Virginia Employee News Form

Description

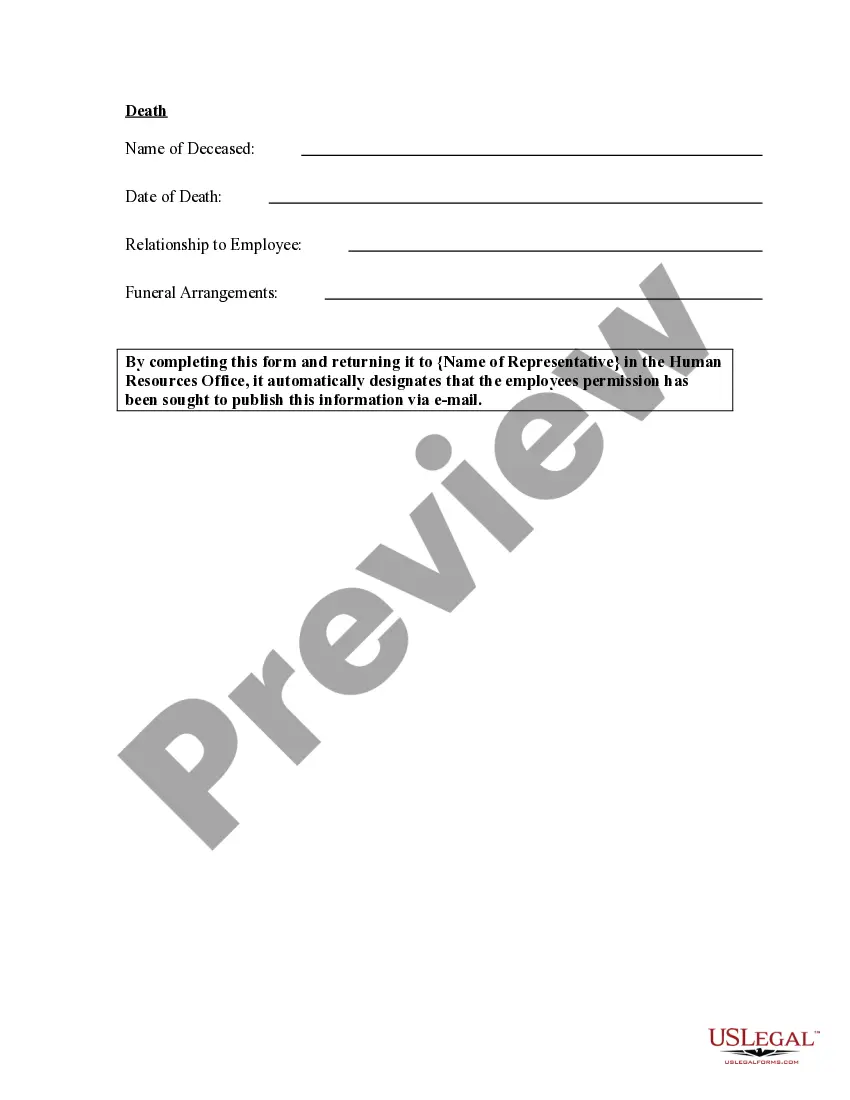

How to fill out Employee News Form?

US Legal Forms - one of the most important repositories of legal templates in the U.S. - offers a variety of legal document templates that can be downloaded or printed.

By using the site, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Virginia Employee News Form in an instant.

If you have an account, Log In to obtain the Virginia Employee News Form from the US Legal Forms library. The Download button is displayed on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Utilize a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Virginia Employee News Form. Each design stored in your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Virginia Employee News Form via US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wide array of professional and state-specific templates that fulfill your business or personal requirements and preferences.

- Ensure you have selected the appropriate form for your city/state.

- Click on the Review button to examine the form's content.

- Read the form description to confirm you have chosen the correct form.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Purchase now button.

- Then, select your preferred payment plan and provide your details to register for the account.

Form popularity

FAQ

Go to the IRS website. The Virginia Employment Commission will send you (and the IRS) Form 1099G at the year's end detailing the benefits you received plus any federal tax withholdings elected. If you change addresses, you must give the VEC the new address to receive your 1099G.

Form FC-20 / FC-21 - Employer's Quarterly Tax and Payroll Report.

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

You may not receive your payment on the same day of the week each time you file your request for payment. However, no payment will be issued if you have a separation or able and available issue on your claim, until those issues have been addressed and appropriate action taken on them.

Effective September 30, 2020 a program at the Virginia Employment Commission allows smaller employers to file their Quarterly Reports (Forms FC20/21) electronically in a quick and easy manner. This program is called . Key Features of at the VEC: No Sign Up required.

Virginia's Unemployment Insurance program was plagued by understaffing, an outdated filing system, and leadership failures leading to major delays in residents receiving benefits over the last 18 months, a.

Quarterly charge statements are sent to employers identifying claimants and benefit amounts paid. For SUTA TAX Paying Employers: Charge claimant's last 30 working day/240 hour employer.

These programs have been funded and extended for 11 weeks, covering the weeks of December 27th, 2020 to March 14th, 2021. PEUC and PUA programs have a phase out period where existing claimants with remaining weeks/balances can file for benefits until the week ending April 10th, 2021.

Employment Commission Account NumberLog into VATAX Online Services for Businesses.Locate your ten-digit (XXXXXXXXXX) Employment Commission Account Number on any previously filed quarterly report (VEC-FC-21).Call the Employment Commission: 804-786-1082.

NORFOLK, Va. Virginia's big revamp of its unemployment system is delayed another month, with a rollout now planned for early November. State leaders had previously told claimants that they hoped to have a new system live in early October.