Virginia While You Were Out

Description

How to fill out While You Were Out?

Are you currently in a situation where you frequently require documents for either business or personal reasons.

There is a multitude of legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of template formats, like the Virginia While You Were Out, designed to comply with federal and state regulations.

Once you locate the right template, click Download now.

Select the pricing plan you prefer, complete the required information to create your account, and process the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Virginia While You Were Out template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and make sure it corresponds to the appropriate area/county.

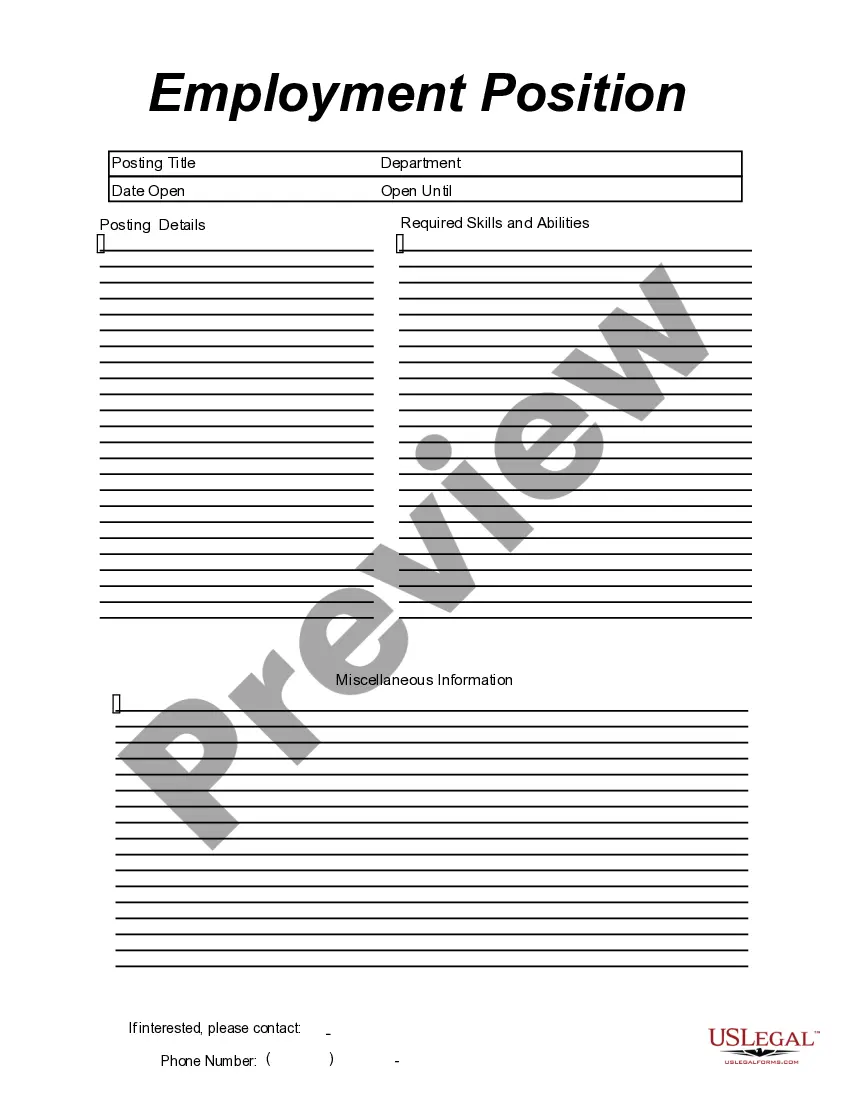

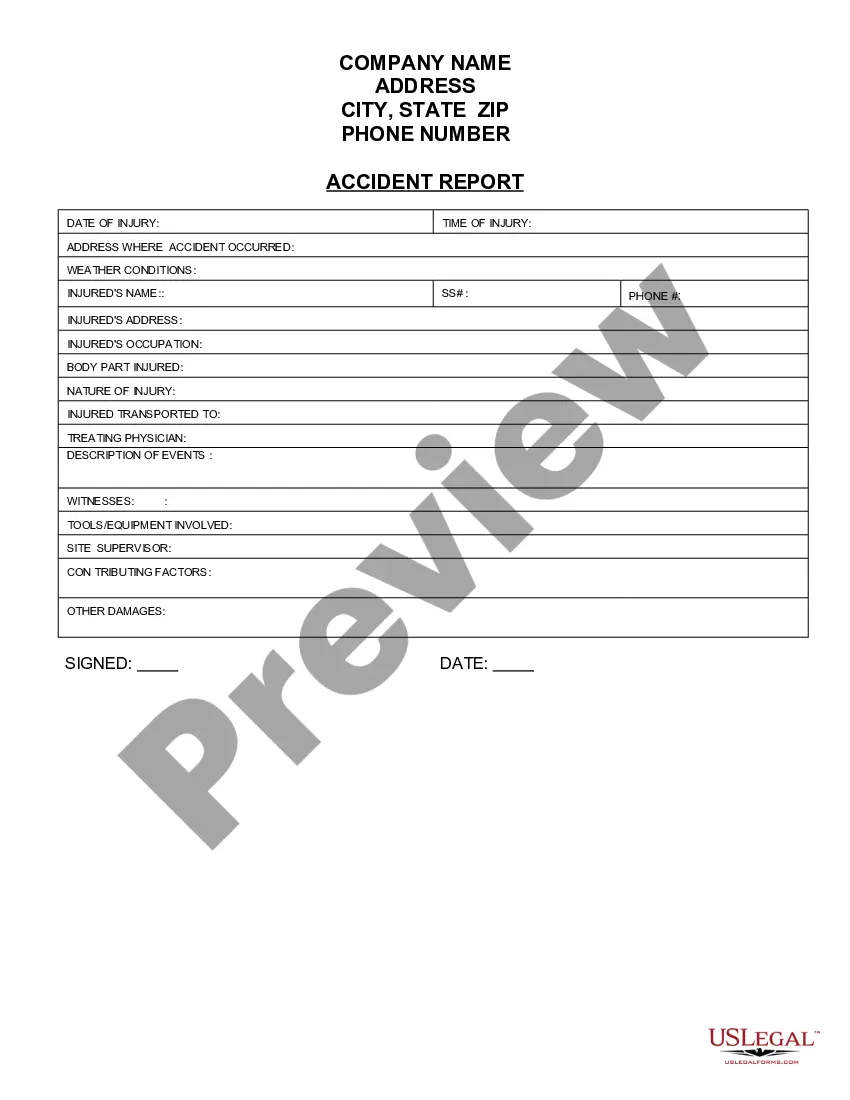

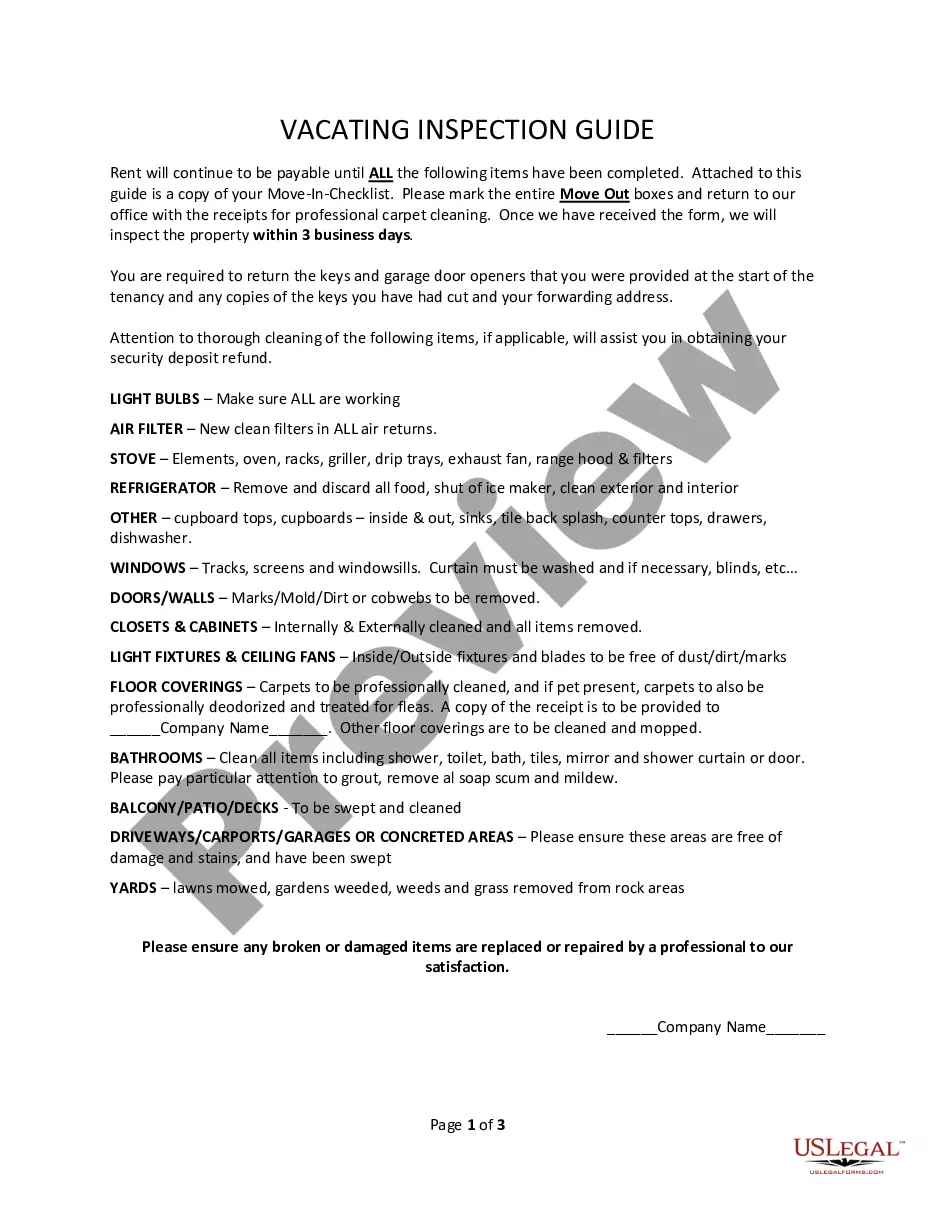

- Use the Review button to evaluate the form.

- Check the description to verify that you have selected the correct template.

- If the template does not meet your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Any complaints relating to the provision of job seeker services may be lodged at any VEC Workforce Center or with the State Monitor Advocate, at (804) 786-6094.

No. You cannot claim yourself as a dependent on taxes. Dependency exemptions are applicable to your qualifying dependent children and qualifying dependent relatives only. You can, however, claim a personal exemption for yourself on your return.

At any given time, you can only have one domicile. However, that doesn't mean that another state can't claim you as a resident for tax reasons.

You must claim your own exemption. To determine whether you are entitled to claim any exemptions for your dependents, you must apply the federal rules for separate filing. Under federal rules, you must demonstrate that you provided at least 50% of a dependent's support in order to claim an exemption for the dependent.

Resident -- A person who lives in Virginia, or maintains a place of abode here, for more than 183 days during the year, or who is a legal (domiciliary) resident of the Commonwealth, is considered a Virginia resident for income tax purposes.

You will file your weekly request for payment of benefits over the Internet at or telephonically using the Voice Response System (VRS) at 1-800-897-5630.

Existing claimants who are eligible for PUA log in here to file their weekly claims. To find out your claim's status, call the Voice Response System at 800-897-5630, and choose Claims and Benefits.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

And you could claim yourself, your dependents and your spouse on your taxes. Unfortunately, the Tax Cuts and Jobs Act (TCJA) eliminated those exemptions from 200b2018 to 2025200b. In return, it doubled the standard deductions that taxpayers could claim. Therefore, claiming yourself on taxes is technically impossible.