Virginia Release and Indemnification of Personal Representative by Heirs and Devisees

Description

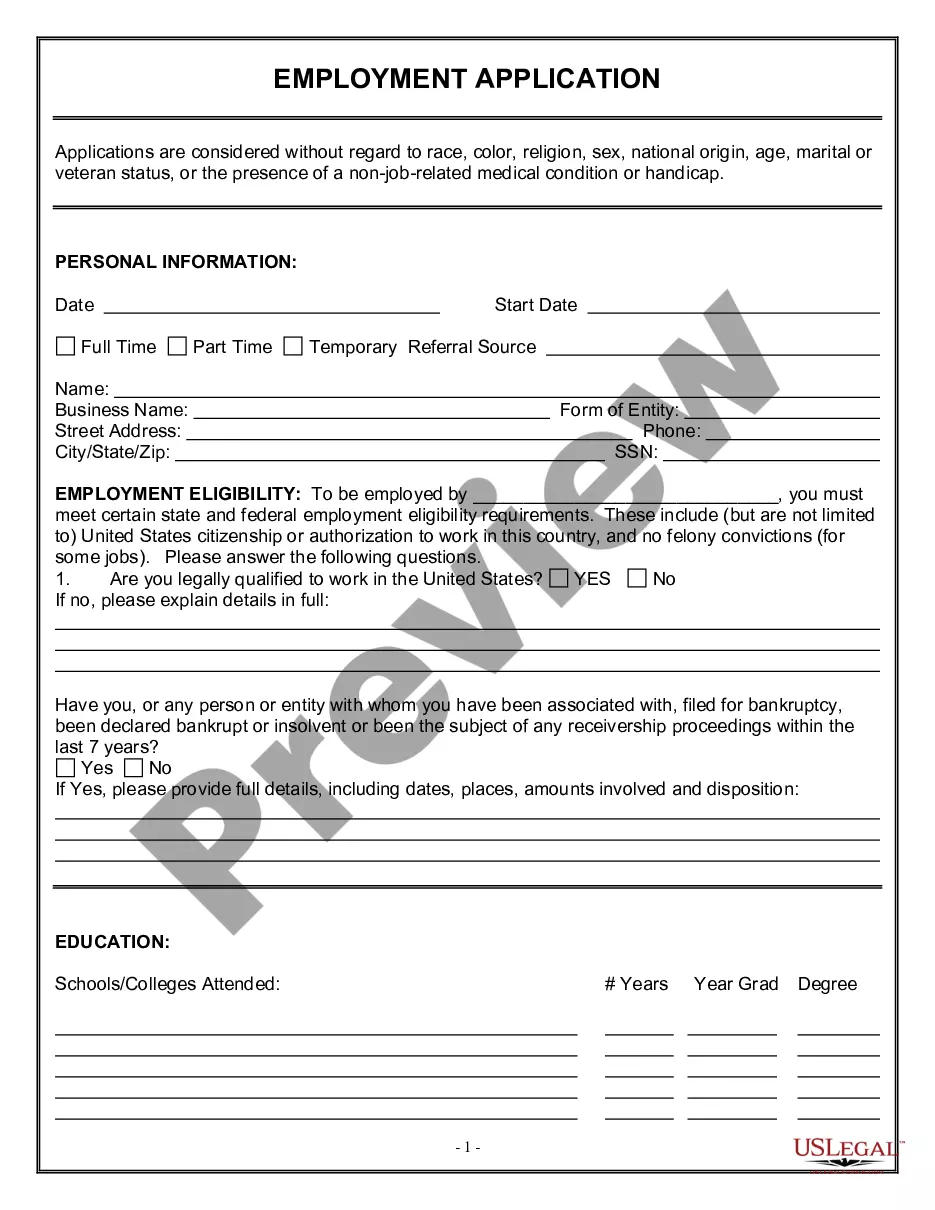

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a wide selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Virginia Release and Indemnification of Personal Representative by Heirs and Devisees in moments.

Review the form information to confirm that you have chosen the right form.

If the form does not meet your criteria, use the Search field at the top of the screen to find the one that does.

- If you have a subscription, Log In and download the Virginia Release and Indemnification of Personal Representative by Heirs and Devisees from your US Legal Forms library.

- The Download option will appear on every form you view.

- You can access all of the previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are easy instructions to help you get started.

- Ensure you have selected the correct form for your city/region.

- Use the Preview option to assess the form's details.

Form popularity

FAQ

Choosing the right executor is crucial for effective estate management. Ideally, the executor should be trustworthy, organized, and capable of handling potential challenges. Often, individuals select a family member, friend, or a professional, ensuring they communicate openly about their expectations. Understanding how this choice impacts the Virginia Release and Indemnification of Personal Representative by Heirs and Devisees can clarify responsibilities.

Generally, estates cannot realistically close before six months after the decedent's death because the surviving spouse has the right to make her claim for an elective share within that six months.

Most times, an executor would take 8 to 12 months. But depending on the size and complexity of the estate, it may take up to 2 years or more to settle the estate.

Under 31 USC section 3713(b), the executor is personally liable for any unpaid taxes of the decedent to the extent of the value of other debts paid by the executor over the outstanding priority claims of the United States.

To summarize, the executor does not automatically have to disclose accounting to beneficiaries. However, if the beneficiaries request this information from the executor, it is the executor's responsibility to provide it. In most cases, the executor will provide informal accounting to the beneficiaries.

An executor can be held personally liable for the debts of the estate up to the value of the estate. If they distribute the estate and leave a creditor outstanding, that creditor may bring a claim against the executors. This is the case even where the executor had no idea the debt even existed.

You're responsible for clearing the estate's debtsIf a creditor comes forward after the estate has been settled and assets have been distributed, again, the executor will be personally liable.

Estates that include no real property and $50,000 or less in personal property are considered small estates, according to Virginia inheritance laws. These estates can avoid any sort of probate proceeding, as long as at least 60 days have passed since the individual's death.

If an executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one personal representative failed to settle the inheritance tax bill before distributing the estate.

Heir generally refers to a person who is entitled to receive the decedent's property under the statutes of intestate succession, the distribution process that occurs when someone passes away without a will. A devisee is any person designated to receive real or personal property in a decedent's will.