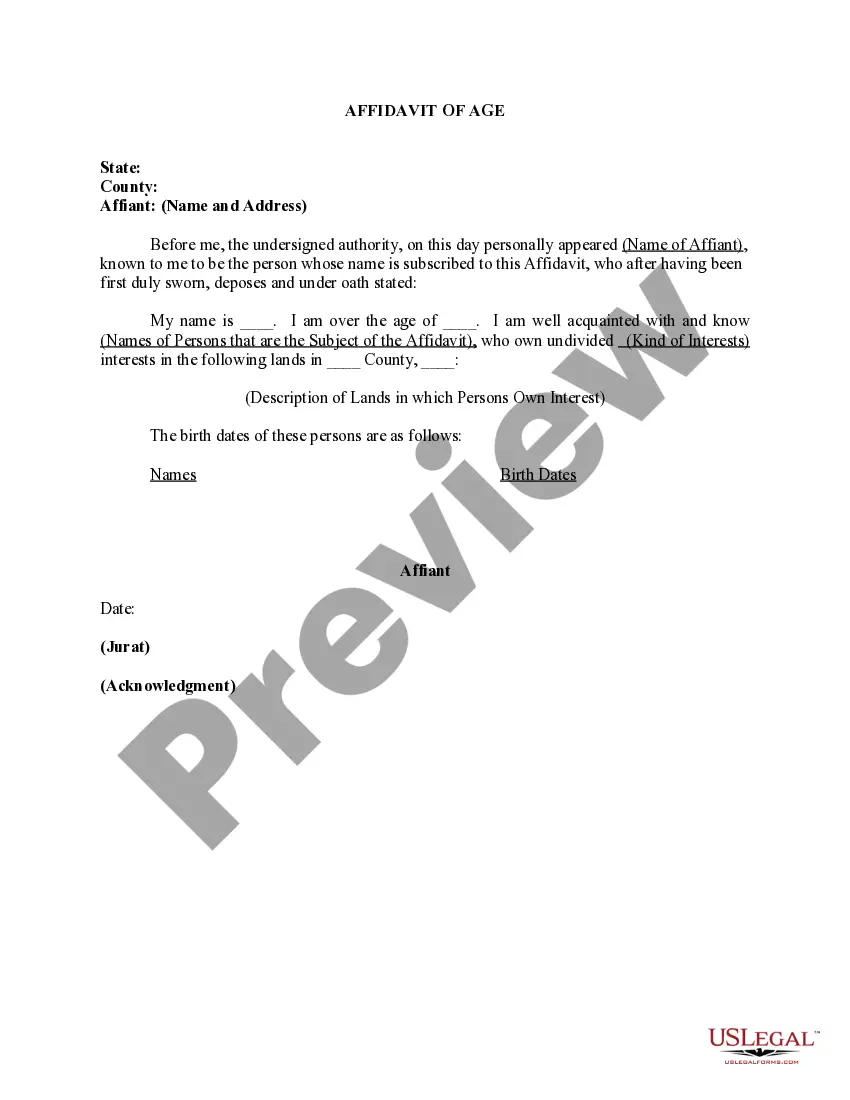

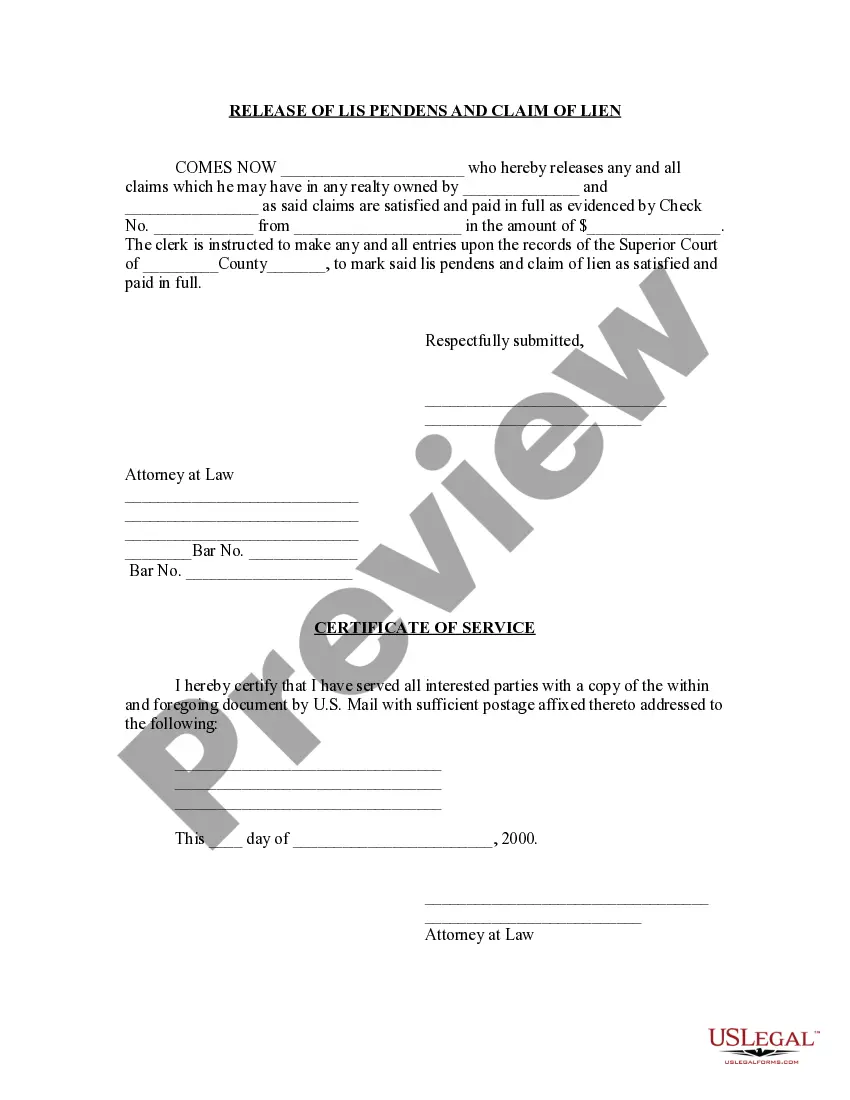

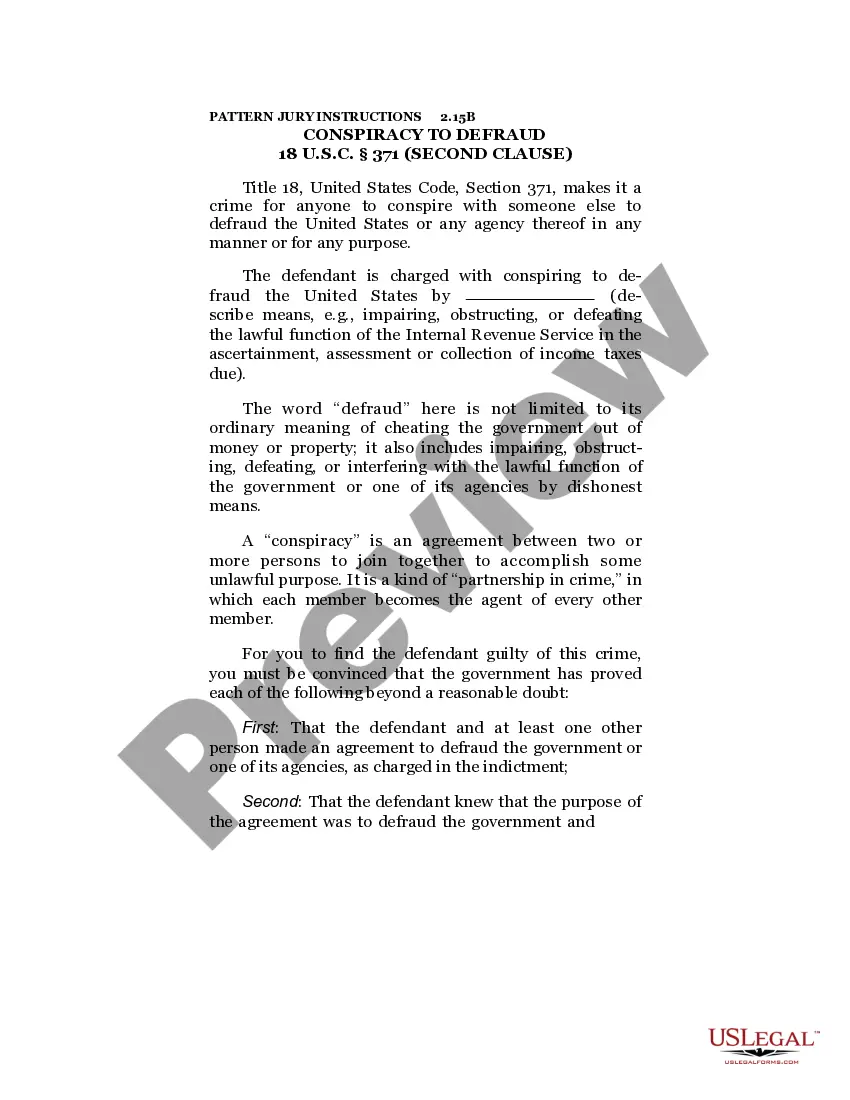

US Legal Forms offers an extensive collection of form templates, such as the Virginia Reimbursable Travel Expenses Chart, designed to comply with state and federal regulations.

Once you find the right form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Reimbursable Travel Expenses Chart template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/area.

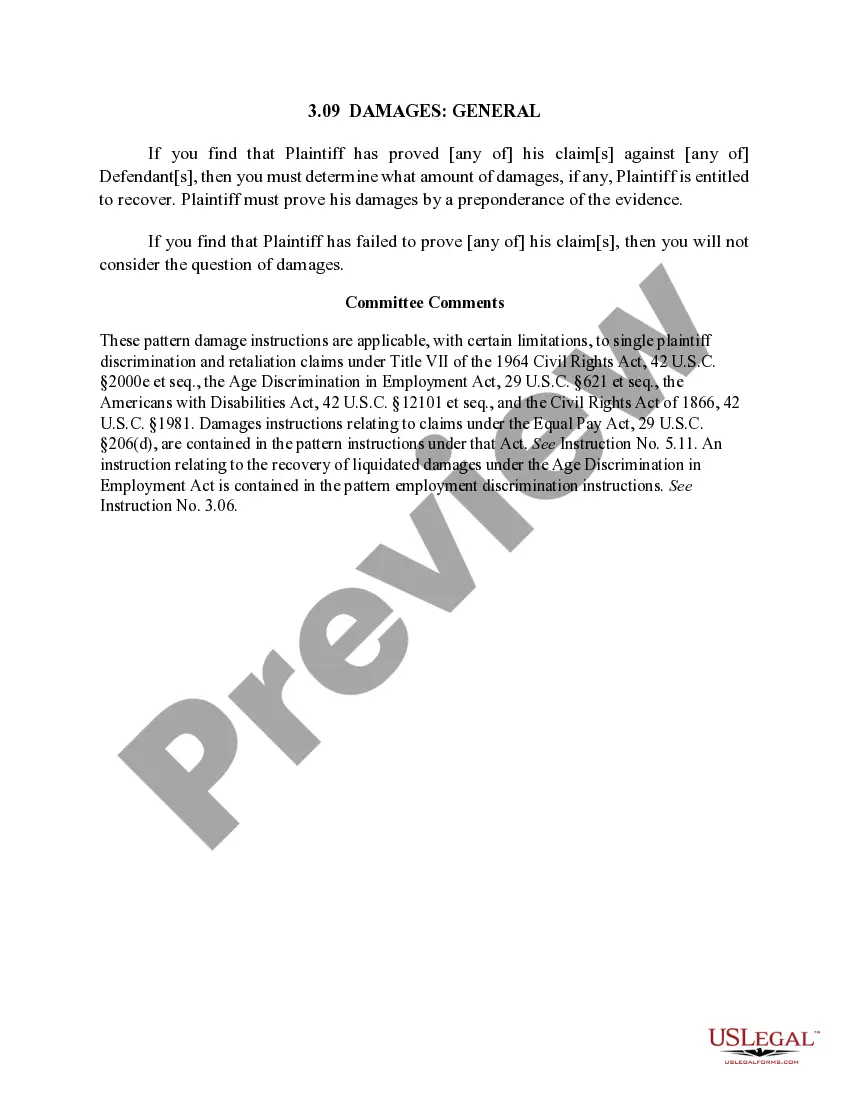

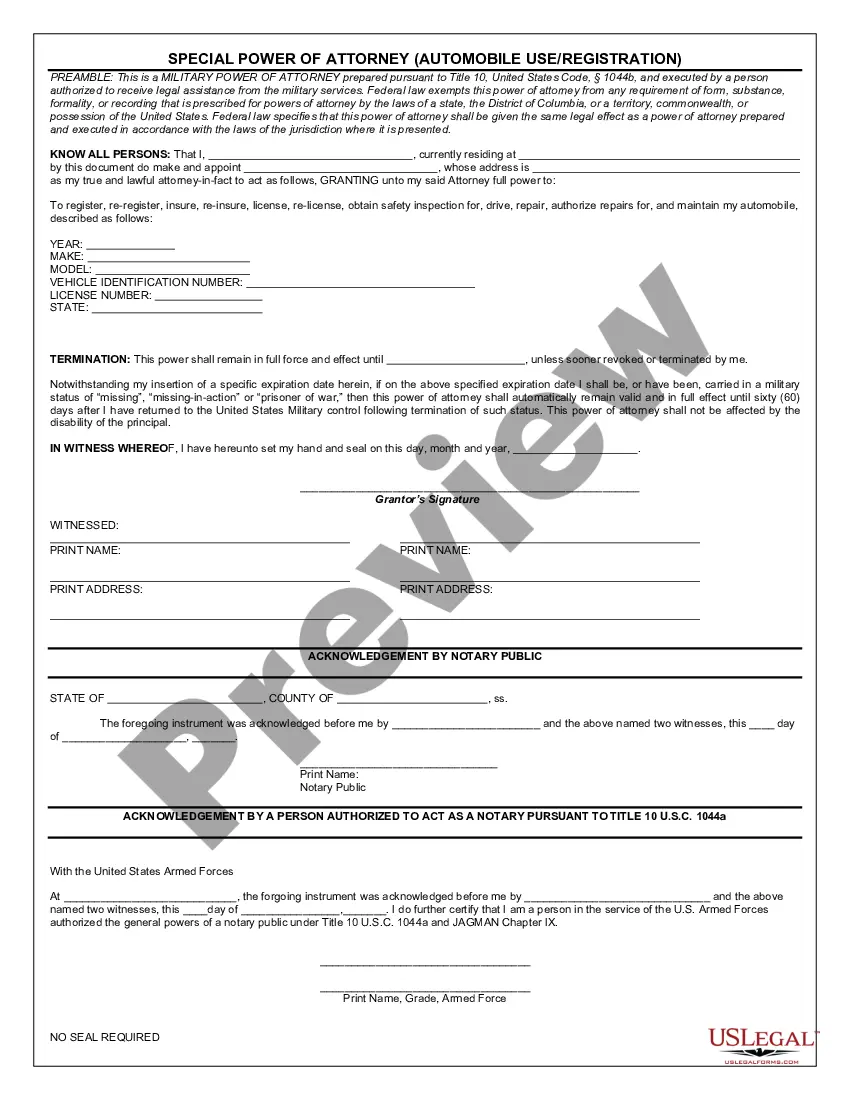

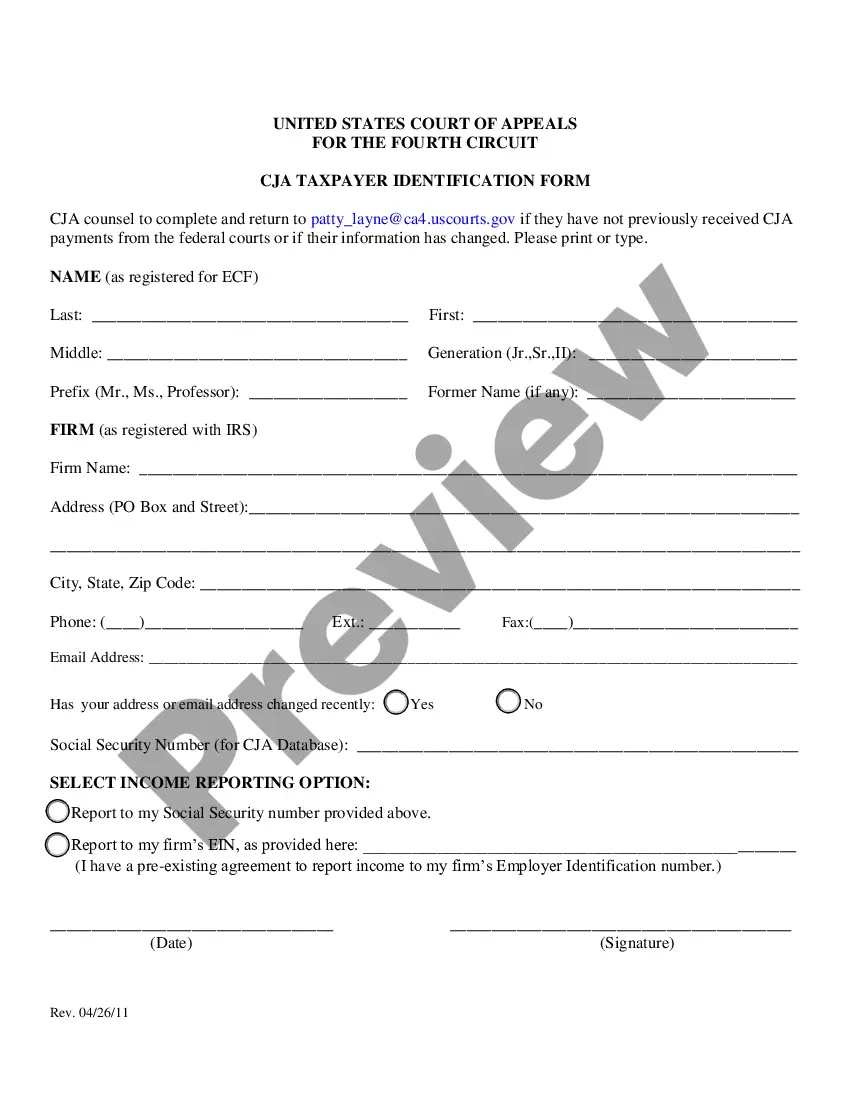

- Utilize the Preview feature to review the document.

- Check the description to confirm that you have selected the right form.

- If the form does not match your needs, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Mileage reimbursement rate We currently pay 41.5 cents ($0.415) per mile for approved, health-related travel. We use Bing Maps to calculate your mileage, based on the fastest and shortest route from your home to the closest VA or authorized non-VA health facility that can provide the care you need.

Examples of travel expenses include airfare and lodging, transport services, cost of meals and tips, use of communications devices. Travel expenses incurred while on an indefinite work assignment, which lasts more than one year according to the IRS, are not deductible for tax purposes.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Reimbursement of travel expenses is based on documentation of reasonable and actual expenses supported by the original, itemized receipts where required. Reimbursements that may be paid by Company Name are shown below. Airfare.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.

A travel and expense policy states the ethics and responsibilities of business travel. It paves the roadmap that every employee should follow to uphold the legitimacy of their business expenses. They are expected to exercise fair judgment while spending and reporting business expenses.