Virginia Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Locating the appropriate sanctioned document template can be a struggle.

It goes without saying that there are numerous templates available online, but how can you find the official form you need.

Utilize the US Legal Forms platform. This service offers a vast selection of templates, including the Virginia Notice of Default under Security Agreement in Purchase of Mobile Home, suitable for both business and personal purposes.

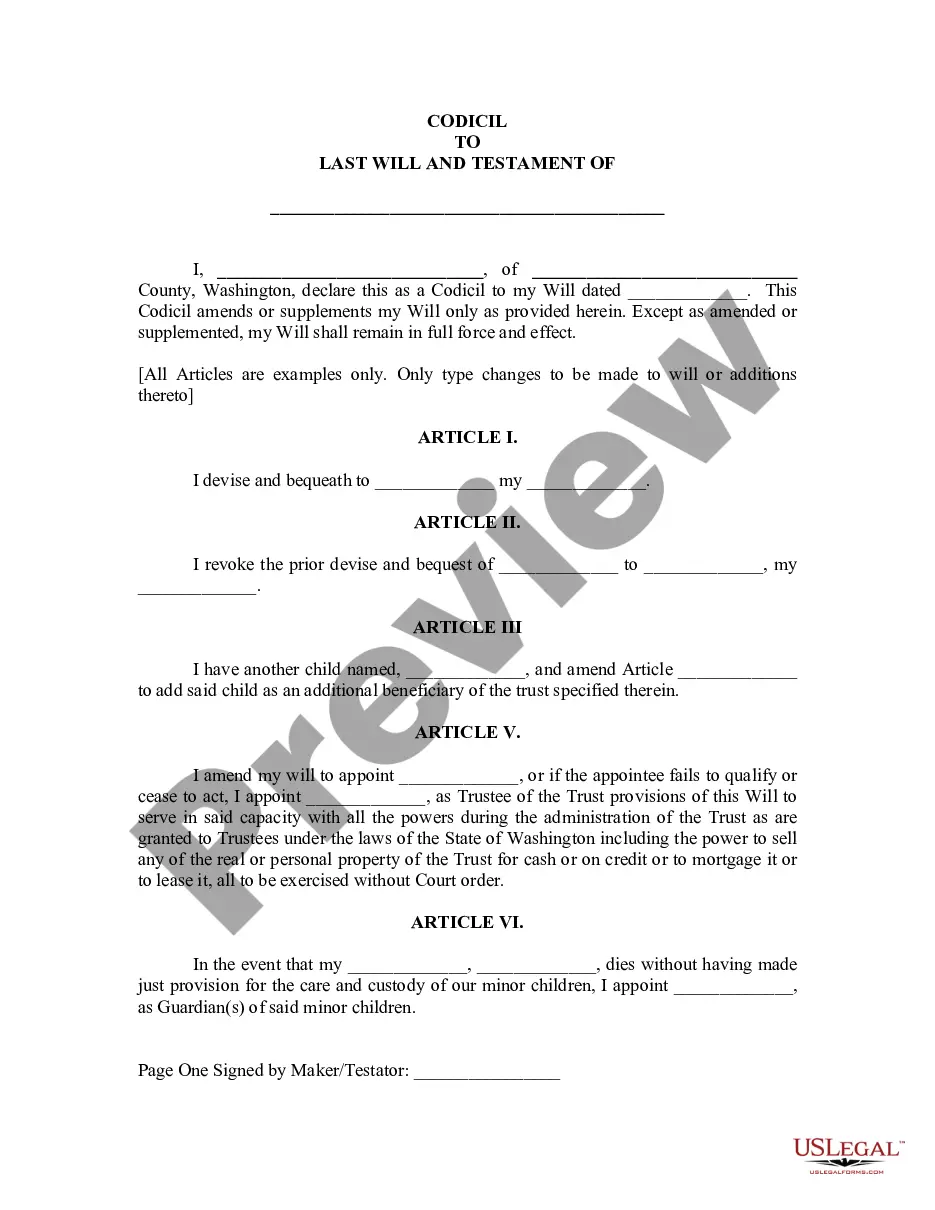

First, ensure you have selected the correct form for the city/state. You can review the form using the Review button and examine the form summary to confirm it suits your needs. If the form does not meet your requirements, utilize the Search area to find the right form. Once you are confident that the form is accurate, click the Get now button to procure the form. Choose your desired pricing plan and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the obtained Virginia Notice of Default under Security Agreement in Purchase of Mobile Home. US Legal Forms is the largest collection of legal documents where you can find a multitude of document templates. Use the service to download legally compliant documents that adhere to state requirements.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Virginia Notice of Default under Security Agreement in Purchase of Mobile Home.

- Use your account to browse the legal forms you may have purchased in the past.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are basic steps you can follow.

Form popularity

FAQ

Virginia instated a new set of tenant protections shortly after the end of the federal moratorium on July 31. One housing lawyer says tenants should remain vigilant.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

However, generally speaking, the primary ways for a secured party to perfect a security interest are:by filing a financing statement with the appropriate public office.by possessing the collateral.by "controlling" the collateral; or.it's done automatically upon attachment of the security interest.

In Virginia, landlords can evict tenants for a lease violation. The landlord must give tenants a 30-Day Notice to Comply, which provides them with 21 days to fix the issue. Should the tenant be unable to resolve the issue within 21 days, the tenant has the remaining 9 days to vacate the rental property.

However, a landlord that owns no more than two (2) dwelling units subject to a rental agreement can opt out of the VRLTA by expressly stating so in the rental agreement with the tenant. If the opt out language is missing from the rental agreement, then the VRLTA will control.

NOTE: Under Virginia law, if you do not have a lease, and you do not pay rent, you are considered a tenant at sufferance. This means you can be evicted for any reason at all, at any time, and no notice needs to be given to you. Under this circumstance you can go from tenant to trespasser very quickly.

The VRLTA establishes the rights and obligations of landlords and tenants in Virginia. The VRLTA supersedes all local, county, and municipal landlord and tenant ordinances. It also prohibits certain lease clauses. The VRLTA covers most residential rental agreements.

IMPORTANT TIP: Under Virginia law you are considered a tenant at sufferance if you do not have a lease or pay rent. This means that you can be evicted for any reason at all, at any time and no particular notice needs to be given to you.

A security interest in a manufactured home that is or becomes a fixture (defined in UCC § 9-102 as goods that have become so related to particular real property that an interest in them arises under real property law) is perfected by one of three methods: making a fixture filing, noting the secured party's lien on

Virginia renters have special protection against evictions until June 30, 2022. Landlords cannot evict tenants for non-payment of rent (because of COVID hardships) unless they follow these rules: The landlord must give the renter a 14-day notice that informs the renter about the Rent Relief Program.