Virginia Statement by Business Entity as to Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I

Description

How to fill out Statement By Business Entity As To Use And Possession Of Firearms Involved In Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I?

You might spend hours online searching for the correct document format that meets the federal and state criteria you need. US Legal Forms provides a vast array of legal templates that are reviewed by professionals.

It is easy to obtain or print the Virginia Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I from our platform.

If you already possess a US Legal Forms account, you can Log In and select the Obtain option. Subsequently, you can complete, modify, print, or sign the Virginia Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I. Each legal document format you purchase remains your property indefinitely.

Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Locate the format in the documents and download it to your device. Make modifications to your document if necessary. You can complete, revise, sign, and print the Virginia Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I. Access and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- To acquire another copy of a purchased form, navigate to the My documents section and click on the relevant option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your chosen region/city.

- Review the form details to confirm you have chosen the right document.

- If available, utilize the Review option to examine the document format as well.

- To locate another version of the form, use the Search field to find the format that suits your needs.

- Once you have identified the format you want, click Acquire now to proceed.

Form popularity

FAQ

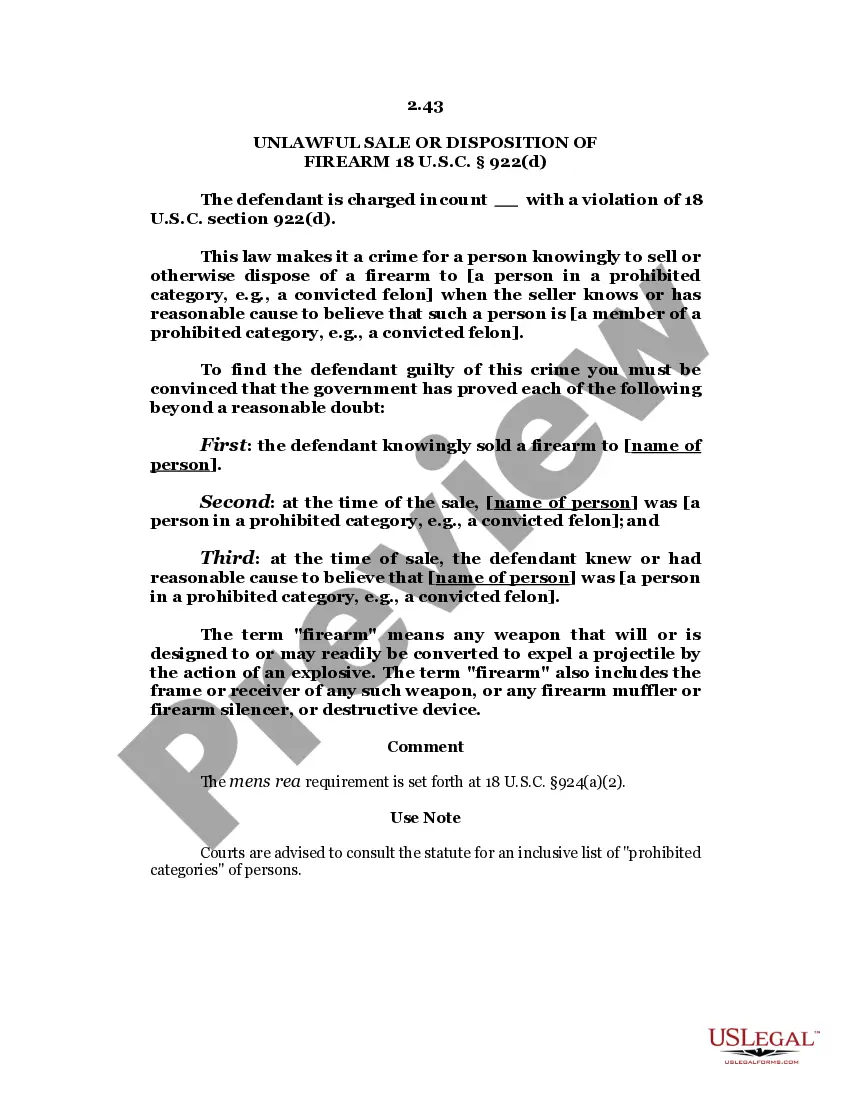

After the transferor/seller has completed the firearms transaction, he/she must make the completed, original ATF Form 4473 (which includes the Notices, General Instructions, and Definitions), and any supporting documents, part of his/her permanent records.

Updated ATF Form 4473 - Firearms Transaction Record (August 2023 Revisions) | Bureau of Alcohol, Tobacco, Firearms and Explosives.

Used by federal firearms licensees (FFLs) to determine if they may lawfully sell or deliver a firearm to the person identified in Section B, and to alert the transferee/buyer of certain restrictions on the receipt and possession of firearms.

All purchases of small arms (handguns) from private individuals from another state are required to have a Form 4473 completed before sale. Some states (such as California, Colorado, Nevada, New Jersey, and Washington) require individual sellers to sell through dealers.

Download Report of Firearms Transactions (ATF Form 5300.5) (222.16 KB) This form must be completed by licensees upon receipt of a demand letter issued through either the Attorney General or an ATF official.