Virginia Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

If you want to completely download, acquire, or create legal documentation templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Take advantage of the site’s simple and user-friendly search feature to locate the documents you require.

An assortment of templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, select the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Virginia Resolution of Meeting of LLC Members to Determine Amount of Annual Disbursements to Members of the Company in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to retrieve the Virginia Resolution of Meeting of LLC Members to Determine Amount of Annual Disbursements to Members of the Company.

- You can also access forms you've previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions provided below.

- Step 1. Ensure you have chosen the form for the correct city/region.

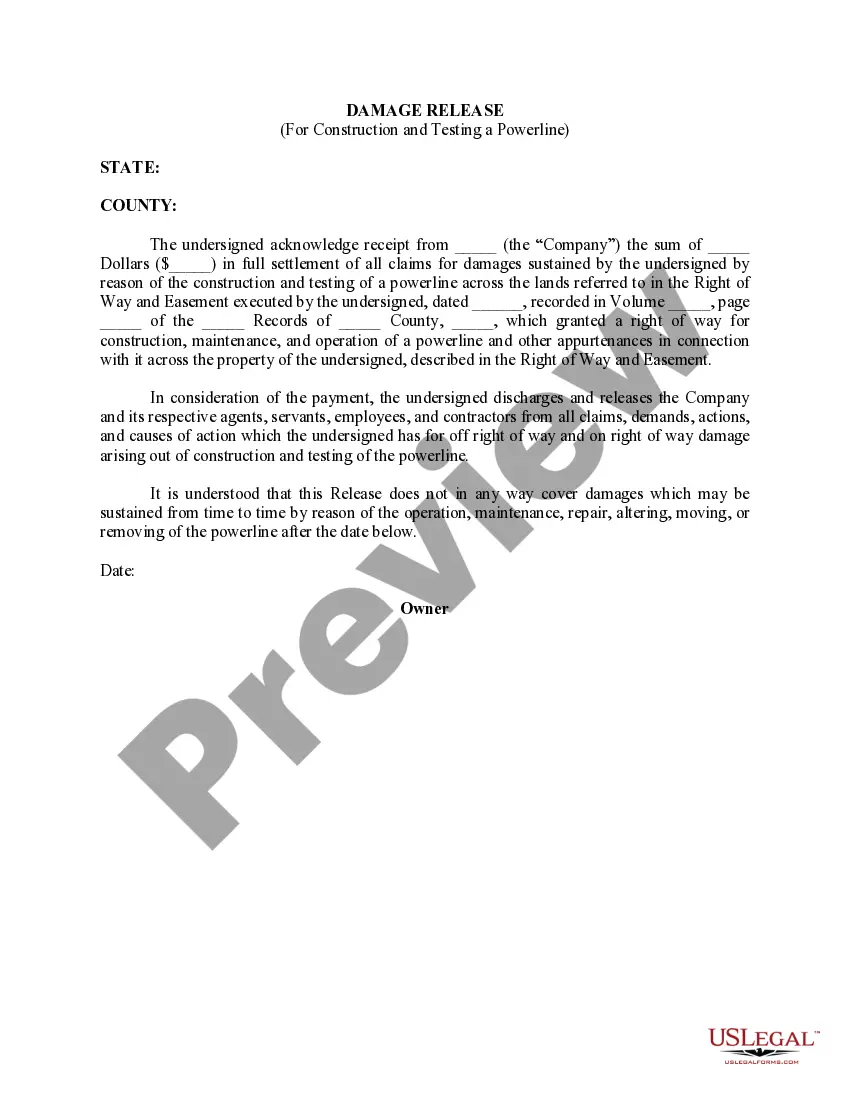

- Step 2. Utilize the Preview mode to review the form’s information. Don't forget to read through the explanation.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find additional options in the legal form format.

Form popularity

FAQ

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

A Virginia LLC operating agreement is a legal document that creates a member-managed company, whereas the members collectively set forth the rules and regulations, among other things, and abide by them. The State of Virginia does not require that a company implements this document.

"Piercing the corporate veil" refers to a situation in which courts put aside limited liability and hold a corporation's shareholders or directors personally liable for the corporation's actions or debts. Veil piercing is most common in close corporations.

A limited liability company (LLC) is a legal business entity that provides some liability protection (like a corporation) and other features similar to a partnership. The owners of an LLC are called members, and LLCs can have several different types of owners, including some other business types.

LLCs have no limit on the number of members and the ownership of each member can be entirely different from another member. For example, one member might have 5% ownership in the LLC, whereas another member could have 45% ownership in the LLC.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

Every Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Every Virginia LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and affairs.