Virginia Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

US Legal Forms - one of the best collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

Through the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest forms such as the Virginia Security Agreement for Member Interests in Limited Liability Company within minutes.

If you have a subscription, Log In and download the Virginia Security Agreement for Member Interests in Limited Liability Company from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Virginia Security Agreement for Member Interests in Limited Liability Company. Each template added to your account has no expiration date and belongs to you forever. Thus, if you wish to download or print another version, simply visit the My documents section and click on the form you need. Access the Virginia Security Agreement for Member Interests in Limited Liability Company with US Legal Forms, the most extensive collection of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your area/county.

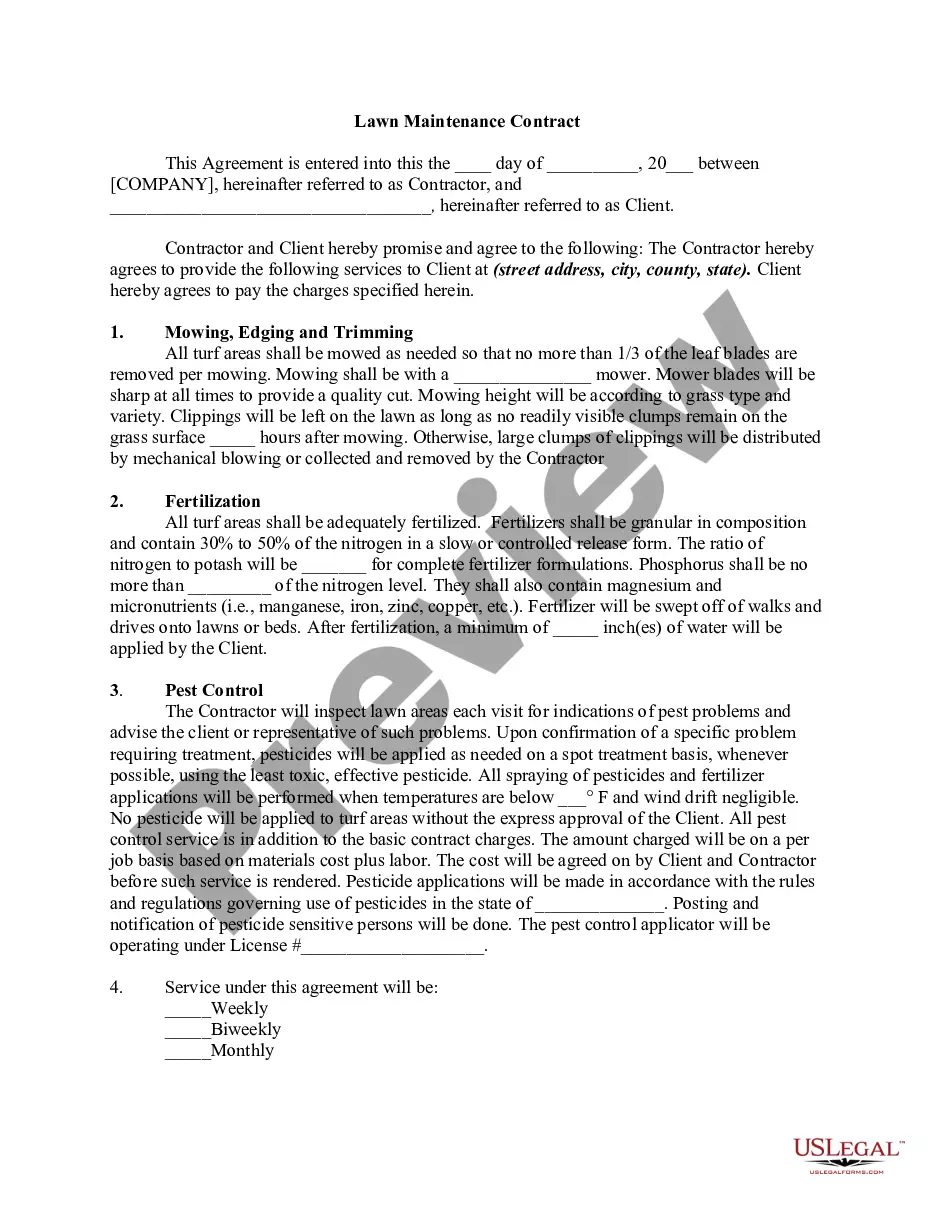

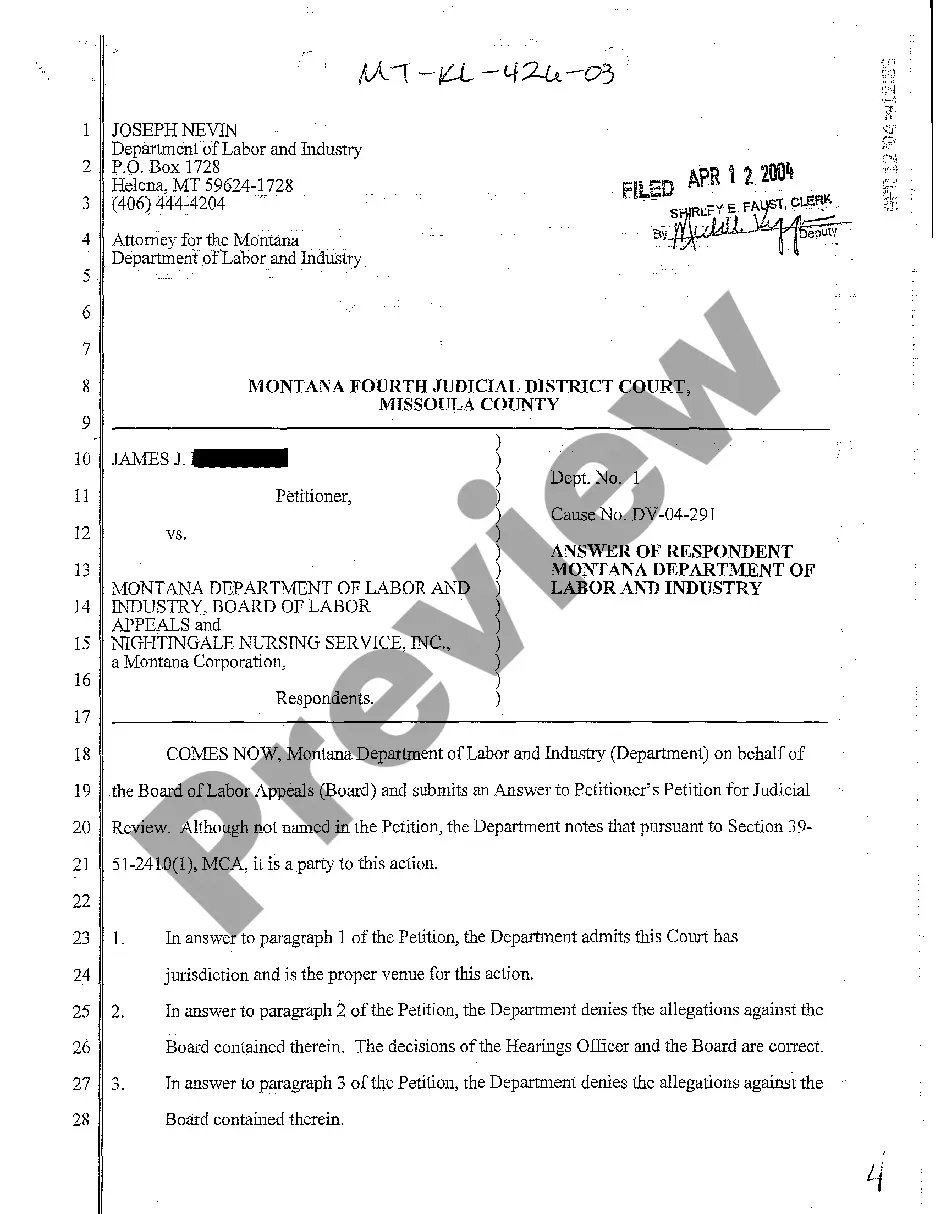

- Click the Preview button to review the contents of the form.

- Examine the form overview to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose your pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

A membership interest may be issued in the form of a percentage ownership interest or number of membership units....Then, you can add documents that pertain to membership interests, such as:Membership transfer ledger.Membership certificates, if any.Balance sheet showing the capital account of each member.

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

LLC MembersThe membership interest is not based on the number of shares a person owns; instead, a person invests money or property into the business and receives an ownership interest based on the amount of his investment.

Rather than issuing stock options like you would in a corporation, in an LLC you hold membership interests. If you're the sole member of an LLC, you retain 100% equity. However, if you're part of a multiple-member LLC, equity is distributed among members based on the terms of your operating agreement.

Under most circumstances, an LLC interest is a general intangible, and the lender will perfect its security interest by filing an initial UCC financing statement in the state where the pledgor is located, which for an individual pledgor is the state of his/her principal residence and for a registered organization

As a result, lenders desiring to secure their loans with an equity pledge (typically either in the borrower itself or its subsidiaries) are increasingly taking pledges of LLC membership interests as part of their collateral.

Subtract the company's debts and add the amount of any cash reserves. Multiply this result by a factor mutually agreed upon by the members to get the estimated value of the company. This may vary based on the industry and the company's stability.