Virginia Financial Record Storage Chart

Description

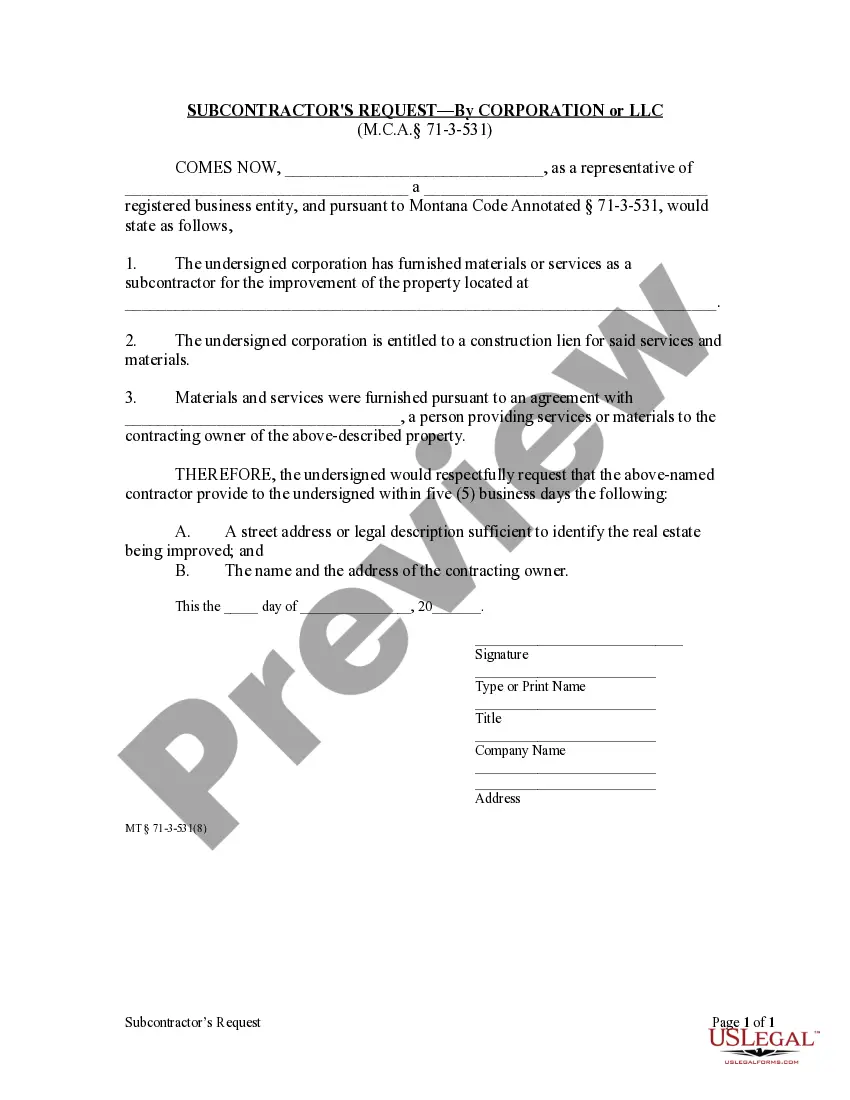

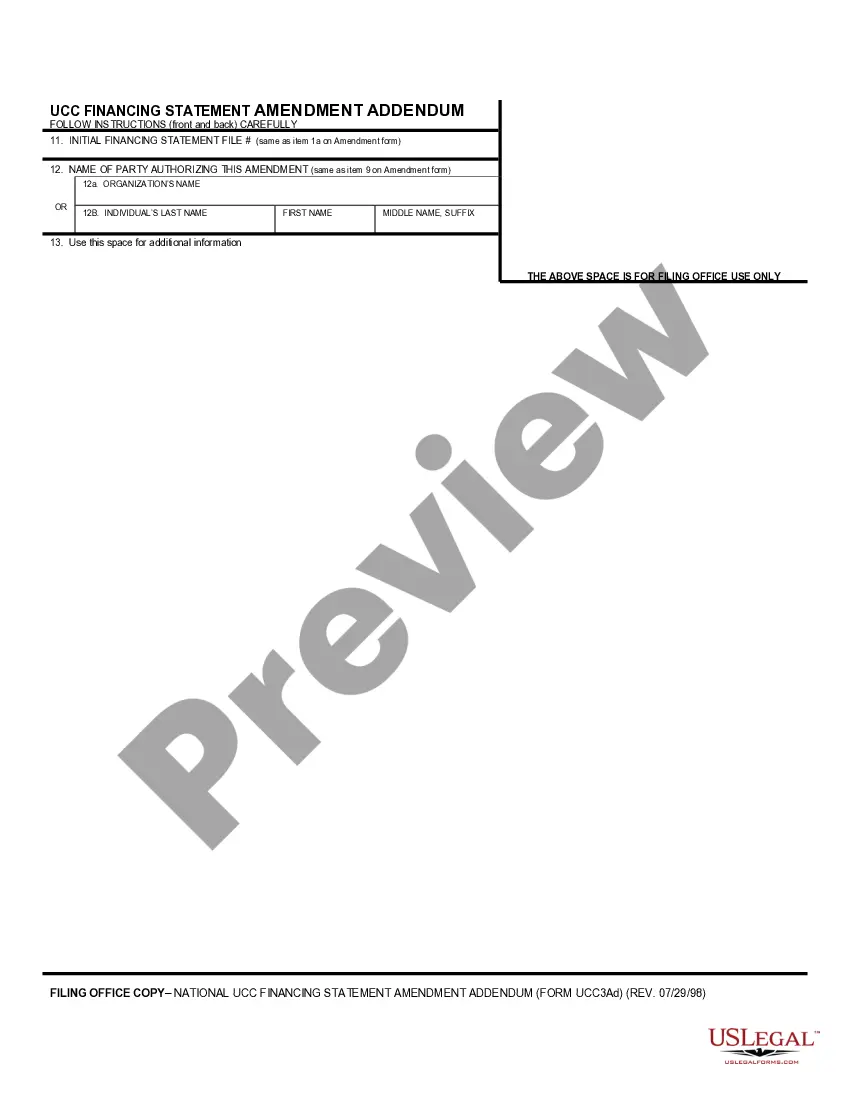

How to fill out Financial Record Storage Chart?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but locating reliable ones isn't easy.

US Legal Forms offers thousands of document templates, including the Virginia Financial Record Storage Chart, that are created to meet state and federal requirements.

Once you locate the appropriate form, click on Download now.

Select the payment plan you want, fill in the required details to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of Virginia Financial Record Storage Chart at any time, if necessary. Just open the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virginia Financial Record Storage Chart template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview option to examine the form.

- Read the details to make sure you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search section to find the form that fits your needs.

Form popularity

FAQ

In Virginia, you are required to keep workers' compensation records for a minimum of 5 years, as outlined in the Virginia Financial Record Storage Chart. This retention period ensures you have documentation in place for any claims or investigations. Maintaining these records helps both employers and employees navigate potential disputes effectively. You can refer to the Virginia Financial Record Storage Chart for a comprehensive overview of record-keeping timelines.

You should retain several important financial records for a period of 3 to 7 years according to the Virginia Financial Record Storage Chart. This typically includes tax returns, bank statements, and documents related to investments and large purchases. By keeping these records organized, you simplify tax preparation and minimize issues during audits. The Virginia Financial Record Storage Chart serves as your reliable guide to determine the appropriate retention periods.

Various records must be retained for seven years to ensure compliance with state and federal requirements. These typically include tax returns, payroll records, and business licenses. The Virginia Financial Record Storage Chart offers comprehensive details on the types of records that should be kept for seven years, helping you maintain proper documentation. By staying informed through these resources, you can safeguard your business from potential issues related to record-keeping.

Certain business records must be kept for seven years to comply with legal and tax regulations. This often includes documents related to employment taxes, financial statements, and business expenses. By referring to the Virginia Financial Record Storage Chart, you can easily identify which records require this extended retention period. Keeping these documents organized can help protect your business during audits or legal reviews.

The IRS generally requires businesses to keep records for at least three years, though some records may need to be retained longer. For example, if you file a claim for a credit or refund after you filed your return, you may need to retain records for up to four years. The Virginia Financial Record Storage Chart is a helpful resource that outlines the different retention timelines, ensuring you stay compliant. Regularly reviewing these guidelines can help you remain informed and organized.

The duration for keeping business records in Virginia depends on the nature of the records. Many businesses are required to retain financial documents, such as tax returns and payroll records, for a minimum of three to seven years. Utilizing the Virginia Financial Record Storage Chart can simplify this process and ensure you meet legal obligations. This chart helps clarify retention timelines for specific business categories.

In Virginia, record retention policies vary based on the type of record. Generally, businesses must retain important documentation for a specific duration, ensuring compliance with state laws. To help you navigate these requirements, the Virginia Financial Record Storage Chart provides clear guidelines on how long to keep different types of records. Implementing these guidelines can aid in avoiding legal complications.

The best way to store financial information combines both digital and physical methods. Utilize secure cloud storage for accessibility and strong firewall protections, while also keeping hard copies in a safe place as indicated in the Virginia Financial Record Storage Chart. Adopting these practices not only protects your data but also enhances organization and retrieval.

Yes, in many cases, it is advisable to keep records for at least seven years. This recommendation aligns with guidelines outlined in the Virginia Financial Record Storage Chart, which is designed to aid in compliance with tax regulations and audits. By retaining records for this time frame, you can ensure that you're well-prepared for any inquiries.

The duration for keeping financial records varies based on the type of documents. Generally, according to the Virginia Financial Record Storage Chart, files should be kept for a minimum of three to seven years. Knowing the specific requirements for your records can prevent unnecessary complications in the future.