Virginia Leaseback Provision in Sales Agreement

Description

How to fill out Leaseback Provision In Sales Agreement?

Are you currently in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding forms you can trust isn’t straightforward.

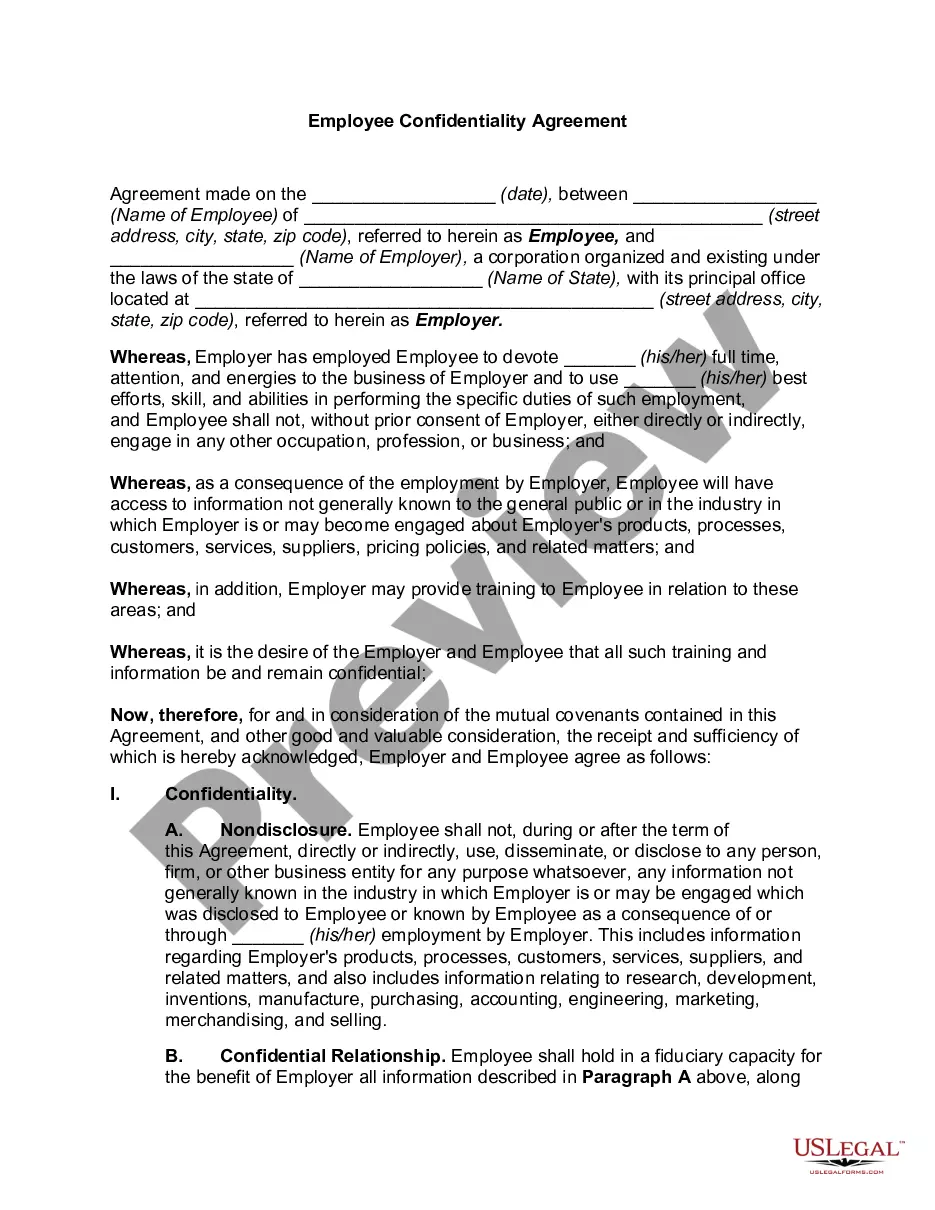

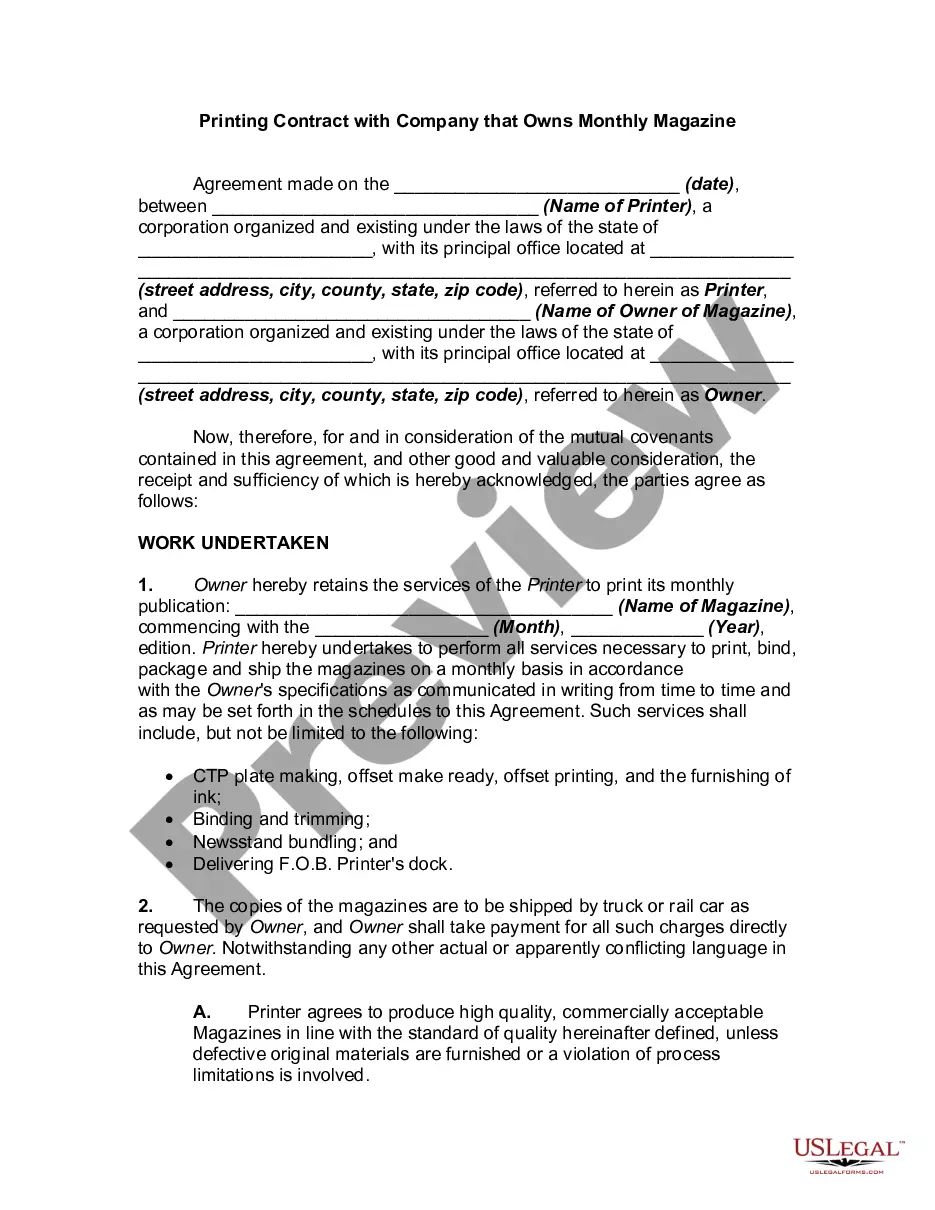

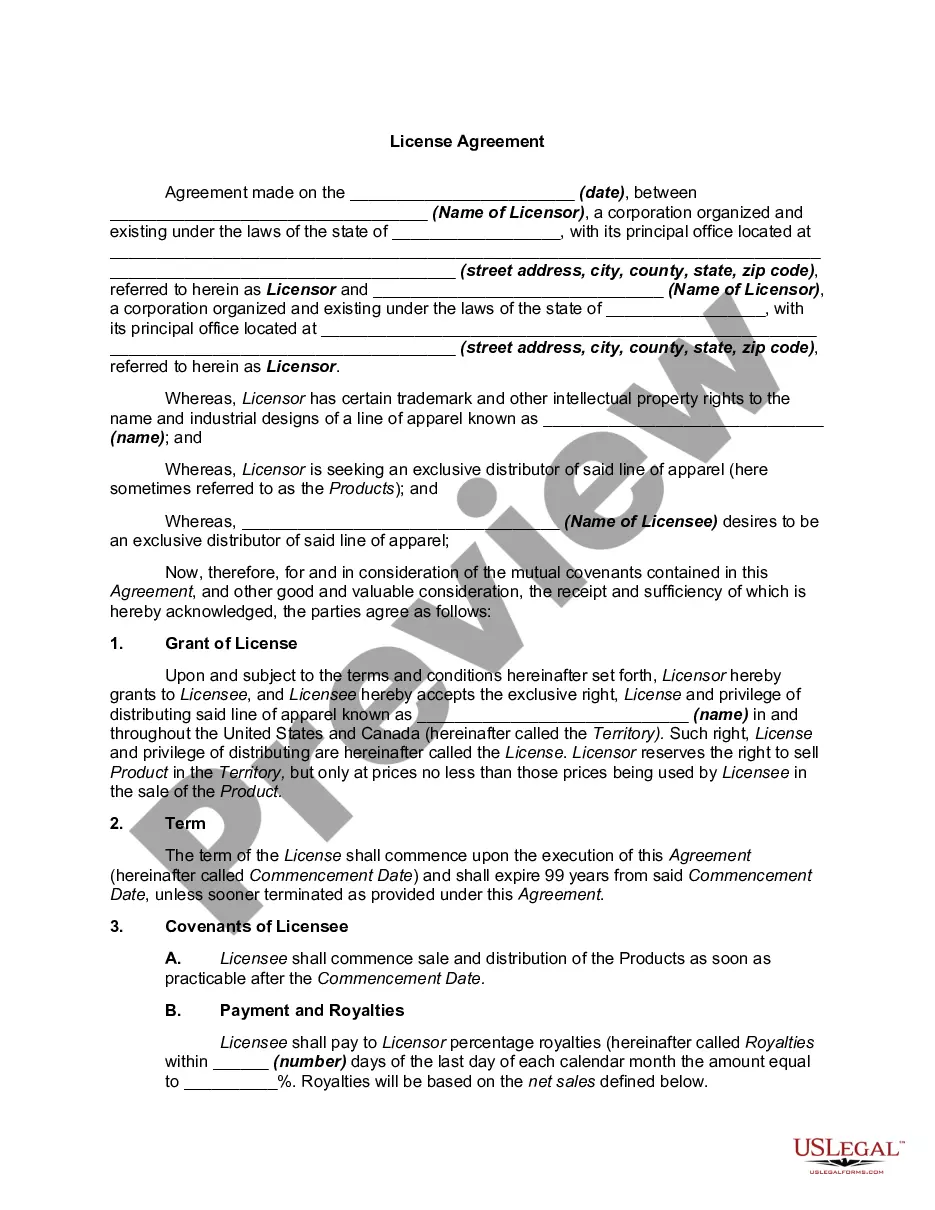

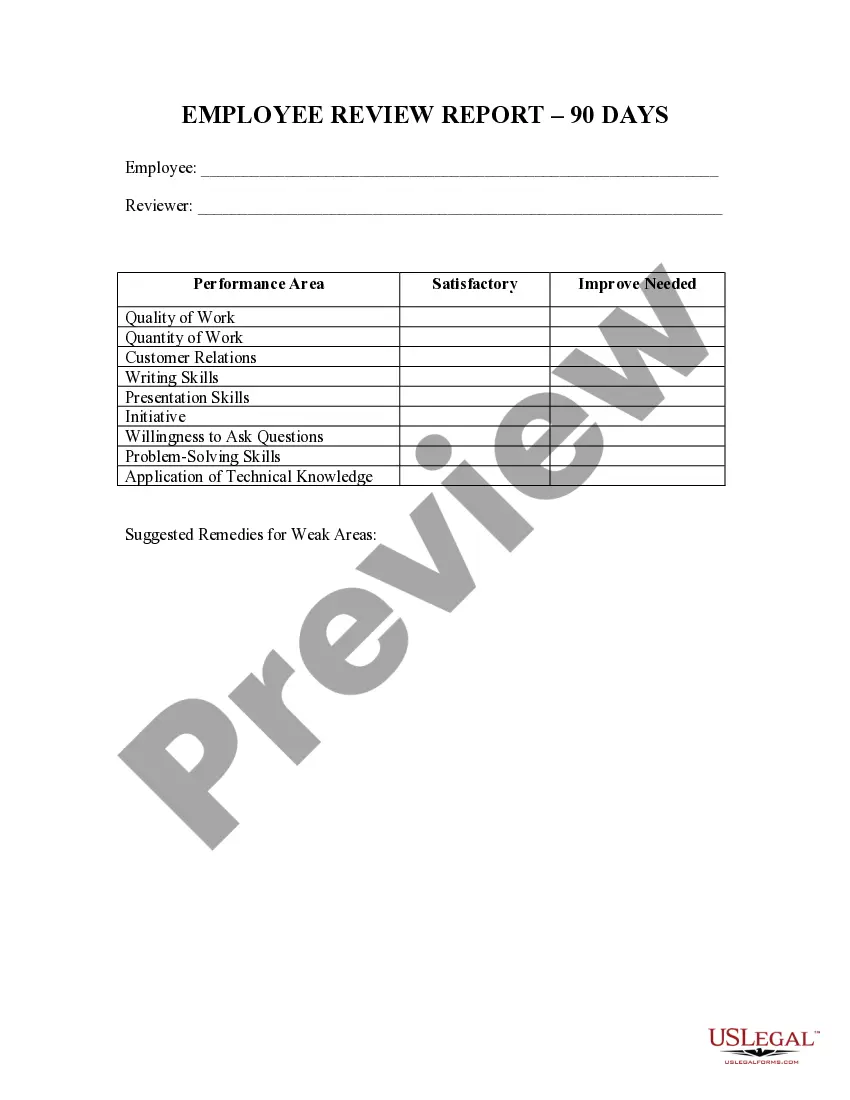

US Legal Forms provides a vast array of document templates, such as the Virginia Leaseback Provision in Sales Agreement, designed to comply with federal and state regulations.

Once you have the appropriate form, click Get now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Leaseback Provision in Sales Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct location/region.

- Use the Preview feature to check the form.

- Review the description to ensure you’ve selected the correct form.

- If the form isn’t what you’re looking for, use the Search box to find the form that fits your needs and requirements.

Form popularity

FAQ

The structure of a sale and leaseback transaction involves the initial sale of property followed by an immediate lease agreement between the seller and buyer. This arrangement often includes detailed terms regarding rent, duration, and maintenance responsibilities. The Virginia Leaseback Provision in Sales Agreement outlines these structures, ensuring that both parties understand the framework of their new relationship.

An example of a leaseback transaction would be a restaurant owner selling the property to a real estate firm while leasing it back for daily operations. This arrangement gives the owner liquidity while maintaining their business's location. The clarity provided by the Virginia Leaseback Provision in Sales Agreement ensures that both parties are aware of their rights and obligations.

An example of a sale-leaseback transaction involves a company selling its office building to an investor and then leasing the same building for continued use. This allows the company to raise capital without losing operational control of its premises. The Virginia Leaseback Provision in Sales Agreement plays a critical role in documenting the lease terms, ensuring a smooth transition.

The latest amendment to IFRS 16, effective from April 2021, addresses accounting for rent concessions as a result of the COVID-19 pandemic. The amendment allows lessees to recognize certain rent concessions as modifications without having to reassess the entire lease. Businesses should stay informed about these amendments, particularly how the Virginia Leaseback Provision in Sales Agreement interacts with evolving standards.

The process of sale and leaseback typically begins with a company identifying an asset it owns, such as real estate or equipment, which it intends to sell. The company sells the asset to a buyer while simultaneously signing a lease agreement to occupy or use the asset post-sale. Familiarizing oneself with the Virginia Leaseback Provision in Sales Agreement can simplify this process and mitigate potential complications.

A lease modification under IFRS 16 occurs when the terms of a lease contract are changed and the alteration grants the lessee an additional right or modifies the lease payments. This could involve extending the lease term, changing the asset being leased, or adjusting the payments. Understanding the implications of lease modifications, especially relating to the Virginia Leaseback Provision in Sales Agreement, ensures that businesses account for such changes correctly.

The IFRS 16 amendment for sale and leaseback provides guidance on how to account for transactions that involve selling an asset and leasing it back. The amendment clarifies the conditions under which a sale is recognized and the accounting treatments involved. By integrating the Virginia Leaseback Provision in Sales Agreement, businesses can better manage these transactions while ensuring compliance with this amendment.

The new IFRS 16 lease standard came into effect on January 1, 2019, and it fundamentally changes how leases are reported in financial statements. Under this standard, lessees must record a right-of-use asset and a corresponding lease liability on their balance sheets for most leases. Businesses utilizing the Virginia Leaseback Provision in Sales Agreement should consider how this new standard impacts their reporting and compliance.

The IFRS 16 adjustment refers to changes made to financial statements to comply with the International Financial Reporting Standard 16, which regulates lease accounting. This standard requires lessees to recognize most leases on their balance sheets, providing a clearer view of their liabilities and assets. Understanding the Virginia Leaseback Provision in Sales Agreement can help businesses adjust their financial reporting to align with IFRS guidelines.

IFRS 16, which governs lease accounting, affects how businesses report sale and leaseback transactions. Under this standard, the seller-lessee must recognize a right-of-use asset and a lease liability on their balance sheet. This framework can change how financial statements appear, making it vital to understand the implications of the Virginia Leaseback Provision in Sales Agreement. Consulting resources like US Legal Forms can provide clarity on compliance requirements and best practices.