Utah Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Choosing the right lawful file format can be quite a have a problem. Of course, there are tons of templates available on the net, but how would you discover the lawful form you require? Utilize the US Legal Forms web site. The service delivers a large number of templates, for example the Utah Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, which can be used for company and private needs. Every one of the types are checked by pros and satisfy federal and state specifications.

If you are currently signed up, log in in your account and click on the Obtain option to obtain the Utah Declaration of Election by Lessor to Convert Royalty Interest to Working Interest. Use your account to appear through the lawful types you might have purchased earlier. Go to the My Forms tab of your respective account and have an additional copy of the file you require.

If you are a fresh user of US Legal Forms, here are straightforward recommendations that you can adhere to:

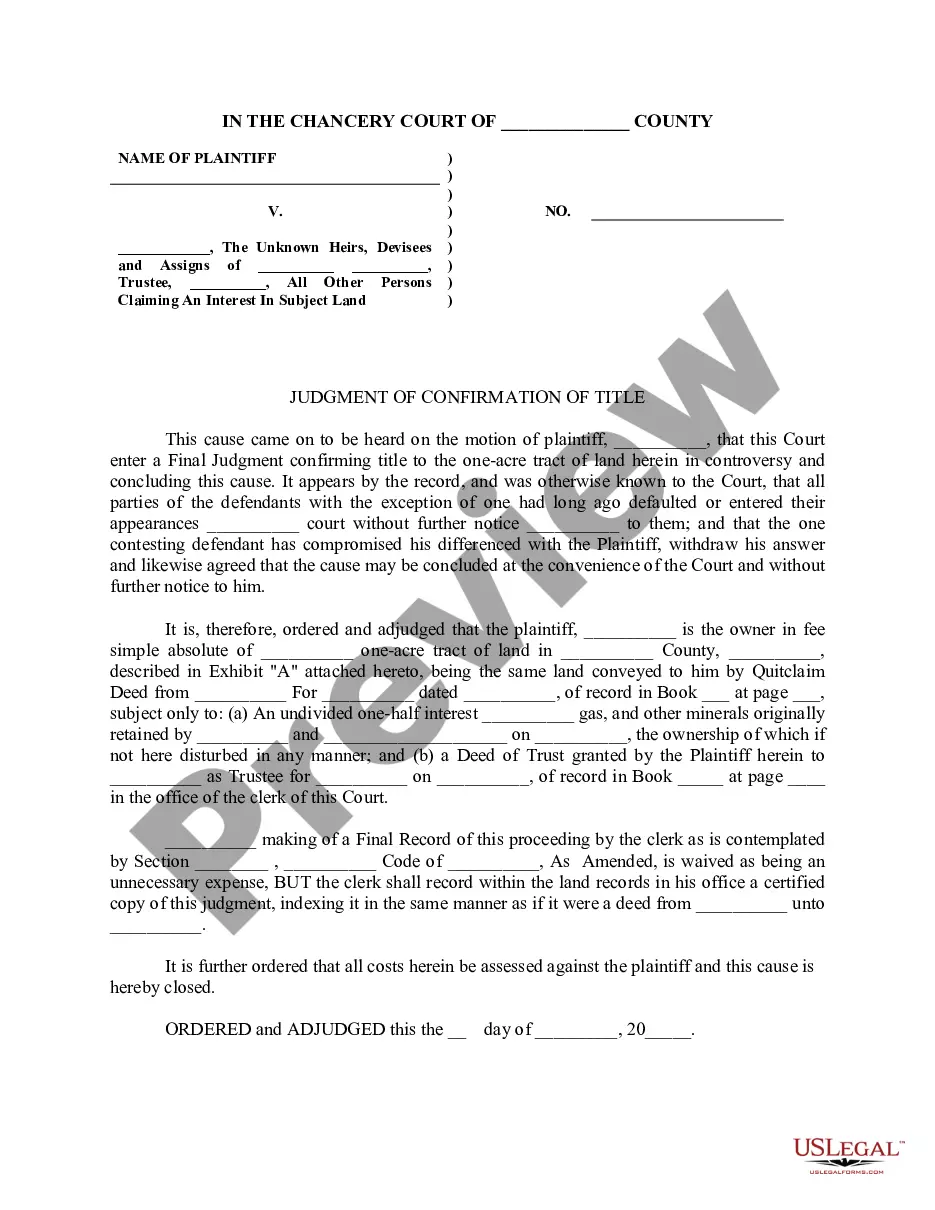

- Initially, make certain you have chosen the appropriate form to your metropolis/area. You can examine the shape while using Review option and read the shape explanation to ensure this is basically the best for you.

- If the form does not satisfy your preferences, take advantage of the Seach discipline to get the appropriate form.

- When you are certain the shape would work, click on the Buy now option to obtain the form.

- Pick the prices strategy you desire and enter the essential info. Design your account and pay money for your order utilizing your PayPal account or charge card.

- Select the data file file format and down load the lawful file format in your gadget.

- Complete, change and print out and sign the attained Utah Declaration of Election by Lessor to Convert Royalty Interest to Working Interest.

US Legal Forms may be the largest catalogue of lawful types that you will find different file templates. Utilize the service to down load appropriately-produced paperwork that adhere to express specifications.

Form popularity

FAQ

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The record title interest includes the obligation to pay rent and the rights to assign and relinquish the lease. [1] The operating rights interest authorizes the holder to drill for and conduct operations and produce the leased substances.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.