Virginia Sample Letter for Written Acknowledgment of Bankruptcy Information

Description

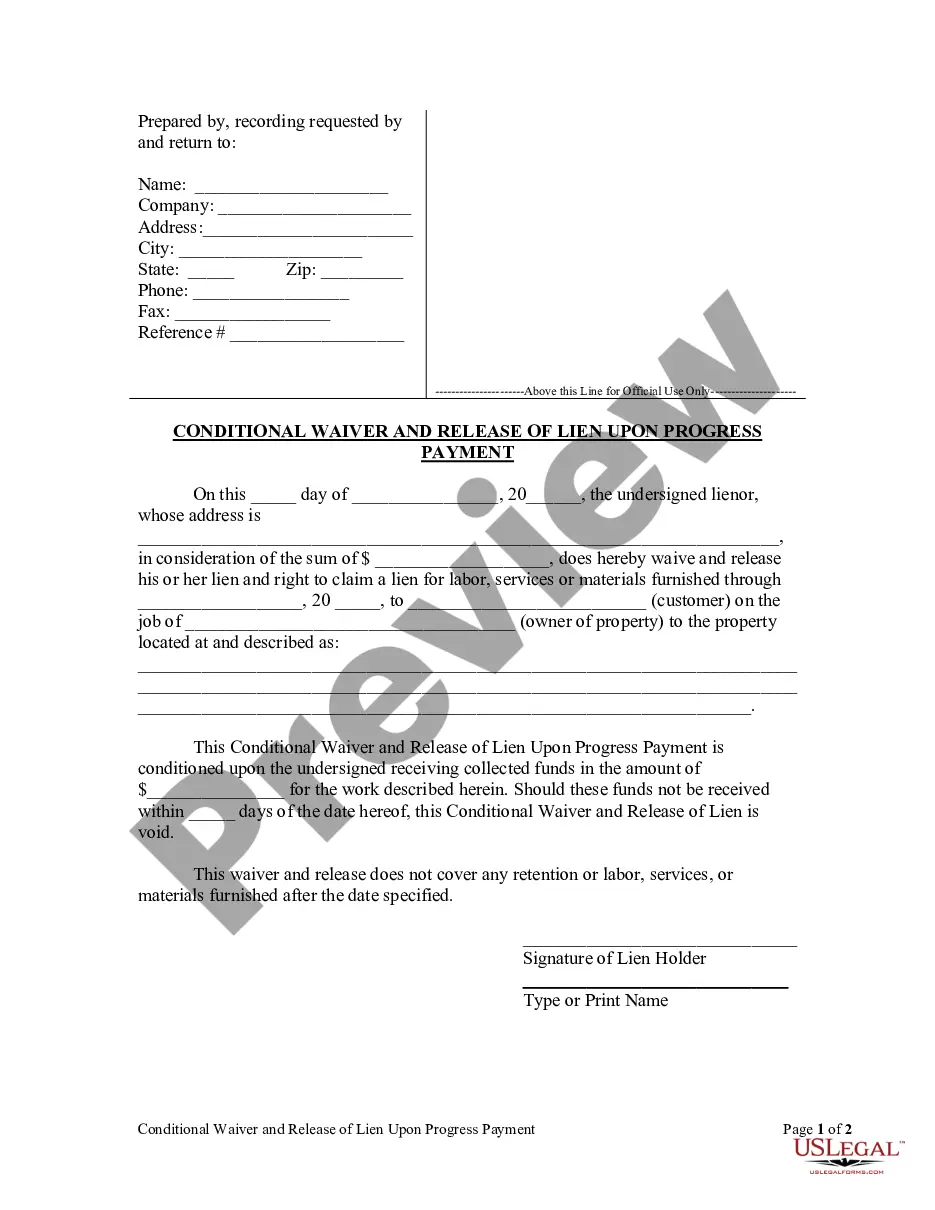

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

If you wish to total, download, or printing legitimate papers web templates, use US Legal Forms, the most important selection of legitimate forms, that can be found on the web. Use the site`s easy and practical lookup to discover the documents you want. Numerous web templates for organization and personal purposes are sorted by groups and claims, or keywords. Use US Legal Forms to discover the Virginia Sample Letter for Written Acknowledgment of Bankruptcy Information with a handful of mouse clicks.

Should you be already a US Legal Forms consumer, log in to your profile and click the Down load key to obtain the Virginia Sample Letter for Written Acknowledgment of Bankruptcy Information. You can even accessibility forms you formerly downloaded from the My Forms tab of the profile.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the correct area/land.

- Step 2. Make use of the Review option to check out the form`s content. Never neglect to read the explanation.

- Step 3. Should you be unsatisfied using the form, use the Search area towards the top of the screen to get other variations of your legitimate form design.

- Step 4. After you have found the form you want, go through the Get now key. Select the rates plan you favor and add your qualifications to register on an profile.

- Step 5. Process the financial transaction. You can utilize your bank card or PayPal profile to perform the financial transaction.

- Step 6. Pick the formatting of your legitimate form and download it on the product.

- Step 7. Total, edit and printing or indicator the Virginia Sample Letter for Written Acknowledgment of Bankruptcy Information.

Every legitimate papers design you purchase is yours forever. You might have acces to every single form you downloaded within your acccount. Select the My Forms section and choose a form to printing or download once more.

Compete and download, and printing the Virginia Sample Letter for Written Acknowledgment of Bankruptcy Information with US Legal Forms. There are many professional and express-particular forms you can utilize for your organization or personal demands.

Form popularity

FAQ

If your bankruptcy is legitimate, you will not be able to legitimately dispute it. In this case, your only option is to wait until the credit bureau removes it after the standard seven to ten years. If the bankruptcy is not removed after that time, you can file a dispute to have it removed.

A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed.

To object to the debtor's discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an "adversary proceeding."

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

A debtor may apply to the Court to challenge (oppose) a bankruptcy notice before the time for compliance with the notice has finished. The debtor can apply to challenge a bankruptcy notice if: there is a defect in the bankruptcy notice. the debt on which the bankruptcy notice is based does not exist.

A notice of bankruptcy case and court-issued notices are sent to the creditors of the individual, corporation, or other entity that has filed for bankruptcy protection. Entities can use the Bankruptcy Noticing Center (BNC) to have notices delivered either: Electronically, or. By mail.

Any creditor is entitled to object to a bankrupt getting a discharge. You have to file a written objection and pay a court fee. It's important to note that the fact you didn't get paid is not a sufficient reason to object to the bankrupt's discharge.