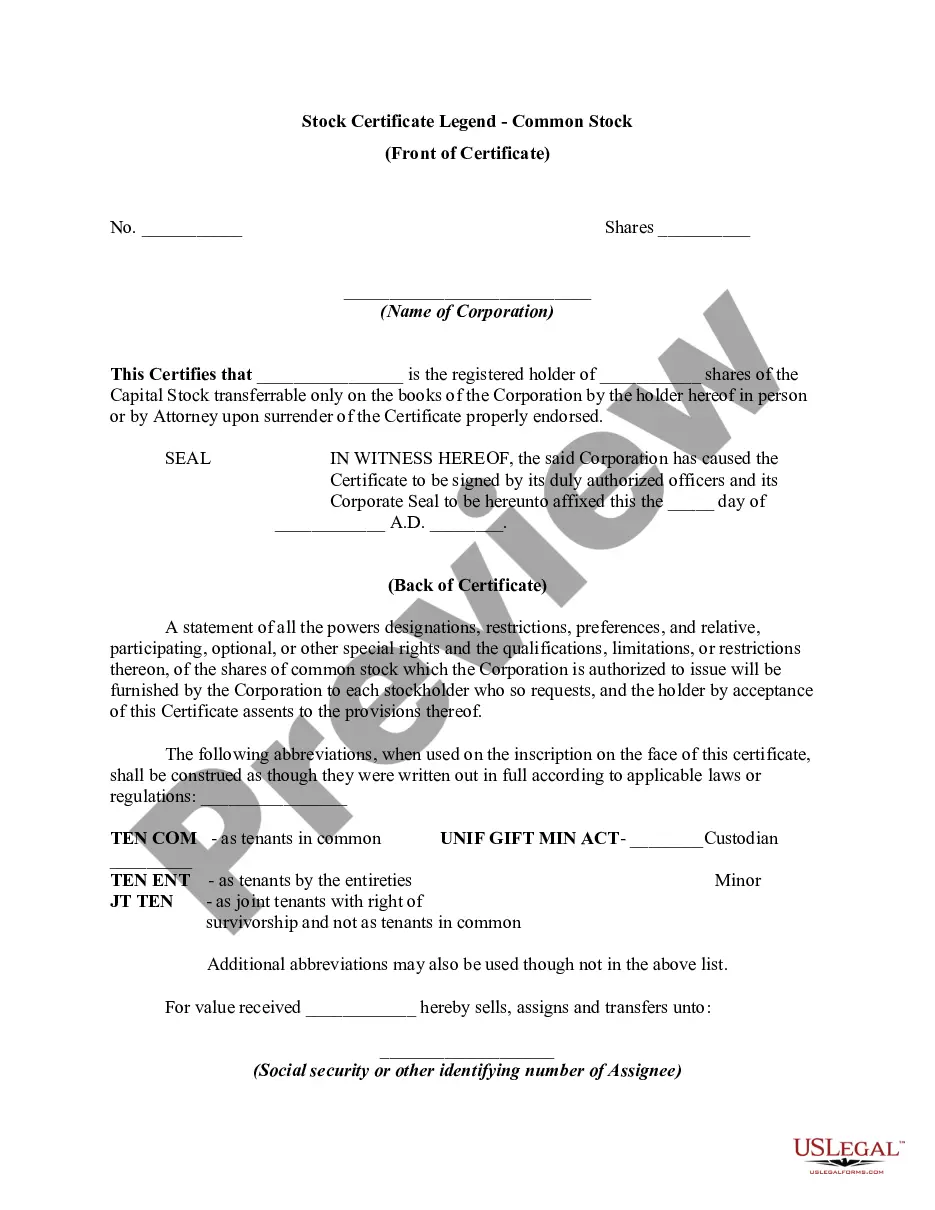

Virginia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

If you have to full, acquire, or produce lawful file themes, use US Legal Forms, the largest selection of lawful types, which can be found online. Take advantage of the site`s basic and hassle-free search to find the documents you need. A variety of themes for business and person reasons are categorized by groups and suggests, or key phrases. Use US Legal Forms to find the Virginia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders with a handful of click throughs.

If you are presently a US Legal Forms customer, log in for your account and click on the Download switch to get the Virginia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders. You may also entry types you formerly delivered electronically within the My Forms tab of the account.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for your right metropolis/country.

- Step 2. Take advantage of the Preview choice to look over the form`s articles. Don`t forget about to see the description.

- Step 3. If you are not satisfied using the type, use the Search industry at the top of the display screen to discover other types from the lawful type template.

- Step 4. After you have located the form you need, click the Buy now switch. Select the prices plan you favor and put your accreditations to register to have an account.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal account to finish the transaction.

- Step 6. Find the formatting from the lawful type and acquire it in your device.

- Step 7. Comprehensive, modify and produce or signal the Virginia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Every single lawful file template you purchase is your own property eternally. You may have acces to every type you delivered electronically inside your acccount. Click the My Forms portion and choose a type to produce or acquire once again.

Compete and acquire, and produce the Virginia Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders with US Legal Forms. There are millions of professional and state-distinct types you can use for your business or person needs.

Form popularity

FAQ

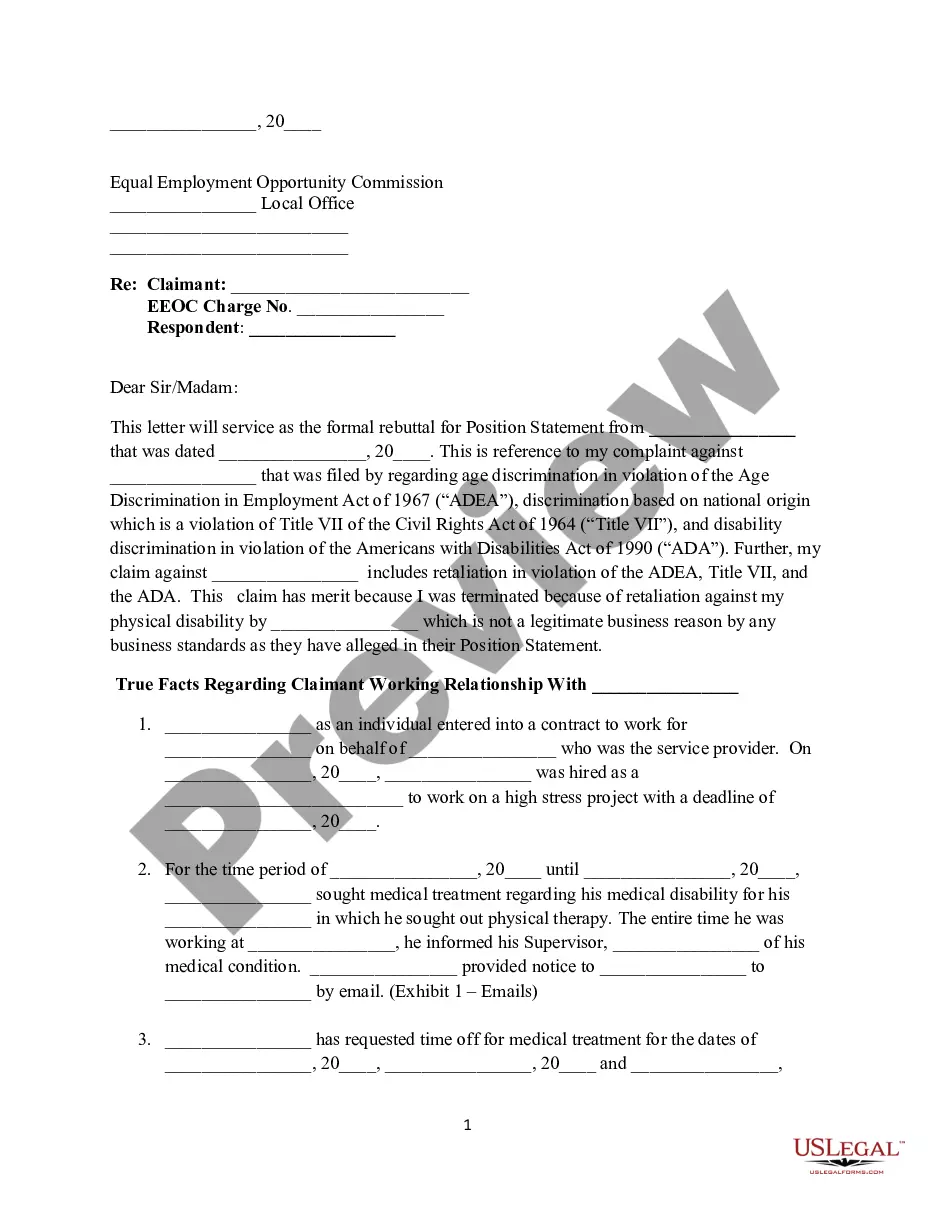

When you sell or redeem your mutual fund units or shares, you may have a capital gain or a capital loss. Generally, half of your capital gain or capital loss becomes the taxable capital gain or allowable capital loss.

A redemption is treated as a distribution in part or full payment in exchange for the stock redeemed and, therefore, not as a dividend if it is "not essentially equivalent to a dividend." A redemption may technically be "essentially equivalent to a dividend" as measured by this rule and still be treated as a redemption ...

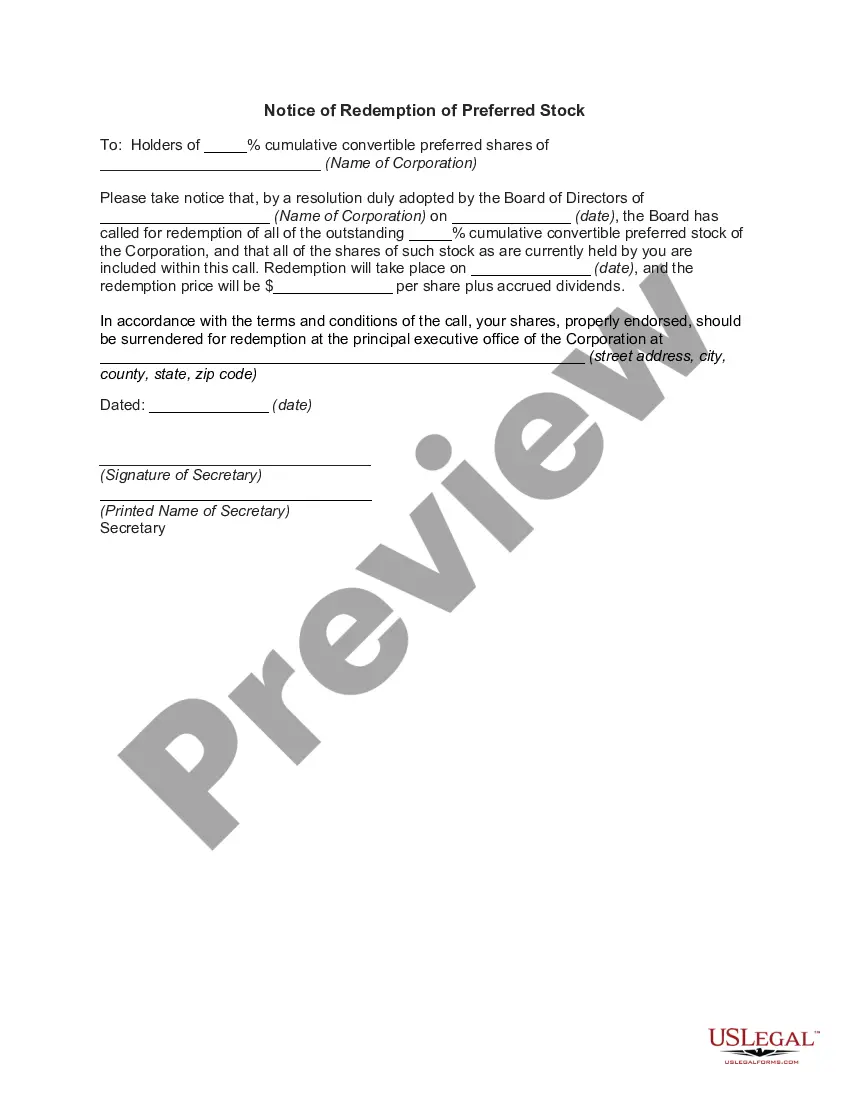

Redemptions are when a company requires shareholders to sell a portion of their shares back to the company. For a company to redeem shares, it must have stipulated upfront that those shares are redeemable, or callable.

Share repurchases are a popular method for returning cash to shareholders and are strictly voluntary on the part of the shareholder. Redemptions are when a company requires shareholders to sell a portion of their shares back to the company.

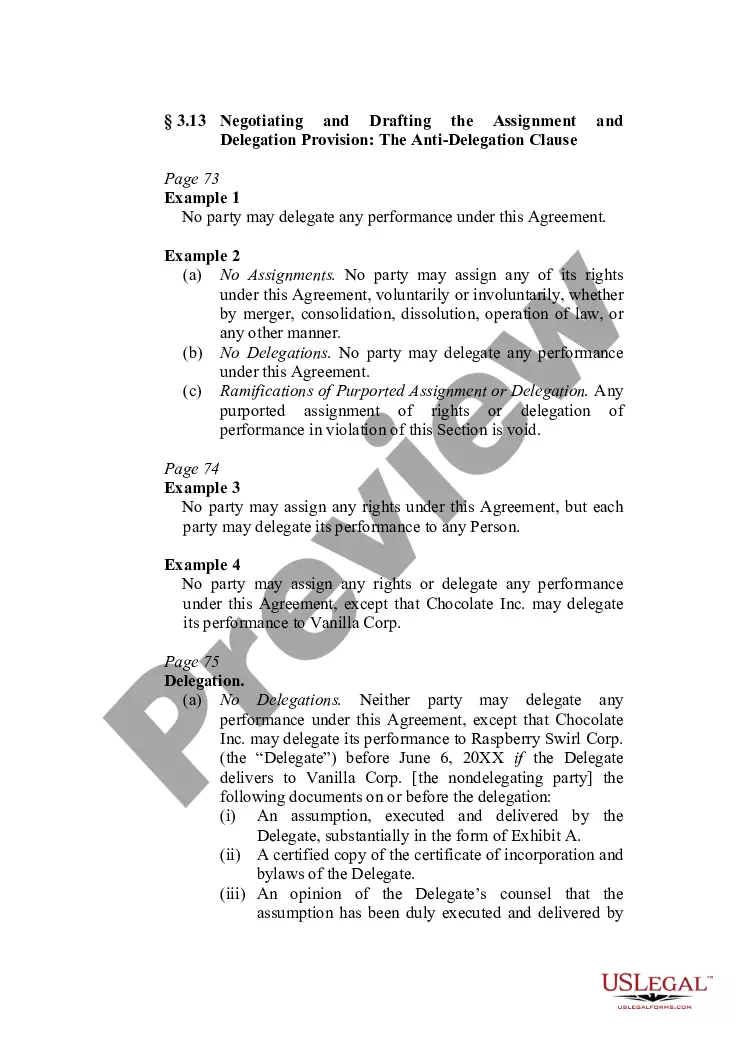

In determining how much stock is owned before and after a redemption, ?attribution? rules apply. These treat a shareholder as owning shares owned by certain family members as well as entities in which the shareholder has an interest.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

Accounting for Redemptions on the Corporation's Books Include all relevant details in the journal entry backup, such as redemption date, number of shares, summary of sale contract terms and payment structure. Debit the treasury stock account for the amount the company paid for the redemption.

A redemption is treated as a sale or exchange in the following situations: The distribution is not essentially equivalent to a dividend. It is substantially disproportionate with respect to the shareholder. It is in complete redemption of all of the stock of the corporation owned by the shareholder.