Virginia Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

It is feasible to spend numerous hours online attempting to locate the valid document template that fulfills the state and federal stipulations you need.

US Legal Forms provides thousands of valid templates that have been reviewed by professionals.

You can effortlessly download or print the Virginia Authorization of Consumer Report from your platform.

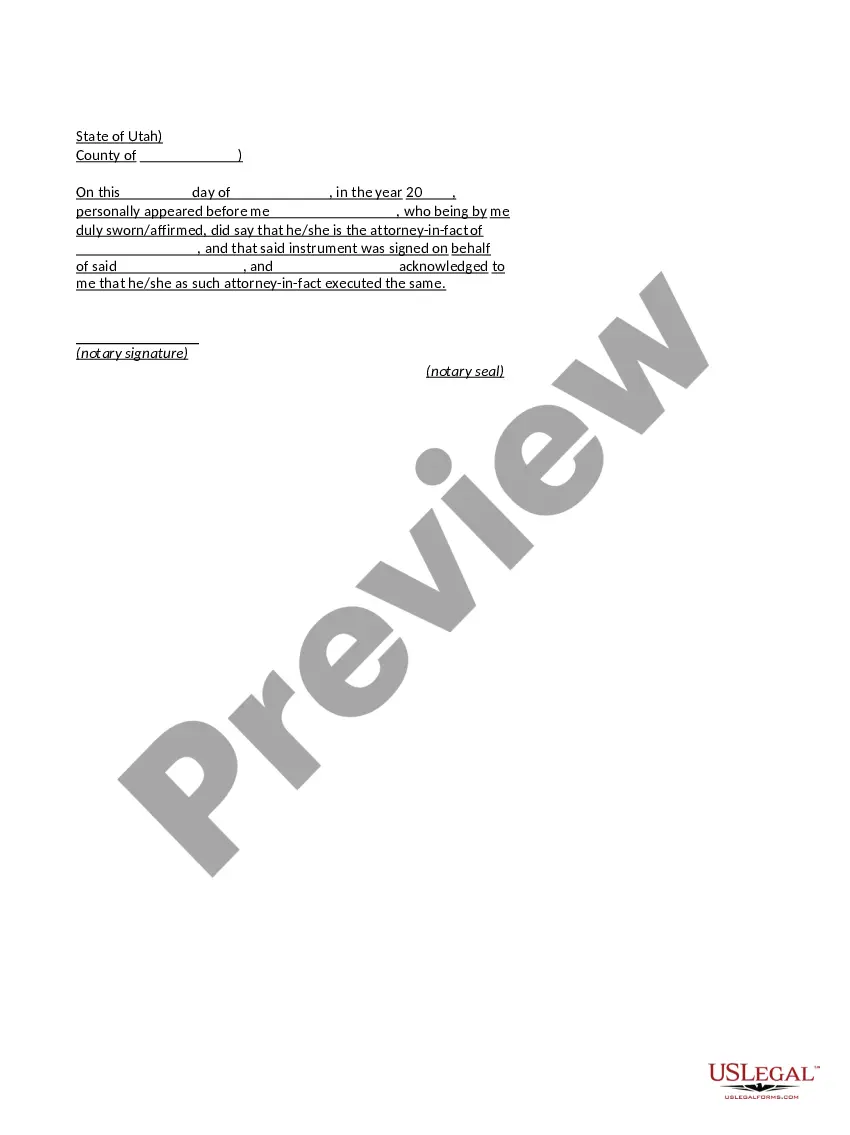

If available, utilize the Preview option to examine the document template as well.

- If you already hold a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Virginia Authorization of Consumer Report.

- Every valid document template you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the relevant option.

- If you use the US Legal Forms website for the first time, follow the straightforward instructions outlined below.

- Firstly, ensure you have chosen the correct document template for the state/city that you select.

- Review the form description to confirm that you have selected the correct template.

Form popularity

FAQ

One important distinction to make is that investigative consumer reports will not include any information about your credit record obtained directly from a creditor or from you. An investigative consumer report cannot and will not be used as part of an application to grant credit.

A consumer report security freezes limits a consumer reporting agency from releasing a credit report or any information from the report without authorization from the consumer.

A credit report is a specific type of consumer report used for lending, while the broader term "consumer report" could be used to describe things like your driving history or criminal record.

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

Hard InquiriesIn response to a hard inquiry, Experian generally sells a complete consumer report (a/k/a credit report) to the potential creditor. Most often, a consumer report sold in response to a hard inquiry includes the consumer's credit score as well as substantial details about the consumer's credit history.

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.

Consumer reports typically include an individual's credit history and payment patterns, demographic and identifying information, and public records information, such as arrests, judgments, and bankruptcies.

In the search bar, type Consumer Reports and click on one of the queries for access. You may then click the name of the publication (Consumer Reports Buying Guide, Consumer Reports, or others) in the source field, then search within this publication or chose from an issue to listed to the right.

Before requesting a consumer report (such as credit reports and background checks), employers now must: (1) make a clear and conspicuous disclosure in a separate document to the applicant or employee that a report may be requested; and (2) obtain written permission from the applicant or employee.

Unlike federal law, California law also requires new consent each time an investigative report is sought during employment if the report is for purposes other than suspicion of wrongdoing or misconduct. Employers must provide the applicant or employee with the opportunity to request a copy of the report.