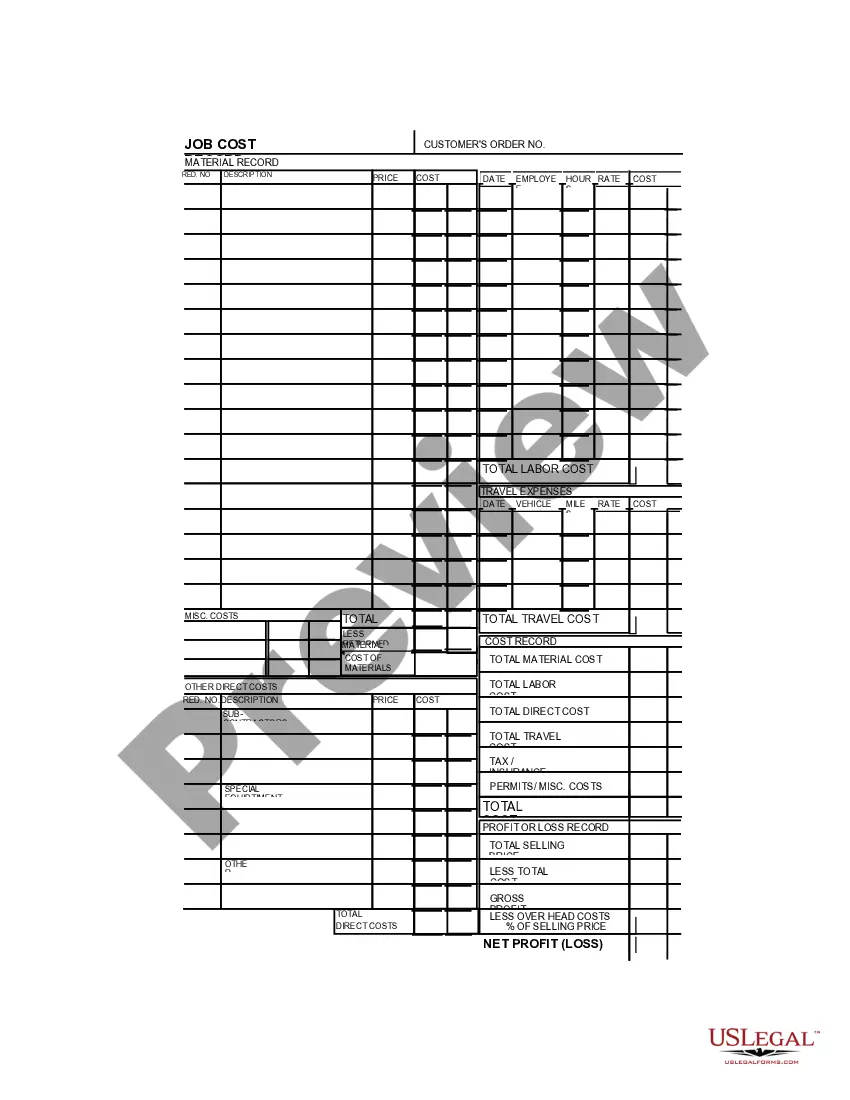

Virginia Job Invoice - Long

Description

How to fill out Job Invoice - Long?

If you require extensive, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. After finding the form you require, click the Buy now button. Choose your preferred pricing plan and provide your details to create an account.

Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize your payment.

- Utilize US Legal Forms to acquire the Virginia Job Invoice - Long with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Virginia Job Invoice - Long.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to review the outline.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

PPA due date: The date on or before which a payment should be made under the Prompt Payment Act. This date will be either the latest date available to take a discount, if the discount is economically justified, or the latest date available to pay and avoid interest penalties.

(2) When an invoice is determined to be improper, the agency shall return the invoice to the vendor as soon as practicable after receipt, but no later than 7 days after receipt (refer also to paragraph (g)(4) of this section regarding vendor notification and determining the payment due date.)

Accounts Payable is required to follow the Prompt Payment statutes in the Code of Virginia when setting due dates for payments of invoices. Invoices must be paid 30 days after receipt of a proper invoice or 30 days after receipt of the goods or services, whichever date is later.

You have to choose but never more than 30 days after you provide service to that client. If you are in the trades such as a plumber, you might bill the day after service, but you cannot wait months to bill a customer. The other way to look at it is to make sure you are billing on a regular schedule.

A reputable contractor should be able to front the costs of most supplies without a large sum of money from you. A good rule of thumb is an initial deposit of no more than 10% down or $1,000, whichever is less.

The CAPP Manual documents the policies and procedures associated with the Commonwealth's centralized accounting and financial systems.

The Contractor may submit not more than once each month a Request for Payment. Each request shall be computed from the work completed on all items listed in the Breakdown of Work and Corresponding Value, less a retention of 10% of the progress payment to the Contractor.

Congress has imposed on agencies an obligation to pay every "proper invoice" within 30 days after its receipt. Under the Prompt Payment Act, an agency that fails to pay within the required time will be liable for interest on the delinquent payment.