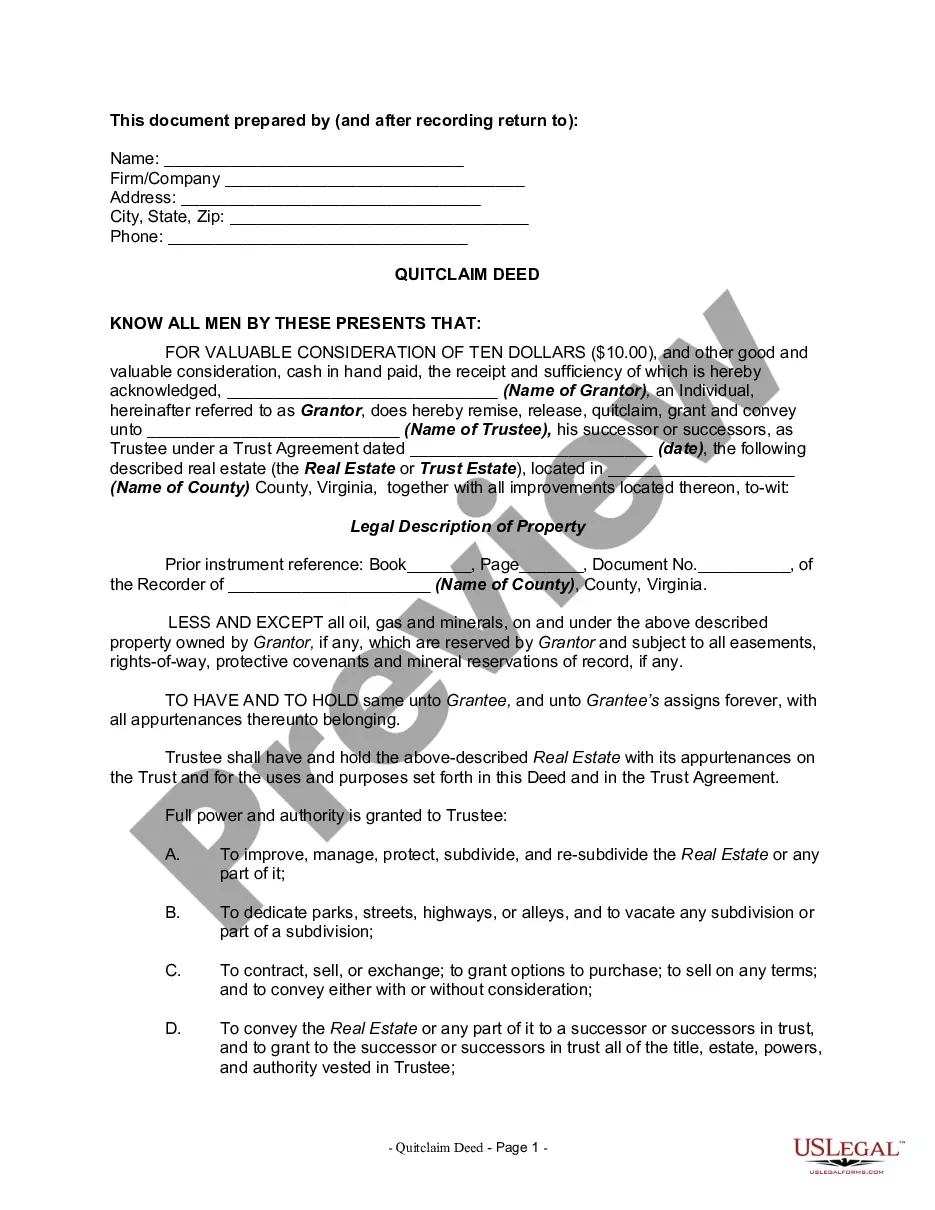

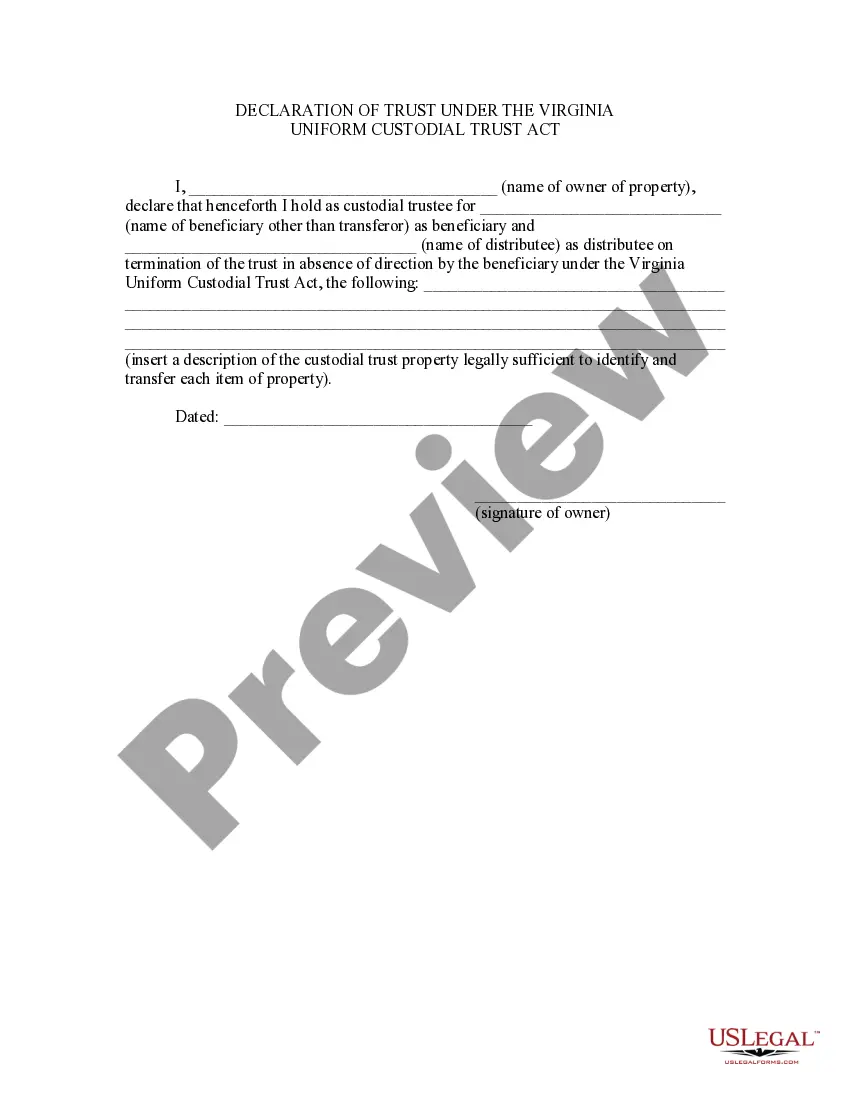

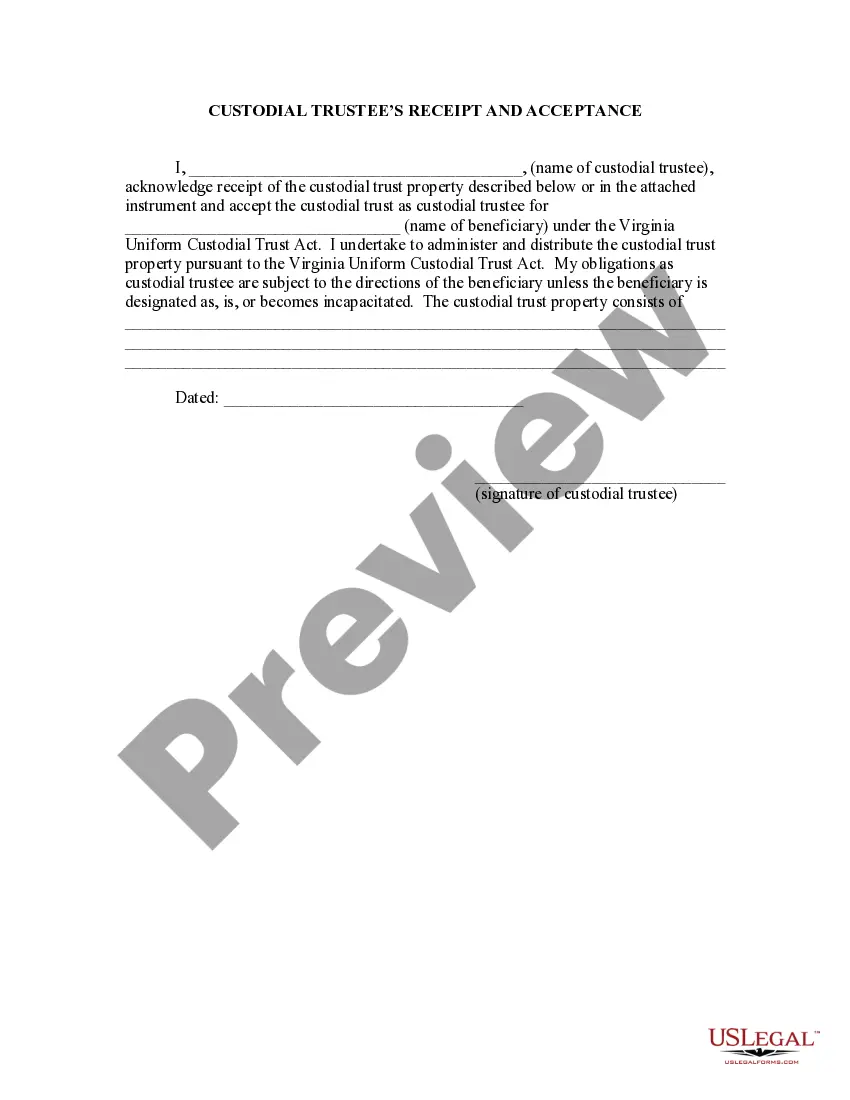

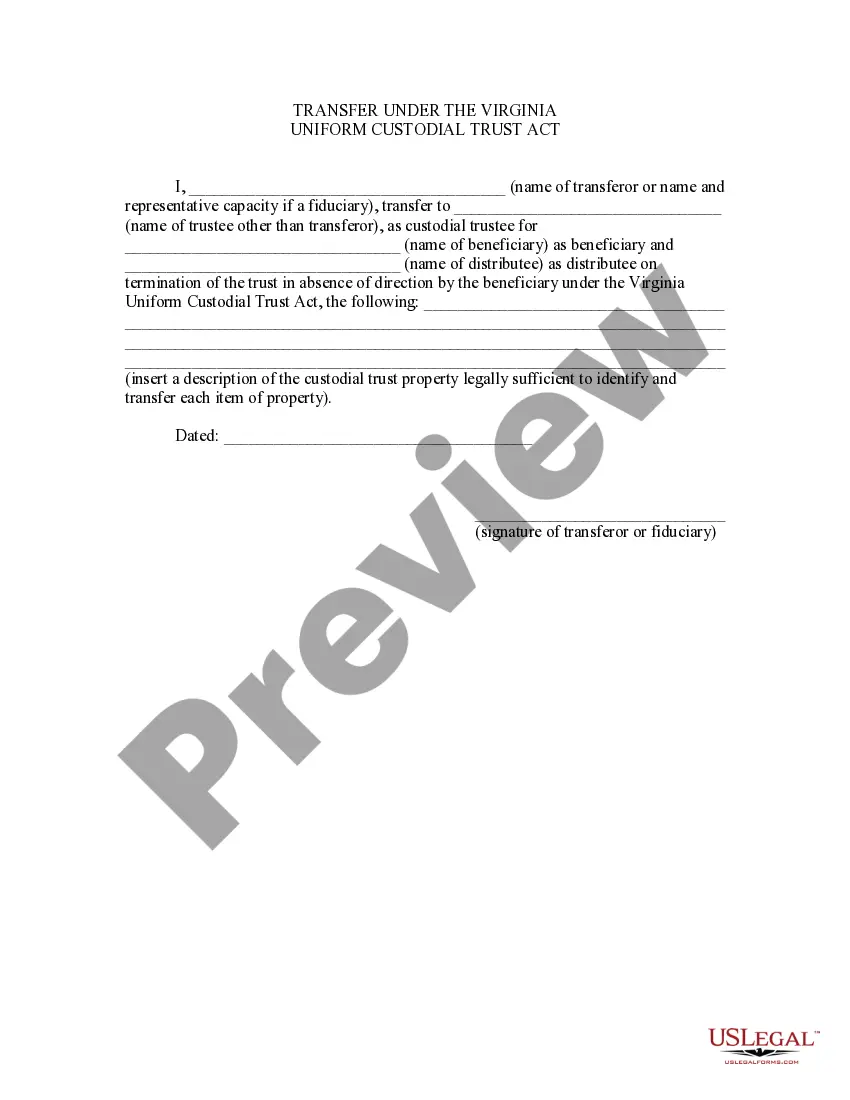

This is a sample form for use in Virginia matters involving trusts, a Transfer Under the Virginia Uniform Custodial Trust Act. Under § 55-34.2. of the Virginia Uniform Custodial Trust Act, a person may create a custodial trust of property by a written transfer of the property to another person, evidenced by registration if the property is of a type subject to registration, or by other instrument of transfer, executed in any lawful manner, naming as beneficiary an individual who may be the transferor, in which the transferee is designated, in substance, as custodial trustee under this chapter.

Transfer Under the Virginia Uniform Custodial Trust Act

Description

How to fill out Transfer Under The Virginia Uniform Custodial Trust Act?

Searching for a Transfer Under the Virginia Uniform Custodial Trust Act on the internet might be stressful. All too often, you find documents which you think are alright to use, but discover afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Get any form you’re looking for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will instantly be added in in your My Forms section. In case you don’t have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step instructions below to download Transfer Under the Virginia Uniform Custodial Trust Act from the website:

- See the document description and hit Preview (if available) to verify whether the form meets your requirements or not.

- In case the form is not what you need, get others using the Search engine or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted templates, customers may also be supported with step-by-step guidelines concerning how to find, download, and fill out templates.

Form popularity

FAQ

Custodial trust is a revocable trust wherein a custodial trustee is named to manage the assets for a beneficiary who is incapacitated or disabled.

Generally, the President gets elected by the Board of Directors of the Trust. The Treasurer of Trust is known to be the chief financial officer of the trust. He is the person accountable for controlling monetary complications, making reports, recording finances, and managing the trust bank accounts.

In a custodial arrangement, the account is owned by the beneficiary, and he or she is entitled to the money upon reaching the proper age.A trust fund, on the other hand, provides the person giving the money with a great deal more control, since the assets are owned by the trust.

Custodial accounts can be thought of as a type of trust account, and are used to save money for children, their beneficiaries. These accounts are set up under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA).The responsibility of managing the account falls to the custodian.

Family trust can be searched using a stack of individual searches, including property search and people search. It can be challenging to find the trustee and it can take some detective work. The key is to use the last name of the family and the property address as your starting point for your search.

The trustees are the legal owners of the assets held in a trust. Their role is to: deal with the assets according to the settlor's wishes, as set out in the trust deed or their will.

A trust is an arrangement in which one person, called the trustee, controls property for the benefit of another person, called the beneficiary. The person who creates the trust is called the settlor, grantor, or trustor.

A custodial account is a means by which an adult can open a savings account for a child. The adult who opens the account is responsible for managing it, including making investment decisions, and deciding how the money is to be used, so long as it benefits the child in some way.

While you can technically withdraw money from a custodial account before your child reaches the age of majority, you can only do so for the direct benefit of the child.Keep in mind that any funds you take out may also create taxable gains for your child, and that withdrawn money won't have as much time to grow.