The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

Virginia Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due - Assets and Liabilities

Description

How to fill out Debtor's Affidavit Of Financial Status To Induce Creditor To Compromise Or Write Off The Debt Which Is Past Due - Assets And Liabilities?

You might allocate time on the Web trying to locate the legal document template that meets the state and federal requirements you will require.

US Legal Forms offers a multitude of legal forms that are reviewed by experts.

It is straightforward to download or print the Virginia Debtor's Affidavit of Financial Status to Encourage Creditor to Settle or Write off the Delinquent Debt - Assets and Liabilities from the service.

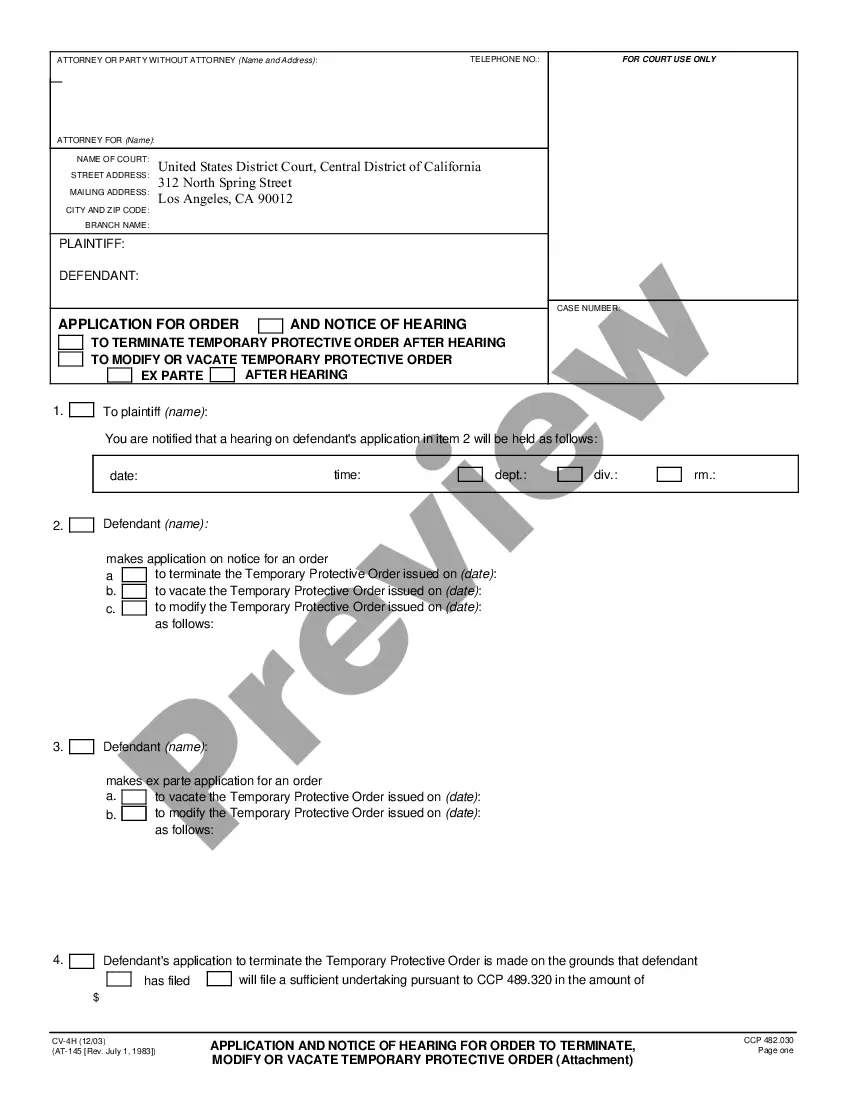

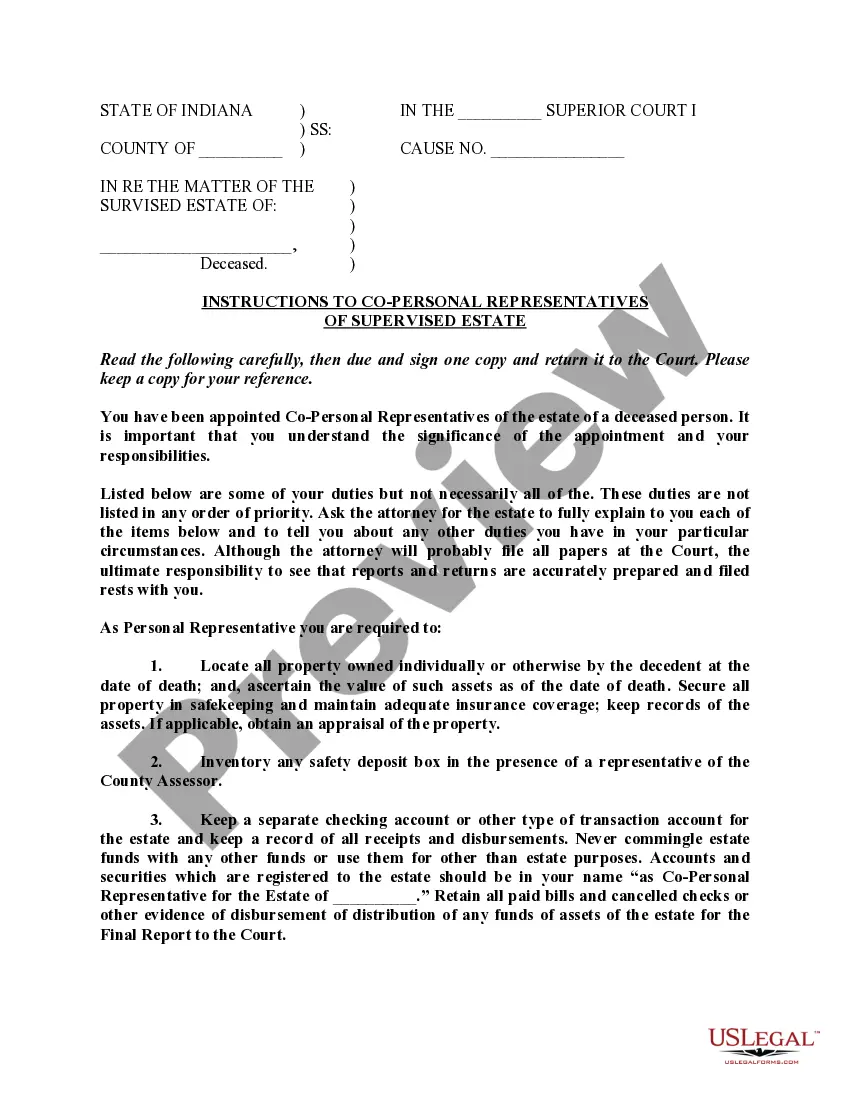

If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Get button.

- Subsequently, you can complete, modify, print, or sign the Virginia Debtor's Affidavit of Financial Status to Encourage Creditor to Settle or Write off the Delinquent Debt - Assets and Liabilities.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the basic guidelines below.

- First, ensure you have selected the appropriate document template for the county/area of your choice.

- Review the form details to ensure you have selected the correct template.

Form popularity

FAQ

Once you've done your research and put aside some cash, it's time to determine what your settlement offer will be. Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor.

02.04a. This Debt Compromise Agreement is a short agreement between Creditor and Customer whereby the Creditor agrees to forgo part of the outstanding debt whilst the customer acknowledges its indebtedness (full sum) to the Creditor.

So, you can get out of debt for a lower percentage of what you owe as the clock runs out. In some cases, you may be able to settle for much less than that 48% average. Collectors holding old debts may be willing to settle for 20% or even less.

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Compromise is an amicable agreement between the parties in which they make mutual concessions in order to solve the differences between them. ARRANGEMENT. Arrangement is the process by which the share capital of the company is reorganised either by consolidation or division of the shares, or doing both.

(Skip to2026)1 Debt buyers purchase debts for pennies on the dollar.2 Before you pay, check the Statute of Limitations.3 Most debt collectors just want to get paid.4 Negotiate the entire debt.5 Be prepared for an IRS 1099C Notice.6 Secured debt typically cannot be negotiated.7 Negotiate a deletion from credit reports.More items...?21-Jun-2021

For example, if you established a payment plan with a creditor to pay off the debt over time, or if the creditor agreed to accept less than the full amount owed, that would be considered a compromise with creditors.

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.