Are you inside a position where you need documents for possibly enterprise or specific functions almost every day? There are tons of lawful file layouts accessible on the Internet, but getting versions you can rely isn`t effortless. US Legal Forms delivers a huge number of form layouts, like the Virginia Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company, that are written to fulfill state and federal needs.

In case you are previously informed about US Legal Forms website and possess your account, basically log in. Next, it is possible to download the Virginia Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company format.

Unless you have an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is to the proper town/region.

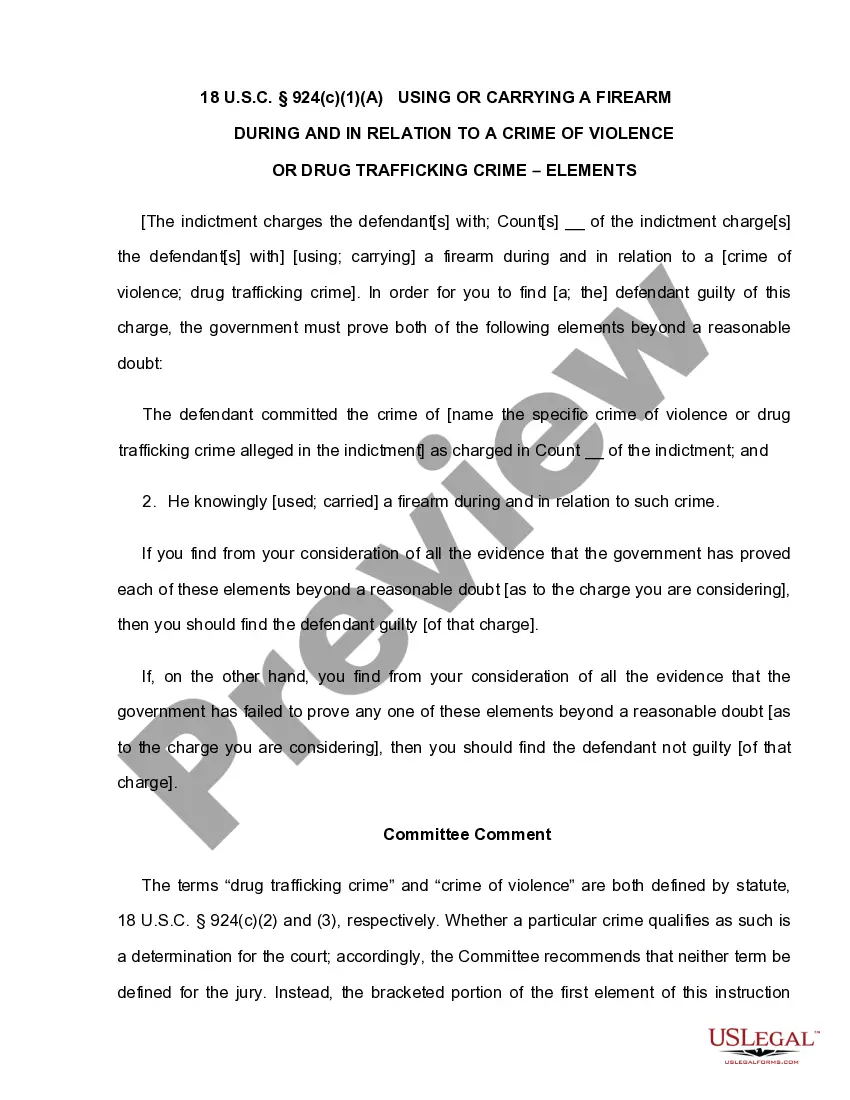

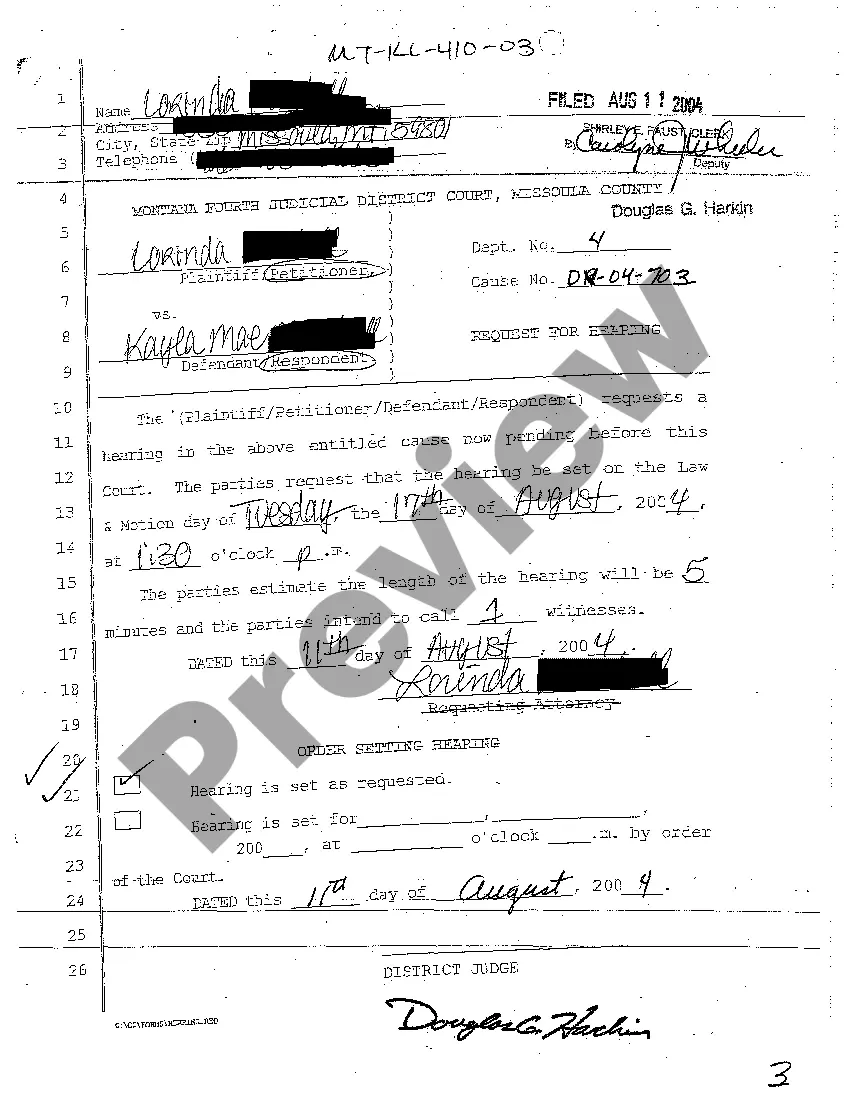

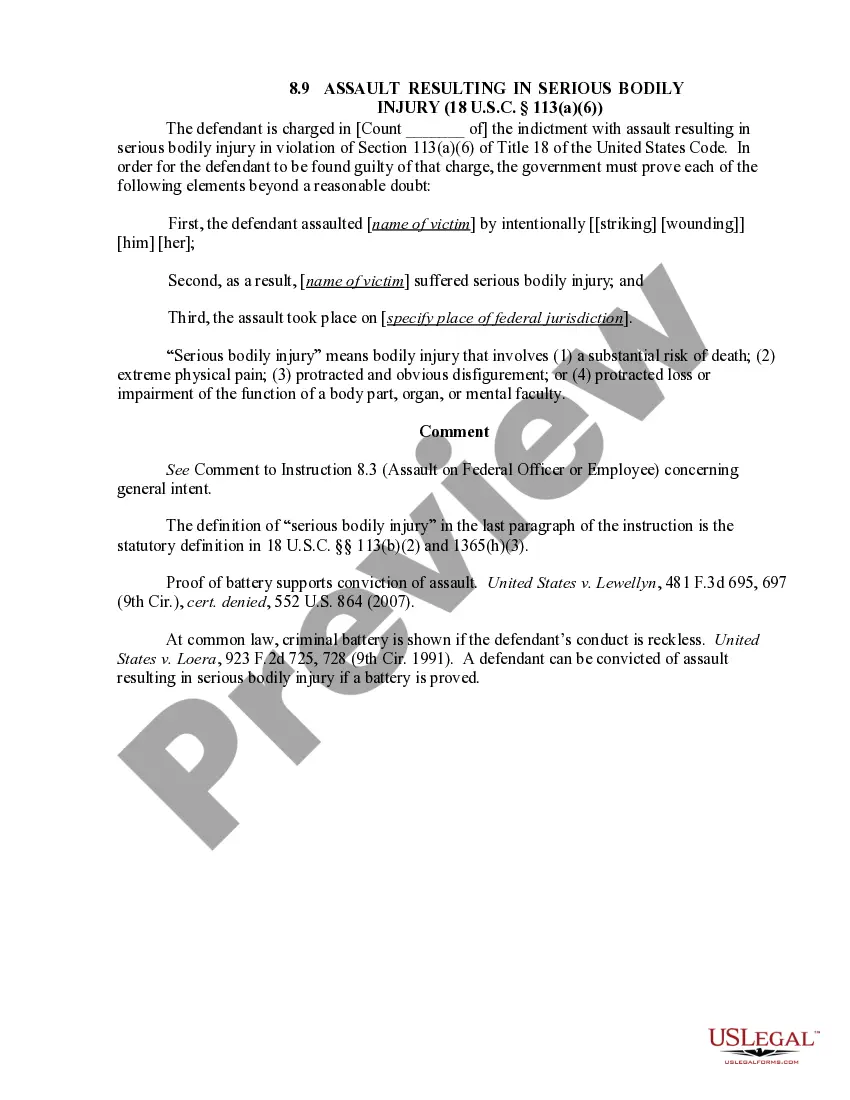

- Take advantage of the Preview button to review the form.

- Read the description to ensure that you have chosen the correct form.

- When the form isn`t what you are trying to find, use the Lookup industry to discover the form that fits your needs and needs.

- Whenever you find the proper form, click on Acquire now.

- Pick the prices prepare you desire, fill out the necessary details to generate your bank account, and buy an order with your PayPal or credit card.

- Select a handy paper structure and download your copy.

Find each of the file layouts you possess purchased in the My Forms food selection. You can obtain a additional copy of Virginia Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company at any time, if necessary. Just select the needed form to download or print out the file format.

Use US Legal Forms, by far the most substantial selection of lawful varieties, to save time as well as avoid errors. The service delivers appropriately produced lawful file layouts which can be used for a range of functions. Make your account on US Legal Forms and start generating your way of life easier.