Virginia COBRA Continuation Coverage Election Form

Description

How to fill out COBRA Continuation Coverage Election Form?

If you wish to obtain, secure, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are classified by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and input your information to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to find the Virginia COBRA Continuation Coverage Election Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to locate the Virginia COBRA Continuation Coverage Election Form.

- You can also access forms you previously obtained under the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific city/state.

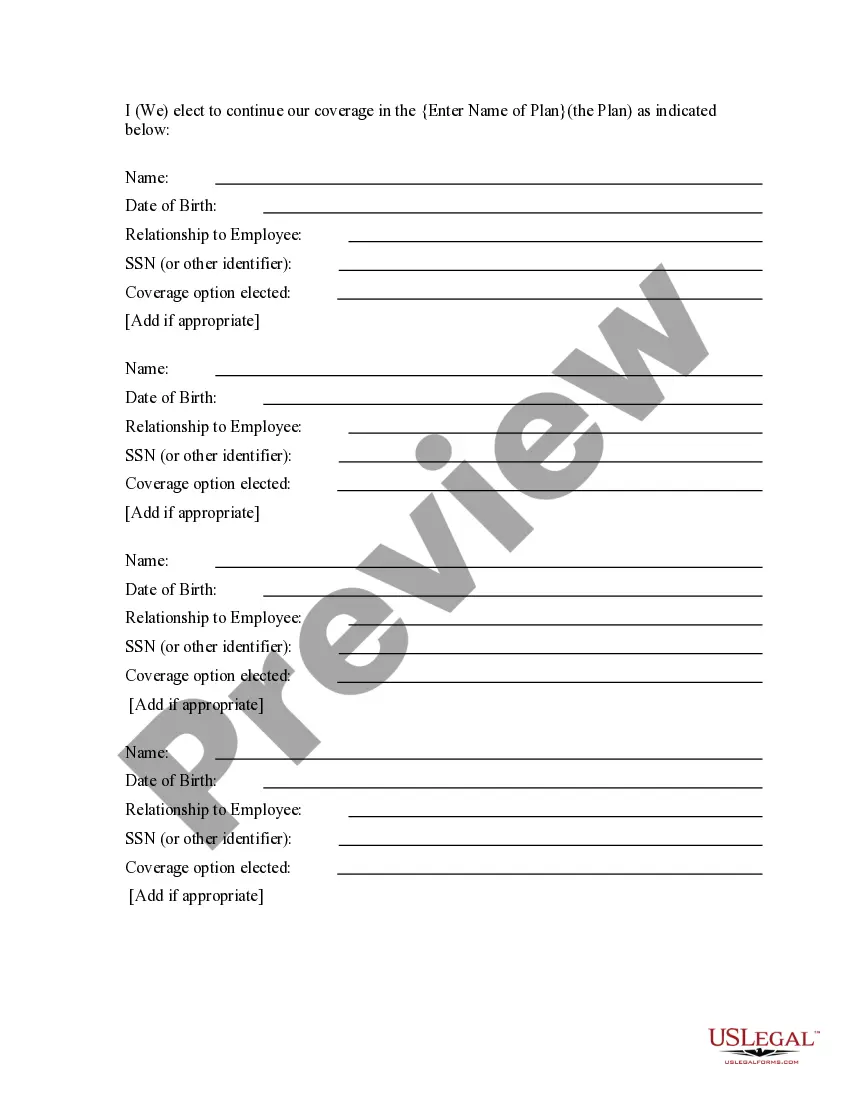

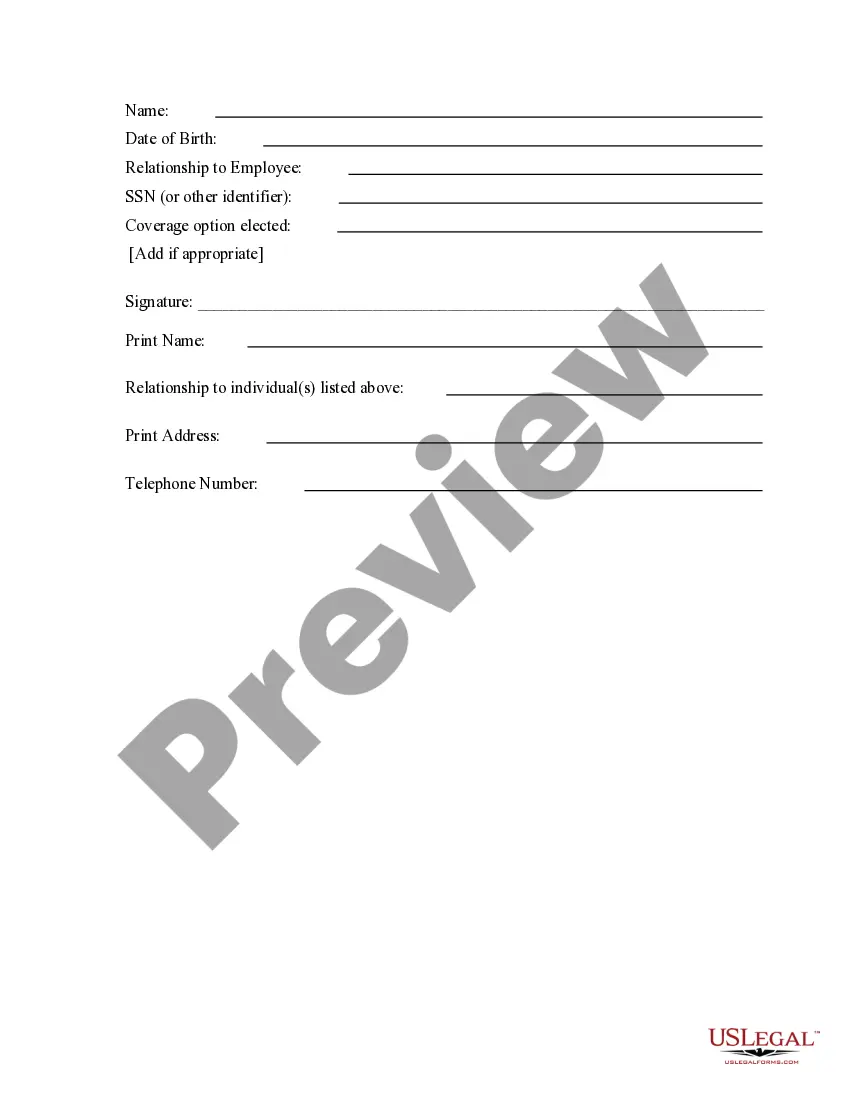

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

How to Administer Cal-COBRANotifying all eligible group health care participants of their Cal-COBRA rights.Providing timely notice of Cal-COBRA eligibility, enrollment forms, and notice of the duration of coverage and terms of payment after a qualifying event has occurred.More items...

Did you know there is a continuation provision that applies to Virginia employers NOT subject to COBRA? It's called Virginia State Continuation coverage aka mini-cobra. Employers must notify individuals within 14 days of learning that a person covered under the health plan is no longer eligible for coverage.

COBRA continuation coverage lets you stay on your employer's group health insurance plan after leaving your job. COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. It's shorthand for the law change that required employers to extend temporary group health insurance to departing employees.

The general notice describes general COBRA rights and employee obligations. This notice must be provided to each covered employee and each covered spouse of an employee who becomes covered under the plan. The notice must be provided within the first 90 days of coverage under the group health plan.

You can reach Covered California at (800) 300-1506 or online at . You can apply for individual coverage directly through some health plans off the exchange.

Federal law requires that most group health plans (including this Plan) give employees and their families the opportunity to continue their health care coverage through COBRA continuation coverage when there's a qualifying event that would result in a loss of coverage under an employer's plan.

Although the earlier rules only covered summary plan descriptions (SPDs) and summary annual reports, the final rules provide that all ERISA-required disclosure documents can be sent electronically -- this includes COBRA notices as well as certificates of creditable coverage under the Health Insurance Portability and

COBRA the Consolidated Omnibus Budget Reconciliation Act -- requires group health plans to offer continuation coverage to covered employees, former employees, spouses, former spouses, and dependent children when group health coverage would otherwise be lost due to certain events.

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.