If you need to comprehensive, obtain, or printing lawful record web templates, use US Legal Forms, the greatest assortment of lawful types, that can be found on the web. Take advantage of the site`s simple and practical search to discover the documents you require. Numerous web templates for company and specific functions are categorized by classes and says, or key phrases. Use US Legal Forms to discover the Indiana Contest of Final Account and Proposed Distributions in a Probate Estate within a few mouse clicks.

When you are previously a US Legal Forms client, log in to your bank account and click on the Download key to have the Indiana Contest of Final Account and Proposed Distributions in a Probate Estate. Also you can entry types you earlier delivered electronically inside the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your appropriate town/region.

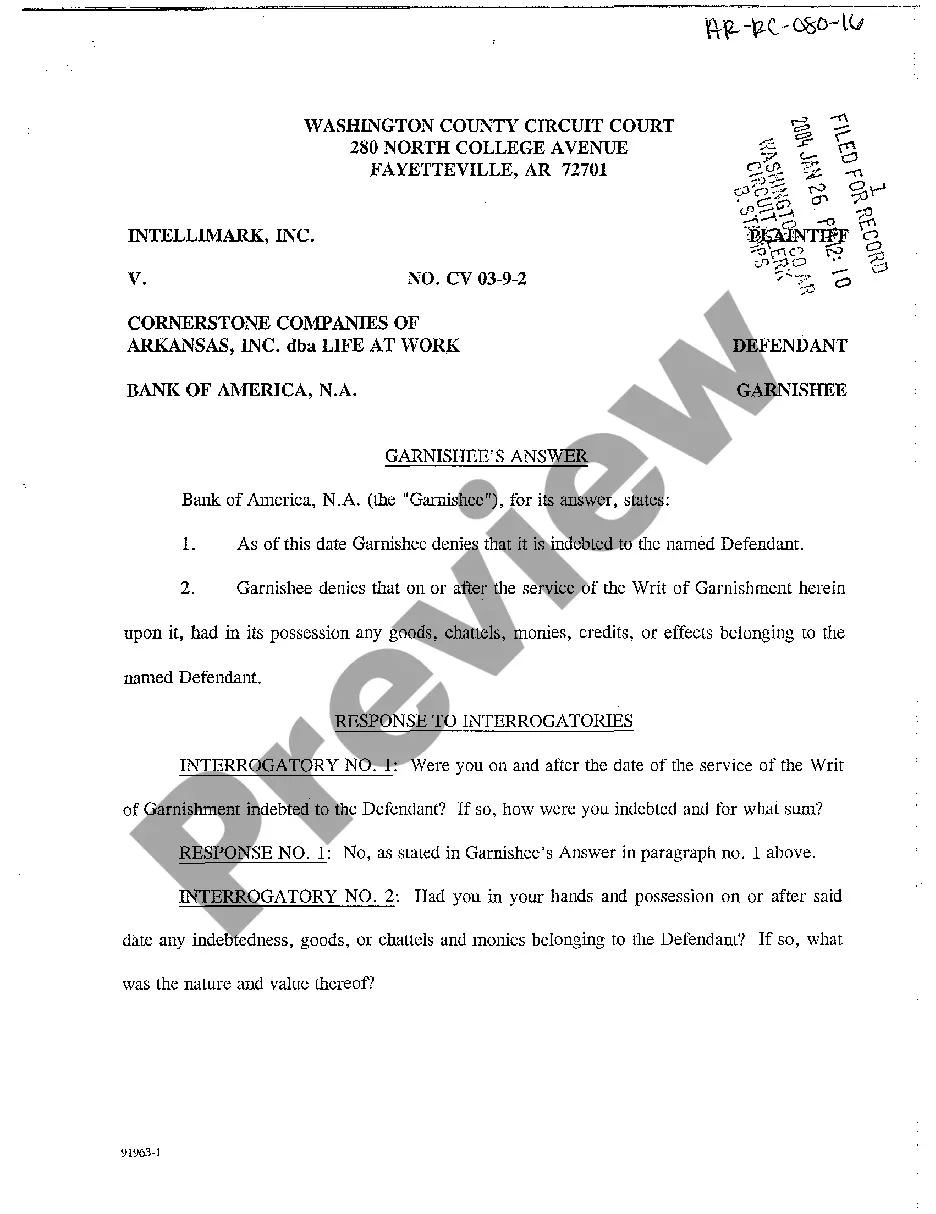

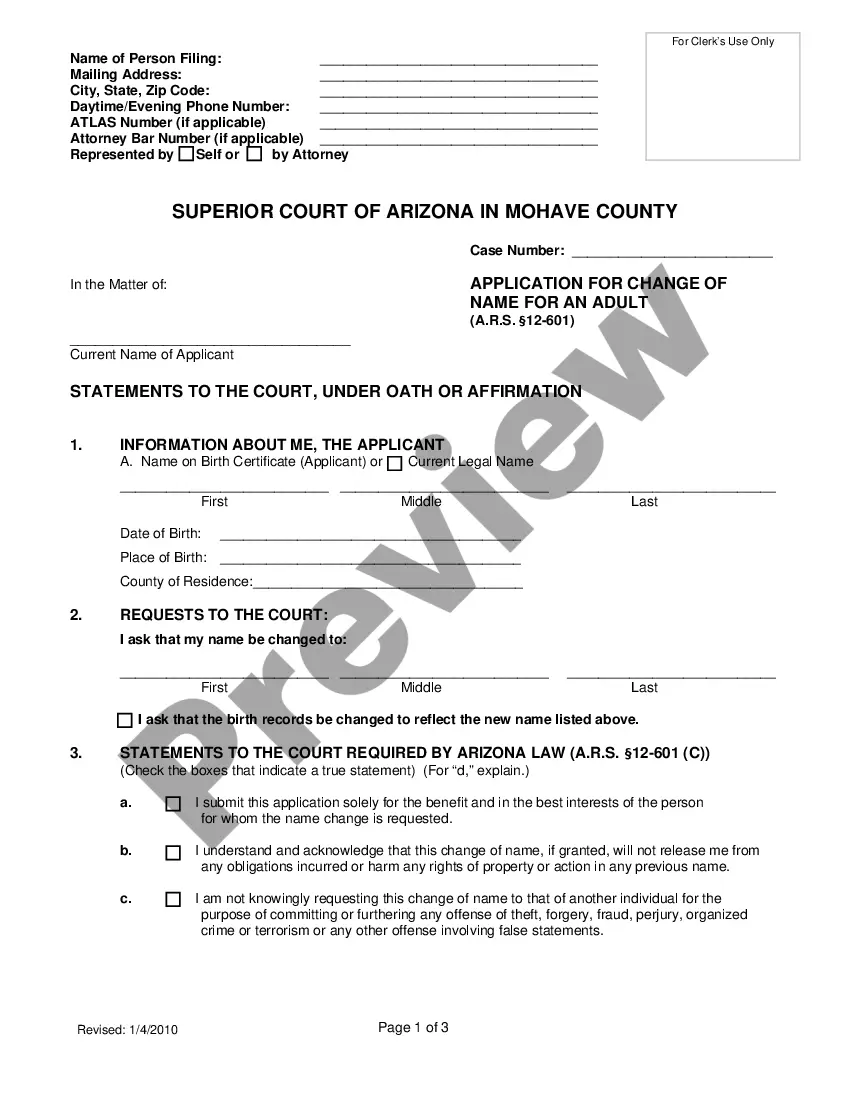

- Step 2. Take advantage of the Review option to check out the form`s information. Never overlook to see the information.

- Step 3. When you are not happy together with the type, make use of the Look for industry towards the top of the display screen to discover other models of your lawful type template.

- Step 4. Upon having identified the shape you require, select the Get now key. Choose the prices prepare you like and add your qualifications to register for an bank account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Pick the structure of your lawful type and obtain it in your system.

- Step 7. Full, edit and printing or indicator the Indiana Contest of Final Account and Proposed Distributions in a Probate Estate.

Each and every lawful record template you buy is your own property forever. You have acces to each type you delivered electronically inside your acccount. Click the My Forms section and pick a type to printing or obtain once more.

Compete and obtain, and printing the Indiana Contest of Final Account and Proposed Distributions in a Probate Estate with US Legal Forms. There are many specialist and express-distinct types you may use for the company or specific requires.