This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

Have you ever found yourself in a scenario where you need documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating ones you can trust isn't easy.

US Legal Forms offers a vast array of form templates, such as the Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, that are designed to meet state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you desire, complete the necessary information to create your account, and finalize the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

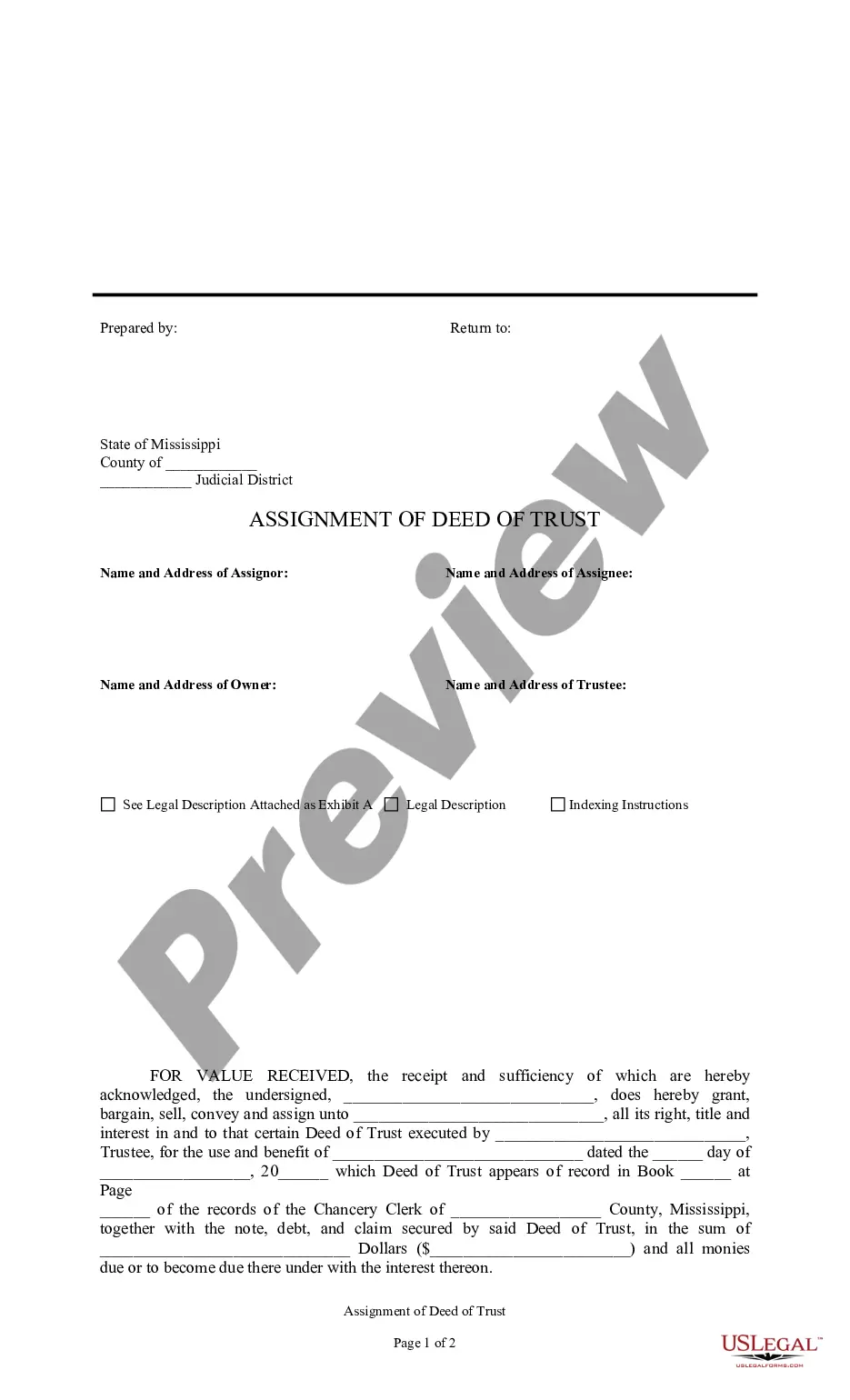

- Use the Preview button to examine the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn’t what you are looking for, utilize the Lookup area to find the form that meets your needs and requirements.

Form popularity

FAQ

To prove an insurance company acted in bad faith, you must demonstrate that the insurer had no reasonable basis to deny your claim and that they knew this. Gathering evidence, such as communication records and expert testimony, can significantly bolster your case. A well-documented approach will be key if you pursue a Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.

To write a bad faith letter, begin by clearly stating the claim details, including the policy number and the specific issue at hand. Next, outline the reasons you believe the insurer has acted in bad faith, providing evidence and examples to support your claims. This letter can serve as a crucial document if you decide to file a Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand.

Statute 8.01 66 in Virginia pertains to the legal process for filing a complaint in civil cases, including those related to wrongful termination of insurance under ERISA and for bad faith. This statute allows individuals to pursue a jury trial if they believe their rights have been violated. By understanding this statute, you can better navigate your Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Utilizing platforms like US Legal Forms can provide you with the necessary documents and guidance to effectively present your case.

ERISA does not typically allow for punitive damages, focusing instead on providing equitable relief for violations. However, if your case involves bad faith practices by an insurer, you may have grounds for a Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Understanding your rights under ERISA is crucial for seeking just compensation.

Recently, Virginia enacted new laws aimed at enhancing consumer protections in auto insurance. These laws may include requirements for greater transparency and fair claims processing. If you face wrongful termination of your auto insurance and wish to pursue a Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, these updates can inform your strategy.

Statute 38.2 231 in Virginia focuses on the fair treatment of policyholders by insurers. It mandates that insurers fulfill their obligations and handle claims in good faith. When dealing with wrongful termination of insurance, this statute can support your Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, emphasizing your rights as a policyholder.

Virginia Code 38.2 231 outlines the regulatory framework for insurance practices in the state. This code specifically addresses the responsibilities of insurance companies regarding policyholder treatment and claims. If you experience wrongful termination of your insurance and need to file a Virginia Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, this code may serve as a vital part of your case.