Virginia Letter regarding Distribution of Estate

Description

Key Concepts & Definitions

A01 Letter Regarding Distribution of Estate: This refers to a formal document sent to the heirs and beneficiaries detailing the distribution process of an estate as per the last will or trust. Estate Planning: Involves making plans for the transfer of an individual's estate after death, including the management of assets and personal financial planning to ensure beneficiaries receive their inheritance according to the owners wishes. Trust and Estate: A legal arrangement in trust law where assets are managed by one party for the benefit of another. Probate Court: A segment of the judiciary system that deals with matters pertaining to wills, estates, and related legal issues.

Step-by-Step Guide to Managing Estate Distribution

- Gather Important Documents: Collect all necessary legal forms online, including the will, trust documents, and any a01 letters.

- Understand the Inheritance Laws: Review inheritance laws of the specific state to ensure compliance with regional legal frameworks.

- Application to Probate Court: Submit necessary documents to the probate court and obtain the authorization to proceed with estate distribution.

- Communicate with Beneficiaries: Use the a01 letter to officially notify beneficiaries about the distribution details.

- Distribute Assets: Proceed with the distribution of assets as outlined by the estate plan, ensuring all debts are settled prior to distribution.

Risk Analysis in Estate Distribution

- Legal Disputes: Inadequate documentation or failure to adhere to inheritance laws can lead to disputes among beneficiaries.

- Financial Mismanagement: Poor personal financial planning can result in insufficient funds to cover debts, leading to claims from debt collectors.

- Breach of Confidentiality: Improper handling of estate information can breach confidentiality agreements, possibly leading to legal repercussions.

Best Practices in Handling Estate Distribution

- Maintain Transparency: Keep all parties informed throughout the estate distribution process to avoid misunderstandings and disputes.

- Utilize Legal Forms Online: Ensure that all paperwork, including the a01 letter and sample confidentiality agreements, are properly completed and recorded.

- Seek Professional Advice: Consult with legal and financial experts to navigate complex inheritance laws and probate processes efficiently.

Common Mistakes & How to Avoid Them

- Neglecting to Update Estate Plans: Regularly update your estate plans to reflect current wishes and legal standards to prevent outdated distributions.

- Ignoring Tax Implications: Understand the tax consequences of estate distribution to avoid burdening beneficiaries with unexpected tax responsibilities.

FAQ

- What should be included in an a01 letter regarding distribution of estate? It should detail the assets, distribution process, and beneficiaries information.

- How can I find reliable legal forms online for estate planning? Consult certified platforms that offer state-specific forms tailored to specific estate planning needs.

How to fill out Virginia Letter Regarding Distribution Of Estate?

Searching for a Virginia Letter regarding Distribution of Estate online can be stressful. All too often, you see documents that you think are alright to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any form you’re looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in in your My Forms section. In case you do not have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step recommendations below to download Virginia Letter regarding Distribution of Estate from the website:

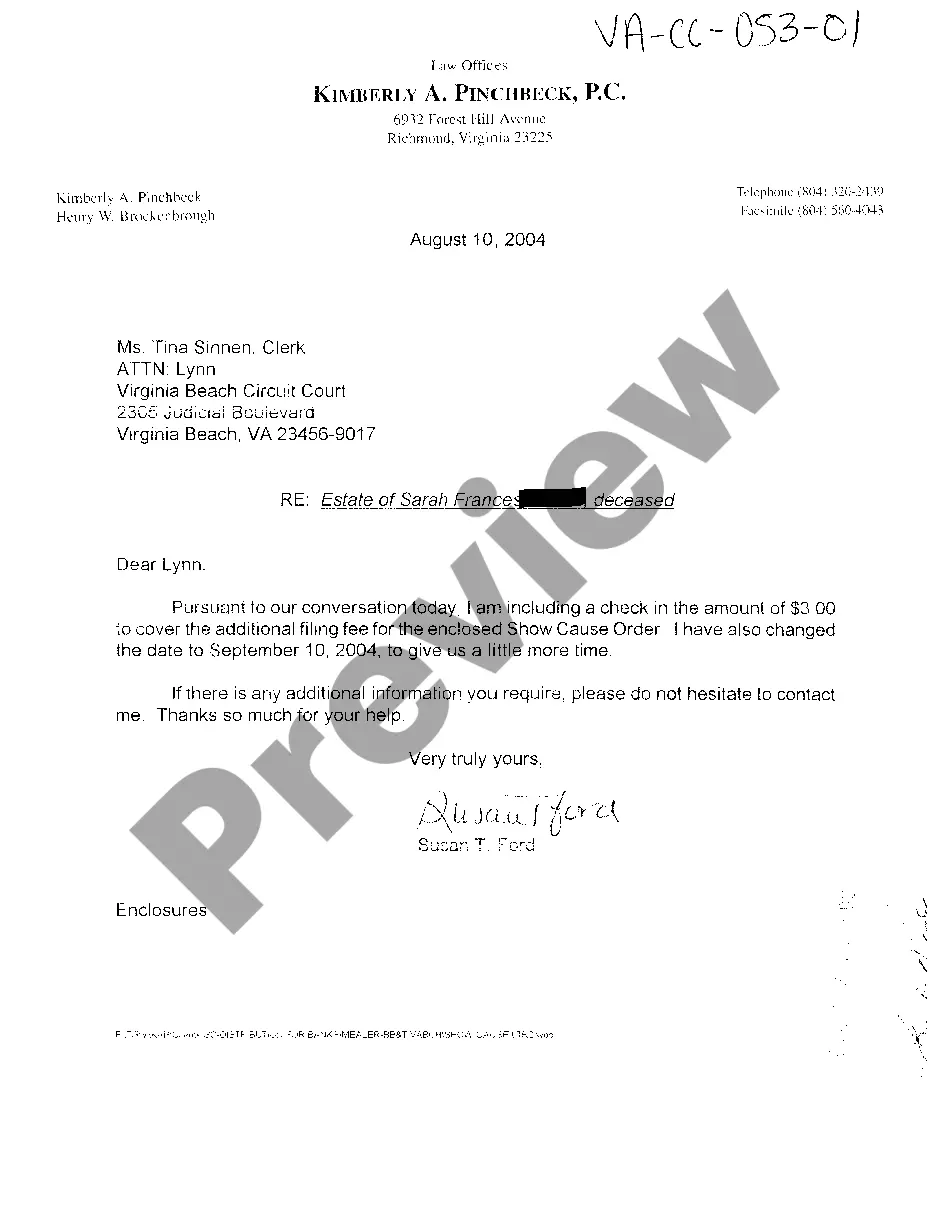

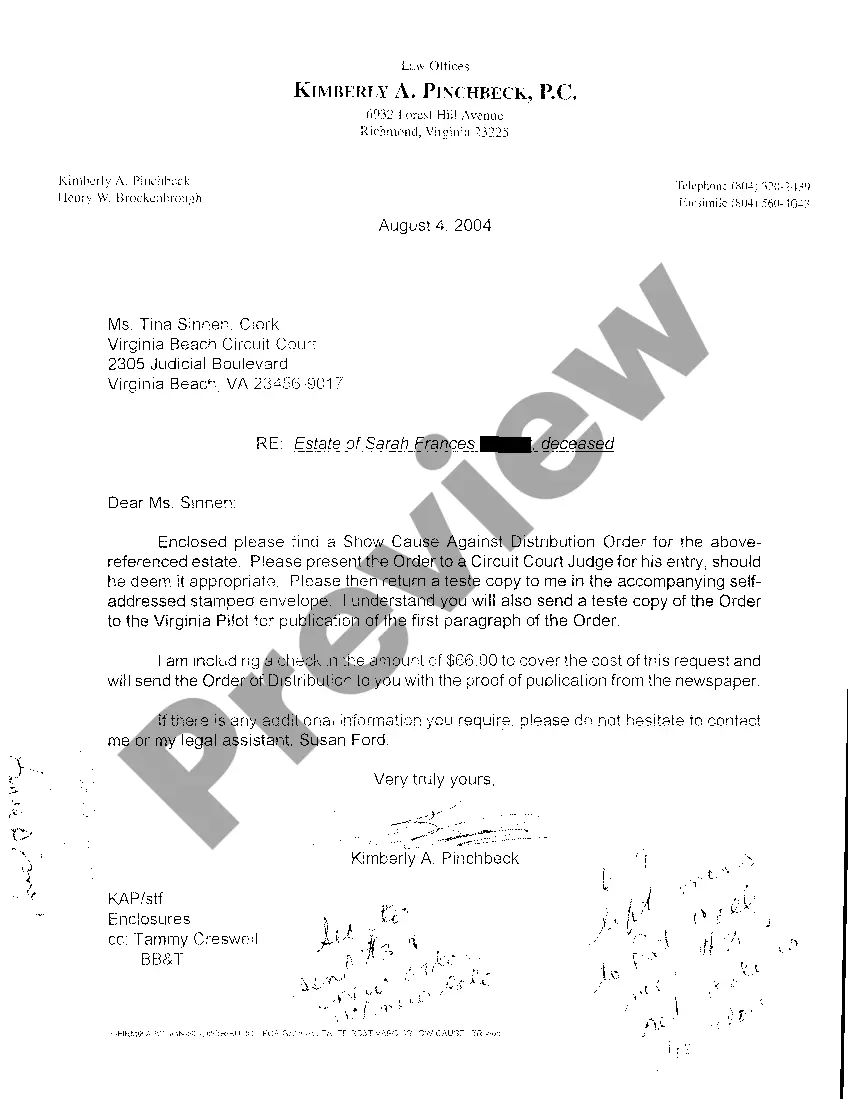

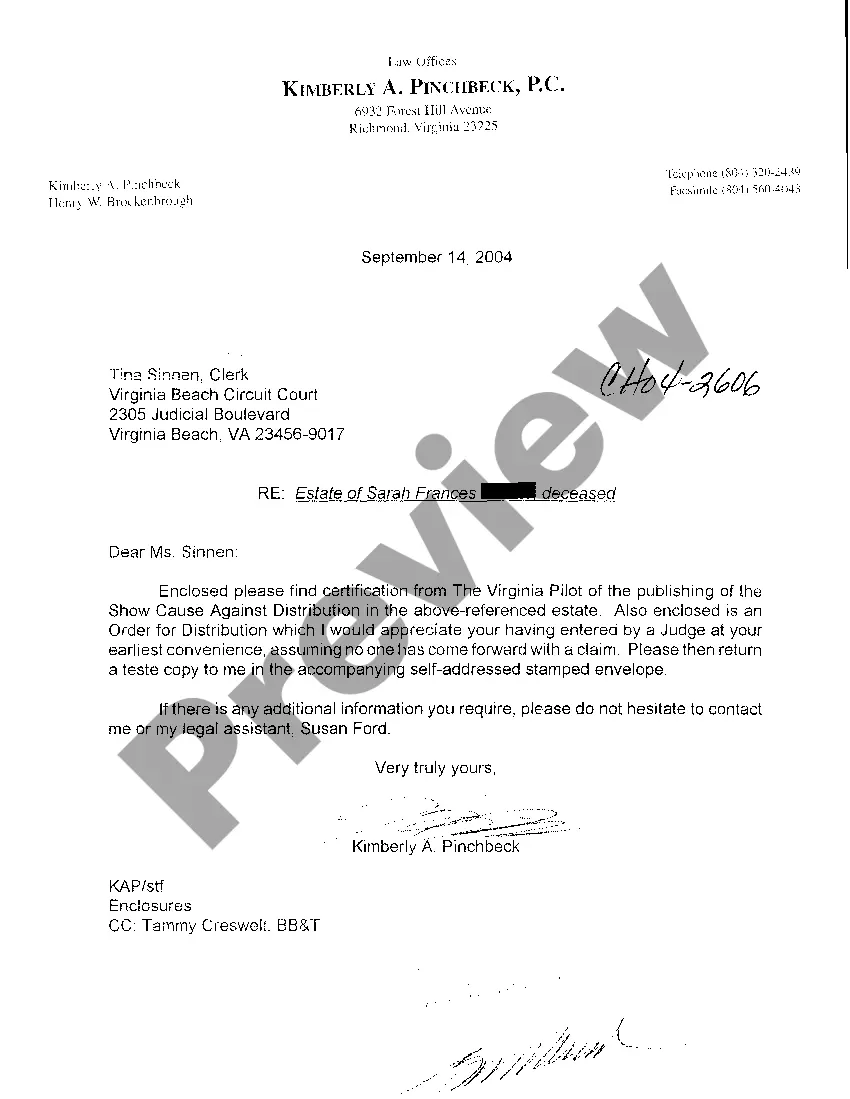

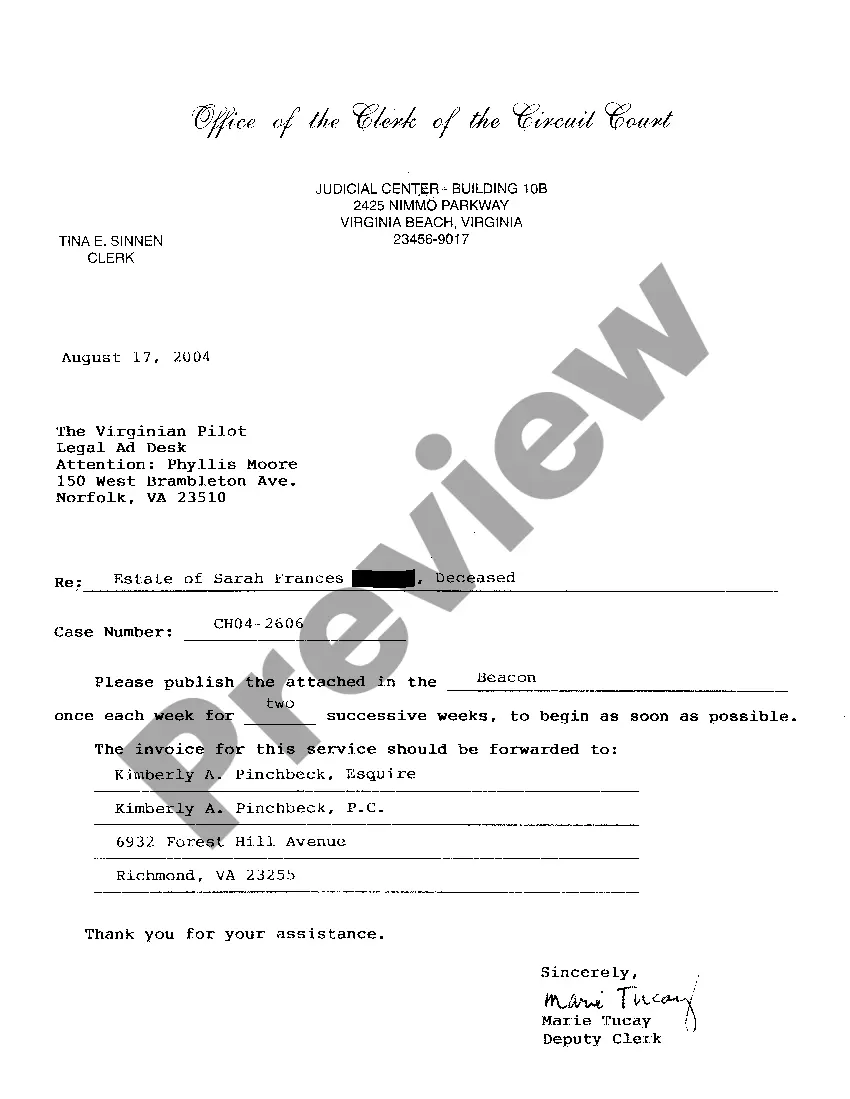

- See the form description and click Preview (if available) to verify whether the form suits your expectations or not.

- In case the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. Besides professionally drafted samples, users are also supported with step-by-step instructions concerning how to get, download, and complete forms.

Form popularity

FAQ

In order for the closing of an estate to occur, a final accounting showing that all estate assets have been distributed to beneficiaries in accordance with the written will or Virginia law if no will exists and a statement by the executor that all taxes have been paid must be filed and approved by the Commissioner of

An estate bank account is opened up by the executor, who also obtains a tax ID number. The various accounts of the deceased person are then transferred to the account. The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Generally speaking, inheritance is not subject to tax in California. If you are a beneficiary, you will not have to pay tax on your inheritance.

Generally, an executor has 12 months from the date of death to distribute the estate. This is known as 'the executor's year'. However, for various reasons the executor may have been delayed and has not distributed the estate within this time frame.

Typically, fees such as fiduciary, attorney, executor and estate taxes are paid first, followed by burial and funeral costs. If the deceased member's family was dependent on him or her for living expenses, they will receive a family allowance to cover expenses. The next priority is federal taxes.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

An estate bank account is opened up by the executor, who also obtains a tax ID number.The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent. Finally, he or she distributes the remainder in accordance with the will.