If you need to full, obtain, or produce legitimate file themes, use US Legal Forms, the greatest collection of legitimate forms, that can be found on-line. Take advantage of the site`s basic and hassle-free look for to get the documents you need. Different themes for company and person reasons are categorized by classes and claims, or search phrases. Use US Legal Forms to get the Virginia Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust within a handful of mouse clicks.

Should you be already a US Legal Forms consumer, log in for your bank account and click the Obtain option to have the Virginia Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust. You can also access forms you earlier downloaded from the My Forms tab of your respective bank account.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that proper metropolis/nation.

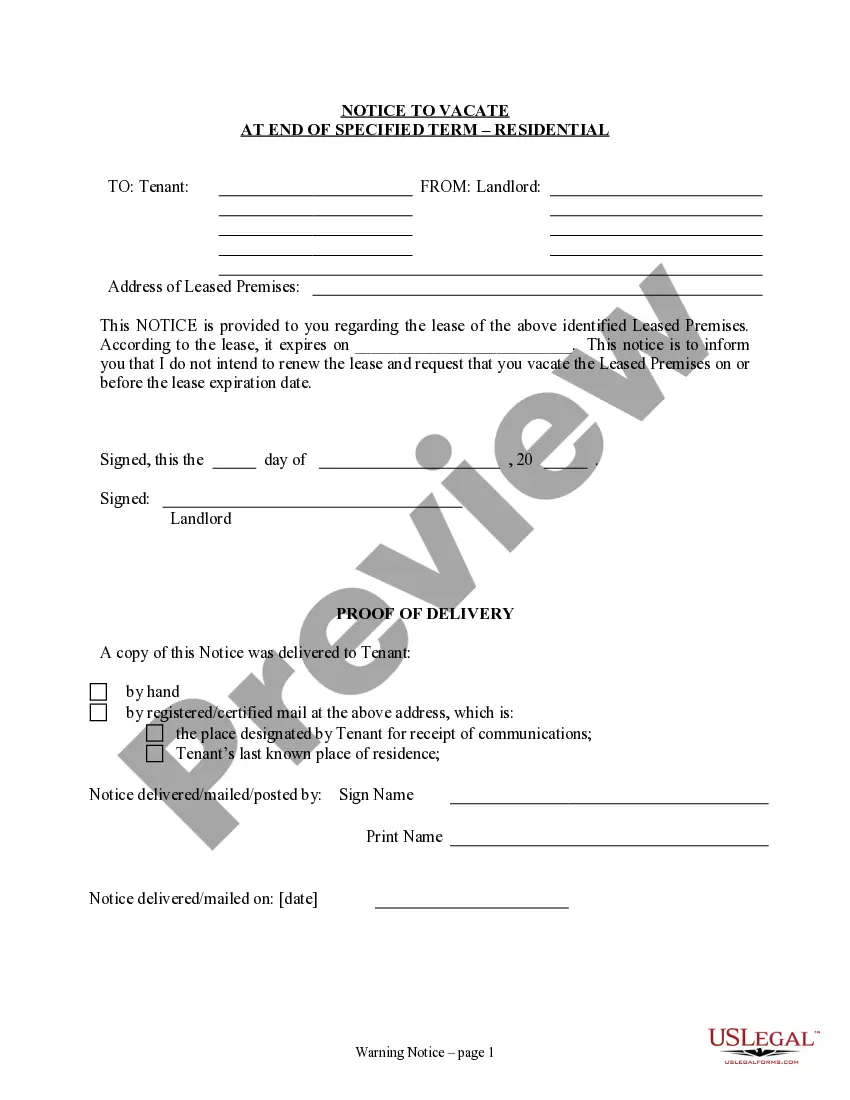

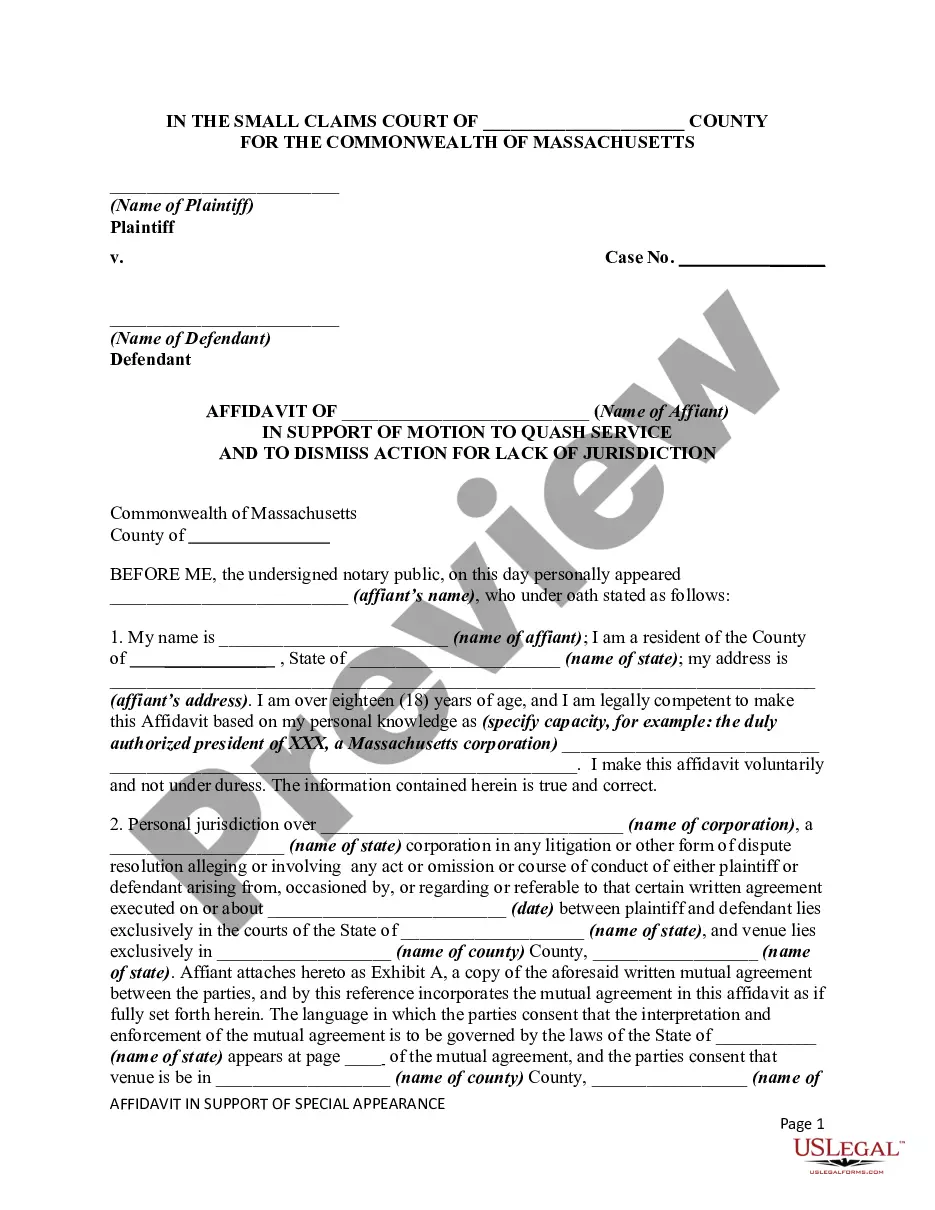

- Step 2. Make use of the Review option to look through the form`s content material. Do not forget about to see the description.

- Step 3. Should you be not satisfied with all the kind, use the Search discipline at the top of the screen to find other models of your legitimate kind design.

- Step 4. Upon having discovered the form you need, click on the Acquire now option. Opt for the pricing strategy you favor and include your accreditations to register to have an bank account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Choose the format of your legitimate kind and obtain it on your gadget.

- Step 7. Complete, revise and produce or sign the Virginia Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust.

Each and every legitimate file design you purchase is your own forever. You may have acces to every kind you downloaded in your acccount. Click on the My Forms segment and decide on a kind to produce or obtain again.

Contend and obtain, and produce the Virginia Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust with US Legal Forms. There are thousands of expert and state-distinct forms you may use for your company or person needs.