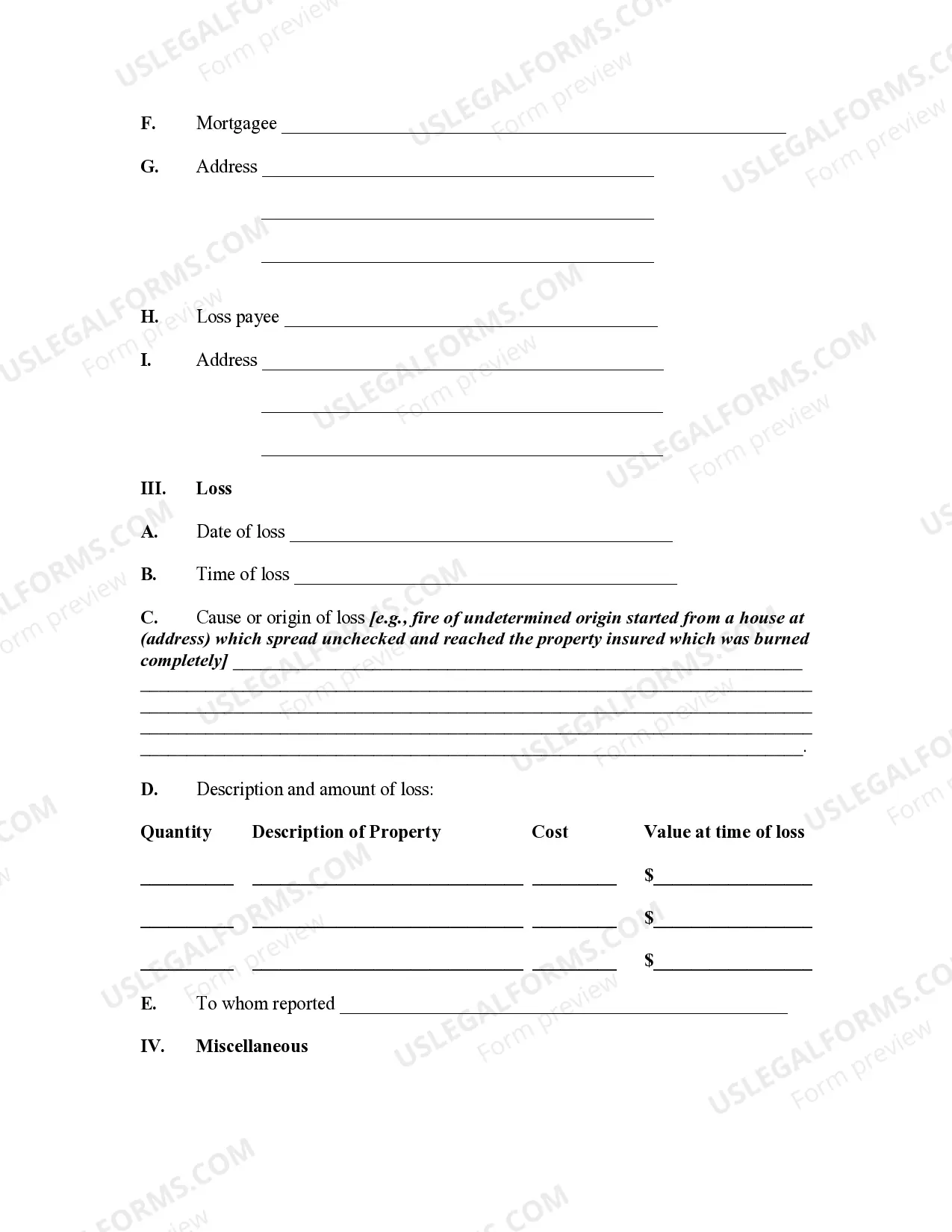

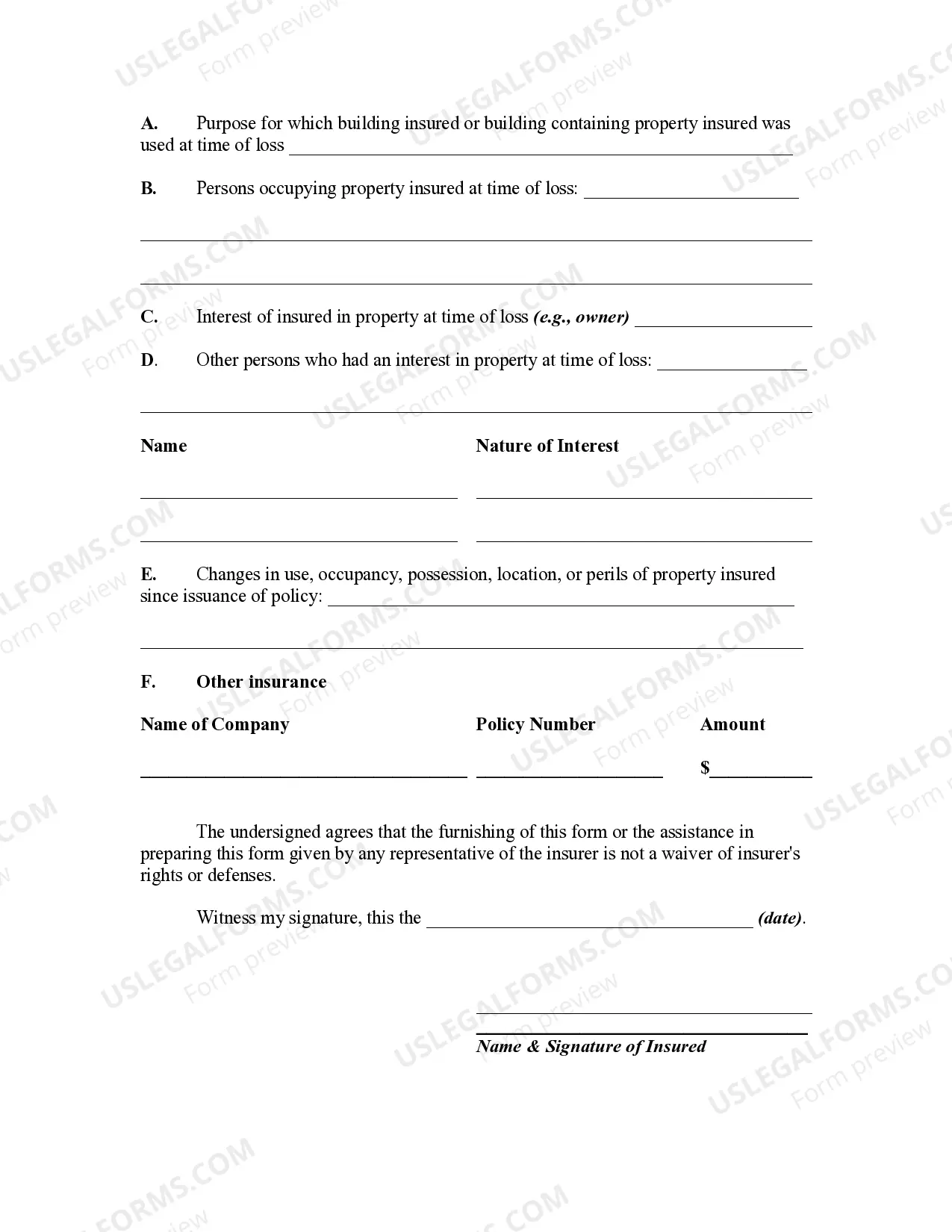

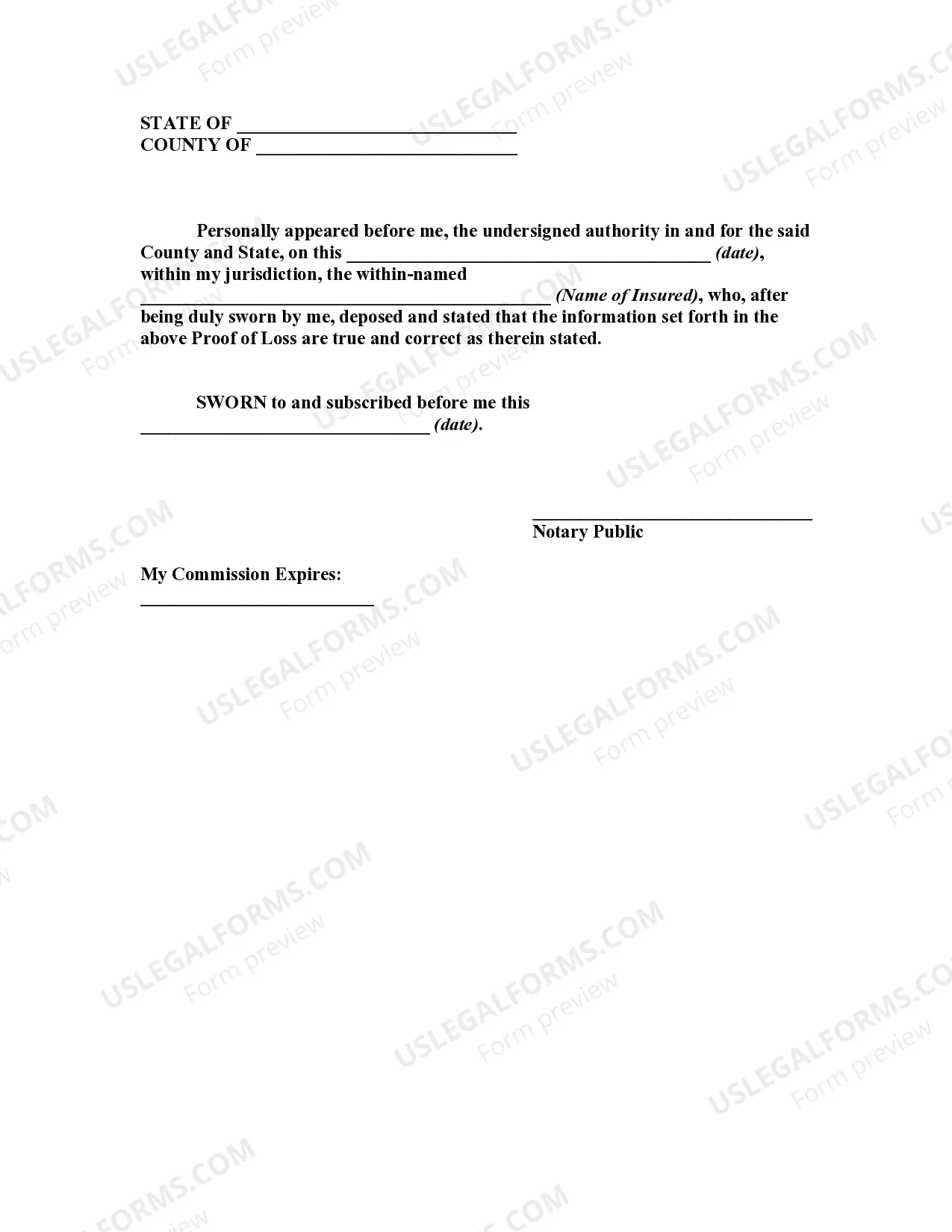

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Virginia Proof of Loss for Fire Insurance Claim

Description

How to fill out Proof Of Loss For Fire Insurance Claim?

You are able to devote hrs on the web attempting to find the legitimate file template that fits the federal and state demands you need. US Legal Forms provides 1000s of legitimate types that happen to be analyzed by professionals. It is possible to download or printing the Virginia Proof of Loss for Fire Insurance Claim from our service.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Down load option. Next, it is possible to full, revise, printing, or indicator the Virginia Proof of Loss for Fire Insurance Claim. Every single legitimate file template you buy is your own property for a long time. To get yet another version for any obtained type, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms website for the first time, follow the basic instructions under:

- First, ensure that you have selected the correct file template to the state/town that you pick. Browse the type information to ensure you have picked the right type. If offered, utilize the Review option to check throughout the file template also.

- If you wish to discover yet another edition from the type, utilize the Research field to obtain the template that suits you and demands.

- When you have located the template you want, click Acquire now to move forward.

- Select the costs plan you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal accounts to pay for the legitimate type.

- Select the file format from the file and download it to your product.

- Make modifications to your file if required. You are able to full, revise and indicator and printing Virginia Proof of Loss for Fire Insurance Claim.

Down load and printing 1000s of file layouts making use of the US Legal Forms Internet site, that offers the greatest variety of legitimate types. Use expert and state-specific layouts to handle your small business or person needs.

Form popularity

FAQ

The insurer may accept your proof or they may reject your proof. If the insurance company is rejecting your Proof of Loss, it is likely because the paperwork is not completed properly, is not signed or not notarized, or is missing information.

Proof of loss is a legal document that explains what's been damaged or stolen and how much money you're claiming. Your insurer may have you fill one out, depending on the loss. Homeowners, condo and renters insurance can typically help cover personal property.

If you do not submit a Proof of Loss statement form when your insurance company asks that you do, your claim could be delayed or denied altogether.

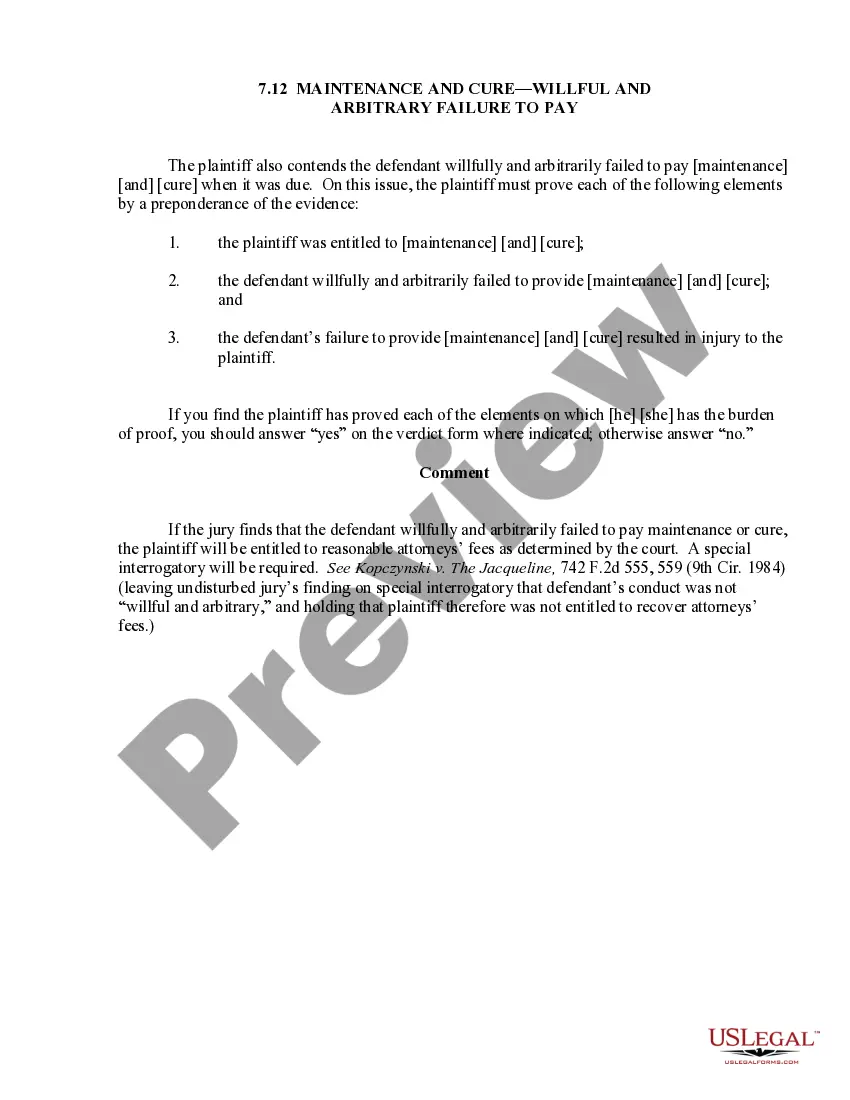

The new law allows ?stacking? of uninsured motorist and underinsured motorist coverage, known as ?UM/UIM? coverage. UM/UIM coverage protects you if the negligent driver that causes an accident does not have any car insurance or does not have enough to cover your damages.

If your car is in a serious accident, your insurance company may declare it a ?total loss.? Virginia law defines a threshold for deeming a car to be a total loss ? a vehicle may be declared a total loss if the cost of repairing the damage is greater than 75 percent of the car's pre-crash ?actual cash value,? which is ...

When Should You Submit Your Proof of Loss Form? When required, you should file your Proof of Loss form as soon as possible but no later than the date specified in your insurance policy. It's typically required within 60 days after the incident that led to your insurance claim.

If your claim has been refused because of a condition or exclusion, you might be able to argue: the insurer was wrong in applying the condition or exclusion. the condition or exclusion did not cause the loss (or only part of it) or the insurer wasn't disadvantaged by it (section 54, Insurance Contracts Act)

Insurance claims are often denied if there is a dispute as to fault or liability. Companies will only agree to pay you if there's clear evidence to show that their policyholder is to blame for your injuries. If there is any indication that their policyholder isn't responsible the insurer will deny your claim.