Virginia Checking Log

Description

How to fill out Checking Log?

If you need to calculate, acquire, or generate legal document topics, utilize US Legal Forms, the largest assortment of legal templates that are accessible online.

Utilize the site’s straightforward and efficient search to locate the documents you need. Various topics for business and personal purposes are organized by categories and phrases.

Employ US Legal Forms to discover the Virginia Checking Log with just a few clicks.

Every legal document template you purchase is yours indefinitely.

You have access to each form you acquired in your account. Navigate to the My documents section and select a form to print or download again. Stay competitive and procure, and print the Virginia Checking Log with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms client, sign in to your account and click on the Obtain button to retrieve the Virginia Checking Log.

- You can also access forms you previously obtained within the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps outlined below.

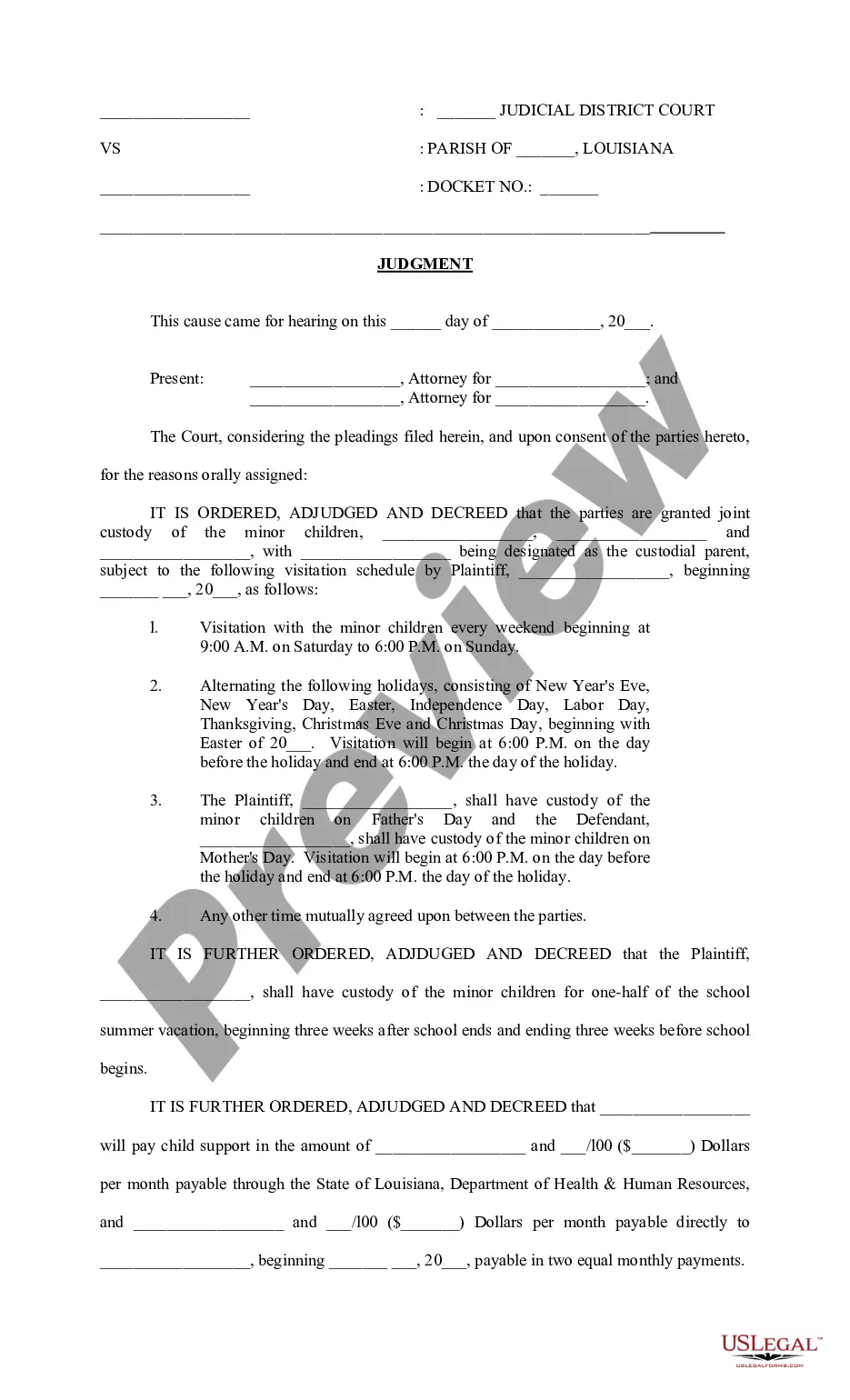

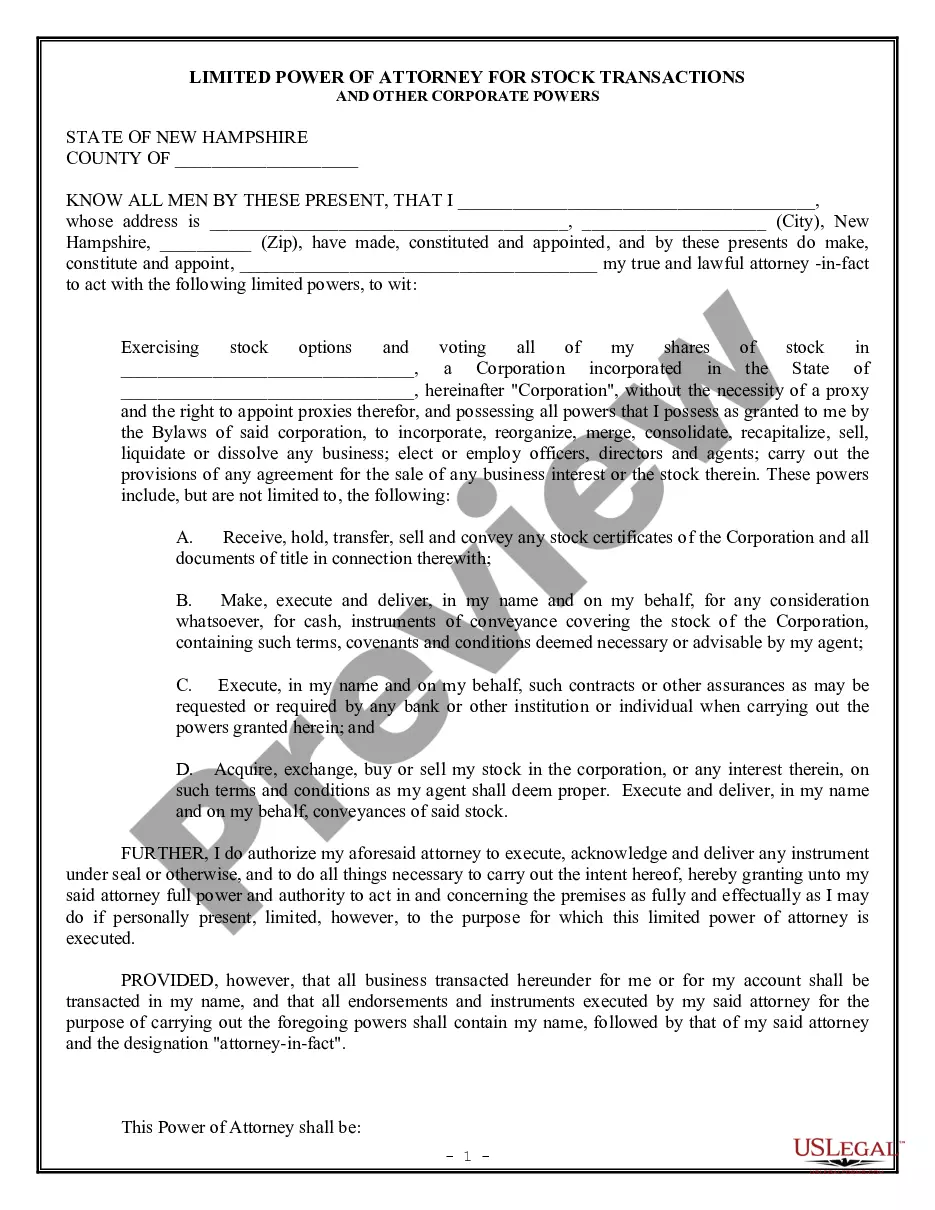

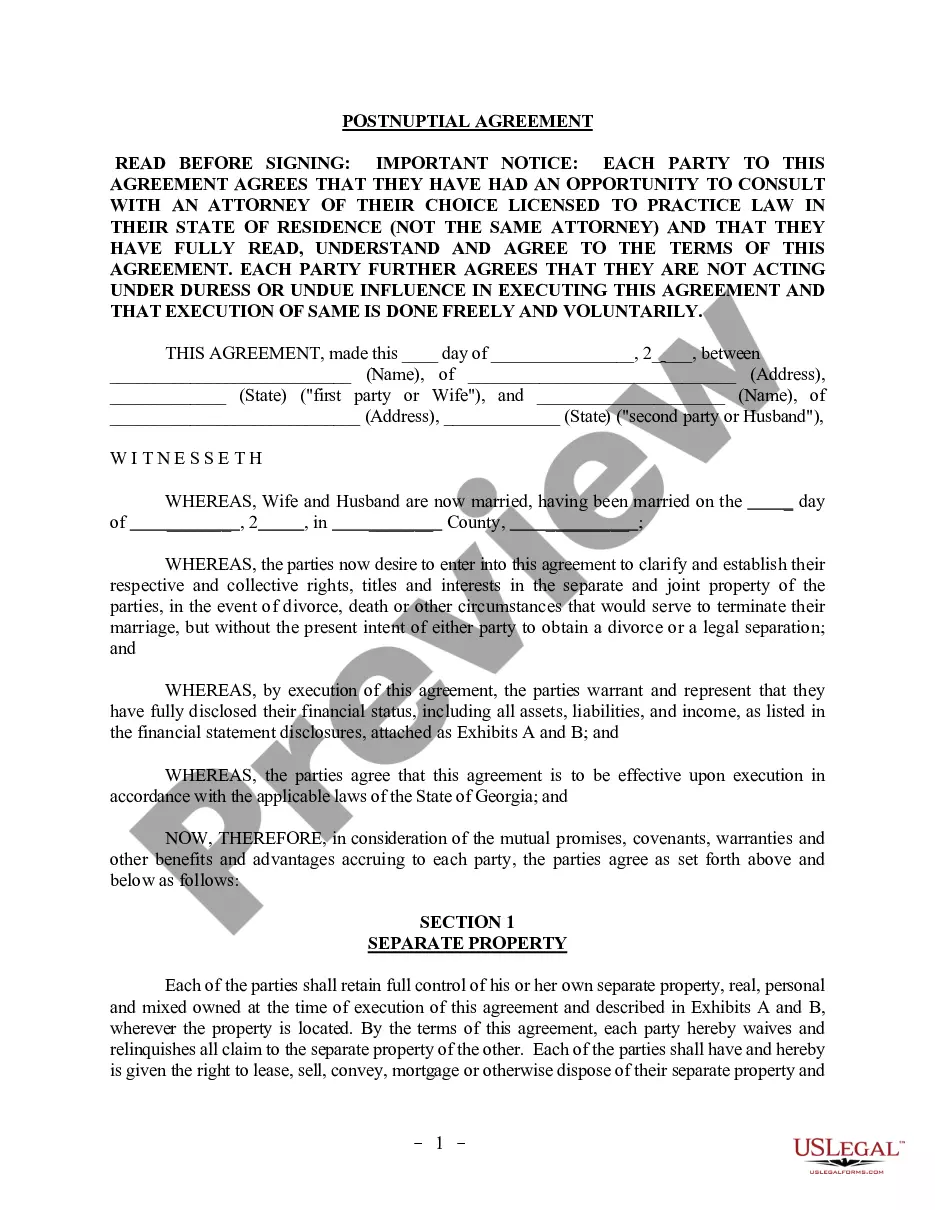

- Step 1. Ensure you have selected the form appropriate for your city/state.

- Step 2. Use the Preview option to review the form’s contents. Do not forget to read the instructions.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have identified the form you wish to obtain, click the Get now button. Choose your preferred payment plan and enter your details to register for an account.

- Step 5. Process the transaction. You may use your Visa or MasterCard or PayPal account to complete the purchase.

- Step 6. Select the format of your legal form and download it onto your system.

- Step 7. Complete, edit, and print or sign the Virginia Checking Log.

Form popularity

FAQ

Attach check or money order payable to Virginia Department of Taxation. Include your Social Security number and the tax period for the payment on the check. If your financial institution does not honor your payment to us, we may impose a $35 fee (Code of Virginia § 2.2-614.1).

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

IndividualsInclude a copy of your notice, bill, or payment voucher.Make your check, money order, or cashier's check payable to Franchise Tax Board.Write either your FTB ID, SSN, or ITIN, and tax year on your payment.Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.