Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report

Description

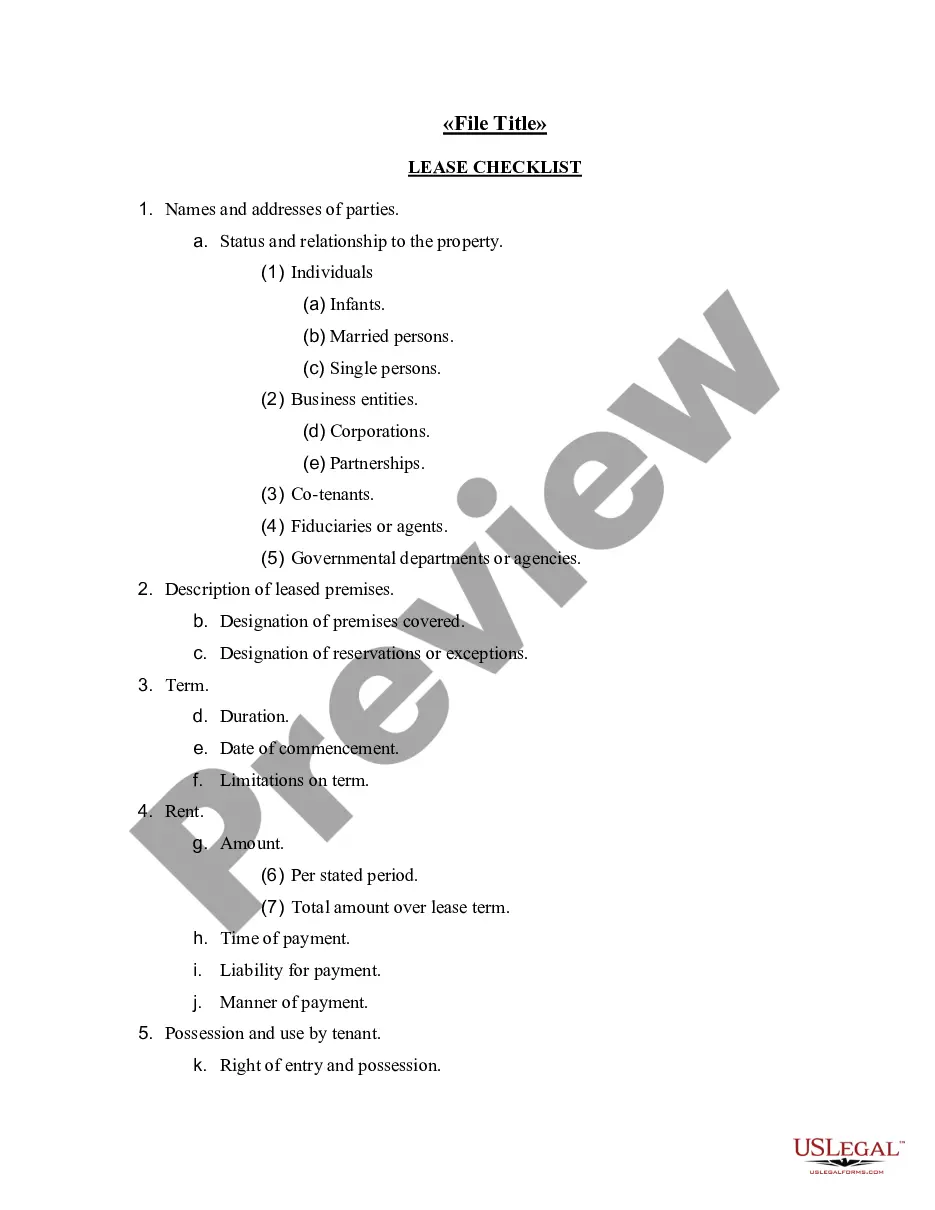

the process that organizations have created to ensure the integrity of their message. The following form is a checklist of comments and questions that may help you prepare a user-friendly and informative annual report.

How to fill out Checklist - Dealing With Shareholders And Investors - Preparing A User-Friendly Annual Report?

If you need to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you require, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Use US Legal Forms to find the Virginia Checklist - Managing Shareholders and Investors - Creating a User-Friendly Annual Report in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Download button to acquire the Virginia Checklist - Managing Shareholders and Investors - Creating a User-Friendly Annual Report.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview mode to review the form’s content. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

If a corporation fails to file an annual report, it may face penalties, including fines or the possibility of administrative dissolution. This can jeopardize the corporation's ability to conduct business legally in Virginia. By following the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, you can avoid such pitfalls and ensure that your reports are completed and filed on time. Staying proactive in these matters is essential for long-term business success.

To file a business annual report in Virginia, you typically submit the report online through the Virginia Secretary of State's website or by mail. Make sure to gather all necessary information, including your business entity number, financial data, and any updates about your company. The Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report can guide you through the filing process. Following these steps correctly will help you stay compliant and maintain good standing.

A standard annual report is a comprehensive document that outlines a company's activities, financial performance, and strategic direction over the past year. It serves as a primary tool for communication between a business and its shareholders. By using the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, you can create a report that meets all requirements while presenting your business in a clear and engaging manner. This not only satisfies regulatory demands but also strengthens shareholder engagement.

An annual report typically consists of four key components: financial statements, management discussion, company description, and shareholder information. Each section plays a crucial role in providing insight into the business's performance and goals. By referring to the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, you can ensure that all necessary components are included. This comprehensive approach enhances communication with shareholders and stakeholders alike.

Yes, you need to file an annual report if your business is registered in Virginia. This filing not only keeps your company in good standing but also ensures that your information is accurate in the state's records. Utilizing the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report can make this task straightforward. Remember, timely filing is vital to avoid unwanted complications.

Annual report compliance refers to the legal obligation of businesses, including S Corps, to file yearly reports with the state. These reports typically include information about business finances, ownership, and any changes that may have occurred over the year. Following the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report will assist you in meeting these compliance requirements effectively. This process keeps your business transparent and accountable.

Yes, an S Corporation must file an annual report in Virginia. This requirement helps the state maintain updated records on business operations and ownership. By adhering to the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, you ensure compliance and avoid late fees or penalties. It's essential to stay informed about your obligations to keep your corporation in good standing.

The requirements for an annual report in Virginia include providing the legal name of the business, registered agent information, and details about equity ownership. You must also disclose financial performance and any major changes from the previous year. The Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report serves as a valuable resource, helping you ensure that all necessary information is included, compliant, and user-friendly.

To file a Virginia annual report, you must first complete the report form using accurate and updated business information. After filling out the form, submit it online through the Virginia Secretary of State’s website or mail it to the appropriate office, along with any required fees. By adhering to the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, you can ensure a smooth filing process.

Writing an annual report involves presenting a clear and concise overview of your business’s performance over the year. Begin with an introduction that summarizes key highlights, followed by detailed sections that cover financial information, shareholder changes, and operational updates. Utilizing the Virginia Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report can guide you in crafting a document that meets regulatory requirements while remaining engaging for your audience.