Virginia Product Sales Order Form

Description

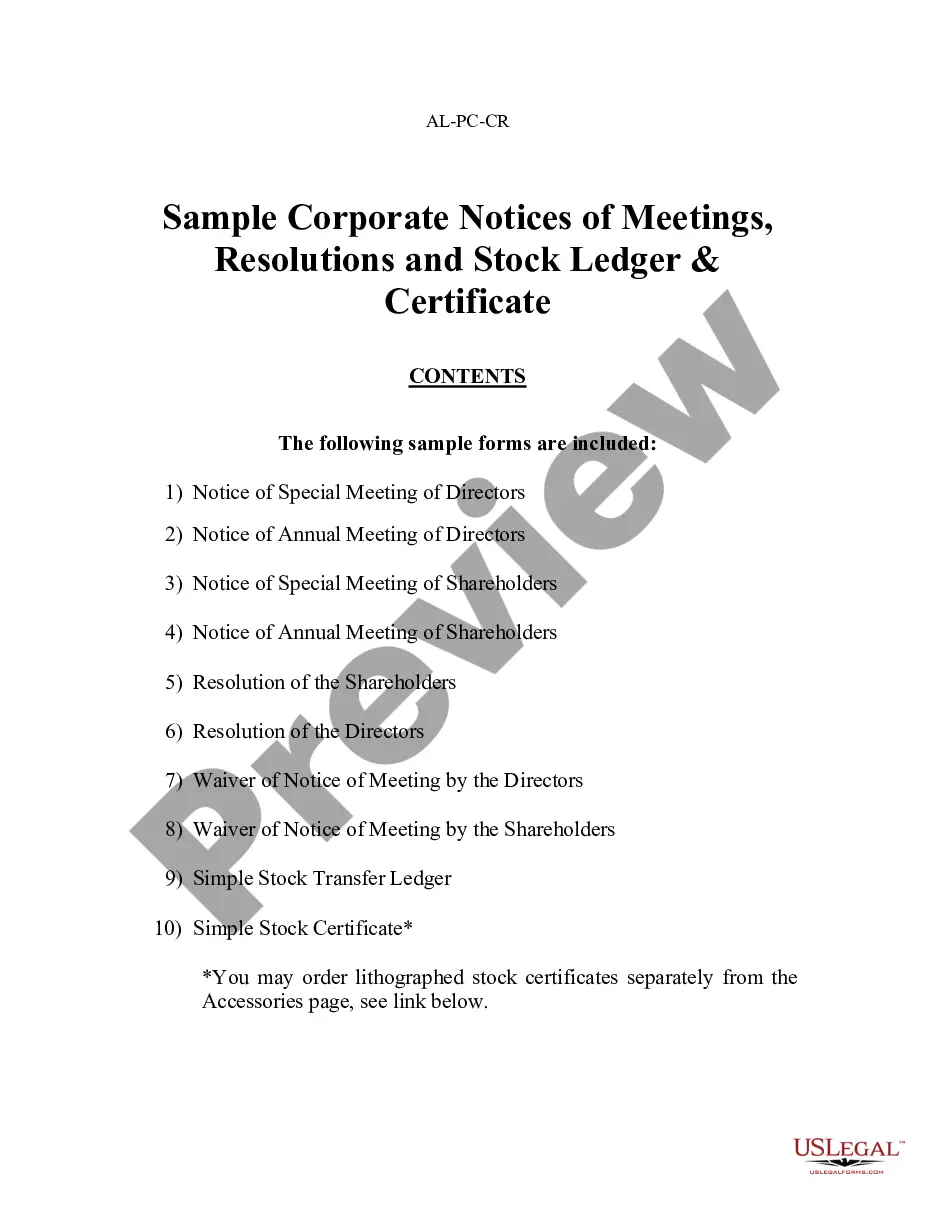

How to fill out Product Sales Order Form?

Have you ever found yourself in a circumstance where you need documents for business or personal reasons nearly every single day.

There are many legal document templates available on the internet, but finding trustworthy ones is not easy.

US Legal Forms provides a wide variety of form templates, such as the Virginia Sales Order Form, which can be customized to comply with state and federal regulations.

Once you find the appropriate form, click Buy now.

Select the payment plan you desire, fill in the required information to create your account, and purchase your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Virginia Sales Order Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Read the description to confirm you have chosen the right document.

- If the form is not what you're looking for, utilize the Search section to locate the document that fits your needs.

Form popularity

FAQ

Most businesses operating in or selling in the state of Virginia are required to purchase a resale certificate annually. Even online based businesses shipping products to Virginia residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Go to Nonprofit Online, or complete Form NP-1 and submit it to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 27125, Richmond, Virginia 23261-7125. For detailed information on exemption requirements, go to Retail Sales and Use Tax Exemptions for Nonprofit Organizations.

In Virginia, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Several exceptions to the state sales tax are certain types of protective clothing, certain assistive medical devices, any learning institute's textbooks, and any software and data center equipment.

How to fill out a Virginia ST-10.Date the form at the top.Name of dealer should be your registered business name.Virginia Account Number should be your registered business number in Virginia.Address should be the registered address of your company.More items...?

Virginia Tax Forms Individuals may obtain free copies of forms, instructions, and publications directly from the state: (view/download tax forms and instructions online) 1-804-367-8031 (request individual tax forms and instructions by phone to be delivered by mail)

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

Download forms at . Order forms online through the Department's website or call (804) 440-2541.

HOW TO GET A RESALE CERTIFICATE IN VIRGINIA2714 STEP 1 : Complete the Virginia Sales and Use Tax Registration.2714 STEP 2 : Fill out the Virginia ST-10 tax exempt form.2714 STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

The farmer must register with the state by filing State Form R1, Virginia Department of Taxation Business Registration Form ( ), and must collect and pay the tax due on retail sales.

Residents of Virginia must file a Form 760. (A person is considered a resident if they have been living in Virginia for more than 183 days in a calendar year). An instruction booklet with return mailing address is also available. Nonresidents of Virginia must file a Form 763.