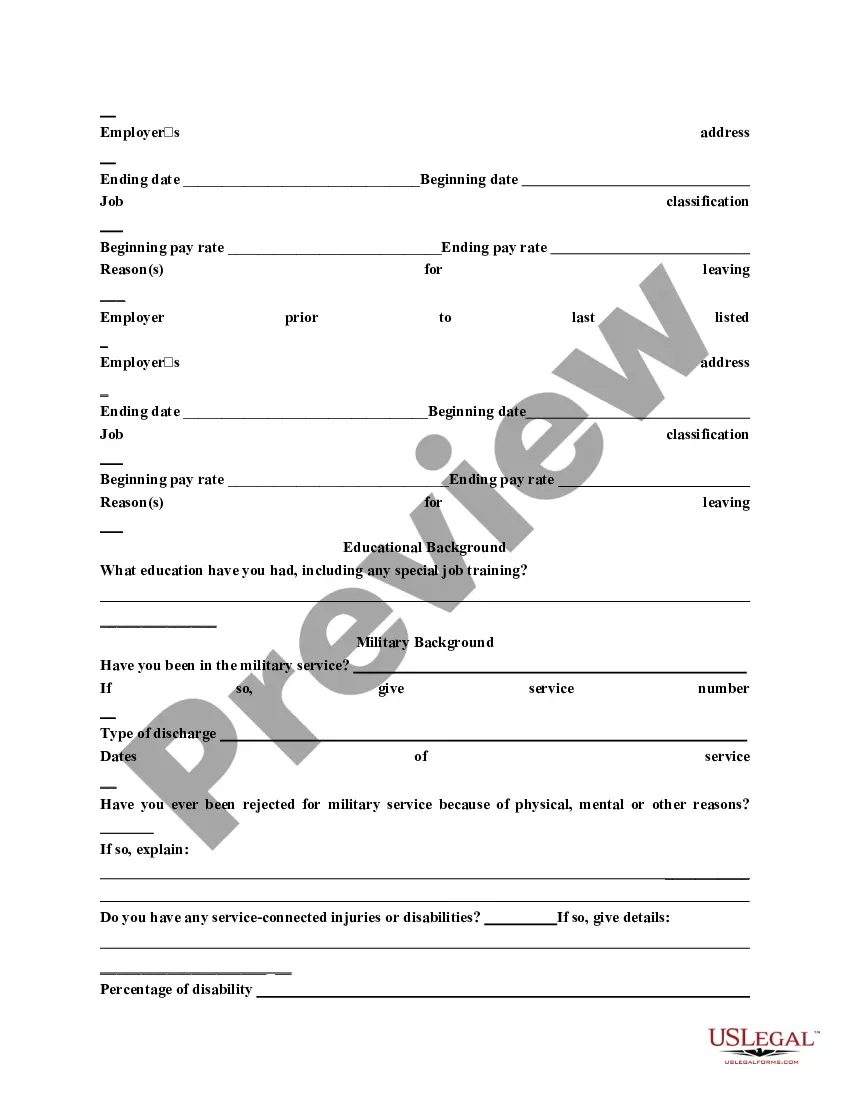

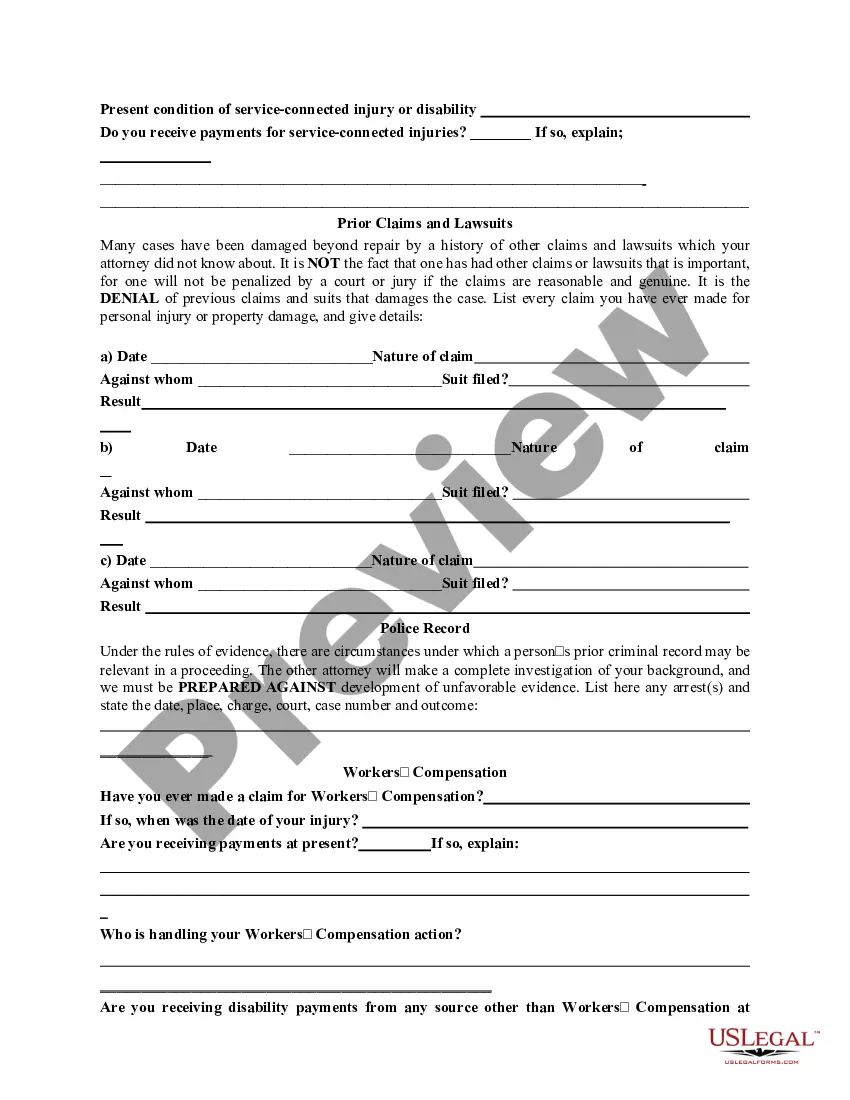

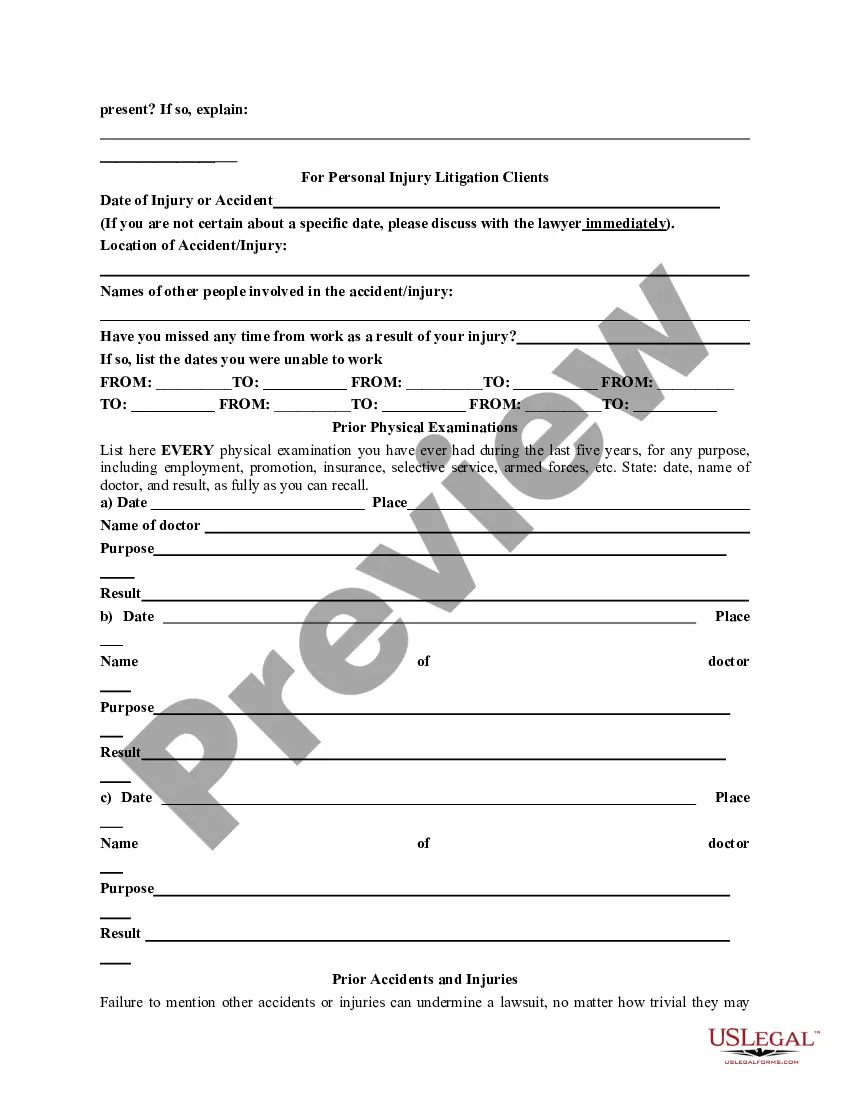

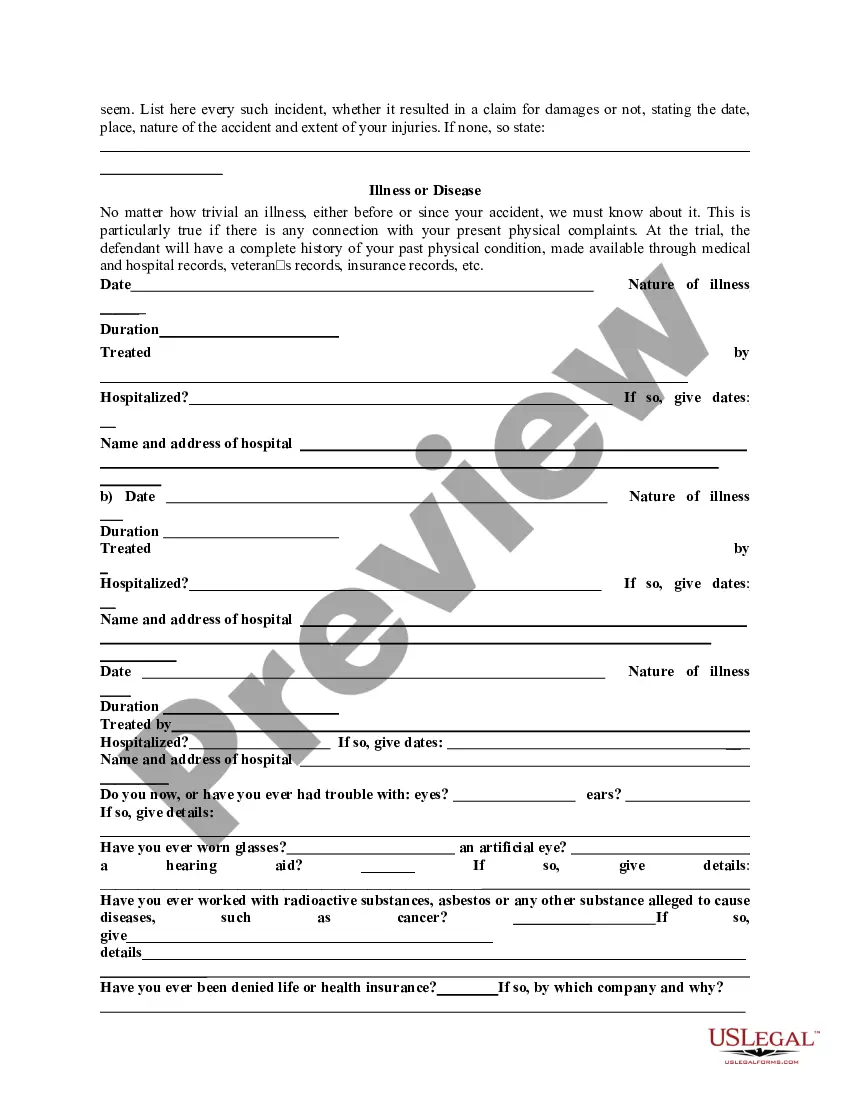

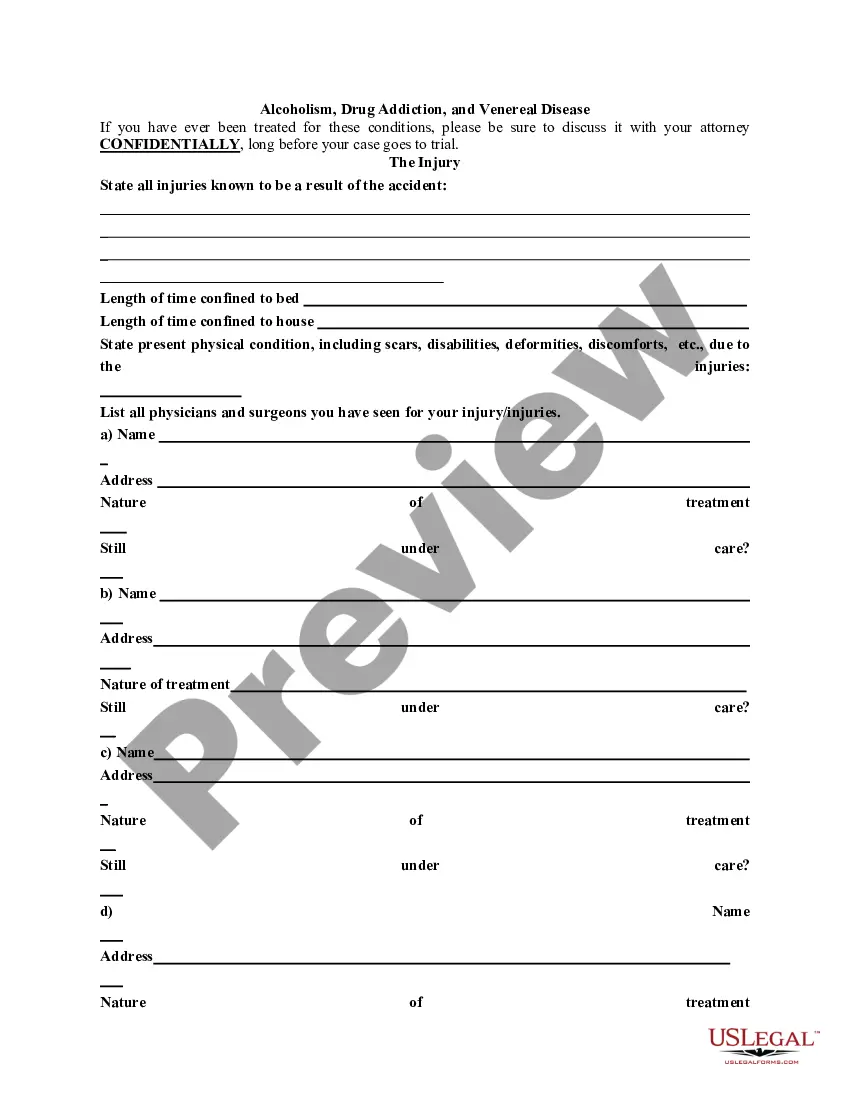

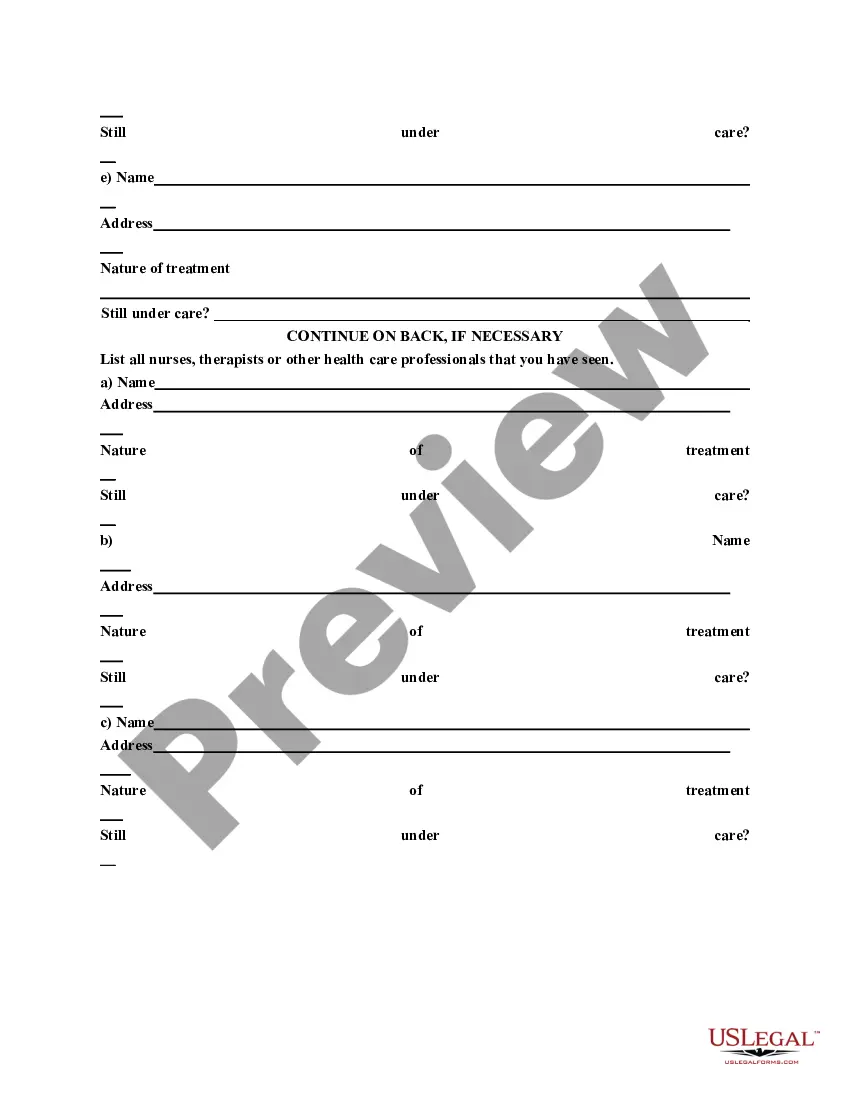

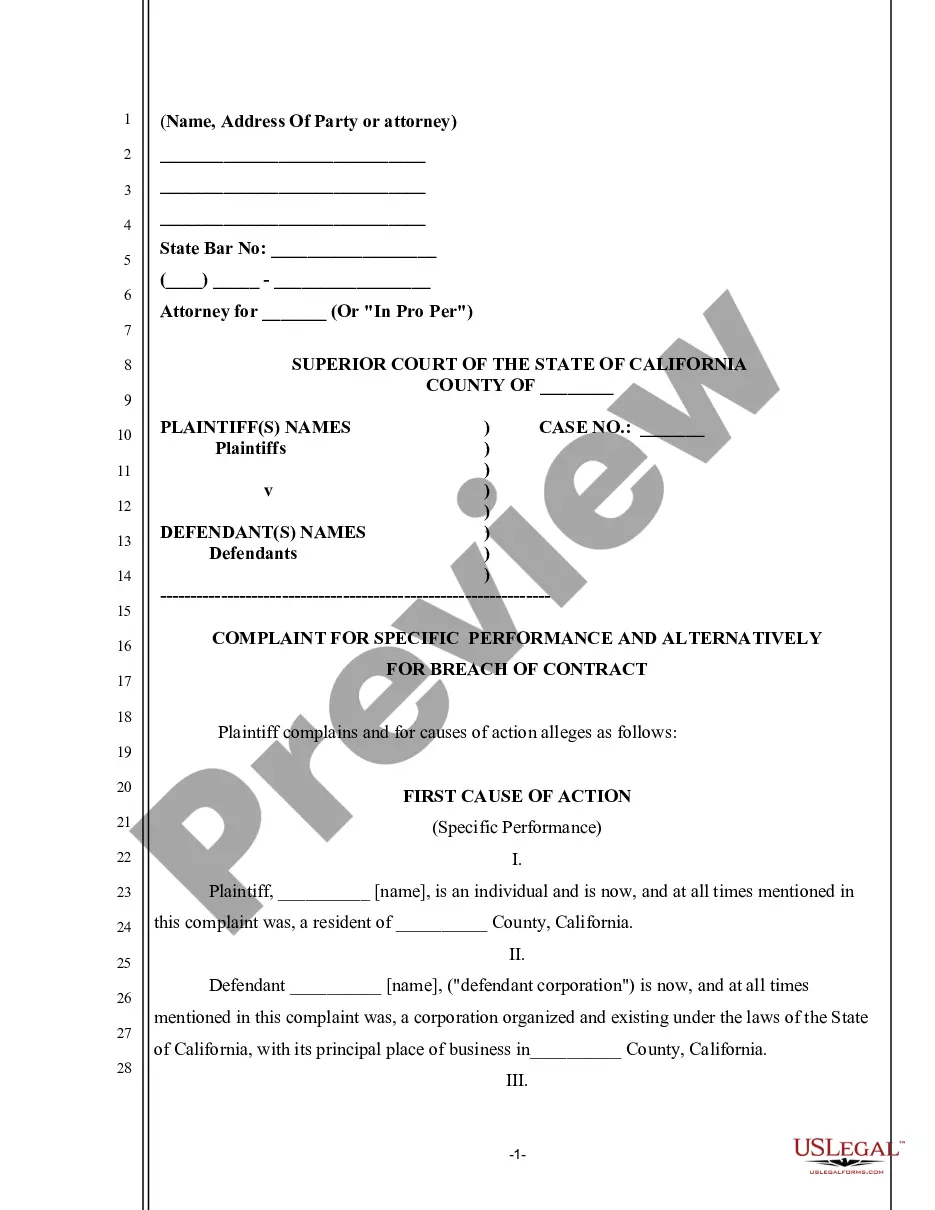

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Virginia General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Have you ever been in a situation where you require documents for either business or personal purposes frequently? There are numerous authentic document templates available on the web, but locating ones you can trust isn't simple. US Legal Forms provides thousands of document templates, including the Virginia General Information Questionnaire, designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. Then, you can download the Virginia General Information Questionnaire template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Get the template you need and ensure it is for the correct city/region. Use the Preview feature to review the document. Read the description to confirm you have selected the right template. If the document isn't what you're looking for, use the Search field to find the document that meets your needs and requirements. Once you find the right template, click Buy now. Choose the pricing plan you want, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents list.

- You can obtain an additional copy of the Virginia General Information Questionnaire at any time, if necessary.

- Just click the needed template to download or print the document format.

- Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors.

- The service offers properly crafted legal document templates that can be used for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Due by . Mail to the Department of Taxation, P.O. Box 1498, Richmond, Virginia 23218-1498. Both spouses must complete a separate Form 763-S when both filers have Virginia income tax withheld.

You may not claim more exemptions on Form VA-4P than you are entitled to claim on your income tax return, unless you have received written permission to do so from the Department of Taxation. You may claim an exemption for yourself. Enter the number of dependents you are allowed to claim on your income tax return.

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

VA 760 CG: Out-of-state income included in total AGI for VA tax in ATX?. Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year. Credit for taxes paid to another state may be claimed by filing Virginia Schedule OSC. Solution Id.

Nonresidents of Virginia must file a Form 763. (A person is considered a nonresident of Virginia if they lived in Virginia for less than 183 days in a calendar year). An instruction booklet with return mailing address is also available on the website. Part-Year Residents of Virginia file a Form 760PY.

If the wages are not subject to federal withholding, they are not subject to Virginia withholding. Complete instructions for withholding Virginia income tax from wages, salaries, and other payments are contained in the Virginia Employer Withholding Instructions.

Virginia does not accept Form 763-S for electronic filing, therefore it must be submitted on paper and mailed to the state.

How do I file taxes without a permanent address? You must include a mailing address on your tax return. This will become the primary ways the IRS communicates with you. Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for your taxes.