Virginia Resolution of Meeting of LLC Members to Borrow Specific Money

Description

How to fill out Resolution Of Meeting Of LLC Members To Borrow Specific Money?

If you wish to obtain, secure, or generate legitimate document templates, utilize US Legal Forms, the finest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the payment. You may use your Visa or Mastercard or PayPal account to finalize the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Virginia Resolution of Meeting of LLC Members to Borrow Specific Funds. Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Complete and download, and print the Virginia Resolution of Meeting of LLC Members to Borrow Specific Funds with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to retrieve the Virginia Resolution of Meeting of LLC Members to Borrow Specific Funds with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Virginia Resolution of Meeting of LLC Members to Borrow Specific Funds.

- You can also access forms you previously downloaded under the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm you have selected the form for the correct city/state.

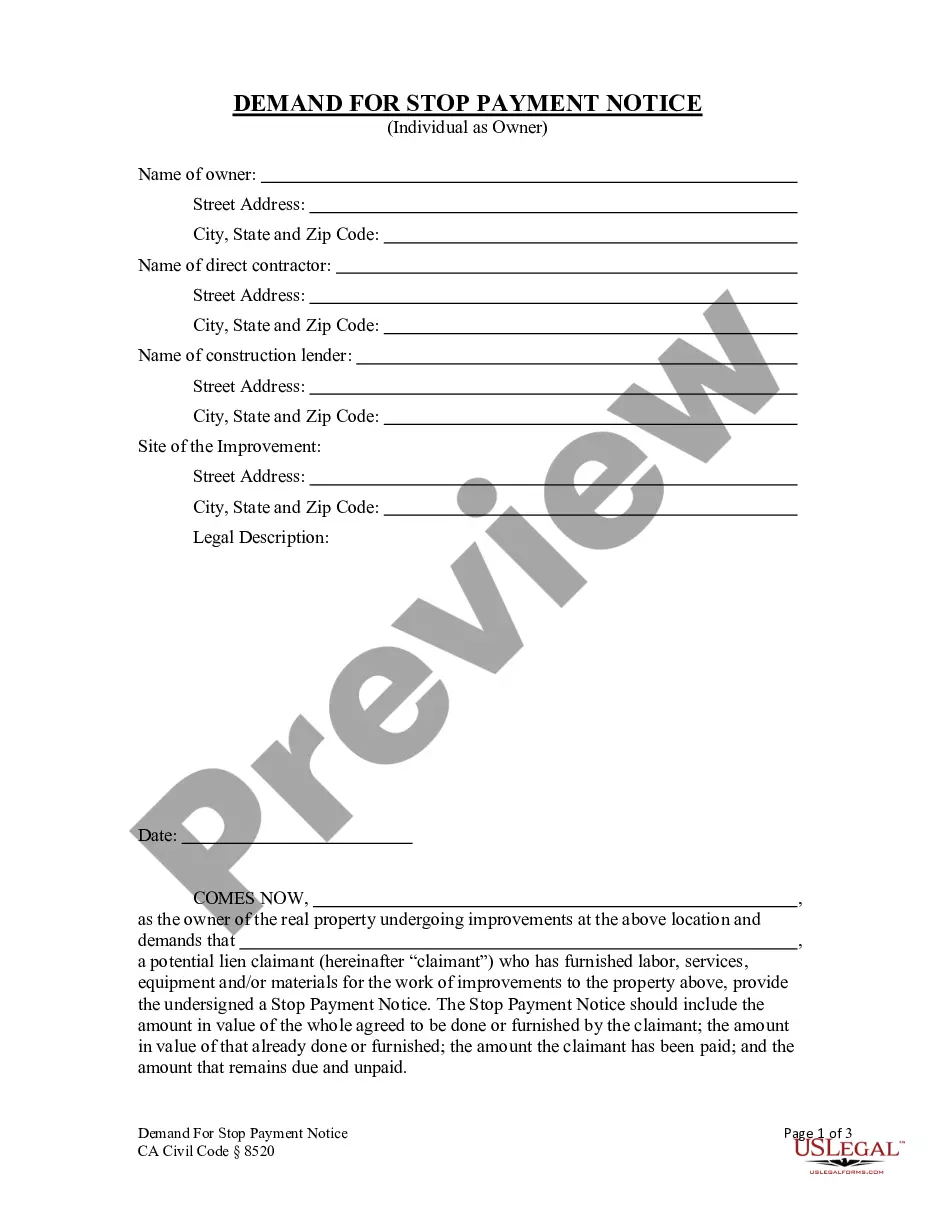

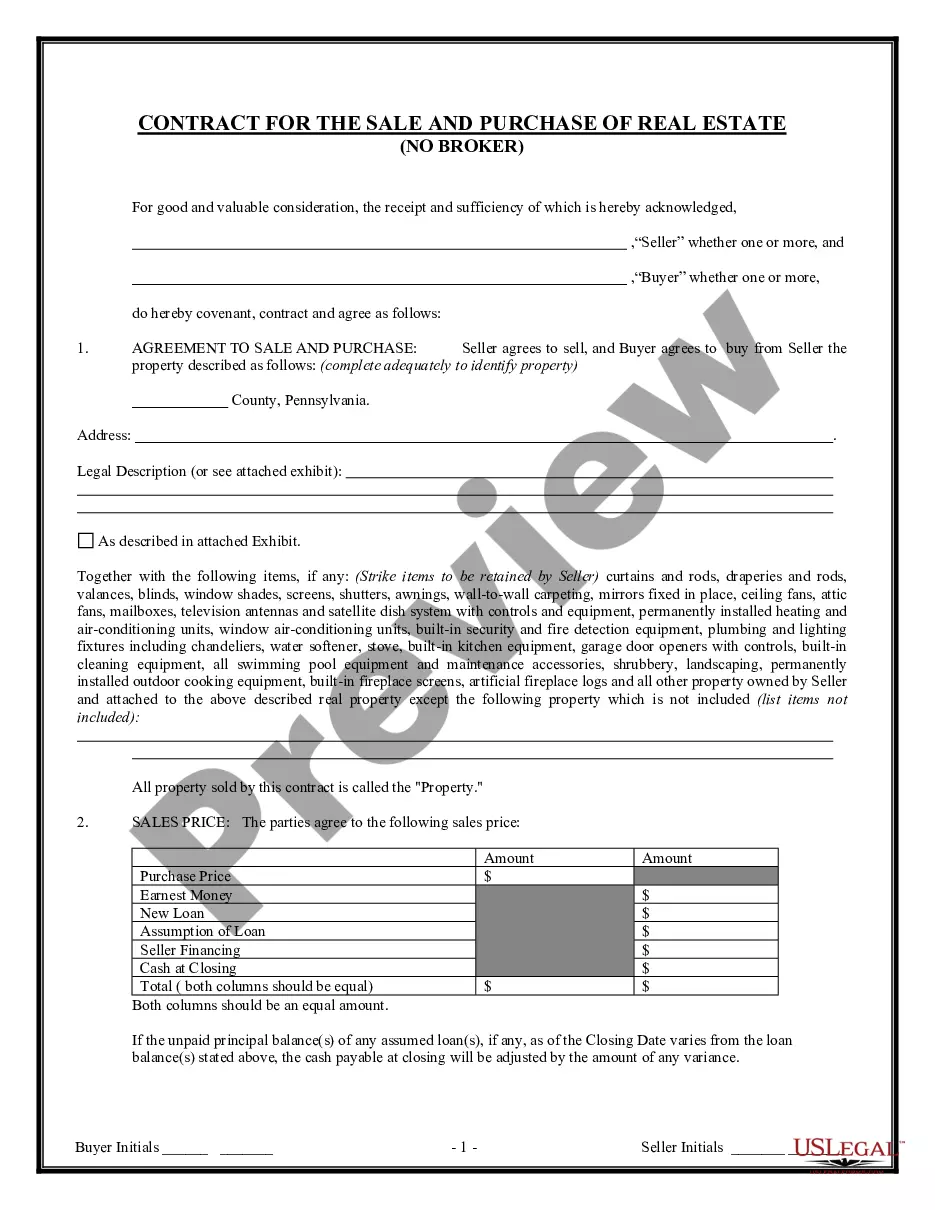

- Step 2. Use the Review feature to scrutinize the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, employ the Search box at the top of the screen to discover alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your pricing option and provide your details to register for the account.

Form popularity

FAQ

To properly write a resolution, start with an appropriate format that identifies the document as a resolution. Clearly state the purpose of the resolution and provide context for the decision being made. For example, a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money should include all necessary legal caveats, member names, and signatures where required. This thoroughness ensures that everyone involved understands the implications of the decision.

A member resolution refers to a formal decision made by the members of an LLC during a meeting. It serves as a written record outlining the agreement among members regarding specific actions, such as borrowing money. When it comes to the Virginia Resolution of Meeting of LLC Members to Borrow Specific Money, this document captures the consensus on financial decisions and commitments.

The resolution of members of an LLC represents an official decision made by the members regarding key company matters. These can include changes in management, financial commitments, or adopting new policies. By recording these resolutions, members maintain clarity on decisions that impact the LLC's direction. Including a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money in your documentation reinforces accountability and provides a solid foundation for the company’s future financial actions.

A resolution letter for a company is a formal document that captures the decisions made by the company's members or managers. It serves as an official record that can be referred to in future dealings, like securing loans or entering contracts. This letter not only enhances transparency but also promotes trust among stakeholders. When you use a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money, you create a letter that serves as a reliable reference point for all financial actions taken.

Virginia Code 13.1-1007 pertains to the management and governance of limited liability companies in Virginia. This section outlines the rules for decision-making among members, particularly regarding financial obligations like borrowing money. Adhering to this code is essential for proper business operation and member protection. Implementing a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money directly aligns with the stipulations provided in this code, ensuring you stay compliant.

A resolution for an LLC in Florida serves the same purpose as other states, allowing the company to document decisions formally. This resolution can include borrowing funds, making significant investments, or any other crucial business operations. The legal framework in Florida requires that members agree on such actions to avoid disputes. When creating a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money, you ensure compliance with Florida law, securing necessary approvals efficiently.

A resolution for an LLC manager outlines the powers and responsibilities of the manager concerning financial decisions, such as borrowing funds. It specifies the extent to which a manager can act on behalf of the LLC, especially in negotiations with lenders. By having a clear resolution, all parties know who is authorized to make financial commitments. Incorporating a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money highlights proper governance within the business's framework.

To add a member to your LLC in Virginia, you typically need to prepare an amendment to your operating agreement or the Articles of Organization. All existing members should agree on the addition, followed by documentation that may include a Virginia Resolution of Meeting of LLC Members to Borrow Specific Money, particularly if this new member will influence financial decisions.

Amending articles of incorporation in Virginia involves submitting the Articles of Amendment to the Virginia State Corporation Commission. This document should clearly state the original articles and the proposed changes. Following amendments ensures that all operational aspects are updated, which can include important financial decisions reflected in the Virginia Resolution of Meeting of LLC Members to Borrow Specific Money.

To acquire an LLC in Virginia, you must first select a unique name and then file Articles of Organization with the Virginia State Corporation Commission. After approval, you can obtain an Employer Identification Number (EIN) from the IRS. Consider using uslegalforms for guidance throughout the formation process, especially concerning financial resolutions such as the Virginia Resolution of Meeting of LLC Members to Borrow Specific Money.