Virginia Bill of Sale by Corporation of all or Substantially all of its Assets

Description

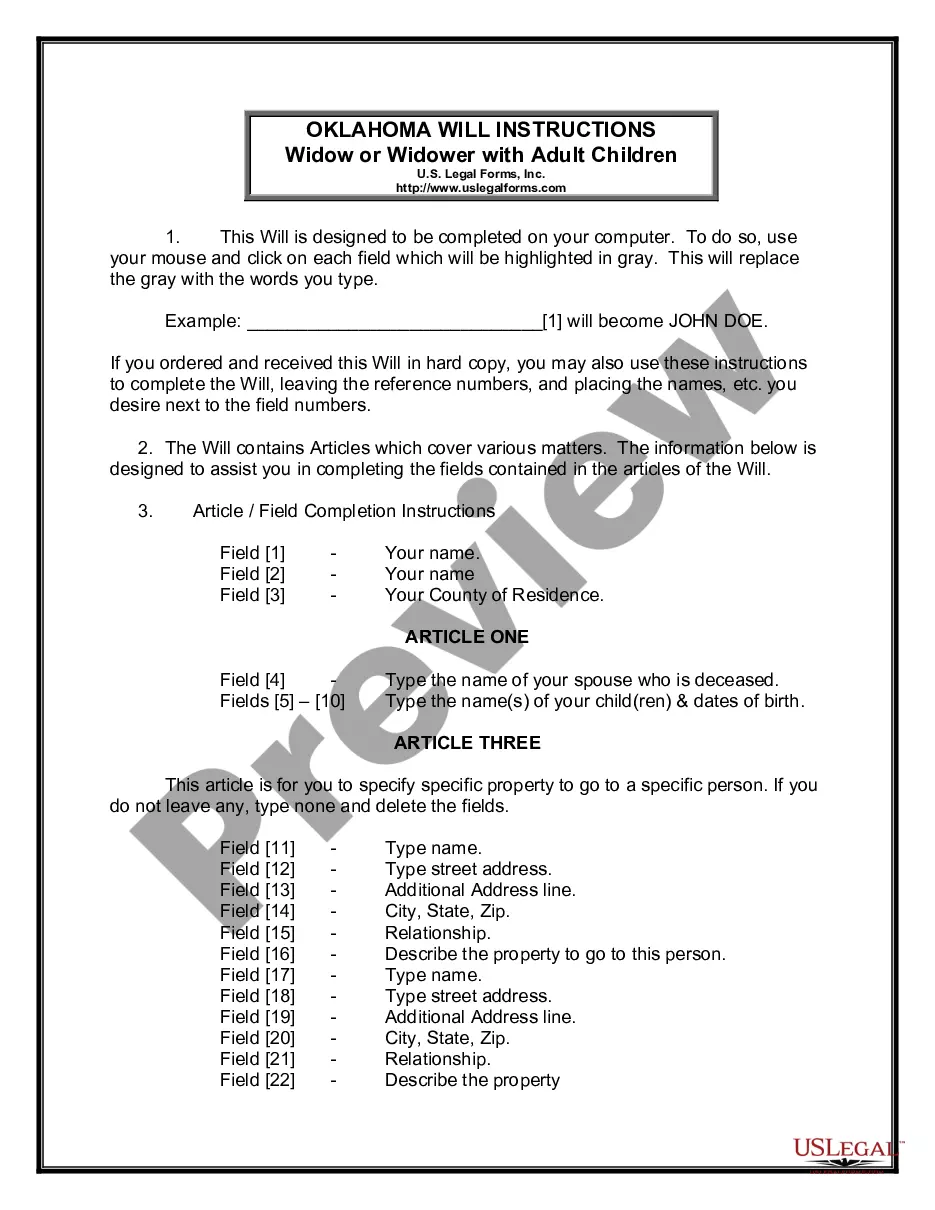

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

You can spend hours online attempting to locate the legal document template that satisfies the state and federal requirements you require.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

It's easy to download or print the Virginia Bill of Sale by Corporation of all or substantially all of its Assets from my service.

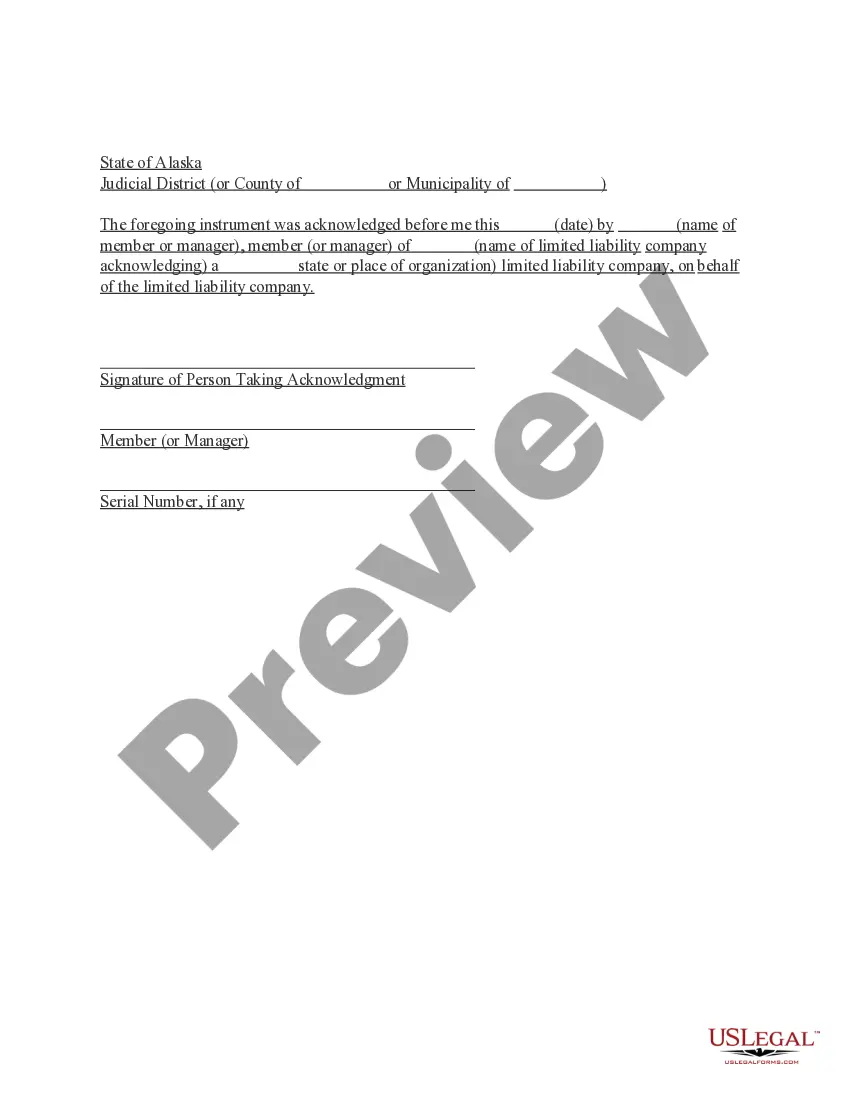

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can fill out, modify, print, or sign the Virginia Bill of Sale by Corporation of all or substantially all of its Assets.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document template for the area/region of your choice.

- Review the form summary to confirm you have chosen the correct form.

Form popularity

FAQ

VA Code 13.1-900 outlines the statutory requirements for a corporation's sale of assets in Virginia. This code specifies the procedural and approval measures necessary for such transactions and ensures fair treatment of all shareholders and creditors. By following VA Code 13.1-900, along with the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets, companies can navigate asset sales with legal clarity and confidence.

Substantially all assets include those assets that are primarily responsible for generating a corporation's revenue and facilitating its business operations. This definition can vary based on the specific circumstances of each corporation. For clarity and legal compliance, using the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets can provide guidance and protect corporate interests.

Under Delaware law, a sale of substantially all assets is a transaction that also necessitates board and potentially shareholder approval, depending on the situation. This legal framework closely aligns with Virginia's requirements. When engaged in cross-state transactions, utilizing the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets ensures validity and compliance across jurisdictions.

A substantial sale of assets involves a significant transfer of a corporation's resources, impacting its business operations and future viability. Typically, this kind of sale requires careful evaluation, as it may involve debts, liabilities, and employee contracts. Corporations engaged in such sales should consider the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets to ensure a legally sound transaction.

A sale of substantially all assets is generally defined as a transaction in which a corporation sells assets that make up the core functioning of the business. This can include equipment, inventory, and key contracts. Using resources like the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets can streamline these transactions while protecting the interests of both the buyer and seller.

The substantially all requirement refers to the legal standard that denotes a significant portion of a corporation's total assets being sold. This standard is important because it impacts the approval process and potential tax implications. By adhering to the standards set forth in the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets, companies can ensure compliance with state regulations.

The sale of all or substantially all of the assets is a transaction where a corporation transfers a majority of its operational resources to another entity. This type of sale often involves physical assets, intellectual property, and goodwill. Utilizing the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets can facilitate this process by providing a clear legal framework.

The approval to sell all the assets of a corporation typically requires consent from the board of directors and may also involve shareholder approval. This process ensures that the decision aligns with the interests of the company and its stakeholders. For transactions involving the Virginia Bill of Sale by Corporation of all or Substantially all of its Assets, understanding these governance requirements is crucial.