Virginia Coverage for Interns under the Affordable Care Act

Description

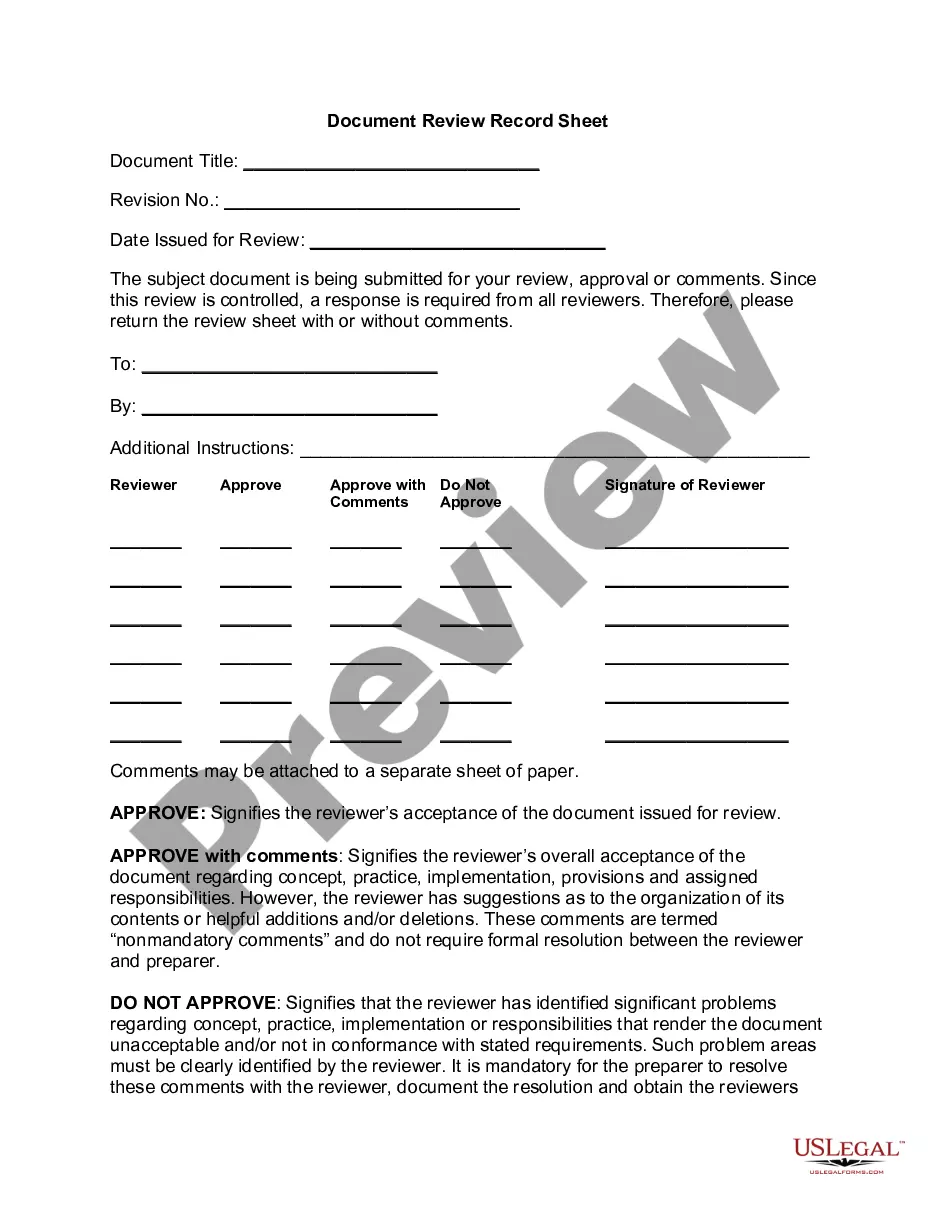

How to fill out Coverage For Interns Under The Affordable Care Act?

You may invest hrs online looking for the authorized document format that meets the federal and state specifications you will need. US Legal Forms gives thousands of authorized kinds that happen to be reviewed by pros. It is simple to download or print the Virginia Coverage for Interns under the Affordable Care Act from the assistance.

If you already possess a US Legal Forms account, you are able to log in and then click the Down load button. Next, you are able to complete, change, print, or indicator the Virginia Coverage for Interns under the Affordable Care Act. Every authorized document format you get is the one you have permanently. To have another duplicate for any obtained form, visit the My Forms tab and then click the related button.

If you work with the US Legal Forms site initially, adhere to the simple guidelines beneath:

- First, make certain you have chosen the proper document format for your area/area of your choosing. Browse the form outline to ensure you have picked the proper form. If readily available, make use of the Preview button to search throughout the document format too.

- If you would like get another model in the form, make use of the Search field to discover the format that fits your needs and specifications.

- Upon having found the format you want, click Acquire now to move forward.

- Pick the prices strategy you want, key in your accreditations, and register for a free account on US Legal Forms.

- Total the financial transaction. You should use your credit card or PayPal account to cover the authorized form.

- Pick the format in the document and download it in your product.

- Make modifications in your document if required. You may complete, change and indicator and print Virginia Coverage for Interns under the Affordable Care Act.

Down load and print thousands of document layouts utilizing the US Legal Forms Internet site, which provides the largest collection of authorized kinds. Use skilled and condition-certain layouts to tackle your small business or individual demands.

Form popularity

FAQ

Temporary workers are employees of your company or a staffing agency. They're at-will workers or under a contract and paid hourly wages, or, in some cases, a salary. Temporary employees can be part-time, full-time or seasonal. Typically, temporary staff members work under 1,000 hours or one year for your company.

What Defines a Temporary Full-Time Employee? ing to the IRS, temporary full-time employees work at least 30 hours per week, or 130 hours per month, and are hired into a job for under 12 months. The Affordable Care Act (ACA) calls those who are temporary full-time employees short-term employees.

Employers are required to offer coverage to at least 95% of full-time employees and dependents.

Generally, college students who become interns are not full-time employees and don't receive the same benefits as their full-time counterparts. However, a paid intern may be considered full-time under Department of Labor and Internal Revenue Service rules, making them eligible for certain benefits.

The answer is generally yes, but different conditions must be satisfied depending on whether the intern job classification results in an indirect service requirement. An employer may exclude certain job titles from participating in its 401(k) plan.

Workers employed through staffing agencies are generally called temporary or supplied workers. For the purposes of these recommended practices, ?temporary workers? are those supplied to a host employer and paid by a staffing agency, whether or not the job is actually temporary.

time employee works an average of 30+ hours of service per week (130 hours per calendar month) and is reasonably expected to work. A parttime employee works an average of less than 30 hours of service per week and is reasonably expected to work.

For the purposes of ACA, a ?seasonal worker? must be a worker who performs labor or services on a ?seasonal basis,? such as a ski instructor or retail workers employed exclusively during holiday seasons.