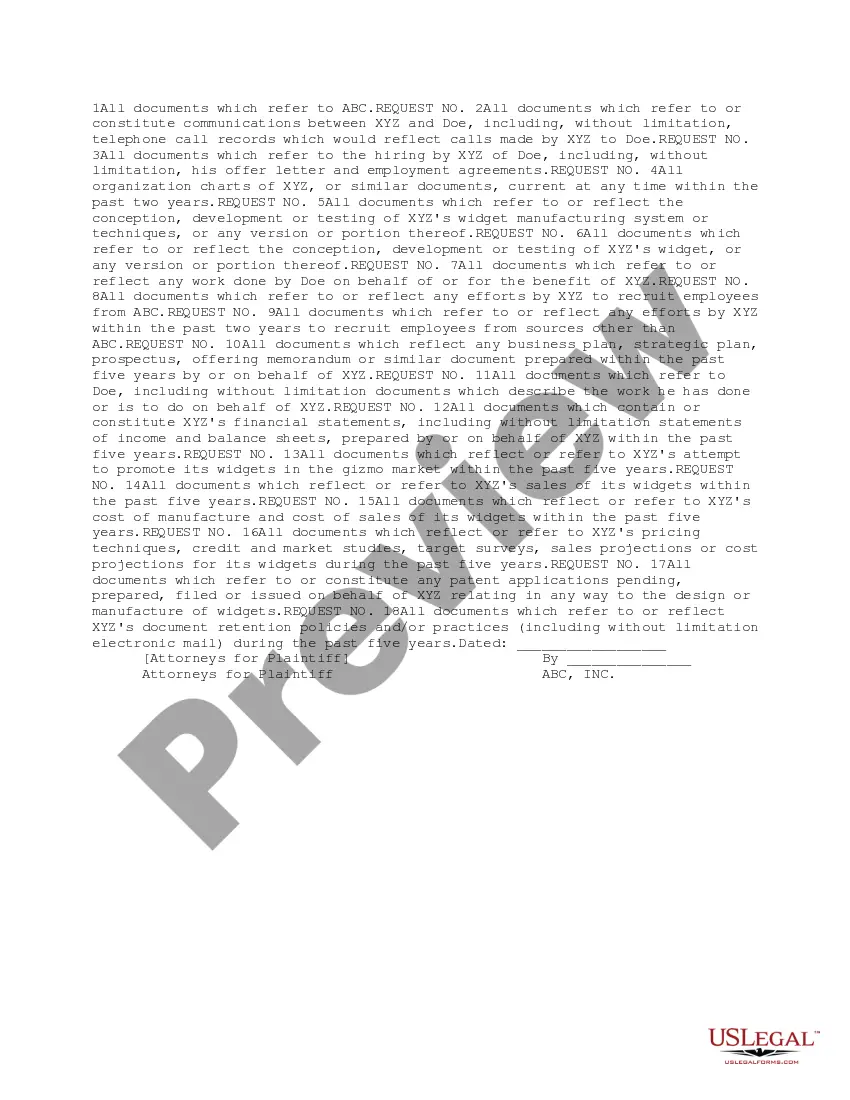

This form is a Plaintiff's Initial Document Request usable by plaintiffs in cases with claims regarding licensing, patents, or commercial trade secrets.

Utah Plaintiff Initial Document Request

Description

How to fill out Plaintiff Initial Document Request?

Are you presently in a placement the place you require files for sometimes enterprise or personal functions just about every day? There are plenty of authorized papers templates available online, but locating types you can depend on is not simple. US Legal Forms offers 1000s of develop templates, like the Utah Plaintiff Initial Document Request, which are published in order to meet state and federal demands.

Should you be previously familiar with US Legal Forms website and also have your account, simply log in. After that, you are able to acquire the Utah Plaintiff Initial Document Request format.

If you do not offer an profile and would like to start using US Legal Forms, abide by these steps:

- Get the develop you need and make sure it is for your proper metropolis/county.

- Utilize the Preview switch to examine the form.

- See the explanation to ensure that you have chosen the correct develop.

- If the develop is not what you are searching for, use the Lookup area to obtain the develop that meets your needs and demands.

- Once you discover the proper develop, just click Purchase now.

- Select the pricing strategy you want, complete the specified information to produce your money, and pay money for the order with your PayPal or bank card.

- Select a handy file format and acquire your backup.

Locate each of the papers templates you possess bought in the My Forms food selection. You can get a further backup of Utah Plaintiff Initial Document Request whenever, if needed. Just click on the necessary develop to acquire or printing the papers format.

Use US Legal Forms, probably the most extensive variety of authorized kinds, in order to save time and steer clear of blunders. The service offers professionally produced authorized papers templates that can be used for an array of functions. Produce your account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Rule 26(a)(1). Not all information will be known at the outset of a case. If discovery is serving its proper purpose, additional witnesses, documents, and other information will be identified. The scope and the level of detail required in the initial Rule 26(a)(1) disclosures should be viewed in light of this reality.

An Initial Disclosure Document is a document designed to help you compare the financial services available from a service provider, such as a bank or building society offering mortgages. The document also covers all fees and charges made by lenders and intermediaries.

By signing the disclosures you are not committing yourself to the lender (i.e., they are not binding), but you are giving your permission for the lender to begin processing and underwriting.

Initial disclosures must be based on the information the parties know or learn after looking into the facts of the case. A party must provide disclosures even if the other party does not. Once the information is disclosed, the parties have a continuing duty to update the information.

These initial disclosures provide a description of the evidence you currently have in your possession to support your claims, including a list of your potential witnesses and a list of documents that support your claims and defenses.

Initial disclosures are the preliminary disclosures that must be acknowledged and signed in order to move forward with your loan application. These disclosures outline the initial terms of the mortgage application and also include federal and state required mortgage disclosures.

Similar to the initial disclosure requirements in Federal court, each side is now going to be required to disclose all existing relevant witness information and documents in response to a demand for initial disclosure.

A disclosure document is the broad term used to describe all regulated fundraising documents for the issue of securities. There are four types of disclosure document: a prospectus. an offer information statement. a profile statement, and.